WHO IS RETURNING CASH TO SHAREHOLDERS WITH STOCK BUYBACKS? – HOW MUCH FIREPOWER IS LEFT?

We know restaurant stocks are priced inexpensively. One way that management can increase shareholder value is to use their current share repurchase authorizations to retires significant amounts of stock when valuations are low. Restaurant stocks sold off significantly over the last several months providing company management the perfect opportunity to utilize their authorizations to shareholder benefit. In this update, we will look at who was the most aggressive with their buybacks and also give a status of all the current authorizations.

Two companies stand out for their aggressive stock purchases in the quarter, Denny’s and Dine Brands Global. In terms of “quality” rather than “quantity”, three companies, Nathan’s Famous, QSR Brands and Domino’s stand out for the timeliness of their purchases as reflected by the spread between their average purchase cost and the current stock prices.

Denny’s – The company deployed over $37M into the stock buyback in the quarter (6% of the current market cap), bringing the YTD total to $46M. But even more impressive was the timing of the purchases. As the table below shows, the company became significantly more aggressive as the stock price declined. The remaining authorization of $168M is about 30% of the current market cap of the company. With only $5M in cash on the balance sheet, the company will most likely have to use leverage to continue buying back stock at this pace.

Dine Brands Global, Inc.- Dine Brands Global, Inc. also stepped up its purchases relative to the first quarter. In the first quarter the company repurchased 588K shares at a cost of $41.4M ($70.40 per share). However, in the second quarter the company repurchased 913K shares at a cost of $62.6m ($68.64 per share). This was approximately 5% of the total shares outstanding. The company currently has $112M in cash that could easily cover the $74M remaining on the current repurchase authorization.

Commentary: We think it is interesting that so much of the purchasing was done by “asset light” franchising companies, absent the need to build and maintain company stores. Exceptions are mostly companies with very strong balance sheets such as TXRH, DRI or CMG, or relatively mature companies like BLMN and CBRL who spent a very modest portion of their cash flow.

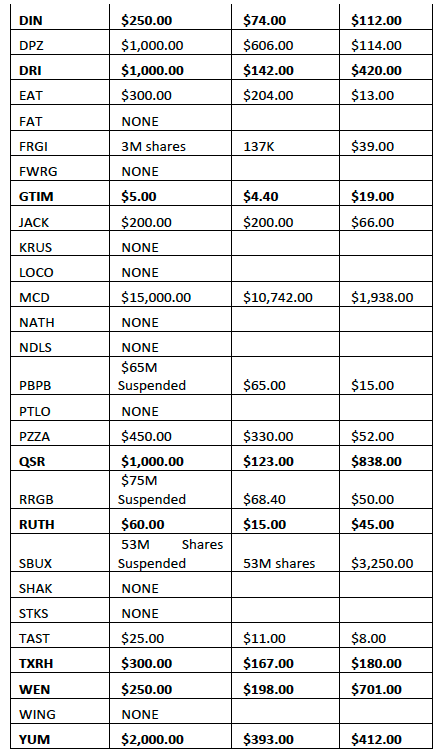

HOW MUCH FIREPOWER IS LEFT?

Below is a compilation of the current buyback authorizations and the amounts remaining on them. We have also listed in bold the companies that have more cash than the dollar amount of the outstanding buyback in order to help distinguish the companies that could complete their buybacks with cash on hand and not rely on free cash flow or debt.

Commentary: On an Enterprise Value relative to Trailing Twelve Month EBITDA, a number of the franchising companies are selling at historically very modest multiples. In an uncertain economy, “asset light” makes a lot of sense to us. Combining that with the financial strength to retire shares, franchising companies such as Dine Brands, Restaurant Brands and Ruth’s Chris seem especially interesting at this juncture.

Note: Roger Lipton of Lipton Financial Services contributed to this post.