Themes and Insights from Q4 Conference Calls

Commodity and Labor Inflation is Moderating

Companies have been able to offset rising labor costs with better management of hours, smaller staffs, and price increases.

Companies have not been able to offset commodity cost increases with price increases. But more price increases are on the way (3-5%).

Most companies have 40-60% of their 2023 commodity costs locked in.

Building Costs are up 10-25% over the last few years. Companies are trying to offset rising costs with smaller footprints and more drive-through locations.

Guidance has returned.

After pausing during Covid, unit growth has returned across the industry.

Generally speaking, traffic has not returned to 2019 levels in the casual dining space. Take out increasing at a percentage of sales.

Digital ordering and off-premises sales approaching 40% of total sales at some chains.

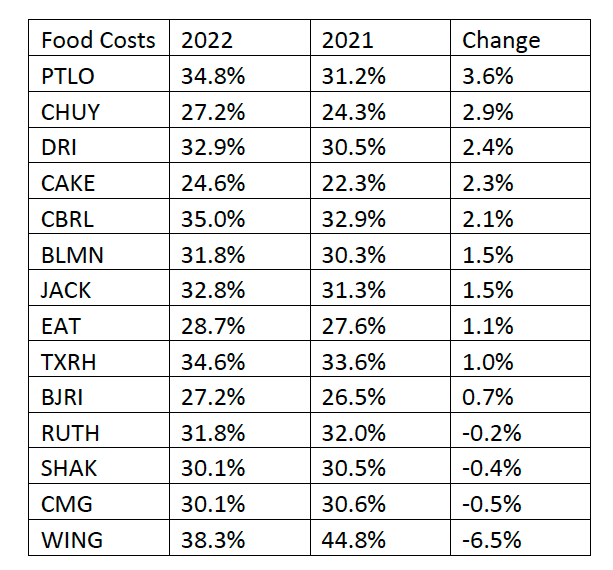

Commodity Inflation Moderating

In 2022, restaurants experienced commodity inflation that ranged from 10-25%, depending on the basket mix. This resulted in 100-300 bps of margin contraction. Restaurants typically hedge 40-60% of their current year commodity exposure. In order to remain competitive with food eaten at home, restaurants generally raised prices less than required to cover the rising commodity costs. In 2023, restaurants are guiding for 2-5% increases in prices, which they believe will be sufficient to cover the expected increase in commodity prices. Depending on the commodity basket mix, restaurants are guiding to LSD-MSD increases in their commodities basket with the first half inflation being higher than the second half of the year.

Conference call comments:

Carrol’s Restaurant Group:

We are expecting to see continued moderation of both commodity and labor inflation over the course of the year relative to the elevated levels in 2022.

From where we stand today, we expect commodity inflation to be in the high single digits for the first half 2023.

As we look ahead, we expect wage inflation in the mid-single digit in 2023 compared to the high single digit we saw last year.

Ruth’s Hospitality:

To give you a sense of the impact of beef prices on our overall financial performance, we estimate that a 10% change in beef costs would impact EBITDA by approximately $6 million to $7 million on an annual basis, all else remaining equal. NOTE: 2022 EBITDA was $84M

But based on the direct visibility that we have, down mid-single digits is what we're planning for.

But we are still expecting mid to -- probably mid-single-digit levels of inflation in both hourly and management wages as we work through the year.

Our research shows that a relatively higher delivery cost during inflationary times leads some customers to prepare meals at home instead of getting them delivered. We believe this dynamic will continue to pressure the delivery category in the short term, as long as consumers' disposable income remains pressured by macroeconomic factors.

Dominos:

We currently project that the store food basket within our U.S. system will be up 3% to 5% as compared to 2022 levels. We expect the first quarter food basket increase to be higher than the rest of the year.

Cheesecake Factory:

We believe commodity inflation will improve as we move through the year and labor will further stabilize as that seems to keep better alignment between cost increases and menu pricing in 2023.

We currently estimate total inflation across our commodity baskets, total labor and other operating expenses to be in the mid-single-digit range, moderating throughout the year.

Wingstop:

In 2022, we saw spot market prices for bone-in wings decline by 44%, which resulted in Wingstop being one of the few brands with significant deflation.

McDonald’s:

I mean, I think in the U.S., we would say we're past the inflation peak and kind of heading on that downward slope. But certainly, we had high inflation, mid-teens in 2022 from a food and paper perspective. I think in 2023, we think our food and paper inflation is going to be kind of mid to high single digits.

I don't think we think inflation will -- in Europe we will start to ease probably until mid-2023. In fact, we'll see some markets in Europe with higher levels of inflation in 2023 than we saw in 2022.

Texas Roadhouse:

For 2023, our commodity inflation guidance remains unchanged at 5% to 6%. We also continue to expect that the majority of inflation for 2023 will be driven by higher beef costs.

BJ’s Restaurants:

We are expecting food cost inflation in the mid single-digit area in 2023.

Dine Brands Global:

So, based on the current trends, we're expecting sort of mid-single digit inflation for our two brands a little bit higher for IHOP, a little bit lower for Applebee's, but roughly in that range, on top of sort of the 18% 20% inflation that we experienced in 2022.

Wendy’s:

As well as easing commodity and labor inflation in the mid-single digits will drive year-over-year margin expansion.

Brinker International:

Based on the current market condition, we are currently expecting commodity inflation of mid-single-digits for fiscal 2023 with high-single-digits for the first quarter.

Portillo’s:

In '23, we expect our overall commodity inflation will ease and our currently estimated mid-single digit commodity inflation for the full year. As you would expect, it will start high and taper down over the course of the year.

our labor inflation in '22, we saw double digit inflation that started to come down a bit in the back half of the year. So we were at about 9% labor rate inflation in the fourth quarter. I expect that to come down as, as we start to lay up some of those numbers, but we do expect to make the continued investments in labor as well in '23.

Bloomin’ Brands:

Commodity and labor inflation are expected to be in the mid single digits range.

Our inflation estimates would make 2023 the second most inflationary year in the history of our company.

Shake Shack:

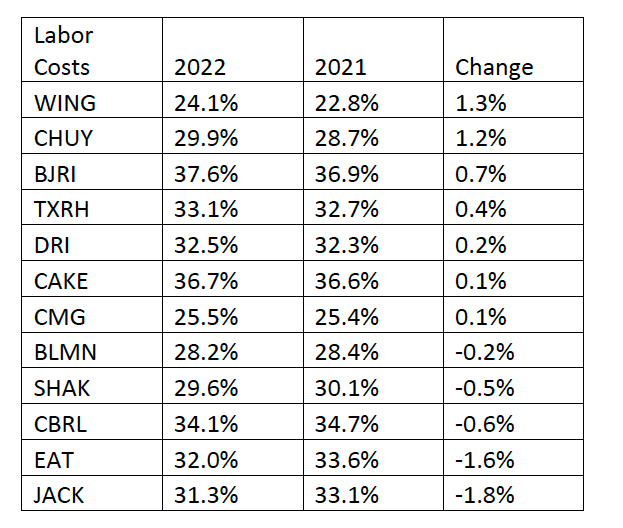

Labor Cost Increases Mostly Offset by Price Increases and Operating Leverage.

Unlike commodity cost inflation, restaurants were able to offset most if not all of their wage increases. While wage inflation was also in the 5-10% ranges, the combination of price increase, operating leverage on higher sales and better labor hours management resulted in a more modest impact on margins. Labor costs are expected to increase in the MSD range again in 2023.

Many chains have commented that labor tightness is easing.

Carrol’s Restaurant Group:

As we look ahead, we expect wage inflation in the mid-single digit in 2023 compared to the high single digit we saw last year.

Cheesecake Factory:

We believe commodity inflation will improve as we move through the year and labor will further stabilize as that seems to keep better alignment between cost increases and menu pricing in 2023. We are modeling net total labor inflation of about 6% when factoring in the latest trends in wage rates, channel mix as well as other components of labor.

In 2022, we had over 1 million applications. And as of January, applicants available to hire were more than 3 times what they were a year ago, with approximately 57 applicants for every one need.

Wingstop:

And obviously, part of what helps us do that is just the unique labor profile we have at Wingstop where at a $1.6 million AUV, you can run a Wingstop with as few as 4 team members.

Yum Brands:

And then on the labor side, we're seeing an increase in applications.

BJ’s Restaurants:

With commodity and labor costs now each up approximately 30% since 2019, menu pricing will play a role in our expected margin growth this year. To-date, we have priced more conservatively than many peers during the recent period of rapid inflation, which has benefited our guest traffic trends and value scores.

Wendy’s:

We anticipate that the benefit of our sales growth, including cumulative pricing of approximately 6%, as well as easing commodity and labor inflation in the mid-single digits will drive year-over-year margin expansion.

Bloomin’s Brands:

Modeling and labor inflation are expected to be in the mid single digits range.

Chipotle Mexican Grill:

December being one of our best months in the past two years for both hourly and salary turnover rates. And our staffing levels continue to improve with 90% of our restaurants fully staffed. This, combined with better stability, leads to more experienced teams.

Building Costs are up 15-25% over the last few years. Companies are trying to offset rising costs with smaller footprints and more drive-through lanes.

Building costs have increased about 15-25% on a square foot basis over the last two-three years. As margins have declined due to rising commodity and labor costs, many chains are seeing lower cash on cash returns on their store base. As off-premises sales increase as a percentage of total sales (i.e. delivery and carryout), chains are choosing to shrink the footprint of their new stores and are including more drive-through lanes to increase volume with less labor. Chipotle has been extremely successful with their Chipotlane concept, driving $1M of additional revenue per store.

Cheesecake Factory:

In 2022, total construction costs to build our restaurant premises average approximately $1,000 per interior square foot.

In 2019, total costs are targeted at approximately $900 to $1,000 per interior square foot for The Cheesecake Factory restaurants.

BJ’s Restaurants:

In 2022, our current restaurant prototypes average approximately 7,500 square feet with seating for as many as 250 guests with a targeted all-in gross construction cost of approximately $6.0 million to $7.0 million.

In 2019, our current restaurant prototypes average approximately 7,500 square feet with seating for as many as 250 customers with a targeted gross construction cost of approximately $4.5 million to $5.5 million.

Chuy’s:

For our new unit openings in 2023, we estimate the cost of a conversion or ground-up buildout will require an average net investment of approximately $4.5 million.

For our new unit openings in 2019, we estimate the cost of a conversion or ground-up buildout will require a total cash investment of $2.5 million to $3.5 million.

Shake Shack:

In 2022, the average investment cost was approximately $2.7 million, or approximately $2.4 million net of tenant improvement allowances received from our landlords.

In 2019, the with an average investment cost of approximately $2.4 million, or approximately $2.0 million net of tenant improvement allowances received from our landlords.

Texas Roadhouse:

In 2023, we expect our capital expenditures to be approximately $265 million as we currently plan to open approximately 25 to 30 Texas Roadhouse and Bubba’s 33 company restaurants.

In 2020, we expect our capital expenditures to be $210.0 million to $220.0 million, the majority of which will relate to planned restaurant openings, including at least 30 company restaurant openings in 2020

But you probably have seen -- your ballpark 10% to 15% increases in the cost of building a restaurant. But we're also embedded in that is, we're building a bigger restaurant than we have in the past. So, it's hard to separate those two items out.

Dine Brands:

Over the last two years now, the restaurant industry experienced rising land acquisition costs and construction cost inflation.

Portillo’s:

The Colony has averaged $48,000 in sales per day since the grand opening. Now that annualizes to $17 million per year, and that's a crazy number, so please don't model that.

Unit Growth is Normalizing with Some Companies Increasing Their Growth Plans

Restaurant Brands:

Popeyes In 2022, we opened over 180 net new stores outside of North America. That's a nearly 7x increase versus 2017 levels. We also closed out 2022 with some improved momentum in development, delivering 754 net new restaurants in the quarter and 1,266 net new openings for the year.

Ruth Hospitality:

In 2023, we expect to open five company restaurants, including one new opening in the Casino Resort in Michigan. In addition to these new openings, we expect one relocation in the second quarter and as many as 10 remodels and refreshes to our portfolio throughout the year.

Dominos:

We are lowering unit growth from 6% to 8% global net unit growth to 5% to 7% global net unit growth.

Cheesecake Factory:

We expect to open as many as 20 to 22 new restaurants in fiscal year 2023, including 5 to 6 Cheesecake Factories, 5 to 6 North Italias and 10 FRC restaurants, including 3 to 4 Flower Child locations.

Wingstop:

We opened 228 net new units globally, representing a 13.2% growth rate, achieving record years for both our domestic and international businesses.

We also see opportunity to maintain this accelerated pace of unit growth and anticipate opening approximately 240 net new restaurants in 2023, which is well above our 3- to 5-year targeted growth rate.

McDonald’s:

Overall, we anticipate almost 4% unit growth from about 1,500 net restaurant additions in 2023.

If you look specifically at the U.S. and IOM segments, we're planning about 400 openings there. That's up about 25% from where we landed on in 2022.

We haven't added new units in the U.S. in eight years. I mean 2014 was the last year that we actually grew restaurants in the U.S. So we've had eight years where we have been focused largely on a remodel program.

Yum! Brands:

We achieved record-breaking industry development, opening 4,560 gross units that translated to nearly 3,100 net new units, beating our prior record set just last year and ending the year with over 55,000 restaurants globally.

First, we expect to deliver on our long-term growth algorithm with healthy unit growth momentum continuing into 2023.

Texas Roadhouse:

Moving on to development, we opened 23 company restaurants across all concepts in 2022. And in 2023, we expect between 25 and 30.

BJ’s Restaurants:

In the fourth quarter we opened the final three restaurants of the year for a total of six new restaurants open in 2022.

We expect to open another five new restaurants in 2023, one of which is a relocation of our Chandler Arizona restaurant to a new prime location in the same trade area.

Wendy’s:

We expect an initial step-up in 2023 and 2024 with an anticipated annual net unit growth rate of 2% to 3%, ramping towards the high end of the range in 2024. We expect growth will increase even further over the longer term as we bring in even more growth-minded franchisees into the system and are anticipating annual net unit growth of 3% to 4% in 2025.

Bloomin’ Brands:

We intend to remodel over 100 locations this year as the beginning of a multiyear effort to touch a large percentage of our business.

We see major expansion opportunities at Outback where our goal is to significantly grow our U.S restaurant base. We intend to grow Fleming's from 65 to 100, and plan for more than double our footprint in Brazil. And finally, keep an eye on Carrabba’s.

Chipotle Mexican Grill:

We opened 236 new restaurants, including 202 Chipotlanes. In 2023, 23 expect 255 to 285 new restaurant openings (including 10 to 15 relocations to add a Chipotlane), which assumes utility, construction, permit and material supply delays do not worsen.

Shake Shack:

We ended the year opening 69 Shacks globally, growing our unit count by more than 18%,

This coming year, we expect to open about 40 Shacks,

Jack in the Box:

Starting essentially from scratch, we have built our new restaurant pipeline by accelerating existing and new development commitments, and approving more sites over the past year than we did in the prior three years.

For example, let's briefly discuss some preliminary results at our newest Jack prototype, the drive-thru only location that opened in Tulsa, Oklahoma in the fourth quarter.

Three of these deals include new franchisees to our system, which make up the first new franchisees in the Jack in the Box system in over a decade.

The brand has never been in Arkansas in its 70 year history that has been over 30 years since our brief and relatively small presence in Florida in the 70s and 80s.

Guest Traffic Continues to Decline for Most Chains, Especially Casual Dining.

Restaurant Brands:

For the quarter, comparable restaurant sales at our Burger King restaurants increased 6.2%, comprised of a 13.3% increase in average check, which was partially offset by a 6.2% decline in traffic.

Cheesecake Factory:

Pricing was 8.5%. Traffic was a positive 0.3%. And the mix was a negative 4.8%

McDonald’s:

It's been fascinating to see how McDonald's traffic in the U.S. has largely declined, most years at least, even as you've added about $1 million in sales per unit

Texas Roadhouse:

1.1% increase in guest traffic.

So I would say the traffic is just a tick over 10% of that 15.8%.

BJ’s Restaurants:

Of note, our comparable sales performance has accelerated in fiscal 2023 to-date, driven by growth in the dining room guest traffic.

Brinker International:

Negative traffic at Chili's of 7.6% was in line with our expectations and was clearly more than offset with the ability to incrementally price and drive mix.

I thought that your traffic in the dining room was down double-digits versus pre-COVID, something like that. And I mean assuming I -- is that right? Yes.

Bloomin’s Brands:

All this is about bringing in restaurant traffic back to pre-pandemic levels.

In our U.S brands, traffic was down 7.3% in Q4, relatively consistent with Q3.

Digital Sales, Including Off-Premises Sales are Approaching 40% at Some Chains.

McDonalds continues to dominate the QSR industry with over 40M downloads in the U.S. alone. This is more than the 2nd, 3rd and 4th brands combined. While there doesn’t seem to be an industry standard for what the term “digital” actually means, generally speaking, a digital sale is a sale made from an app, an in-store kiosk or a third-party delivery partner.

Bloomin’s Brands:

At 24% of U.S sales, Q4 off-premises was slightly lower than Q3. In Q4 approximately 76% of total U.S off-premises sales were through digital channels. Given the emphasis on special occasions we tend to see in Q4 and Q1, this change was expected and was primarily a migration from our curbside business to in-restaurant dining. Importantly, the highly incremental third-party delivery business was flat from Q3 at roughly 12% of U.S sales.

Cheesecake Factory:

The Cheesecake Factory off-premises sales for the fourth quarter totaled 23% of sales for the second consecutive quarter. Additionally, we've not seen any material changes in on-premises incident rates over the past three quarters with incident rates remaining above 2019 levels.

Dominos:

Carryout now comprises approximately half of the orders and about 40% of sales in the U.S.

Dine Brands:

Q4, mark Appleby's eighth consecutive quarter of positive comp sales growth. Our solid momentum resulted in q4 average weekly sales of $52,500 per restaurant. Volume across our sales channels was split with 76% generated by on premise sales and 24% from off premise sales, with 13% coming from to go and 11% from delivery.

IHOP posted positive 2% comparable store sales growth in the fourth quarter, and it represented the brand seven consecutive positive quarterly gain. Average weekly sales of 38,200 were modestly ahead of the prior years 37,500. Our to-go business was 22% of sales and continue to be led by the 14% mix for delivery and traditional takeout generated the remaining 8% of sales.

Cracker Barrel:

I would just say our off-premise business is composed of 40% individual to go pick up, 40% third-party delivery and then 20% like catering and Heat n' Serve.

Off-premise sales were approximately 23% of restaurant sales.

Texas Roadhouse:

For the quarter, our restaurants averaged over $130,000 in weekly sales and To-Go represented approximately $16,400 or 12.6% of these total weekly sales.

BJ’s Restaurants:

We maintained our off-premise weekly sales average in the low 20,000 while generating dine in sales of more than 92,000 in Q4 (22% of sales).

Chuy’s:

Next we will turn to off-premise. Our momentum continued with the growth of our off-premise, which represented approximately 29% of total sales for this quarter.

Brinker International:

One of the big drivers of growth during the quarter was the off-premises business, which delivered an 82% increase versus pre-pandemic levels.

Chili's was just over 30% and Maggiano's was -- sorry, I'm looking at Maggiano's didn't have it memorized right here. Maggiano's -- 27%, Maggiano's.

And then in this new world where a third of our businesses transacted digitally, you're literally always in the market, you could always buy Chili's, whether you're at home or you're out shopping or you're at a restaurant, right?

Darden Restaurants:

Digital transactions accounted for 62% of all off-premise sales during the quarter and 10% of Darden's total sales.

Chipotle Mexican Grill:

Digital sales continue to represent 37% of sales. Speaking of our digital business, it is over $3 billion in revenue and represents 39% of our sales.

Potbelly Corporation:

During the quarter, we reported strong digital engagement, representing 38% of revenue, which, when combined with our perks loyalty program activations, meaningfully contributed to our record fourth quarter top line results. Our digital engagements were further supported by a combination of digital only promotions such as National Cookie Day, Week of Perks, as well as our successful LTO offerings and promotions, which this quarter included the Pastrami Sandwich and the Eggnog Shake.

While our digital business remains strong and is a tailwind for the business, in-shop represented 57% of sales as our customers continue to enjoy the unique dining experience we offer.

Wingstop:

Our digital mix has sustained above 60%, in fact, reached an all-time high in Q4 and represents the stickiness of the new guests we've acquired.

McDonald’s:

These investments are paying off. In the fourth quarter, digital represented over 35% of system-wide sales in our top six markets.

In 2022, the McDonald's App was downloaded over 40 million times in the U.S., greater than the total downloads of the 2nd, 3rd and 4th brands combined. Through our loyalty program, which we've expanded over 50 markets and counting, customers are feeling more connected to McDonald's, which in turn increases visits and frequency.

As we closed the year, we had almost 50 million active loyalty users in our top six markets.

Restaurant Brands:

These results were aided by continued growth in our digital channels, with global digital sales up 24% year-over-year to over $3.5 billion in the fourth quarter, representing over 1/3 of consolidated system-wide sales.

For the full year, we grew digital sales 31% to $13 billion.

Wendy’s:

Our global digital business averaged over 10% sales mix in the fourth quarter and now represents over $1.3 billion business. In the U.S., our strong digital results were driven by growth across both delivery and mobile order channels. Our U.S. loyalty program continued to grow, reaching over 29 million total members at year-end, an almost 40% increase versus year-end 2021. Internationally, Q4 digital momentum accelerated to approximately 17% of sales due in part to our recent loyalty launch in Canada, which is exceeding our expectations and driving a sharp uptick in mobile order transactions.

We expect our momentum will continue with high single-digit global digital sales growth reaching approximately $1.5 billion of digital sales in 2023. As we continue to further refine our tools and customer crew experiences, we expect our digital business to grow to over $2 billion in 2025, representing global digital sales mix in the mid-teens.

Shake Shack:

36% of Shack sales were from our digital channels of app, web, and third-party delivery. And since March 2020, we have obtained 4.8 million digital first-time purchasers in our app and web channel.

Jack in the Box:

On an annual basis, we now generate $500 million in digital sales across Jack and Del Taco. And digital sales represent over 10% of our business at both brands, up from less than 1% in 2019.

Yum! Brands:

Habit's burgeoning digital channel finished the year strong with digital mix ending at 35%, a truly impressive level after only launching in 2020.

Starbucks:

China, just to give you an example, in 2019, digital was about 10% of overall sales in the market. It's now closer to 50%.