Viad Corp. One Hour Analysis: Company Has Long History of Divestitures, Could One More Enhance Shareholder Value?

Market Data:

Price: $33.00 per share

Market Capitalization: $924M (assumes conversion of preferred stock into 6.7M shares).

Cash: $49M

Debt: $406M

Enterprise Value: $1.285B

EBITDA Guidance: $180M

EV/EBITDA Multiple: 7.13X

Summary:

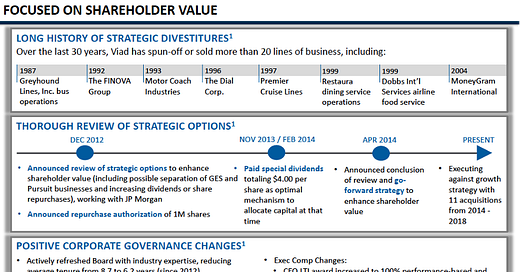

Viad has a long history of making divestitures in an attempt to increase shareholder value.

Viad currently consists of two businesses that have no apparent synergies.

Management has made statements in the past that a separation of the two businesses would make sense.

Crestview’s 24% ownership stake (via conversion of their convertible preferred) is one of only two investments in a limited partnership (4th year of investment) and they could eventually look for an exit of this profitable investment. Viad is the third largest public holding in their total investment portfolio.

Pursuit as a stand-alone business could carry a higher EV/EBITDA multiple or make an attractive acquisition candidate for a company like Vail Resorts.

Background:

Viad Corp is the successor company of The Greyhound Corporation that was incorporated in 1926. Greyhound’s first operations, transportation, began in 1914 in Hibbing, Minnesota. That business grew to become the largest bus company in the world, known as Greyhound Lines.

In the 1960s, we began transforming into a conglomerate and diversified into various industries with hundreds of businesses, including the two that we know today as Pursuit and GES.

From the 1980s to the early 2000s, we made many strategic divestitures of businesses, including Greyhound Lines, Inc. bus operations, The Finova Group, Motor Coach Industries, The Dial Corp, Premier Cruise Lines, Restaura dining servings operations, Dobbs International Services airline food service, and MoneyGram International.

In 2014, we announced a go-forward growth strategy to enhance shareholder value, which was focused on scaling Pursuit and improving the profitability of GES. Steve Moster was appointed President & CEO to lead the company forward and remained President of GES. In 2015, David Barry was appointed President of Pursuit to drive its growth journey.

Source: 2019 Presentation

Management’s Elevator Pitch:

Source: May 2024 presentation.

Current Guidance:

Source: Q1 ‘24 presentation

A Closer Look at the Pursuit Segment:

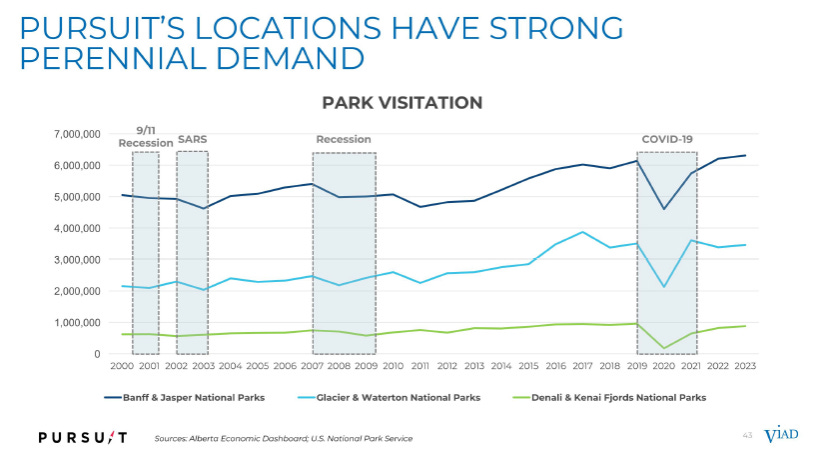

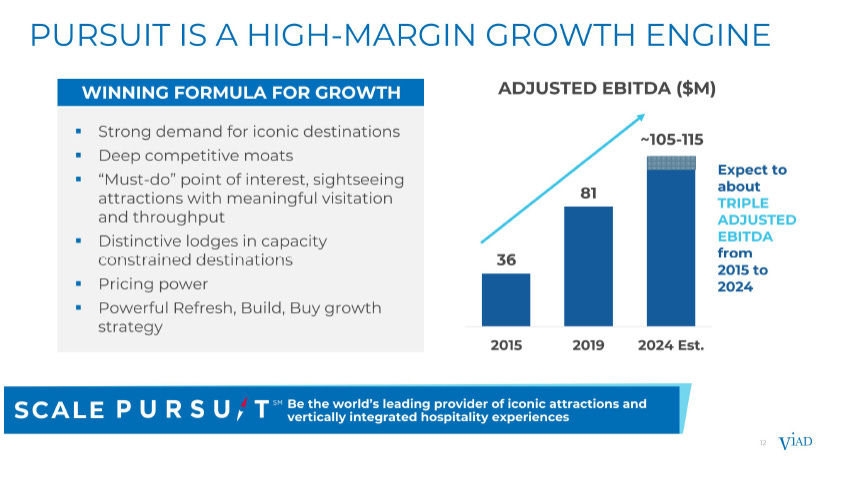

Pursuit is a collection of high-end, unique and world-class assets in desirable locations. The assets also focused on providing experiential vacations, which are becoming more popular. These assets are also highly rated by guests. We believe this indicates a sustainable competitive advantage which can produce pricing power and help the company on a relative basis in a weak economy. We believe the Pursuit segment would be an attractive stand-alone business.

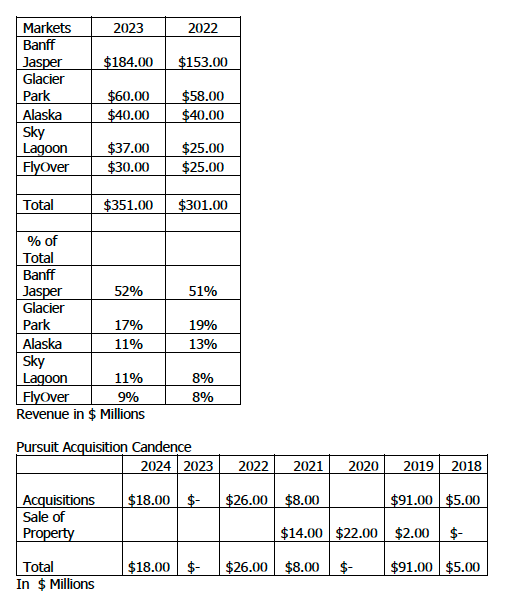

Since 2015, the company has grown revenue from $112M to $350M. The growth has come from a combination of acquisitions and construction projects. The company has built a strong presence in Banff and Jasper Canada. The company increased its exposure to Jasper with its just announced the acquisition of the Jasper SkyTram attraction in Jasper National Park. The company paid $18M or 7X estimated EBITDA. Management believes the SkyTram can be redeveloped or repurposed to boost EBITDA.

Revenue Breakdown by Market:

The FlyOver Segment Could be a Cash Cow to Help Fund Further Growth or Be Sold.

In 2016, Viad acquired the FlyOver Ride Experience in Vancouver. Since then, the company has built three more rides, including the Chicago FlyOver that was opened in March of this year. Between the initial acquisition and the construction of the three other rides, the company has spent a total of $143M on these rides.

While we are not convinced that there is a great deal of synergy between these rides and the rest of the company, if these rides are achieving the company’s stated goal of a 15% IRR, they could be throwing off upwards of $20M in cash flow. However, the FlyOver segment only generated $30M (Chicago was opened in 2024). If we assume a 30% EBITDA multiple, it appears as though the company is only earning about a 10% IRR on this segment ($10M EBITDA on a $103M investment). To be fair, we understand the initial FlyOver Vancouver was doing close to 50% EBITDA margins when they bought it. It should be noted that Las Vegas and Chicago are still in the ramp up phase and are not at peak margins or volumes yet. The cash flow from these rides could help fund the acquisition of other unique attractions or hotels (like the $18M acquisition of the Jasper SkyTram). Another possibility is that the rides could be sold to someone like the new Six Flags/Cedar Fair company. Even if they just got back their book value in a sale, this would provide a substantial windfall.

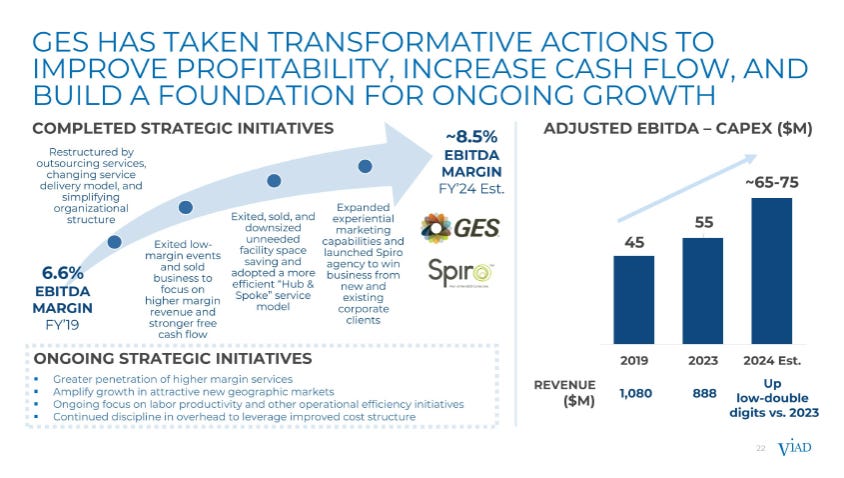

A Closer Look at the GES Segment:

Since we are assuming this business is sold, we are not going into great detail in our analysis.

GES is one of the largest global operators in the $128B exhibition and experiential marketing sector.

#2 market share in U.S.

90% recurring revenue.

90% retention of $500K+ clients.

25-year tenure of top 10 client.

Has INCREASED EBITDA margins by 190bps (6.6% to 8.5%) since 2019.

EBITDA – Cap Ex has increased from $45M in 2019 to $70M in 2024.

Guiding replacement of $65M in non-annual 2024 revenue in 2025. This is impressive.

In spite of predictions of the death of face-to-face exhibitions, the exhibition business is NOT dying.

Attendance at U.S. exhibitions in 2025 are estimated to be nearly flat with 2019.

Dominant position in a global stable business with growth potential with Spiro segment makes this business an attractive acquisition candidate.

What Would RemainCo Look Like if GES is Sold?

We believe that both businesses are attractive as acquisition candidates.

If one of the businesses were sold what would the RemainCo look like?

For this report we are just going to consider what the RemainCo would look like if GES was sold.

While top management has spent their career on GES, we do believe they could add value at RemainCo if they chose to stay.

Assumptions:

This is a theoretical exercise, and we have no knowledge of any plans for this transaction would even occur.

Using management guidance, GES could generate $85M in EBITDA.

Assigning a modest 6X multiple, the sale would generate approximately $510M in gross proceeds.

Purely for simplicity, we assume the net cash proceeds to the company are $450M (transaction costs and potential taxes). This number could be off by a significant amount.

The company lists $479M in “debt and financing obligations” of which $406M is actually debt.

The debt is almost entirely credit facilities and term loans.

There for there would be little pre-payment penalty if the company used the proceeds to pay off all of the debt.

The blended cost of the debt is a relatively high 10%.

Paying off the debt would result in the saving of approximately $41M in cash interest costs.

Estimated balance sheet after the sale of the GES business:

The remaining company would have over $90M in cash and no debt.

Notes:

We have made no assumptions as to where the $70M in lease and finance obligations would reside or how investors would view them when determining the company’s value.

Valuation Assumptions of RemainCo.

As usual in our One Hour Analysis, we make extremely simple scenarios and valuation assumptions to get a feel for the potential of an investment.

Assumptions:

Company achieves 2024 guidance of “mid-single digit” revenue growth.

Revenue growth in 2025 and 2026 is 3%.

No acquisitions are made.

No recession.

EBITDA margin expands to company long-term goal of 33%.

In 2018-19 this segment generated EBITDA margins of 37-38%.

Net cash assumes NO free cash flow accumulates on the balance sheet.

If our assumptions are remotely close to being correct, the implied EV/EBITDA multiple is very pedestrian relative to its proxy peers. Hotel REITs, Ryman Hospitality, Six Flags/Cedar Fair, etc. all trade at multiples substantially higher than the multiples in the three scenarios. It should be noted that scenario 3 assumes NO increase in EBITDA and the implied valuation is still under 8X.

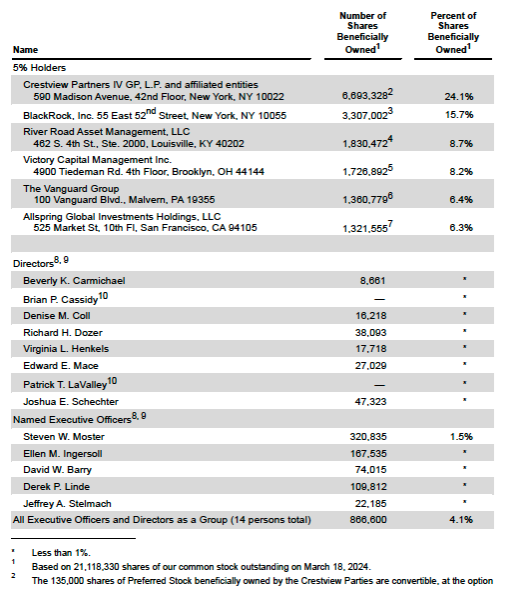

Shareholder Base Seems Like They Would Be Supportive of a Transaction.

Three hedge funds own 41% of the stock.

Blackrock owns 16%.

Management owns less than 5%.

What About Crestview Partners IV GP LP and Their 24% Ownership Stake?

Like many travel and leisure companies, in 2020 Viad received a liquidity injection to help with liquidity during the Covid lockdowns. In August of 2020, Crestview Partners invested $135M in Viad by purchasing a perpetual convertible preferred stock that carries a 5.5% dividend. The preferred is convertible into 6.67M shares at $21.25 per share. Upon conversion, Crestview Partners will own 24% of the company.

Crestview was granted two Board seats, which increased the Board from seven to nine. The preferred is currently in the Crestview Partners IV GP LP. The partnership has only two investments remaining. The Viad preferred with a value of about $250M and 17M shares of Fidelis Insurance Holdings worth $289M.

The limited partnership is approaching its 4th anniversary in August. While we do not know the final termination date of the partnership, we would not be surprised if the current investors would be looking for an exit after five or six years. The initial investment of $135M has turned into approximately $250M, making this investment a success.

Crestview has made 57 total investments. There are 25 holdings in their various portfolios, seven of which are public. Adjusted for the current value of the Viad convertible preferred, this investment is the third largest of their public holdings.

Source: TIKR

Final Thoughts and Caveats:

We have followed Viad since the late 1980’s and watched it sell or spin out, the Greyhound Buses, Dial, Finova, Premier Cruise Lines and Moneygram. We do not feel as though the two remaining businesses have any synergies as a combined entity. Either or both of the businesses could be sold. If Pursuit were to remain as an independent entity, the RemainCo appears to be substantially undervalued relative to its proxy peers. The company would be debt free and have a significant cash hoard to acquire new assets.

The company also has the opportunity to create a robust loyalty program. Numerous companies from McDonald’s to Marriott to Delta Airlines, Vail Resorts has shown that having a strong loyalty program can produce significant long-term benefits to customers and shareholders alike. Since Viad has two clusters of attractions and hotels in Canada, we believe it would a robust loyalty program could increase revenue and margins over time.

While we believe that Pursuit could be an attractive stand-alone company, we also think that the company would make an attractive acquisition candidate for a company like Vail Resorts for the following reasons:

Like Vail, Pursuit focused on unique assets that provide above average experiences for their guests.

Pursuit’s properties could easily fit into Vail’s highly successful Epic Pass loyalty program.

Pursuit’s business peaks in the summer (79% of business in Q2 and Q3) the opposite of Vail’s business (95% of gross profits occur in Q1 and Q4).

Vail has been diversifying its assets outside of the U.S. with its acquisitions of Whistler Blackcomb in Canada and two resorts in Switzerland. The Banff/Jasper assets would compliment the Whistler Blackcomb assets and reduce the dependency on highly unpredictable snow falls.

Ed Mace (72 years old) is a Board member that was a member of the Concessions Management Advisory Board of the U.S. National Park Service from 2010 to 2012. He was also President of Vail Resorts Lodging Company and Rock Resorts International LLC, both subsidiaries of Vail Resorts, Inc. (NYSE: MTN), an owner, manager and developer of ski resorts and related lodging, from 2001 to 2006.

Vail could absorb the $1B+ price tag that would most likely be required for the acquisition to be successful.

Caveats:

This is an entirely theoretical mental exercise, which continues the long history of divestitures to a final conclusion. There is no guarantee that the company will sell GES or Pursuit or be acquired. But the idea is intriguing.

We try to be conservative in our assumptions. If management could achieve 50% EBITDA margins for FlyOver, that would be a great bonus to our base case.

While Viad does have one of a kind assets that should command a higher multiple than a typical hotel REIT or other proxy peer, there is no guarantee that the market will ever recognize this. In past presentations management has used an “exit multiple” of 10X for these assets.

While we have not used any FCF accretion in our scenarios, we have also not incorporated a recession scenario.

We did not adjust the EV for the 60% ownership of Mountain Park Lodges. The EBITDA is consolidated, but the ownership stake is not 100%.

We did not include the SkyTram purchase in our scenario due to the timing of the announcement.

SOTP valuations usually take a transaction or a spinout to help shareholders achieve those theoretical valuations.

Our One Hour Analysis reports are intended to be a starting point for readers to do the rest of the work. We try to get investors to about 70% of what they made need to be comfortable making an investment. Please do your own work.

Disclaimer

Investing501 uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The articles and reports published by Investing501constitute the author’s personal views only and are for entertainment purposes only. They are not to be construed as financial advice in any shape or form. Investing501 does not predict the price at which the securities of any company may trade at any time. Every investor has different strategies, risk tolerances and time frames. You are advised to perform your own independent checks, research, or study, and you should contact a licensed professional before making any investment decisions. From time to time, the author may hold positions in the stocks mentioned in articles published by Investing501. To the extent the author does have such positions, there is no guarantee that he will maintain such positions. Neither the author nor any of its affiliates accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.