UNPRECEDENTED TURNOVER OF CEOs IN THE RESTAURANT INDUSTRY – WHAT’S IT ALL ABOUT?

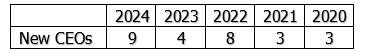

The turnover in the CEO position in the restaurant industry in the last three years has been extraordinary. Since 2021, twenty-one CEOs at 35 of the largest publicly held restaurant companies we follow have been replaced, including nine in 2024, the highest number in at least seven years. To put this in perspective, from 2017 to 2020, only ten CEOs were replaced in total. There is no doubt that the distortions within the Covid pandemic have been a factor, but the industry is also dealing with significant changes that new leadership leads to address.

Examples of this include ever increasing wage inflation, rising building costs, the rise of third-party delivery companies, digitalization of everything (kiosks, loyalty apps), and more competition from convenience stores and grocery stores as “eat at home” takes more share due to menu price inflation.

THE BOTTOM LINE

The turnover as described below is symptomatic of the challenges facing the “food prepared away from home” industry, our attempt to describe “restaurant” facilities that are doing so much of their business by way of drive-thrus, pick-up & delivery. The “playbooks” as described on recent conference calls, provided by the new CEOs at Wendy’s, Noodles and Cracker Barrel, hit most of the “hot buttons” that the industry faces, though the other situations listed below can no doubt educate us even further. These new CEOs are uniformly well qualified and have astutely described the opportunity for improvement. In the context of a generally unforgiving environment, however, whatever rewards they reap will no doubt be well earned. We wish them well and will no doubt be betting on some of them along the way.

C-SUITE ADJUSTMENTS IN THE “MEALS PREPARED AWAY FROM HOME” INDUSTRY

Some interesting characteristics of the twenty-one replacements in ’22-’24:

The average tenure of the replaced CEO was only 6 ½ years.

The average age of the new CEO is 53 years old.

Only seven of the twenty-one were replaced with internal candidates (typically the CFO or COO).

Three came from outside of the restaurant industry.

Several CEOs have work experience at Taco Bell and/or KFC.

Retirement or “semi”-retirement was by far the most common reason given for leaving, a convenient rationale when it’s not as much fun as it used to be.

Within the most recent ten CEO changes, only SHAK stock has performed well.

There are still two vacancies.

RECENT CONFERENCE CALLS AT WENDY’S, NOODLES & CRACKER BARREL PROVIDE THE NEW CEO’s PLAYBOOK

WENDY’S

In January 2024, Kirk Tanner was hired as the CEO of Wendy’s, replacing Todd Penegor, who was the CEO for almost ten years. Mr. Tanner is one of the few new CEOs that comes from outside of the restaurant industry (although he did work in foodservice division at PepsiCo). His most recent position was CEO of North American Beverages at PepsiCo (5 years) and more than 30 years total at PepsiCo. At PepsiCo, he oversaw the $26+ billion business unit, which accounts for approximately 30% of PepsiCo’s overall business. While Wendy’s business is not broken, (for example, 12 consecutive quarters of double-digit two year SSS increases in International division), the stock has been flat since 2019 and trading near the lows over that range. It is possible that Tanner’s marketing background could help Wendy’s improve its communications with consumers.

The Playbook at Wendy’s:

“I wanted to share some of my thoughts on the business now that I’m almost three months in….we have an amazing brand, the highest quality food in QSR and a great foundation for growth…..there’s one thing I know for certain. The experience we deliver to our customers is the most impactful driver of our business……We are committed to ensuring each interaction our customers have with us is brand building… plans will be centered on three things……. (1) driving strong same restaurant sales growth in all our restaurants, including continued momentum in our digital channel…..(2) significant acceleration in global net unit growth and (3)unlocking meaningful improvements in restaurant level profitability….. we have a platform that delivers everyday value. It’s our Biggie platform……..separately. we’re leveraging our digital communication to drive value…… allows us to add customers to our platform. It’s an exciting way to engage, drives personalization……..building the daypart of breakfast…. allows us to build out and use the restaurant, use the labor model and build out a profitable daypart……we’re delighted with the digital performance…..now we’re at about 40 million people on the platform. Our average monthly users went up to about 6 million…..when we have a digital order, it’s a larger order. It has a nice impact to our profitability in our restaurants.”

NOODLES

In March of 2024, Noodles announced that Drew Madsen would become the permanent CEO, graduating from the “interim” role since November ’23. It is always intriguing when relatively small companies hire managers from larger successful companies within the same industry. While these situations do not always work out due to company cultural differences or lack of resources, etc., we believe that Mr. Madsen’s relevant industry experience (especially at Panera and Darden) appear to be a significant upgrade from the prior CEO and could be what Noodles needs to solidly establish its turnaround. Madsen had been a Noodles Board member since September 2017. From May 2015 to December 2016, Mr. Madsen served as President of Panera Bread Company. From October 2014 to March 2015, Mr. Madsen was President and Chief Operating Officer of the Norwegian Cruise Line division of Norwegian Cruise Line Holdings Ltd. NYSE: NCLH) From 2005 to 2013, he was President, Chief Operating Officer and a Board member of Darden Restaurants, Inc. (NYSE: DRI)”

The Playbook at Noodles:

“Now let’s talk about the progress on our five strategic priorities…… creating a foundation of operations excellence is our top priority…..to focus our operations teams on the guest experience….. that correlate most strongly with traffic growth…..focus more on the dinner daypart, where we have lower guest satisfaction……. we introduced biweekly training sessions…a new service standard, a new accuracy standard and a new food execution standard……ensure that critical management positions were in our restaurants more often during our busiest times…….. to coach and reinforce the standards that were just trained….. guest satisfaction ratings at dinner improved significantly in the first quarter….. Food taste and accuracy guest ratings also both improved……led to improved dinner traffic……. General Manager retention is significantly better than the industry and at a 10-year high for Noodles…..make our brands more relevant, primarily through a comprehensive menu transformation….. use compelling LTOs to bridge the gap until our core menu testing plan has been successfully completed……Phase 1 of our menu transformation plan involved a rigorous concept testing process….During Phase II, we placed the new and improved dishes….. where Noodles customers….tasted and rated each dish….have identified multiple new dishes that address gaps in our current menu plus improvements to existing niches….. also working on a new menu board design…. easier to place an order and more contemporary……Phase 3 will marry our new and improved dishes with our new menu board design…… keep the number……and operational complexity close to the current menu….we will introduce…… improved dishes as well as our new menu design nationally early in Q1 of 2025…… Our third strategic priority is…… leveraging our strong digital ecosystem….Noodles has 53% of sales from digital channels and 26% of orders from loyalty members and our loyalty members spend twice as much per year as non-loyalty members…..During Q1 we increased our active rewards audience and transactions while reducing our discount rate by using smart segmented and personalized offers…….a sustained commitment to grow catering sales…. ultimately create a culture where we can confidently say yes to every order….Catering is roughly 1.5% of sales today. We believe it can be 5% of sales or more……reduce the complexity in our operating model and enhance our menu offering ……..our cost structure is now more closely aligned with the size of our current business….also created a smart cost savings team….”

CRACKER BARREL

In July of 2023, Julie Masino was named the CEO of the company. She was President of International Taco Bell and also led US Taco Bell. She also worked as CMO of Starbuck’s China business and worked for Coach, J Crew and Macy’s. While her experience at youth-focused international brands does not correlate with Cracker Barrel’s customer base, 63% of which are over the age of 45, a fresh look may be especially useful to revitalize the Cracker Barrel brand. The Conference Call on May 16th discussed the planned strategic transformation, including an 80% reduction in its dividend.

The Playbook at Cracker Barrel:

“…. I believe Cracker Barrel was one of the industry’s most iconic and differentiated brands with high guest affinity, a great culture, a national footprint and a strong balance sheet…..I also believe, however, that the brand has lost some of its shine…I believe that the company’s strength more than outweighed its challenges…….. with the proper strategic focus, we could put the ship on an outstanding course….. to ignite growth, we must revitalize the brand….…The study we undertook highlighted and confirmed the various core positives…. such as the distinctiveness of the brand and the strong affinity it has with consumers……the challenges we face and why a transformation is necessary….. research showed we generally rank in the middle of the peer set across many of these attributes, and we are not leading in any area…..compared to fiscal 2019, our comparable store traffic year-to-date is down approximately 16%……reality is we’ve lost some market share, especially at dinner….our strategy revolves around 3 critical imperatives: first, driving relevancy; second, delivering food and an experience that guests love; and third, growing profitability….we are just not as relevant as we once were. We need to address….. by refreshing and refining the brand…..our marketing and messaging, our delicious food and unique retail products, our visual identity and atmosphere, and our in-store and off-premise experience….. Cracker Barrel is known for our home style country cooking, so we need to enhance our menu and make it more relevant to guests. We also have to make it easier to execute for our employees and help us reduce our fixed labor requirements….Simply put, we have to have more food, especially at dinner, that is authentically Cracker Barrel that speaks to more current tastes. In February, we launched a core menu revamp test that included approximately 20 new items, several modified items and over 20 deletions. We’ve been pleased……8 of the new lunch and dinner entrees are in the top 20 for entree product mix at these stores…..We have begun to realign our pricing tiers and optimize them based on more sophisticated criteria. We currently have 5 pricing tiers……approximately 60% of our stores are in a single tier, which happens to also be the tier with the lowest pricing……For example, we have stores in metro areas with an average annual household income of $55,000 in the same pricing tier as one with $90,000….Historically, Cracker Barrel has…..probably relied a little too much on what was perceived to be the timeless nature of our concept…..after launching in mid-September, we already have nearly 5 million Cracker Barrel Rewards members, which is approximately 25% higher than our initial projections.”

Roger Lipton of Lipton Financial Services was a contributor to this article.

Disclaimer

Investing501 uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The articles and reports published by Investing501constitute the author’s personal views only and are for entertainment purposes only. They are not to be construed as financial advice in any shape or form. Investing501 does not predict the price at which the securities of any company may trade at any time. Every investor has different strategies, risk tolerances and time frames. You are advised to perform your own independent checks, research, or study, and you should contact a licensed professional before making any investment decisions. From time to time, the author may hold positions in the stocks mentioned in articles published by Investing501. To the extent the author does have such positions, there is no guarantee that he will maintain such positions. Neither the author nor any of its affiliates accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein