UGI Corporation (Symbol: UGI). One Hour Analysis: Weak Performance at AmeriGas Division Obscures Strong Performance of Natural Gas Utility and Midstream Assets.

Recent Management Changes Could Help Unlock the Value of Those Assets with Improvement or Sale of AmeriGas.

You've got to know when to hold 'em

Know when to fold 'em

Know when to walk away

And know when to run

Kenny Rogers

Market Data

Price: $30.25

Market Capitalization: $6.44B

Cash: $.213M

Debt: $7.1B

Enterprise Value: $13.327B

EBITDA: 1.709B

EV/EBITDA Multiple: 7.8X

Business Description:

UGI Corporation, together with its subsidiaries, engages in the distribution, storage, transportation, and marketing of energy products and related services in the United States and internationally. The company operates through four segments: Utilities, Midstream & Marketing, UGI International, and AmeriGas Propane.

Management’s Elevator Pitch:

Summary

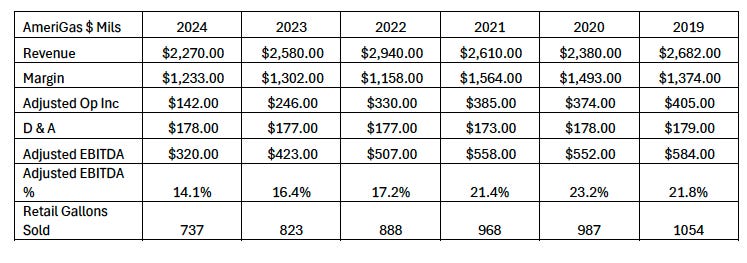

AmeriGas acquisition has not been a success.

o AmeriGas EBITDA has declined from $584M in 2019 to $320M in 2024

o EBITDA margin has declined from 21.8% in 2019 to 14.1% in 2024.

o Retail gallons sold have declined by approximately 30% due to poor execution/customer service and warmer than usual weather.

o UGI has taken $850M in impairments on AmeriGas the last two years. Nearly 50% of initial goodwill.

· UGI recently hired a new CEO and a new President for the AmeriGas division. They appear to be ready to address the long-standing issues with AmeriGas.

o For the first time, AmeriGas has to stand on its own.

o No additional equity.

o AmeriGas recently entered into a new $200M revolver that eliminated a restrictive debt-to-EBITDA ratio covenant. This increases management flexibility in resolving division’s issues.

o Guidance for the division seems reasonable (lower volumes in 2025).

· We believe that management would prefer to sell AmeriGas in order to focus on the growing and profitable Nat Gas and International LPG businesses.

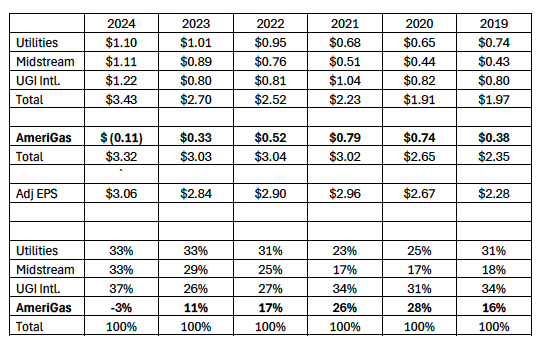

o Utilities division has grown EBITDA from $230M in 2019 to $400M in 2024.

o Midstream and Marketing division has grown EBITDA from $170M in 2019 to $310M in 2024.

o International LPG division has grown EBITDA from $260M to $320M.

· Current valuation would seem to provide reasonable support even in the event that AmeriGas business does not turnaround.

o 5% dividend yield is well covered by cash flow and 10X earnings is one of the lowest valuations in the nat gas utility industry. EV/EBITDA of 7.8X is also one of the lowest for a regulated gas utility.

· UGI other assets are performing well and are attractive acquisition candidates, but we feel any acquirer would like to see AmeriGas stabilized or sold before acquiring the rest of the company.

· Investors could see 30-50% increase in the value of the stock once AmeriGas is stabilized/sold. Could re-rate to 3% dividend yield or 15X EPS of $2.90 per share.

Why does the opportunity exist?

The Acquisition of AmeriGas in 2019 Has Not Been Successful.

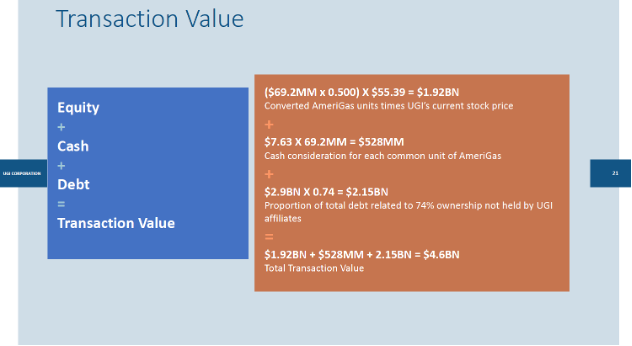

· In 2019, UGI acquired the 74% of AmeriGas it did not already own for $4.6B.

· AmeriGas acquisition has clearly not been a success.

o EBITDA has declined from $584M in 2019 to $320M in 2024

o EBITDA margin has declined from 21.8% in 2019 to 14.1% in 2024.

o Retail gallons sold have declined by approximately 30% due to poor execution/customer service and warmer than usual weather.

o Original guidance was for acquisition to help UGI earn $3.75 - $4.05 per share in FY23. In FY32 the company only earned $2.84 per share.

Stock performance before the acquisition:

Stock performance after the acquisition:

Company has missed guidance several times and lowered its long-term EPS growth target since the AmeriGas acquisition.

Poor performance at Amerigas is obscuring relatively strong performance of the other divisions.

Overview of AmeriGas Acquisition:

A Combination of Factors has Contributed to a Significant Decline in EBITDA Since the Acquisition.

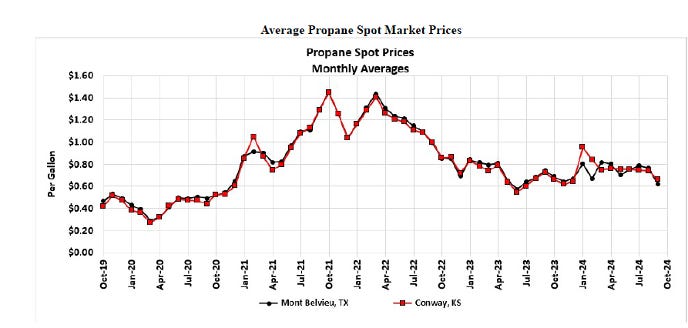

· Lower Propane Prices

o Since 2021 propane prices have declined nearly 50%. This has put pressure on margins.

· Poor Execution has caused significant customer attrition.

o Poor execution has led to a significant decline in customers.

Customers have declined from 1.4M in 2021 to 1.1M in 2024.

· Warmer Weather also reduced demand.

o Weather has been warmer than normal for at least three of the last five years in AmeriGas service area.

· Over the last two years, poor performance has resulted in the write-down of nearly 50% of goodwill associated with the AmeriGas acquisition ($850M).

New CEO of UGI and President of AmeriGas Could be the Catalyst to Finally Fix AmeriGas.

In November 2024, UGI announced that Bob Flexon would become the CEO, He replaced Mario Longhi, who was interim-CEO since November of 2023. Mr. Longhi’s previous employer was U.S. Steel. Unlike Mr. Longhi, Mr. Flexon has extensive experience in the utility industry (see below). In December, Michael Sharp was named president of AmeriGas. Mr. Sharp and Mr. Flexon worked with each other at Dynegy. We believe these two hires could finally be the catalysts necessary to stabilize the business and eventually lead to a sale of the division.

Who is Bob Flexon?

Resume:

· Serves as Chair of the Board of Nexus Water Group, a privately held company, a position he has held since 2024.

· Serves as Chair of the Board of Capstone Green Energy Holdings, Inc., a position he has held since 2021. Joined the Capstone Board as a director in 2018 and also served as Capstone’s Interim President and Chief Executive Officer from August 2023 until March 2024 to lead the Company’s restructuring.

· Previously Chair of the Board of Directors of PG&E Corporation (NYSE: PCG), a position he held since the Company’s emergence from Chapter 11 in 2020 until October 31, 2024.

· Beginning 2021, as a result of winter storm Uri, he served as a director of The Electric Reliability Council of Texas, Inc. and will depart the Board at the end of his term in December 2024.

· Served as President and Chief Executive Officer and Director of Dynegy Inc. (2011 to 2018).

· Prior to his service with Dynegy, Mr. Flexon was UGI’s Chief Financial Officer (February 2011 to July 2011).

Who is Michael Sharp?

Press Release:

· Mr. Sharp joins AmeriGas from Talen Energy, LLC where he has served as Vice President of Asset Management since 2023 and was responsible for integrating the operational and commercial aspects of the fleet to maximize long-term value. Prior to Talen Energy, Mr. Sharp held several senior leadership positions, including Chief Operations Officer at Virgin Islands Water & Power Authority, Senior Vice President of Commercial Asset Management at Dynegy, and General Manager of Commercial Generation for Duke Energy.

· “I am pleased to welcome Michael to AmeriGas, and I look forward to our reuniting and working closely together to drive performance in the business,” said Bob Flexon, President & CEO of UGI Corporation. “Having worked closely with Mike before, I am very familiar with his leadership capabilities, his thoughtful approach to business, and his ability to embrace and drive change that leads to performance. Mike’s experience in physical and financial commodity management, hands on operations, and driving an operating culture will be of significant value to AmeriGas, its customers, and employees. He has a proven track record in transforming and maximizing the value of assets and organizations and creating an environment that promotes a strong safety mindset and a high-performing customer service-oriented culture. I am happy to have someone with his capabilities joining us to lead AmeriGas.”

Last Three Conference Calls Comments Show Change in Strategy at AmeriGas

We are always interested in looking at companies that have had long-term problems and have recently made management changes. Of course, there is no guarantee that they can fix the problems. As Warren Buffett said, “When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.” However, we believe that the new CEO and new President have significant relevant experience in the utility industry and could be a better fit than the previous CEO. It is always difficult to change employee behavior and culture, which is one of the biggest challenges these new managers face. AmeriGas has been underperforming for quite some time and the propane industry in general and been declining.

What gives us some encouragement is the comments that management (including the new CEO) have made over the last three conference calls. There has definitely been an increase in the sense of urgency and focus on the problems. While progress has been made, there is a significant amount of work to still be done. It is interesting that the new President left Talen Energy, which has been at the forefront of the nuclear renaissance and seems to have a very bright future.

Q2 FY24 Conference Call:

Mario Longhi - Interim CEO

As we announced yesterday, we completed the strategic review of the LPG businesses, primarily focused on AmeriGas, that was launched at the end of August 2023. The process was extensive and together with our financial advisers, we considered different scenarios including a potential sale, spin and joint venture of AmeriGas. Although, we conducted a due diligence process with multiple strategic and financial parties, the Board decided that in the current market the company should focus on a restructuring and operational improvement plan for AmeriGas. The Board remains open to all opportunities to maximize shareholder value.

Similarly in the US, AmeriGas has a market-leading position in retail propane distribution in a highly competitive market. We must run that business differently and better to realize the benefits of that position.

Bob Beard - COO

As you are aware, AmeriGas has encountered operational challenges over the past several years that have impacted our service standards, resulted in higher customer attrition rates and placed significant pressure on our debt covenants. The strategic review helped us better frame the weaknesses in our operating model. While these challenges are not new and you've heard us discuss several of them over time, the strategic review identified a level of detail that was necessary for us to formulate a more comprehensive and effective action plan to address those shortcomings. We gained more clarity on what needs to be done, and we're committed to doing it.

Our overall focus will be on improving our performance in customer satisfaction, service reliability and overall operational excellence. We are committed to addressing these challenges.

Also of importance, we are working to adjust our capital structure and address AmeriGas' balance sheet, which is currently constrained..

Overall, with diligent execution of our new operating strategy and a renewed commitment to our values, we anticipate that AmeriGas will begin to see stability in its operating performance and resume being a cash contributor to UGI by fiscal 2026.

Since the beginning of fiscal 2023, we have reduced absolute debt at AmeriGas by approximately $340 million, executing on our objective to strengthen and provide more buffer on the credit metrics. During the back half of fiscal 2024, our goal is to reduce debt by another $350 million to $450 million, using both, free cash flow generated from AmeriGas, and between $200 million to $300 million of parental contribution.

As Bob mentioned, he is spearheading the action to stabilize and optimize AmeriGas. To support those actions, we will pursue options to address the revolver that while undrawn has restricted debt covenants. This will enable the business to work through the planned operational improvements without quarterly covenant compliance pressures.

Between fiscal 2024 and 2026 as we focus on strengthening the balance sheet and stabilizing AmeriGas, we expect that dividends will stay flat, while still achieving a payout ratio close to 50%. Now as we move to fiscal 2027, we anticipate returning to our targeted 4% dividend growth rate over the long term.

Q3 FY24 Conference Call:

Mario Longhi - Interim CEO

At AmeriGas, we continue to execute on our objectives to stabilize and optimize the business and this includes reducing costs and eliminating inefficiencies. Across the enterprise, the actions taken to optimize our cost profile and create greater efficiencies have begun to provide a meaningful contribution to our financial performance and we expect to achieve the target of $70 million to $100 million in permanent cost savings by the end of fiscal 2025. With this backdrop and based on our assumptions for the fourth quarter, we are on track to deliver on our fiscal 2024 adjusted EPS guidance range of $2.70 to $3.

Next, we repurchased $475 million of the 2025 senior notes at AmeriGas using cash on hand, $315 million in parental contribution and other sources of liquidity. With these actions, UGI's Q3 leverage ratio was 3.9 times within our target range of 3.5 times to 4 times. Most importantly, AmeriGas leverage was 4.9 times.

Lastly, on August 2nd, AmeriGas entered into a new five-year senior secured asset-based lending revolver, which has a credit line of $200 million. Concurrent with the execution of the new revolver, AmeriGas terminated the prior facility and with it eliminated the debt-to-EBITDA covenant ratio.

Q4 FY24 Conference Call:

Sean O’Brien -CFO

And now this brings me to our focus on strengthening the balance sheet, which is crucial to sustaining operations and driving earnings growth. At AmeriGas, we reduced absolute debt by approximately $460 million and replaced the pre-existing revolver, which had more restrictive debt covenant metrics. This action was important to provide the business with runway to drive better performance. Additionally, we completed over $2.5 billion of debt financing actions across the enterprise to support our ongoing operations and improve liquidity.

Finally, earlier this month, we also increased the borrowing capacity on AmeriGas's revolver from $200 million to $300 million, providing additional liquidity for the business. Looking ahead, we will continue to focus on improving our free cash flow generation and reducing absolute debt through operational actions, monetization of LPG assets, and disciplined capital allocation.

Bob Flexon - CEO

At AmeriGas, fundamental change is needed to reduce customer churn, win back customers, and drive performance in that business, assuring we remain customer focused. We must get back to where customers want to do business with us, and we are their propane provider of choice. While the company is taking action in some of these areas, we are in the early stages, and so fiscal 2025 will be an important year to drive stability and subsequently better business performance.

Next is focusing on optimizing our overall LPG portfolio, pursuing opportunities where the economics make sense to monetize assets, and moving the company to become more heavily weighted to natural gas. With the execution of these priorities and the continued focus on right sizing our balance sheet, the intent is to improve UGI's financial profile for the benefit of our stakeholders.

Thanks, Julien. And then focusing specifically just on AmeriGas on your question, that the immediate action for AmeriGas is really to solidify the business, bring stabilization to it. We've had a good running start of fixing a lot of the past practices that were contributing to the churn of customers. Long way to go, but we've got teams mobilized and there'll be some supplemental talent coming in as well, but right out of the gate, what we need to do is to stabilize that business. I operate under the principle that from a capital allocation standpoint, each business needs to support itself.

So AmeriGas needs to support itself. You're not going to see funds going from the parent company down to AmeriGas. So AmeriGas has to perform. AmeriGas has to work on their balance sheet. And a AmeriGas has to work on providing excellent customer service and really fix our business processes that have gone array over the past few years. So that's where I see spending a lot of my time will be on AmeriGas to really focus on those things and getting the performance up stabilization and driving the cash flow there.

Yeah, so I'll reiterate that. So no equity going down to AmeriGas. It has to support itself. It has to manage its own balance sheet.

I think that will drive the most value for our shareholders to get this thing stabilized as quickly as we can. And like I said, a lot of good things have been happening over the past year, and we're going to keep that momentum going and expand the improvements

Sean O'Brien CFO

Yes, I can take that Gabe. AmeriGas going into 2025 on the volume metric side, there's still work to be done, if you listen to some of Bob's comments. So we are assuming continued volume declines from 2024 to 2025 as the team really works on turning that business around and stabilizing it. So you would expect if you're modeling that to see volume declines continue.

On the positive side, if you looked at the 2024 results on the AmeriGas side of the equation, there was -- we were able to drive some efficiencies in costs. I think costs were down $17 million. And then on the capital conservation side regarding AmeriGas, I believe capital was down about $50 million. So we're trying to make sure that we're controlling the levers while the business is really focused on volumes and really getting that under, as you said, you heard Bob say stabilized.

So for 2025, continued volume declines as the business stabilizes. We're pulling all the levers we can to make sure that the variable nature of cost and capital that we see those efficiencies as we continue to turn the business around.

UGI’s Other Businesses have Performed Much Better.

The poor performance of the AmeriGas division has been obscuring the strong performance of the company’s other divisions. The focus of this analysis has been AmeriGas and the potential for a turnaround there. In the future, we will revisit these divisions. However, there is no doubt that natural gas utilities and midstream assets are extremely popular at these point and unbundling them from AmeriGas should highlight their value to investors or potential acquirers.

Natural Gas Business

Global LPG Business (Includes AmeriGas)

Renewables Business

Disaggregated Financials

Conclusion:

UGI’s stock has significantly underperformed its peers since it acquired AmeriGas in 2019. Several attempts have been made to turn the business around, but up to this point, the division is still not producing the expected results. The poor results at AmeriGas have obscured relatively solid performances of the other divisions. In fact, earnings growth, excluding AmeriGas have been very strong from 2019-2024.

We believe the new CEO and the new President of AmeriGas have the skills and motivation to effect real change at the division. Comments made on recent conference calls increases our conviction that this is the year of “fix it or flip it”. UGI is significantly undervalued relative to its peers and sports nearly a 5% well-covered dividend. While we hate the phrase “you get paid while you wait for the turnaround”, in this case you are getting paid while you wait for a turnaround. Natural gas utility assets and midstream pipelines are in heavy demand by investors and strategic acquirers. At some point, most likely after AmeriGas is stabilized or sold, we believe the value of rest of UGI’s assets will be re-rated higher by investors or acquired by a strategic buyer.

Disclaimer

Investing501 uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The articles and reports published by Investing501constitute the author’s personal views only and are for entertainment purposes only. They are not to be construed as financial advice in any shape or form. Investing501 does not predict the price at which the securities of any company may trade at any time. Every investor has different strategies, risk tolerances and time frames. You are advised to perform your own independent checks, research, or study, and you should contact a licensed professional before making any investment decisions. From time to time, the author may hold positions in the stocks mentioned in articles published by Investing501. To the extent the author does have such positions, there is no guarantee that he will maintain such positions. Neither the author nor any of its affiliates accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.