Huck Chillin’ on a nice day.

Themes

Positive traffic at more chains, but weather impacted January and February negatively.

2. Digital, Digital, Digital.

3. Numerous companies announcing increased advertising spend for 2024.

Wage inflation continues in 4-5% range driven by increases in state minimum wage requirements (CA largest factor).

Commodity inflation (deflation in some areas such as chicken) is expected to be modest (1-3%), with beef prices being the outlier.

6. Virtual Brand experiment is over.

7. Higher construction costs driving smaller units and more drive throughs.

8. Unit growth accelerating.

9. Menu innovation is back as are LTOs.

10. Off premise sales (20-25% of sales) and catering (4-8% of sales) remain strong.

Advertising is increasing at many firms.

12. International growth increasing.

13. Breakfast is major focus of both QSRs and Fast Casual.

Brinker International

· Traffic Positive

o Excluding the traffic decline from virtual brands, Chili's base business traffic for the quarter was a positive 1.9%, a great indication the traffic-driving aspects of our strategy are resonating and attracting many new guests.

o 200bps better than industry

o We delivered strong financial results while continuing to grow share during the quarter with Chili's, beating industry sales by 4% and traffic by 2%. It's another data point that gives us confidence.

· Employee Retention Improving

o 12-month turnover down 200bps to 22%

o Improving guest satisfaction

§ Two years ago, 5% of guests reported a problem.

§ Now 3.6%

· Menu Tweaking to Reduce Trade down.

o Our strategy to merchandise wings in quesadillas as appetizers on our August menu effectively significantly drove those items. We believe that strategy would drive significant incrementality through attachment, but it drove more trade down than we expected because some guests order these items as their entrees.

o We dropped a new menu yesterday that we believe will help reverse some of this negative mix trend

o The other factor that impacted mixed during the quarter was our decision to stay with 3 for Me messaging, which is clearly resonating in driving incremental traffic. But we did see a lower level of add-ons, alcohol and trade up versus previous advertising waves indicating we may be seeing a more conservative consumer. We expect maintaining leadership value on air will continue to drive Chili's growing sales and traffic share, but we might see some softening and mix given where the consumer is.

o So the percentage of checks on deal went up from 29% the previous quarter to 31% this quarter.

o And then within the tiers of 3 for Me, we are seeing a little bit more preference on $10.99

o So we had really blown out the picturing of wings on the menu with the thought that we were going to bring the virtual brand into Chili's. And the thought there was we were going to drive more wing attachment to alcohol only guests as well as drive trade up for those guests that are coming in for dinner, for appetizer. And that's exactly what happened. Unfortunately, many of those guests are trading down from entrees versus either that incremental add-on to a bar tab or an incremental trade up on an appetizer.

o We've removed the pictures of wings off the menu, it's back to being line listed, and we expect that mix will come down on wings because of that move, and that will reduce the amount of trade down that we're seeing from entrees into wings.

o We've done the same thing on quesadillas. So the thought process there was quesadillas a very expensive appetizer, but it's a very cheap entree. And so we were not listing it as an appetizer. So we had put it in the appetizers, we had pictured it, and in fact it drove more trade down in entree.

· Commodity

o We have recently locked in some poultry pricing. We always expected poultry to be inflationary in the back half. It's actually more favorable, still inflationary, but less inflationary than we originally anticipated. That's actually been a good guide for us in the back half. We have had a few other contracts and things. Dairy has been positive. We have some positivity in the ground beef. We actually have had some positive news on that front. We are still going to be slightly inflationary in the back half, but for the full year, it's now going to be slightly deflationary. We made up some ground there in those markets.

· Other comments

o We doubled our advertising as a percent of sales. So last year we were about 1.5% and this year we are just at 3%, so that's getting close to pre-COVID level before we pull back on that.

§ I don't think many casual diners have ever spent above 4%, at least not materially more.

McDonald’s

· Sales & Traffic

o Global comparable sales +9% 2023.

o Global comparable sales +30% since 2019.

o Systemwide sales to loyalty members (150M active users) over $20B in 2023 and $6B in Q4.

§ Up 45% in 2023.

§ We aim to reach 250 million active users and $45 billion in annual loyalty system-wide sales by the end of 2027.

o Traffic up 3% in 2023.

o Our chicken category now represents $25 billion in annual system-wide sales, on par with beef.

o Our quarter four comp sales performance of over 4% in both the U.S. and IOM segments and over 3% globally.

o As we look to 2024 with elevated absolute prices and muted consumer confidence, we believe that consumers will continue to be more discriminating with their dollars.

o As Chris and I have both mentioned before, the war has meaningfully impacted our IDL segment performance, resulting in fourth quarter comp sales of less than 1%.

· New concept CosMc’s

o And about a year ago, we formed a new business ventures team designed to operate as an entrepreneurial startup within McDonald's. The team quickly identified an opportunity in a $100 billion category across our top six markets that comprised of beverage-led occasions where our core McDonald's business underindexes. In a little less than a year, the team opened a pilot CosMc's restaurant, and the buzz has been electric.

· MONOPOLY in Canada was a huge hit.

o The customer excitement was on full display and the market achieved record-setting results generating nearly 700,000 new app customers in just five weeks and driving significant lifts in mobile app sales. In fact, more than 43 million MONOPOLY codes were digitally redeemed during the promotion. That's more than the entire population of Canada.

· Increasing unit growth

o And as you heard during our investor update, the world's largest restaurant company is planning to grow even faster over the next four years. We know our ambition to reach 50,000 restaurants by the end of 2027 is a compelling opportunity and we've done our homework.

o We expect our net restaurant expansion in 2024 along with restaurants we opened in 2023 will contribute nearly 2% to system wide sales growth.

· Guidance

o We anticipate 2024 comp sales growth will continue to moderate as we return to a more normalized level of growth with expectations closer to historical averages of between 3% and 4% in our U.S. and IOM segments. And in IDL, we do not expect to see meaningful improvement until there is a resolution in the Middle East.

o We expect 2024 G&A as a percentage of system wide sales to be about 2.2%

o We're projecting interest expense this year to increase between 9% and 11% compared to 2023 due to higher average debt balances and interest rates and we expect our effective tax rate for the year to be between 20% and 22%.

· Q&A

o We are seeing, as I've talked about on prior calls, that particularly among the low-income consumer, there's some transaction size reduction that we're seeing. We're also seeing some trade down there. So that offset a little bit of the pricing -- the absolute pricing that we took. But I think as you think about 2024, certainly, inflation is going to be less, probably in the low single-digit inflation in 2024, and that will be consistent with where we end up on pricing.

o From a daypart standpoint, I'd say pretty balanced there. But breakfast continues to be a competitive area, a lot of activity going on in breakfast. Our business, as you know, is dominated around particularly lunch. That's our single biggest daypart and that daypart continues to do well.

o Sure. I think consistent with what we talked about on the prior call, where you see the pressure with the U.S. consumer is that low-income consumer. So call it, $45,000 and under. That consumer is pressured. From an industry standpoint, we actually saw that cohort decrease in the most recent quarter, particularly I think as eating at home has become more affordable. There's been much less pricing that's been taken more recently on packaged food. So you're seeing that eating at home is becoming more affordable, that I think is putting some pressure from a IEO standpoint on that low-income consumer.

o If you think about middle income, high income, we're not seeing any real change in behavior with those. We continue to gain share with those groups. But the battleground is certainly with that low-income consumer. And I think what you're going to see as you head into 2024 is probably more attention to what I would describe as affordability. So think about that as being absolute price point being probably more important for that consumer in a lower absolute price point to get them into the restaurants than maybe a value message, which is a two for six or something like that. Those probably are going to resonate a little bit less in 2024, particularly we think in the front half with the consumer there may be something that's lower absolute price points.

o If you look at kind of commodity inflation for 2024, we think that will be in the low single-digit range. I think wage inflation probably in the mid to higher single-digit range.

o This means, that the restaurants can take full advantage of Ready on Arrival. In addition to a national average 60-second reduction in wait times for customers that pick up curbside in our restaurant, or higher customer satisfaction in these transactions. (Geo-location on the app).

Chipotle Mexican Grill

· Sales & Traffic Positive.

o For the quarter, sales grew 15% to $2.5 billion driven by 8.4% comp. Digital sales represented 36% of sales.

o Sales in the fourth quarter grew 15% year-over-year to reach $2.5 billion as comp sales grew 8.4% driven by over 7% transaction growth.

o This is driving a much better experience for our teams and our guests and resulted in accelerating transaction growth throughout 2023. For the year, sales grew 14% to reach $9.9 billion driven by a 7.9% comp.

o We hit some big milestones, including surpassing 3, 400 restaurants, 800 Chipotlanes, $3 million in AUVs, and forming our first international partnership.

o I see the opportunity longer term to more than double our restaurants in North America, increase our penetration of Chipotlanes, surpass $4 million in AUVs, expand our industry leading margins and returns and further our purpose of cultivating a better world globally.

· Operational/App improvements.

o Since we put these coaching tools in place in the third quarter, we have seen the number of restaurants with at least four crew members on the front line during peak periods improve from 30% to around 50%.

o This is driving an acceleration in our throughput performance as the number of entrees in our peak 15 minutes improved by a full point in the fourth quarter compared to last year.

o We made several enhancements to our app functionality, including order readiness messaging, wrong location detection, reminders to scan for points to check out, prior order history and more. This has helped to reduce friction points and improve the overall experience for guests. We also launched Freepotle for our rewards members, which was successful in driving engagement and enrolling new members as we were able to surprise and delight our guests with free rewards such as guac, a beverage, or double meat.

o From the Freepotle drops, we were able to learn more about our rewards members to improve our ability to deliver relevant experiences in the future. Finally, we recently rolled out suggestive upsell on our app at checkout, based on data we have on our rewards members including prior order history. Going forward, I believe we are on a multiyear path to commercializing our customer data and insights into more targeted marketing campaigns and improving the overall digital experience that will drive increased frequency and spend over time.

· Q&A

o Andrew Charles

§ Great, thanks. Brian, I appreciate the ambitions that you talk about the $4 million AUVs and I think the same drivers that were used to reach the $3 million level are still the largest drivers to get to the $4 million level which includes operations, marketing, loyalty to Chipotlane and many innovations. But if you look back from several years from now and you get to that $4 million fast and expected, what driver do you work better than it has in recent years or maybe you think about it differently, are there new drivers that will help you get to the $4 million level such as catering, breakfast or automation?

o Brian Niccol

§ I do believe at the end of the day the thing that will get us to $4 million and probably beyond that is going to be great execution in the restaurant meaning focusing on great culinary, great people and great throughput. I think we're very fortunate that it doesn't require another day part, it doesn't require something that we aren't currently doing today to achieve that result. I do think things like automation like Hyphen and Autocado and continuing to do things with our rewards program, the menu innovation, the marketing will obviously be things that push us further and further but one thing I think that we demonstrated this last quarter is when we perform better on the operation front all those things I just listed off, have a, I would call it almost like a multiplying effect.

§ From the margins, I would expect margins to continue to expand. We still expect to see a pass-through every time we grow our transaction, grow our sales through additional customers. About a 40% flow-through, as that 40% gets averaged in against the 26% we delivered last year, I would expect the margins to go up. And as we get up to $4 million, I would expect we'd be in the high 20%, maybe even in a 30% range.

Yum! Brands

· Sales & Traffic

o Digital sales approached $30 billion in 2023, up 22% year-over-year, with mixed now exceeding 45%. At the same time, we have accelerated the deployment of our proprietary technologies to optimize back-of-house operations and make it easier to run our restaurants.

o We delivered 6% unit growth, 10% system sales growth, and 12% core operating profit growth. We entered 2024 having opened just shy of 10, 000 net new restaurants over the past three years and are well on our way to reaching 60, 000 restaurants this year.

o Turning to 2023, it was a remarkable year for Yum! Brands as we crossed the $60 billion system sales threshold and exceeded all aspects of our long-term growth algorithm.

Guidance

§ We expect to deliver our long-term growth algorithm in 2024. This includes core operating profit growth to be at least 8%, excluding the benefit of the 53rd week. We have a strong unit development pipeline thanks to attractive and reliable paybacks and growth-minded franchisees, which gives us confidence in our ability to deliver strong system sales growth. For the shape of the year, we expect top line trends in Q1 to be the most challenged, with same-store sales trends improving sequentially as laps ease and a range of sales driving initiatives take hold. We expect full year, Taco Bell company operated margins to be in the range of 23% to 24%. We anticipate flat, ex-special G&A growth as we manage spend across the organization.

§ And so we're confident in the trajectory on that piece. But then you get to the 8%, at least 8% core operating profit growth, which is really what the algorithm is intended to drive. And that's where we've got, even more levers at our disposal. So we mentioned that we expect flat G&A year-over-year which reflects, how we're managing that component of the P&L.

· Unit Growth is strong.

o Key to our growth is the performance of our twin growth engines, KFC International and Taco Bell U.S., which account for approximately 70% of Yum! system sales and roughly 80% of Yum!’s division operating profit. In 2023, KFC International opened nearly 2, 700 new restaurants reaching 10% growth with restaurants opened across 96 countries. More than 80% of unit growth came from our 15 publicly traded franchisees.

· Brands

o Taco Bell

§ On a global basis, Taco Bell crossed the $15 billion system sales milestone this year, reflecting the growing scale of this powerhouse brand. Turning to Taco Bell U.S., which contributes more than 75% of our U.S. divisional operating profit, the brand maintained its two year same-store sales trend in the fourth quarter, outperforming the QSR industry. Taco Bell continued to deliver industry-leading margins at 24% this year, while at the same time leading the QSR industry in several key value perception indicators.

§ At Taco Bell U.S., fourth quarter same-store sales grew 3% and 15% on a two year basis, outperforming the QSR industry by three points.

§ The quarter included a record digital sales mix, which reached 31%, up 7 points year-over-year. Growth in kiosk sales was a large driver, with in-store kiosk sales mix increasing 15 points from Q4 last year. Optimizing our digital channels is also contributing to growth in Taco Bell's loyalty program, with active loyalty users growing 17% in 2023.

o KFC

§ Starting with the KFC Division, which accounts for 50% of our divisional operating profit and will soon cross the incredible milestone of 30, 000 units. For the year, system sales grew 12% with 8% unit growth and 7% same-store sales growth. For the quarter, KFC achieved 7% system sales growth, owing to 8% unit growth and 2% same-store sales growth.

§ KFC China grew system sales by an impressive 20% during the quarter. We had several other standouts markets this quarter, including 16% system sales growth in Latin America and 13% system sales growth in both Africa and Thailand.

§ Our team sampled amazing new menu items in their innovation kitchen, and we saw firsthand the digital capabilities that enable Yum! China to engage with an astounding 470 million members in its loyalty program.

§

o Pizza Hut

§ Next at the Pizza Hut Division, which comprises 15% of our divisional operating profit and will soon eclipse 20, 000 units. In Q4, system sales grew 1% with 4% unit growth and a 2% decline in same-store sales. Sales trends decelerated during the quarter in several markets as a result of the conflict in the Middle East. For the full year, system sales grew 5%, including 4% unit growth and 2% same-store sales growth. At Pizza Hut International, same-store sales were flat for the quarter.

§ Pizza Hut U.S. will face another challenging lap in Q1 as same-store sales increased 8% last year, reflecting a full quarter of sales from the melts platform and the Big New Yorker. However, we expect performance trends on a two year basis to improve in the first quarter.

§ Yes, I'll talk about pizza, but on the digital front, one thing I really want to emphasize is just the talent we've been able to attract to the digital space, both at Yum! and at the brands, is unbelievable.

§ We are becoming a talent magnet in digital. It's a great place to work. We're investing behind this. Our franchisees are quickly adopting it. And even though we're at $30 billion of sales and growing fast, we're still in the early innings of what this can do to the business and the way it can transform us

o Habit Burger Grill

§ Lastly, at the Habit Burger Grill, for the full year, system sales grew 6%, led by 8% unit growth. Reflecting on 2023, Habit's new leadership team focused on improving all elements of Habit's operations, including expediting a robust kiosk rollout, implementing a sales-driven labor optimization model, and harnessing Yum!’s Co-op purchasing group to lower procurement costs and rationalize SKUs. As a result of these efforts, the team achieved a 380 basis point increase in full year store level margins despite softness in sales.

Restaurant Brands International

· Sales & Traffic & Digital

o For 2023, comparable sales grew 8.1% and net restaurants grew 3.9%, resulting in 12.2% system-wide sales growth and 7.5% organic adjusted operating income growth. For the fourth quarter, we delivered 5.8% comparable sales and 3.9% net restaurant growth, which drove year-over-year system-wide sales growth of 9.6%.

o We grew full-year global digital sales 20% to over $14 billion, representing over a third of consolidated system-wide sales. We opened 695 net new units during the quarter and 1,168 net new openings for the year, resulting in net restaurant growth of 3.9%.

o Our digital community of over 5 million monthly active users continues to drive over 30% of sales in Canada. In 2023, 45% of our Tims rewards loyalty guests visit us in the morning and returned in the afternoon on the same day.

o Shifting now to our International segment, which ended the year with over 14,700 restaurants, over $17 billion in system-wide sales and grew system-wide sales 17.6% for the full-year. You've heard us say that the international business is an important growth engine for our brands, and that is one of the reasons why we are so excited to now have international as its own segment.

o Given that nearly 90% of Tim Hortons and over 50% of Popeyes stores were opened in the past five years, we have a very high proportion of modern image restaurants overseas at over 75%, including Burger King.

o International digital sales grew 20% year-over-year to represent over 50% of international system-wide sales in 2023.

· Unit Growth

o As a result, we now expect consolidated global net restaurant growth in the mid-4% range for 2024, with growth expected to ramp up over the course of the year and improve into 2025.

· Burger King

o We've already seen guests create about 1.5 million new Whoppers. This campaign is one of the many ways we'll accelerate digital adoption to drive higher guest frequency. Digital sales grew 40% year-over-year, resulting in a digital sales mix of 15%, including 27% mix in our company-operated restaurants. The positive results from our kiosk pilot across our company restaurant portfolio led us to expand our trial, and now we are testing this new kiosk pilot across over 100 stores in our franchisee system.

o

· Popeye’s

o Turning now to Popeyes. Sami and team are one-year into their easy to love plan. Popeyes U.S. grew comparable sales by 5.8% and net restaurants by 4.5%, resulting in another quarter of double-digit system-wide sales growth of 11.2% and a record digital sales mix of 25% up from under 20% in 2022.

Denny’s

Highlights:

· According to recent Yelp data there were nearly 6,000 new restaurant openings with the breakfast and brunch category in 2023. Clearly, there’s an enormous demand for breakfast coupled with consumers wanting breakfast items whenever it suits them. This is obviously our sweet spot.

· Mix on our value platform remained consistent at 17% but we grew check with premium offerings merchandize in restaurant, which is proof positive of our successful barbell strategy where some guests indeed are coming in for our rallied equity, but others are ordering more premium options.

· Specifically off-premise sales were approximately 20% of total sales, up from 19% in the third quarter.

· Denny’s domestic system-wide same restaurant sales were 3.6% for the full year 2023 exceeding the performance for eight of the nine years prior to the pandemic.

· Denny's domestic system-wide same restaurant sales growth was primarily driven by pricing of approximately 7.5%, along with a product mix benefit of approximately 0.3%.

· We are projecting commodity inflation to be between 0% and 2% for 2024. We expect labor inflation between 4% and 5% for the year.

· Profitability breakevens are close to $1.2 million now at Denny's.

· I can tell you that our lowest quintile in aggregate is actually above the $1.2 million. So it's only a subset of that lowest quintile that we are really dealing with.

Wendy’s

· Highlights:

o This marks our 13th consecutive year of global same restaurant sales growth, which highlights our consistent execution and dedication to growing The Wendy’s brand. Our international business achieved 8.1% same restaurant sales growth in 2023, laddering up to 20.5% on a two year basis and extending to eleven consecutive quarters of double-digit two year same restaurant sales growth.

o Our U.S. business reached 3.7% same restaurant sales growth in 2023, resulting in 7.6% on a two year basis. This growth allowed us to maintain our dollar and traffic share within the QSR burger category each quarter of 2023. We delivered meaningful year-over-year digital sales growth every quarter, growing nearly 30% across the full year to almost $2 billion, which was well ahead of our original expectations. We reached a record high 14.5% global digital sales mix in the fourth quarter,

o On a net basis, we achieved our goal of 2% net unit growth with 75% of that growth in international markets.

o Our U.S. Company-operated restaurant margin of 13.5% contracted versus the prior year, primarily due to a quarter-over-quarter acceleration in commodity inflation to mid-single digits, customer count declines and labor inflation of almost 4%. These were partially offset by the benefit of a higher average check, driven by cumulative pricing of approximately 4.5%.

o We can grow our breakfast business significantly without adding incremental labor, which drives meaningful improvement of our restaurant economic model. To fuel the acceleration of this daypart to new heights, we are planning to invest approximately $55 million of incremental company advertising in the U.S. and Canada, split evenly over the next two years.

o We expect our investment and plans will drive a 50% increase in weekly U.S. breakfast sales per restaurant over the next two years as we charge forward on our journey towards earning our breakfast day part fair share of approximately $6,000 weekly per restaurant.

o We’ve made a ton of progress on our digital journey as we’ve grown digital sales from under $250 million in 2019 to almost $2 billion in 2023. We are clearly seeing the benefits of the higher frequency and checks that digital drives. We also know there’s a massive opportunity to further unlock digital sales growth and benefit even more from the margin expansion these channels can generate. To drive digital’s new phase of growth, we are planning to invest approximately $15 million, primarily in 2024, to further enhance our mobile app experience and step change our loyalty capabilities.

o now expect global digital sales will reach over $2 billion in 2024, a full year earlier than planned. We are always focused on improving the customer and crew experience, and in that spirit, we are leveraging technology in our restaurants even more. We are planning to invest approximately $20 million to roll out digital menu boards to all U.S. company operated restaurants by the end of 2025 and approximately $10 million over the next two years to support digital menu board enhancements for the global system.

o These growth drivers, alongside our continued focus on supporting the restaurant economic model through cost management and strategic pricing are driving acceleration in our U.S. company-operated restaurant margin outlook to 16% to 17% in 2024. And our plans perfectly position us to continue driving meaningful margin expansion into the future. The top 25% of our company-operated footprint already achieved over 20% restaurant margin, so we know significant growth is achievable.

o These plans support our goal of driving global net unit growth of north of 2% in 2024 and further acceleration to 3% to 4% in 2025. As of today, we have over 90% of our new restaurant pipeline through 2025 committed under a development agreement.

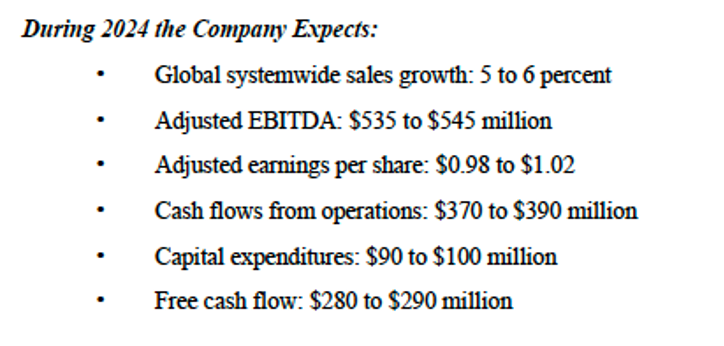

o We expect to deliver significant sales growth of 5% to 6% this year, driven by global same restaurant sales growth of 3% to 4% and global net unit growth north of 2%.

o This sales growth flows through the P&L, benefiting royalties and our company operated restaurant EBITDA and driving our 2024 forecasted EBITDA outlook of approximately $535 million to $545 million, flat to slightly up versus the prior year, as we are making significant incremental investments across the business.

o We are expecting us company operated restaurant margin expansion of approximately 100 basis points to 16% to 17%. This is supported by our sales growth, including cumulative pricing in the low-single digits and flat commodity inflation. We expect labor inflation will hold relatively steady versus the prior year at 3% to 5%.

· So you’re right, the consumer is definitely under pressure, continues to be under pressure. The trend that the lower income consumer, which we define as somebody with a household income of less than $75,000. Traffic is down with them. Our share is unchanged. So we are not losing there. Same thing on the higher household income consumer. Traffic there is up. And again, our share is unchanged.

· Little bit of color on the commodity front. We definitely expect chicken to be deflationary for us, beef and fries inflationary all of that balances out to flat. From a visibility point of view, about 75% of our commodity pricing is locked down. The remaining 25%, as you know, a decent amount of debt is beef, as you know, we cannot lock that down throughout the year.

Shake Shack

· Highlights:

· We grew system wide sales by 24% year-over-year to a record $1.7 billion.

· We opened 85 total restaurants, the most ever in a single year, ending 2023 with 518 Shake Shacks across the world. We grew Shack sales by 20% to over $1 billion with 4.4% same Shack sales growth and a strong class of 41 domestic company operated restaurants. In just the past four years, we've nearly doubled our footprint, system wide sales, and total revenue and we have a robust pipeline of opportunities going forward.

· Shack level operating profit even faster than our total revenue, expanding restaurant margin by 240 basis points year-over-year to nearly 20%.

· At the beginning of 2023, staffing pressures were material. We’re negatively impacting sales, profit, guest experience, but throughout the year, we improved staffing retention to the best levels we've seen in years, which had a direct tie to our stronger labor and restaurant level margin performance.

· We're seeing a high-single digit check lift on kiosk channel versus the traditional cashier experience.

· We showed leverage across every Shack level operating expense line item and drove 240 basis points of expansion for the year to nearly 20%. Importantly, we have line of sight to further margin expansion this year in 2024.

· grew adjusted EBITDA by over 80% to nearly $132 million.

· For the first time, we're targeting throughput improvement by reducing guest order times by roughly 30 seconds and even more in our drive-through locations. We've generally said over time that's been a sort of 6 to 8 minute ticket time as we cook fresh to order over time.

· We've nearly doubled our footprint since '19, but we believe we're still early in our growth journey at just a small fraction of the scale that our competitors have.

· Our advertising spend at roughly 1% of sales is a fraction of many of our peers (typically 3-4% of sales). We know we can and will invest with success here moving forward.

· On development, plan to open approximately 40 company operated Shacks and approximately 40 licensed Shacks this year in '24.

· We plan to further margin expansion in 2024, with our next goal of reaching 20% to 21% Shack level operating profit margin, continuing our work to close the gap to our pre-COVID profitability levels.

· We grew Same Shack sales by 2.8% versus 2022 with traffic up 1.4%.

Texas Roadhouse

· Highlights:

o We generated over $4.6 billion in revenue and increased average unit volumes to over $7.6 million at Texas Roadhouse. And for the full year, comp sales grew over 10%, with more than half of that increase coming from higher guest traffic.

o Along with this top line growth, we also reported double-digit increases in restaurant margin dollars, income from operations and earnings per share for full year 2023.

o For 2024, we continue to expect to open approximately 30 company-owned restaurants across the three brands.

o Of course, we expect to continue to face inflationary pressures in 2024, albeit at a lower rate than we have experienced the last several years. Cattle supply will continue to be a challenge in 2024. However, we now expect the majority of the financial impact of this tightening supply to be in the back half of 2024.

o As such, we are updating our full year 2024 commodity inflation guidance to approximately 5%, from between 5% and 6%. On the labor side, our guidance for wage and other labor inflation remains unchanged at between 4% and 5%.

o The addition of dedicated to-go areas and more back-of-house space needed to serve higher guest volumes has increased the size of the current prototype by approximately 10% from our pre-COVID prototype. Returns on investment for our portfolio of new restaurants continue to exceed both our cost of capital and our targeted mid-teen IRR.

o At this time, our capital expenditure guidance for 2024 remains unchanged at between $340 million and $350 million.

o This total return of 16.4% is consistent with our average return over the past 10 years.

o Comparable sales increased 9.9% in the fourth quarter, driven by 5.1% traffic growth and a 4.8% increase in average check. By month, comparable sales grew 9.2% in both October and November and 11.1% in December. And while weather has negatively impacted our year-to-date 2024 sales, comparable sales are still up 6.8%, including 3% traffic growth for the first 50 days of the year, with our restaurants averaging sales of approximately $155,000 per week during that time frame. 4.8% check increase, offsetting the 3.2% commodity inflation for the quarter. Commodity inflation for full year 2023 was 5.6%, which was the midpoint of our guidance.

o Labor as a percentage of total sales decreased 28 basis points to 33.1% as compared to the fourth quarter of 2022. Labor dollars per store week increased 7.9% due to wage and other labor inflation of 5.5% and growth in hours of 2.4%. For the full year, wage and other labor inflation came in at 6.6%, which was the midpoint of our 2023 guidance.

o As Chris mentioned, we continue to expect wage and other labor inflation of between 4% and 5% in 2024.

BJ’s Restaurant

· Highlights:

· We expanded our restaurant margins to 14.4%, representing an increase of 150 basis points from the prior year, and generated adjusted EBITDA of more than $27 million in the quarter.

· For the fiscal 2023 full year, adjusted EBITDA increased to approximately $104 million, an increase of more than 30% on a reported basis, and more than 40% from last year when adjusting for gift card breakage and the 53rd week that benefited fiscal 2022.

· We expect restaurant level margins to expand again this year, and increase from our fourth-quarter exit rate in the mid-14 percentage points, and further close the gap to pre-pandemic levels consistent with what we outlined in our Investor Day presentation in November.

· We shared with the investment community in November our three-year culinary strategy, which includes upgrading 50% of our menu to have a more visual wow for our guests, ongoing investment in our core items, and further innovation around 20% of our menu focus on value and price point.

· In Q4, our team member retention improved for both hourly team members and managers compared to the prior year and are now better than pre-COVID levels, bringing added stability and less training time and cost to our business. In fact, our retention was better than our casual dining peers, which has created tremendous synergy in our restaurants, bench strength, and career advancement opportunities.

· Going into 2024, we plan to reduce the investment cost for newbuilds by approximately $1 million, which will bring down our investment cost to around $6.1 million net of landlord allowances. At the same time, we are working on further refining our prototype with the goal of reducing our investment cost by another $500,000.

· Our long-term cadence in this business is to drive top-line sales in the 8% to 10% range through a combination of 5%-plus unit growth and comparable restaurant sales in the low- to mid-single digits. At the same time, we continue to expand margins through sales leverage and productivity and savings initiatives.

· We are targeting total CapEx in the $70 million range, net of tenant improvement allowances, including remodeling at least 20 restaurants this year.

· We expect to generate over $40 million of cash flow this year that we can use to enhance shareholder value through share repurchases or debt reduction.

· To this point, as we announced today, our Board of Directors have has approved an increase of $50 million to our share repurchase plan.

· Our restaurant-level cash flow margin was 14.4% in Q4, which was 150 basis points better than a year ago on a reported basis. When adjusting for gift card breakage and the 53rd week, our restaurant-level cash flow margin was nearly 300 basis points higher than last year.

· Despite the challenging weather to start the year for the industry, we continue to beat the casual dining trends when compared to Black Box. In fact, our quarter-to-date comp sales is approximately 250 basis points ahead of the industry through the first couple of weeks of February.

· We are encouraged by our continued progress in closing the gap to our 2019 restaurant margins of 16%, and maintain our confidence in being able to meet and then surpass historical margin levels.

· Food costs were down about 1% quarter on quarter, with new meat program sourcing driving down costs and more than offsetting inflation on other items. Food cost inflation was approximately 1% for the 2023 full year period, and would have been approximately 300 basis points higher without our savings initiatives.

· Sure. So in the fourth quarter, we had around 7% to 8% of pricing, and that's about what flowed through to check a little bit less on check in the mid-7s. So traffic was down about 6%, so those are kind of the components that are built up to the 0.6% of comp in Q4.

· Thanks, guys. As we look back at the Investor Day in November, you did issue a long-term algorithm to grow your EBITDA by 12% to 15% annually over time. And as we look into '24, it clearly seems like you have the margin momentum in your favor going into this year. But this algorithm on the EBITDA, it's also predicated on low- to mid-single digit comps, which clearly are looking like there's just less visibility there.

Bloomin’ Brands

· Highlights

· Importantly, we had a sequential U.S. comp sales and traffic improvement from Q3 into Q4, and within Q4, a softer October was offset by progressively improving comp sales, ending with the strong holiday season. Carrabba's in Brazil. Carrabba's continues to take share versus the industry. Carrabba's posted comp sales growth of 3.9% and positive traffic growth for the year. In 2023 Carrabba's outperformed the industry in sales by 90 basis points and in traffic growth by 300 basis points.

· Our primary focus remains improving in restaurant sales and traffic at Outback.

· The first step of this effort was the launch of Outback's No Rules, Just Right campaign.

· In addition, we spent more on marketing and advertising in 2023 to improve our share of voice in a highly competitive marketplace. During Q4, we saw positive response to our additional marketing spend. We plan to increase our 2024 spending by approximately $20 million. This investment will improve our share of voice and build traffic, utilizing a blend of television, and high return digital tactics. The advertising highlights Bloomin' innovation, accessible price points and great value.

· Over the last year baking accuracy is up 400 basis points and consistency of experiences up 700 basis points. This progress is further validated by casual dining industry metrics, which have continued to improve. Friendly service and food quality are now 300 and 360 basis points ahead of our casual dining peers, respectively.

· We are confident in the strategy at Outback, and it is working. In 12 of the last 14 weeks, Outback has beaten the industry in comp sales growth. Based on recent trends, we expect to see Outback perform above the industry and this is reflected in our guidance.

· The To-Go business has more than doubled since 2019 and currently represents 24% of our U.S. sales.

· We periodically review our asset base and in our latest review we made the decision to close 41 underperforming locations. The majority of these restaurants were older assets with leases from the 90s and early 2000s.

· Traffic in Q4 was down 3.1%, which represented a 160 basis point improvement in traffic from Q3. Average check was up 2.9% in Q4 versus 2022

· Q4 adjusted restaurant level operating margins were 15.9% versus 16.8% last year. The reduction in restaurant margin from last year was driven by a couple of factors. First, as we mentioned on the last call, in Q4 we were lapping significant beef favorability from 2022.

· Second, inflation levels remained somewhat elevated in Q4 and drove additional year-over-year margin unfavorability. Labor inflation was up 4.4% in Q4, and restaurant operating expense inflation was up 4.7%.

· As indicated in this morning's earnings release, the Board has cancelled the existing $125 million authorization, and approved a new $350 million authorization, expiring in August of 2025. This is a larger authorization than we would normally put in place. The purpose of the authorization is two-fold. First, $150 million of this authorization allows us to continue to repurchase a typical volume of shares over the next 18 months.

· Second, our convertible bond matures in May of 2025. The remaining $200 million of this authorization allows for flexibility to retire the convert, sometime between now and next May. There are a number of ways to structure a potential transaction, and these additional dollars give us the flexibility to retire the remaining $105 million of principal on the convert and remove the dilution from the convert that currently exists in our share count.

· Conference call Notes:

o Yes, sure. I'll give you some perspective. So I think if you think about traffic, there's a pretty wide range of possible outcomes here. I'd say anywhere from flat, which I think is certainly doable, but also down to like, maybe down to 2%. A lot of it's going to depend on sort of the external environment.

o I mean, first, we're going to start out in a little bit of a hole here in Q1 because of the weather from a traffic perspective. And then I would say candidly, the category is measured by Black Box or NAP however you choose to look at the category. Look, it's likely going to have a negative traffic outlook for 2024. And I don't think that's anything new. I mean, I think that outside of a couple of years around COVID, the category has generally speaking been down 2% to 3% pretty much every year that I can remember going back quite aways.

o So I think those two things taken in perspective, it is our goal and is our commitment to try to outperform the category in traffic this year, which is why if the category is down 2% to 3%, our traffic is going to be flat to down 2% in that range. We expect to outperform if the category does a little better because consumer seems to be hanging in there.

o Now, in terms of average check pricing, et cetera. Start with average check, in the full year guide, it assumes an average check increase of, call it 2% to 3%, and that's going to be comprised of about, I'd say, 3.5% or so of pricing, and then some negative mix.

o But beyond '24 and into '25, how should we think about your ability as a Company to get back to that 8% or so target.

o Yes. Before I turn over to Chris, I just want to mention, there's a very benign commodity basket peak, one exception, that's beef. And so we don't want to price up to cover that beef cost entirely.

o Yes, well, I think that, look, longer term, I think we still feel good about using 8% as an operating margin target. I think the problem has been and the time period between 2022 and 2024, we've had this massive inflation that's been really tough to leverage, not just for us, but candidly for everyone who's trying to be thoughtful about menu pricing and things and balancing that dynamic.

o So I'll start and I'll turn it over to Dave. Yes, I think the way I think about 2024 marketing is, yes, it will be higher. It's probably going to be higher in every quarter, to be honest, even Q1 than it was a year ago. So there's going to be increases in marketing spend. I think we've talked about marketing, we've talked about this for years in terms of -- we used to spend 3.5% of sales on marketing. We got down to the low 2s. We recognized but we've always talked about, hi, look, even when we laid out that margin framework a couple of years ago, we said, hi, look, we think the sweet spot for marketing is probably in that 2.5% to 3% of sales range. I think that's kind of where we really think it's going to be long term as well.

o So I think that, if we land this year sort of in that 2.5% to 3% range, then I would say that that's probably a good thought for us moving forward. But obviously the spending can ramp up as our sales increase. So I think we feel good about it as a percentage of sales.

Wingstop Inc.

Highlights:

· We delivered an unprecedented 20th consecutive year of same-store sales growth with a comp of 18% for the full year, primarily driven by transactions.

· We opened a record 255 net new restaurants, fueling system-wide sales growth of 27% to more than $3.5 billion. Company-owned restaurant margins were 26%, a proof point of the effectiveness of our supply chain strategy and our industry-leading unit economics. This translated into adjusted EBITDA growth of 39% when excluding the benefit of the 53rd week during 2022.

· 2023 started strong as we delivered a 20% domestic same-store sales comp in the first quarter. That was driven entirely by transaction growth. We saw the strength of our business to build as we progress through the year, while we lapped a couple of key growth levers we executed in 2022, such as the launch of Uber Eats, and the addition of the Wingstop Chicken Sandwich. This momentum was demonstrated with the fourth quarter marking our strongest quarter in the year. Our domestic same-store sales growth in the quarter was 21.2%, driven almost entirely by transaction growth.

· As we look at the opportunity to more than triple the size of our existing Wingstop footprint, that was 2,214 restaurants at the end of 2023, it all starts with the strength of unit economics. Our AUVs are now above $1.8 million, and we believe we have clear line of sight to expanding AUVs well north of $2 million. Our supply chain strategy is creating more – greater predictability with restaurant margins and combined with our AUV growth, our brand partners saw returns strengthened and are now enjoying an unlevered cash-on-cash return of more than 70% and on a low upfront investment that is still less than $500,000 on average and less than 2-year payback. In the last year, we made great progress against these strategies, increasing AUVs by more than $200,000 to $1.8 million, AUV growth that was fueled primarily by transaction growth, double-digit transaction growth, which is against an industry backdrop that has seen a decline in traffic.

· And another unique part of the Wingstop story is that we are seeing transaction growth across all vintages. In fact, even in our original restaurant, we continue to see healthy transaction growth. Our always-on media strategy is helping us make great progress against our awareness gap, which remains a meaningful opportunity. With system-wide sales growth of nearly 30% during 2023, this gives us the firepower in our national ad fund to invest behind this strategy and continue to expand brand awareness.

· We have many examples today where restaurants operating with boneless mix that exceeds 50% are enjoying food costs in the low 30% range.

· We also saw an increase in frequency across all income cohorts, including the low income gap. Our digital sales surged passed $2 billion in the last 12 months and we exited 2023 with a digital sales mix at 67%, up from 63% at the end of 2022.

· Our digital guest database is now over 40 million users strong.

· We hit our 20th consecutive year of same-store sales growth with an 18.3% comp for 2023 that was driven primarily by a double-digit increase in transactions. We opened 255 net new units and generated adjusted EBITDA of $146.5 million.

· The progress we have made is carrying into 2024 and for modeling purposes, we anticipate company-owned restaurant food costs to be approximately 35%. Additionally, our boneless mix for the system reached a new high of 47% in Q4, which helps advance, our whole bird strategy.

· This is a strategy we deployed a couple of years ago, where we really leaned into live sports. And our hypothesis at the time is that’s where the eyeballs would be. And we think that’s really shown up and demonstrated itself. And obviously, when you combine that with, as you pointed out, meaningful increase in our ad dollars that we’re able to deploy. If you look at just 2023 alone, system-wide sales growth of almost 30% translates to an equal increase in the amount of ad dollars we have to go invest.

· Yes. No, I appreciate the question. And there is a few components to unpack here, but I would say, just to answer directly your comment about some other national brands promoting wings at this time. What we have seen historically is when other brands promote wings, it’s actually a benefit to our business. In fact, if consumers are aware of Wingstop and someone makes wings top of mind, there is really not a decision tree, they go to Wingstop versus that other brand. And so historically, we have seen that as a tailwind to our business.

· We talked about our average unit volume for our 2022 vintage was $1.3 million. Restaurants come out of the gate strong and then they comp from there. That 2022 vintage is comping very similar to the rest of the system, growing transaction growth. And so that is all centered upon a very efficient model. Alex mentioned, our labor profile, our footprint, on average, 1,700 square feet in line. We are not competing for in cap. 94% of our business is off-premise, allowing us to operate a very efficient box. And so I think the – and then we mentioned the 6% to 7% digital mix,

· Yes. There is really one common denominator in that difference, and that is tenure. The difference between higher-volume restaurants versus those that are maybe below that $2 million threshold is really just how many years of these 20 years of consecutive same-store sales growth, those restaurants have participated in. I think a great market for me to highlight just to kind of showcase that is the Dallas-Fort Worth market, which is sitting at an AUV for the entire market that is above $2 million, and we have over 135 restaurants in that market today. And that market is comping double digits as well. And so I think it really speaks to the fact that the difference is really tenure.

· There is 2.4 billion chicken sandwich occasions in the U.S. annually. And so we think we are just scratching the surface there.. They are a little bit higher income, they are less likely to have children at home, they are demonstrating a higher frequency coming back a little bit quicker after that initial visit.

Chuy’s

·

Highlights:

· We grew revenues almost 9.3% driven by comparable restaurant sales of approximately 3.3%. Our team’s ability to effectively execute on our four-wall operations resulted in a 200 basis point expansion of restaurant-level margins to over 20%, representing our best result in over a decade.

· As we mentioned on our last call, we introduced our first barbell approach to the CKO platform during the fourth quarter, and we were very pleased with how well it was received by our guests. In fact, this was our second most successful Chuy’s Knockouts campaign to-date.

· We also delivered another strong off-premise performance during the quarter, mixing at approximately 31% with our delivery channel continuing to perform well at mixing at approximately 12%, a 160 basis point increase from last year. In terms of catering, we continue to roll out the ezCater platform to our restaurants and are on track to complete this rollout by the end of the first quarter. Our channel -- our catering channel is currently mixing at approximately 4.8% for the quarter.

· Going forward, we continue to believe our off-premise channel will be at least 25% of our sales with catering contributing between 4% and 6% of total sales.

· Comparable restaurant sales in the fourth quarter increased 0.3% versus last year on a 13-week comparable basis, primarily driven by a 3.4% increase in average check, partially offset by a 3.1% decrease in average weekly customers. Effective pricing for the quarter was approximately 3%.

· Hourly labor inflation of approximately 4% at comparable restaurants.

· And so we’re looking at kind of flat to up 1% for the year in total same-store sales. Now obviously, with our pricing in that of approximately 3%, just shy of 3%. We’re going to have about 2% negative traffic in that -- 1% to 2% negative traffic into that.

· We’re opening, as we mentioned, in roughly five states that we have good AUVs, strong AUVs that are a lot higher than our system-wide AUV, which is currently at $4.5 million. You’ll probably see a pickup of $10 million to $15 million in the five states will -- I mean, 10% to 15% in the states that we’re looking at. So we feel real comfortable about our growth over the next three to four to five years.

· You mentioned I know at ICR that you were confident in your ability to return to a 10% unit growth in 2025. But right now, for this year, I’m comfortable in that 6% to 8% range.

· And certain ones, but right now, as you heard me talk about programmatic TV currently. Right now, we’re doing a lot on ESPN and a lot of stuff around sports, especially as we were mentioning to you on the call about looking at it more so in -- as we get into March Madness and so forth. But we’ll definitely look in probably more on the programmatic side of it, probably not major media.

· Sure. So I mean, the biggest component would be our beef. Our beef, we’ve got locked in through the third quarter of this year as far as fajita beef, those are at increased prices as well as our ground beef. We only have locked in through the Q1 we expect when we start buying that after Q1 that will be elevated compared to the prices of this year. And so those are the two big drivers as well as some of the -- maybe the chicken coming back a little bit as well, since we had it -- since it was down so much last year.

· But currently, I would say those targeted cash-on-cash returns are more in the way of about 25% versus 30%, but our ultimate target is 30%.

Jack in the Box

Highlights:

· We communicated our bold ambition, starting with expanding our reach to achieve 2.5% net new restaurant growth based upon the tremendous whitespace we have in new and existing markets.

· We want to increase AUVs at our two challenger brands by exceeding $2.5 million in sales at Jack and $2 million for Del Taco. Our AUV goals will be supported by achieving 20% digital sales. And lastly, if we can generate 15% four-wall franchise EBITDA with a sub-five-year new restaurant payback, our top-tier restaurant economics will further support our growth strategy.

· Our AUV performance for both brands is driven by steady same-store sales for Jack in the Box and Del Taco. We generated systemwide sales of over $1.3 billion for Jack and nearly $300 million for Del Taco

· Both brands continued to accelerate digital sales, having now achieved 12% of total revenue with year-over-year growth in all channels and particularly strong growth in first-party web and app ordering.

· Breakfast continues to be an opportunity we are addressing, starting with bringing back some deleted items that, while good for margins and speed, were too strong of a headwind to sales. I am confident we can improve our breakfast share helped by three tactics. First, making breakfast a regular recurring part of the marketing calendar, innovating around new breakfast items while continuing to roll out fan-favorite LTOs such as French Toast Sticks or Mini Cinnis, and testing new breakfast offers, especially through digital channels, to target and reengage the valued guest.

· Jack restaurant-level margin continued to accelerate and serve as a highlight for our business. Coming off a year of 4.5% improvement in 2023, our 23.1% margin in Q1 is a 3.3% increase year-over-year and demonstrates that our margin initiatives are working.

· Our new restaurant pipeline continues to grow, as we now have 91 signed development agreements for 399 future restaurants. We currently have 81 restaurants that are in the construction or permitting phases.

· At Del, we had flat net unit growth, including three restaurant openings in the first quarter. We currently have 155 development agreements at quarter end and 49 sites that are in the construction or permitting phases.

· Quarter two will see the systemwide launch of Smashed Jack. Our most exciting burger innovation in nearly a decade, and I may be biased, but it is the best burger I have tasted in QSR.

· Our overall average check increased in the prior year driven by price. And while transactions were down.

· Jack restaurant level margin expanded year-over-year by 330 basis points to 23.1%, driven primarily by commodity deflation, strong sales leverage, and operational improvements. Food and packaging costs of the percentage of company-owned sales declined 310 basis points to 29.7%, primarily due to lower commodity costs. Commodity deflation was 2.9% for the quarter.

· Labor inflation was 2.8% in the quarter, in line with our expectations.

· Turning now to Del Taco. System same-store sales rose 2.2%, consisting of company-owned comps of 1.8% and franchise comps of 2.4%. Average check was up year-over-year, partially offset by lower transactions.

· Del Taco restaurant level margin was 15.6%, compared to 16.1% in the prior year. The decrease was due to wage and utility inflation, as well as a change in the mix of restaurants, partially offset by higher sales performance and commodity deflation.

· Food and packaging as a percentage of sales decreased 120 basis points to 27%, which was primarily due to menu price increases and commodity deflation of 0.5%. Labor as a percentage of sales increased 100 basis points to 35.2%, primarily due to wage inflation, which was approximately 3.2% in the quarter.

· I think we're seeing the same thing that most of our competition is, is that as you -- the consumer that's $75,000 and under, particularly the $45,000 and under, you're definitely seeing some challenges with attach rates.

· And so again, with breakfast, I think it's one of the more competitive areas right now that we have to make sure we're competing heavily in and having the right offerings. So I think that's one that we have to lean into and be more aggressive.

Cheesecake Factory

Highlights

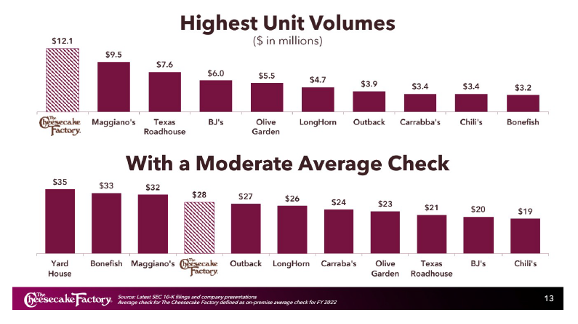

· Fourth quarter revenues were $877 million led by comparable sales at the Cheesecake Factory restaurants up 2.5% versus the prior year, and 14% versus 2019. Once again meaningfully outpacing the casual dining industry and demonstrating the strength and consistency of our brands. Importantly, the improvement was driven by better traffic and menu mix as year-over-year menu pricing declined.

· Cheesecake Factory restaurants delivered the highest average weekly sales in the company's history in the last week of the fourth quarter.

· We exceeded our expectations and labor productivity, food efficiency and wage management contributing towards restaurant level profit margin of 16.1% at the Cheesecake Factory not only exceeding our projections, but also surpassing fourth quarter 2019 margin levels.

· Next, at this time, we expect effective commodity inflation of low single digits for Q1, as our broad market basket continues to stabilize. We're modeling net total labor inflation of mid-single digits, when factoring the latest trends in wage rates and minimum wage increases as well as other components of labor.

· What we saw is, in '21 and '22 was significantly outsize purchasing behaviors. I think this has been pretty well documented. And so the preponderance of the mix negativity is really associated with kind of what we consider to be a return to normal. I would say we are still running slightly above 2019 levels. So it's actually pretty historically relevant. So we would anticipate continuing to run in this negative 4 to 5 range for the first quarter, maybe 3 to 4 negative in the second quarter. And then, it's hard to say for sure, but relatively stable in the back half of the year. So we've seen very stable consumer behavior over the past six to nine months..

· Many of the California QSR urban locations are already paying $19 and $20. We believe that's partly why they agreed to do it in the first place.

· We've also been able to take the opportunity to, as an example, bring a 1-star cook up to a 2-star to a 3-star because of that retention. So the longer that we're keeping people, the more that we can train them on multiple stations, the more that they can handle big volume of the Cheesecake Factory restaurants. So a lot of it is driven by that initial retention piece and then our ability to leverage that operationally once we're there.

Domino’s Pizza

Highlights

· Our positive U.S. same-store sales and transaction growth in both delivery and carryout underscore the strength and momentum that we're building in our business.

· We're currently on air with Pan Pizza advertising for the first time since 2014. We call Pan Pizza, our best kept secret.

· Hungry for MORE, that I'll share a brief update on. Let's start with M. M is for the most delicious food.

· The O in Hungry for MORE stands for operational excellence,

· In 2024, we're rolling out a new service program. We're calling that MORE Delicious Operations. This program will be a series of three product training sprints focused on our dough, how we build and make our products and how we cook them. All of this is being done with a keen focus on driving more consistency in our food by providing the proper teaching, tools and processes for our team members to succeed.

· Our third pillar is R for Renowned Value. We've always been known as a premier value player, and we believe this can continue to be a differentiator for us in '24 through our improved loyalty program, our national promotions, and our rollout on Uber. Domino's rewards is off to a great start and was a key driver of our strong comp performance in the fourth quarter, when we saw positive sales and transactions in both our U.S. delivery and carryout businesses.

· We've also seen the following: an uptick in active members. We are up 3 million active members in 2023, with 2 million plus since our relaunch in September. Domino's Rewards ended the year with approximately 33 million active members, a big driver of the increase in active members as well as the early success of the program was our Emergency Pizza promotion.

· Now everything we do at Domino's is enhanced by our best-in-class franchisees, the E in our Hungry for MORE strategy.

· We ended 2023 slightly ahead of our expectations on U.S. store growth and profits, adding 168 net new stores and finishing the year with estimated average franchisee profitability per store of $162,000.

· For the year, delivery represented 48% of our transactions and 58% of our sales, while carryout represented 52% of our transactions and 42% of our sales.

· We are expecting that our average franchisee profitability per store will come in at $162,000 in 2023, up $23,000 from the prior year.

· Please note that the Middle East represents a relatively small portion of our profits at less than 3% of our operating income.

· From meeting's perspective, we expect the Q1 food basket to be deflationary as we lap the only quarter from 2023 when the basket increased followed by moderate increases for the remainder of 2024. We are expecting our supply chain margins to be roughly flat for the year, barring any unforeseen shifts in the food baskets. We are expecting an increase in year-over-year supply chain margins in Q1 due to the expected negative food basket, followed by a slight moderation for the balance of the year.

· And our conversations with the investment community suggests the expectations for Uber mix currently is still relatively low, maybe that 1% to 1.5% range. And you talked about getting to 3% by the end of the year.

· And so it's important to know because I'll talk about Emergency Pizza in a second and the effect on loyalty there. But the loyalty program out of the gate before even Emergency Pizza was doing exactly what we needed it to do, which was engage lower-frequency users, engage carryout users, then we brought in this powerhouse of Emergency Pizza that continue to inflect those numbers.

· All of this is included in the $170,000 or more in franchisee EBITDA that we’re expecting for 2024, and we feel very good about it.

· And there's a famous player, Joe DiMaggio who there's a quote Somebody asked him one, why you play so hard every game. And what he said was there's going to be someone who sees me for the first time in that game and so I'm playing for them. And that is how we need to approach making our pizza. Every pizza you're making is for your mom, right? And that's what some of these sprints are all about with more delicious operations. We're making promises in our advertising we need to deliver it, and it's more than just time. It's quality, it's consistency in all of those. And we like to say, down, we don't sell 1 million pizzas a day. Our goal is to sell one pizza a day 1 million times. And that's kind of the new thinking behind Delicious operations.

Portillo’s

Highlights

· Today, catering represents only about 5% of our overall revenue.

· So speaking of marketing, in the lead-up to the holiday season we ran an advertising campaign in Chicago that brought the sites, smells and sounds of Portillo's to the forefront.

· Instead of using discounting to drive traffic, we simply reminded fans in our largest market why they love Portillo's

· And as we move forward in the New Year, we're going to continue to leverage traffic driving tools and initiatives. One that I'm excited to share is that we'll be adding two new salads to our permanent menu soon.

· Portillo's already generates more than $650,000 in salad sales per restaurant, per year, with our beloved Chopped Salad is the best seller.

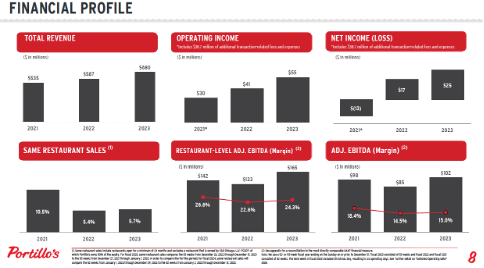

· The same-restaurant sales increase of 4.4% was primarily driven by an increase in average check of 3.1% and a 1.3% increase in transactions. The higher average check was driven by an approximate 6% increase in certain menu prices, partially offset by product mix.

· Moving on to our costs, food beverage and packaging costs as a percentage of revenues decreased to 34.8% in the fourth quarter of 2023 from 35% in the fourth quarter of 2022. This decrease was primarily due to an increase in our revenue and lower third-party delivery commissions, partially offset by 4.4% increase in commodity prices. We estimate overall commodity inflation to stay consistent with recent trends and are currently estimating commodity inflation in the mid-single digits in 2024.

· Hourly labor rates were up 2.4% in the fourth quarter of 2023, and up 4.3% year-to-date versus the prior periods. We are currently estimating labor inflation in the mid-single digits in 2024.

· As of today, our outstanding borrowings under the revolver are $13 million. Our effective interest rate was 8.4% for 2023 versus 10.4% for 2022.

Cracker Barrel

Highlights:

· Good morning and thank you. In the second quarter, we delivered solid sales, which included a meaningful improvement in our traffic trend of 300 basis points in Q2 compared to Q1. Our traffic driving tactics, particularly our efforts to improve the guest experience and the effectiveness of our marketing are working and supported this improvement. Traffic was negative 4% for the quarter.

· While we were pleased with our sales results, our margins remained pressured. As I will touch on later, improving profitability is a top priority. We are confident we will see improvements as our initiatives gain traction, but we anticipate continued margin pressure in the near-term, particularly in Q3 and improved margins in Q4.

· For example, loyalty members accounted for nearly 50% of our Thanksgiving heat and serve sales which we believe was partially driven by our direct engagement with them around this offering.

· Our retail business remains challenged. We believe this is due in large part to the pressures the broader retail industry is facing, particularly in more discretionary categories, which is resulting in a highly promotional environment.

· For the second quarter, we reported total revenue of $935.4 million. Restaurant revenues increased 1.8% to $730.7 million, and retail revenues decreased 5.2% to $204.7 million versus the prior year quarter. We saw declines across most categories with toys, food and decor, seeing the largest decreases.

· Comparable store restaurant sales increased by 1.2% over the prior year.

· Pricing was approximately 4.8%. Our quarterly pricing consisted of approximately 3.4%, carryforward pricing from fiscal 2023 and 1.4% new pricing from fiscal 2024.

· Off-premise sales were approximately 23.7% of restaurant sales.

· Moving on to our second quarter expenses, total cost of goods sold in the quarter was 33.7% of total revenue versus 35% in the prior year quarter. Restaurant cost of goods sold in the second quarter was 28.2% of restaurant sales versus 29.3% in the prior quarter. This 110 basis point decrease was primarily driven by menu pricing partially offset by higher mix of off-premise as our Heat n’ Serve and catering offerings have a higher cost of sales than other channels. Commodity inflation was approximately 1.4%, driven principally by higher beef and turkey prices.

· Hourly wage inflation of approximately 5.4%, partially offset by pricing.

· One, driving relevancy; two, delivering food and an experience that guests love; and three, growing profitability.

· Turning to the three imperatives, the first is driving relevancy, which means evolving the brand to meet changing consumer tastes and needs. In my view, while we’ve taken some steps in this direction over the past few years, we need to do more. Cracker Barrel is a timeless brand, but even timeless brands must evolve as consumer preferences change, which means evolving our brand positioning, our stores, our menu and our messaging.

· We’ve already started this work. In the coming weeks, we will be commencing a brand repositioning initiative, which entails a full review of our brand strategy and identity. Our refined positioning will inform all aspects of the brand from menu and marketing to digital and store experience.

· We have also begun testing changes to decor, lighting, paint, and fixtures, and our initial work suggests that we can update and brighten our interiors in a way that appeals to both core guests and people newer to the brand. Future changes will be informed by the learnings from this test and others, as well as our brand strategy work, and we are committed to being disciplined and thoughtful before deploying capital and expanding design changes to our stores.

· Innovation will continue to fuel relevancy in our menu for our guests. We recently launched a core menu revamp test and while it is only in a few stores, it is a significant test because of the scale of the changes. This test includes approximately 20 new items, several modified items and over 20 deletions, as we seek to balance our innovation with simplification.

· Thanks. I believe you guys noted that the upward revision in that 2024 revenue guidance number was at least partially driven by increased advertising.

· Traditionally, Cracker Barrel’s advertising as a percent of sales or marketing as a percent of sales was somewhere mid to high 2% range. And now we are expecting to be in the kind of mid to low 3% range through this fiscal year.

Dine Brands Global

Highlights:

· First Applebee’s and IHOP both delivered another year of positive comp sales growth for Applebee’s 2023 was the third year of consecutive positive comps.

· And finally, we refinanced our debt while returning $210 million back to equity and bond investors.

· During the year, we found that guests limited their discretionary spend in response to economic pressures, and that this value conscious behavior continued in the fourth quarter, while this certainly creates challenging and dynamic market conditions, it also allows us to leverage our expertise in delivering exceptional value. Our brands are known for delivering abundant value, and we are able to meet the guest at the right intersections, even in a price sensitive environment.

· We successfully built our limited time offerings and other offers throughout the year to ensure our promotions were highly visible and appealing to our guest. That is why it is no surprise that our 2023 top performing campaigns included Applebee’s, DOLLARITA, and all you can eat Wings and IHOPs kids eat free and all you can eat pancakes.

· We expect that the consumer will remain cautious in 2024, and we are planning for it with a compelling calendar of LTOs and value driven promotions across our brands.

· Our revenues were up 5% for the full-year and up 4% in Q4. IHOP achieved full-year comp sales growth of 3.5% on top of 2022’s comp sale growth of 5.8%, and for the quarter, IHOP posted its 11th consecutive quarter of positive comp sales with a Q4 increase of 1.6%.

· Applebee’s delivered positive 0.6% comp sales for their full-year maintaining momentum from 2022’s comp sale growth of 5.1%, and in Q4, Applebee’s reported a slight decline of negative 0.5% in comp sales, and adjusted free cash flow was $103.3 million in 2023, which was an improvement from 2022’s adjusted free cash flow of $64.6 million.

· In fact, 93% of DOLLARITA purchases had an additional menu item attached. DOLLARITA also expanded our demographic reach, attracting a younger age group, many of whom visited Applebee’s for the first time.

· Applebee’s also has a full pipeline of new menu products and exciting marketing partnerships. The culinary team has now tested over 200 new menu concepts, and we are excited to start rolling out the top performing items to Applebee’s nationwide in Q2.

· We want to continue to be at the forefront of guest minds and in an increasingly crowded space being culturally relevant is essential, which is why we will be increasing the number of On-Air Weeks in a marketing calendar. Our approach is to weave together a strategic mix of promotions, new menu items, and to drive traffic frequency and check.

· In Q4, we also took a big step forward improving our guest digital experience. In December, Applebee’s launched its new website and mobile app, which features a fresh design and offers guests a personalized and elevated ordering experience.

· We have seen a higher percentage of guests choosing to place their order digitally, higher conversion rates and increased check averages compared to our prior site and app.

· Now moving on to IHOP. In the fourth quarter, we delivered our 11th consecutive quarter of positive comp sales, average weekly sales over $50,000 for the first time in the last week of December, and we opened 46 new IHOP restaurants domestically.

· Last year, we enrolled over three and a half million new members bringing our total loyalty members to 8 million people.

· Our Dine-in loyalty members are on average visiting nearly twice as often as non-members, and they spend on average 5% more than non royalty members. The IHOP app is being downloaded 8,000 times per day, and Newsweek for the second year in a row recognized our loyalty program is one of the best in America.

· Loyalty only accounts for approximately 6.5% of total sales for IHOP up from less than 3% in 2022.

· We are also starting to learn the purchasing habits of our loyalty members that will lead to more personalized marketing, 2023 was also an important year for IHOPs menu with the knowledge that 70% of our sales are breakfast items, including at dinner.

· In fact, IHOP outperformed black box in family dining and comp sales four out of five weeks during Q4s Wonka campaign on the technology front.

· 92% of our IHOP restaurants have implemented the new POS system and server tablets. Our preliminary data shows that franchisees that have fully enabled their server tablets are experiencing a higher beverage attachment rate, improvement in ticket time, higher average check, and higher tips for servers.