Market Data

Price: $14.80

Market Capitalization: $2.99B

Cash: $.482B

Debt: $2.75B

Enterprise Value: $5.25B

EBITDA: $.533B

EV/EBITDA Multiple: 9.9X

Earnings Estimates

2024 $1.00

2025 $1.04

2026 $1.17

2027 $1.31

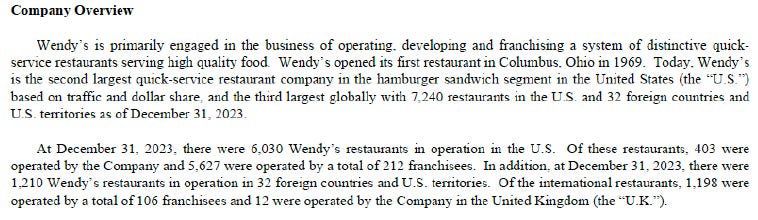

Business Description

Recent Management Comments on Trends:

“As we continue to open new restaurants, we are using data-driven insights to target high-growth trade areas. These new restaurants have delivered an exceptional customer experience, enhanced by technology and improved drive-through and delivery experiences, higher employee satisfaction levels under a more efficient labor model, and U.S. AUVs above $2 million and operating margins above the system average.

Overall, the Wendy's system is incredibly healthy, and our restaurant re-imaging has been completed at 89% of restaurants globally, and we want to further improve our restaurant footprint and overall system health. In order to do so, we conducted a robust review of individual restaurants to ensure they meet our expectations for sales, have the profitability to fuel growth, and deliver the Wendy's brand experience for customers. Following this review, I have made the strategic decision to close additional restaurants this year that are outdated and located in underperforming trade areas. These restaurants have AUVs of approximately $1.1 million and operating margins well below the system average. We have designed this initiative to ensure that over time, many of these units will be replaced by new restaurants at better locations with significantly improved sales and profitability. We anticipate that total closures in 2024, including additional closures in the fourth quarter, will be offset by new restaurant openings this year, leaving our net unit growth approximately flat compared to the prior year. By the end of 2024, we will have opened more than 500 new restaurants over the last two years and have the confidence we will deliver an elevated growth in 2025 and the years to come. As we shared last quarter, we have development commitments in place to meet our 2025 new build goal, which supports our previously stated outlook for 3% to 4% net unit growth.”

My first job was working at the Wendy’s restaurant just down the street from the corporate headquarters in Dublin, OH. It was used as a training store for managers going through the management training program. I started on fries and by the end of the summer I was working the main grill!!! I think this experience is why I have always followed, analyzed and invested in restaurant stocks (not all successfully and of course missed the huge winners like Chipotle so take this analysis with a grain of salt). I also had a fraternity brother that was a co-founder of Buffalo Wild Wings and Wecks (yes that Buffalo Wild Wings). Needless to say, Wendy’s has always been a stock I have owned off and on over the years and continue to follow closely. So, with rose colored glasses here is a look at that Hot ‘N Juicy dividend yield and see if it is sustainable and worth the operating risk.

Main Investment Points

Wendy’s pays a $1.00 per share dividend ($205M in cash a year). The current yield on the stock is 6.8%.

Excluding Fat Brands, the current yield is one of the three highest in the restaurant industry (Bloomin Brands yield 7.65%, Dine Brands Global yield 6.57%).

Bloomin Brands and Dine Brands Global are struggling brands with significant leverage and virtually no growth in their store base. Wendy’s system seems in much better financial shape.

Same-store sales have been positive for over 10 years and the company is growing units 1-2% a year.

The dividend was raised to $0.25 per share from $0.13 per share in 2023. The yield on the stock in 2023 was approximately 4.5%.

The business has been performing better than the share price would indicate.

Company is growing units by 1-2% a year.

Same-store sales have been positive for over 10 years.

After a previous attempt failed, the company’s newest breakfast strategy appears to be gaining traction.

Relaunched in 2020 with a goal of 10% of sales by 2022.

Since 2022 breakfast sales have ranged from 6% to 8.5% of sales.

Company goal is to increase breakfast sales 50% over the next two years.

Company store (18% of pre-SG&A operating income) margins continue to lag the peak margins by 160bps and are no higher than 2019.

Wendy’s has lagged behind its main competitors like McDonald’s, Taco Bell and Burger King in rolling out a digital strategy.

While digital sales now account for approximately 17% of sales, Wendy’s still lags McDonald’s (25% of systemwide sales), Burger King (20% of systemwide sales) and Taco Bell (55% of systemwide sales). Wendy’s has 45 million loyalty members, which is significantly smaller than the 166 million loyalty members that McDonald’s claims.

We believe this is a significant competitive disadvantage.

The restaurants with the highest digital loyalty memberships (MCD, YUM, DPZ, SBUX, CMG, etc.) tend to have stronger same-store sales and have the ability to personalize offers to those members to drive higher frequency of visits and higher average checks.

While Wendy’s has made steady progress from 10% of global sales in 2021, to 17% in 2024, it still has a significant way to go to become more competitive with its peers.

A large stock buyback program has been value destructive.

Lots of investors talk about “shareholder yield” or dividends + stock buybacks dividend by market capitalization. We tend to use free cash flow yield because companies frequently use debt to finance the stock buybacks, which to us is usually unsustainable. We believe that is the case with Wendy’s.

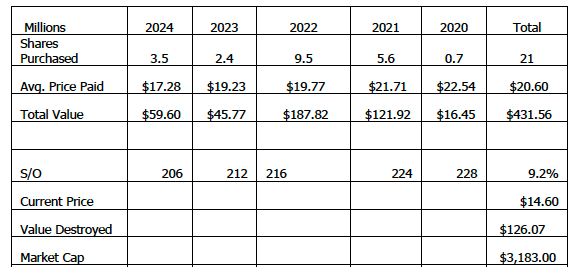

Company has spent $690M on stock repurchases since 2020. The company bought back 9% of shares outstanding at an average price of $20.60 per share.

The company has made significant management changes over the last year.

We are always interested in looking at companies with significant management changes, especially at the top. Wendy’s has made nine significant changes in management and at the Board level in the last twelve months. Kirk Tanner replaced Todd Penegor, who was CEO for eight years. The company also has a new CFO, US and International Presidents and a new CMO.

Trian Partners owns 15% of shares outstanding and has two Board seats. What is their exit strategy?

Nelson Peltz and Trian Partners have been involved with Wendy’s since 2008 when the firm combined Wendy’s and Arby’s. Arby’s was sold in 2011. Trian’s ownership has been as high as 20%. The firm has considered making a bid for the company in 2022.

Trian Partners currently owns 30.5M shares or approximately 15% of Wendy’s shares outstanding. The company has been a seller in recent years.

Two members of Trian currently sit on the Board.

Nelson Peltz – stepped down as Chairman in September 2024.

Peter May – Co-founder and President of Trian

Matthew Peltz – Partner

What is their exit strategy?

What Could Go Wrong?

Companies don’t trade with a yield that is significantly above their peers for no reason. What could investors be concerned about?

While there are always macro concerns about the “consumer weakening” or “inflation in the QSR space is higher than food at home inflation”, we believe Wendy’s is handling them as well as its peers and these concerns will always be there.

Margins at the corporate stores not improving

Lack of further success in breakfast initiative

Increased leverage from stock repurchases.

Digital loyalty programs do not achieve goals.

Wendy’s releases Q4 2024 earnings on February 13th and will have an Investor Day on March 6th, 2025.

All of this analysis could be rendered as worthless after these events.

How the Business is Performing

A dividend yield of nearly 7% for a restaurant company would seem to imply a dying business under financial distress. However, none of the key financial indicators are signaling a significant decline in the underlying business. In this section we will look at metrics such as unit growth, same-store sales, margins, digital sales and the company’s breakfast initiative. It is important to keep in mind that 95% of the company’s stores are franchised, which lowers operating risk for the company.

The company is growing units

One sign of health of a restaurant company is unit growth. Wendy’s is growing units at a small, but consistent basis.

Wendy’s same-store sales have been positive for over 10 years. Average unit volumes continue to increase.

Unlike other high yielding restaurant companies, Wendy’s has had consistently positive same-store sales.

However, most, if not all, of the increase has come from higher prices as traffic has typically been negative.

Average Unit Volumes (UAVs) have also been trending up and are now nearly $2M per store. This is not a sign of a weakening restaurant concept.

Wendy’s has lagged behind its main competitors like McDonald’s, Taco Bell and Burger King in rolling out a digital strategy, but they are addressing the shortfall.

While digital sales now account for approximately 17% of sales, Wendy’s still lags McDonald’s (25% of systemwide sales), Burger King (20% of systemwide sales) and Taco Bell (55% of systemwide sales). Wendy’s has 43 million loyalty members, which is significantly smaller than the 166 million loyalty members that McDonald’s claims.

We believe this is a significant competitive disadvantage.

The restaurants with the highest digital loyalty memberships tend to have stronger same-store sales and have the ability to personalize offers to those members to drive higher frequency of visits and higher average checks.

While Wendy’s has made steady progress from 10% of global sales in 2021, to 17% in 2024. It still has a significant way to go to become more competitive with its peers.

The good news is that digital sales showed a 40% YOY increase in both Q2 and Q3 FY24.

The relaunch of breakfast in 2020 appears to be gaining traction.

After a previous failed attempt, the company’s breakfast strategy appears to be gaining traction.

Relaunched in 2020 with a goal of 10% of sales by 2022.

Since 2022 breakfast sales have ranged from 6% to 8.5% of sales.

Company goal is to increase breakfast sales 50% over the next two years.

One concern investors could have is the push to establish a larger position in breakfast has increased advertising spend.

Since the rollout, the company has been spending $20-$22M a year to drive growth in breakfast sales.

The company is increasing spending to $27M in FY24 and FY25 to drive growth.

Company-owned stores are performing OK.

While only 5% of the systemwide stores are company owned, they still generate 18% of operating income before SG&A.

While company operated margins are down 150 bps from their peak in 2021, they are still healthy at 15.3%.

Company restaurant level margins are lower than they were in 2019. While the company has been able to improve food cost margins (price increases above inflation) and occupancy and other costs (smaller stores and higher percentage of drive-through business), mandated wage hikes have caused labor costs to increase almost 200bps as a percentage of revenue.

Without increases in guest traffic, we believe it will be difficult for the company to leverage labor costs and return company operated restaurant margins to previous highs.

So How Sustainable is the Dividend?

A dividend over 6.7% for a restaurant stock that is not in financial distress is rather unusual. Investors could be assuming the dividend is unsustainable, will not grow or that an impeding cut could be coming. In this section we will look at the sustainability of the dividend.

The dividend seems more than covered by cash flow after capital expenditures.

The current dividend consumers approximately $205M a year in cash flow.

The company has been generating between $350M and $360M in cash from operations.

Because the company is a franchisor, capital expenditures of $85M per year only take up 20-25% of cash flow.

Since the company increased its dividend from $0.05 per share in 2020, to $0.25 per share in 2023, dividends as a percentage of cash flow has increased from 23% to 60%. It does seem unlikely that the dividend will be increased any time soon.

Even after accounting for Capital Expenditures + Dividends, the company generates around $60-$80M in FCF.

As we mentioned, many investors look at dividends + stock buybacks and calculate a “shareholder yield” when looking at companies. Using this methodology, Wendy’s has an approximate 10% shareholder yield. However, we do not think the pace of the stock buybacks are sustainable in the long-term.

The company currently has $250M worth of a stock repurchase authorization that expires in February of 2027.

Since 2020 the company has bought back 21 million shares (9% of total shares outstanding) at a cost of $431M. The average price paid is $20.60 per share.

The company is sitting on approximately a $120M loss on those buybacks.

The buybacks have been partially funded with cash on the balance sheet and debt.

Unrestricted cash has declined from $746M in 2022 to $482M.

Net debt has increased from $2.106B to $2.26B

The company has repurchased $300M worth of stock over that period.

Those repurchases have exceeded CFO – Cap Ex – Div by $100M over that time frame.

The company has been taking excess cash on the balance sheet and returning it to shareholders through stock buybacks.

The Company has Made Significant Management Changes over the Last Year.

We are always interested in looking at companies with significant management changes, especially at the top. Wendy’s has made nine significant changes in management and at the Board level in the last twelve months. Kirk Tanner replaced Todd Penegor, who was CEO for eight years. Below is a list of the appointments.

Jan 18th, 2024 - Kirk Tanner appointed as CEO

31 Years at PepsiCo

At PepsiCo, he oversaw the $26+ billion business unit, which accounts for approximately 30% of PepsiCo's overall business, driving operational performance and revenue growth, the incubation and launch of new products and the entrance into new markets over the course of his tenure.

Feb 26th, 2024 - Matt Spessard appointed as CIO.

Six years at Inspire Brands.

VP technology at SONIC

Also worked at YUM! Brands, Church’s Chicken and Braum’s

May 6th, 2024 - Lindsay Radkoski appointed as CMO

Worked at Wendy’s since 2011.

May 23rd, 2024 - Abigail Pringle appointed as President US and E.J. Wunsch appointed as President International.

Abigail Pringle

Worked at Wendy’s since 2002.

E.J. Wunsch

Worked at Wendy’s since 2016.

September 6th - Arthur B. Winkleblack appointed as non-executive Chairman of the Board.

Board member since 2016.

Worked at Ritchie Bros. Auctioneers and Heinz.

September 16th, 2024 – Appointed John Min as Chief Legal Officer and Mary Greenless as Senior Vice President, US Operations.

John Min

14 years at Kellanova/Kellogg

Mary Greenless

25 years experience at Subway and Coca-Cola.

November 18th, 2024 Ken Cook appointed as Chief Financial Officer.

Worked at UPS for 20 years.

Trian Partners Currently Owns 15% of the Shares Outstanding. What is Their Exit Strategy?

Trian Partners have been involved with Wendy’s since 2008.

Trian Partners was instrumental in the merger of Wendy’s and Arby’s.

Arby’s was sold in 2011.

Trian Partners ownership has been as high as 20% in the past.

Firm currently owns 30.5M shares or approximately 15% of Wendy’s shares outstanding. The company has been a seller in recent years.

Two members of Trian currently sit on the Board.

Nelson Peltz – stepped down as Chairman in September 2024.

Peter May – Co-founder and President of Trian

Matthew Peltz – Partner

We do not believe Trian will attempt another take over.

We also do not believe that a sale of the company will occur in the foreseeable future.

Some of the current discount valuation to its peers for Wendy’s could be shareholder concerns about governance issues.

Could Trian force the company to leverage up to take them out?

What Could Go Wrong?

Companies don’t trade with a yield that is significantly above their peers for no reason. What could investors be concerned about?

While there are always macro concerns about the “consumer weakening” or “inflation in the QSR space is higher than food at home inflation”, we believe Wendy’s is handling them as well as its peers and these concerns will always be there. We have always believed that solutions to macro issues is a what management gets paid to do. The companies that have management teams that are better at dealing with the issues generally have better performing stock prices.

Margins at the corporate stores are about where they were in 2019, while numerous chains (such as Chipotle, Shake Shack, Texas Roadhouse and others) have shown increases in their corporate store operating margins.

Investors appear to be skeptical that, in light of higher wages, facility costs and volatile commodity costs, the company will be able to return margins to 17%+ range of the past. We are as well.

The company is substantially behind its competitors in digital and the slow start relative to its peers could lead to underperformance of same-store sales and a permanent loss of market share.

While same-store sales have been positive, the increases have been driven by price increases and not increases in traffic. This could be a long-term drag on sales. Increased traffic is one of the best ways to boost operating margins.

If the company continues to purchase shares using debt and not just FCF, the company could become overly leveraged. The current leverage ratio is about 5X.

Trian could continue to sell shares that puts a ceiling on the stock price. There could also be governance concerns about Trian wanting to sell its large stake back to the company and increase the leverage.

Summary

CFO after Cap Ex, more than covers current $1.00 per share dividend. $50M to $70M in FCF AFTER dividend.

Franchise model lowers cash flow volatility. Only 18% of operating earnings come from company owned stores.

Underlying system wide business is performing OK in a tough environment.

Positive same-store sales and unit growth are better than some of the company’s peers.

Upcoming Investor Day will give investors a better understanding of how new management hires intend to run the business.

Trian Partners intentions are unknown.

Ongoing share repurchases have been value destroying up until now. $250M still available on authorization.

Current 6.8% yield seems to more than compensate investors for the known risks in the business.

We are looking forward to the Investor Day presentations on March 6th. All of this analysis could be rendered worthless on that date. However, we do think management will present the best case scenario that they can and should provide some clarity on how all the new hires view the business and its future potential.

Disclaimer

Investing501 uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The articles and reports published by Investing501constitute the author’s personal views only and are for entertainment purposes only. They are not to be construed as financial advice in any shape or form. Investing501 does not predict the price at which the securities of any company may trade at any time. Every investor has different strategies, risk tolerances and time frames. You are advised to perform your own independent checks, research, or study, and you should contact a licensed professional before making any investment decisions. From time to time, the author may hold positions in the stocks mentioned in articles published by Investing501. To the extent the author does have such positions, there is no guarantee that he will maintain such positions. Neither the author nor any of its affiliates accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Thanks for reading Investing501 Newsletter! Subscribe for free to receive new posts and support my work.

Well. I guess the answer is "not as much as it seems".. I am obviously surprised that the did this. They are taking about $100M of the dividend savings and repurchasing stock. Next month's analyst day will hopefully bring more light to the grand plan.

Sometimes getting cold emails organized felt like a mess. I tried Mails AI to schedule and automate them, which made follow-ups way easier. Now my outreach runs smoothly without much stress.