I have lived in Texas since the early 1980’s, so I saw the S&L Crisis first hand. Then, when I was an analyst at David Tice & Assoc. in the early 2000’s I was assigned to look at all the homebuilder stocks. Our premise (which came true) was that the housing bubble would eventually collapse and David was looking for ways to profit from the popping of the bubble. I can even remember when Ivy Zelman was the lone housing bear on Wall Street when she was at Credit Suisse and that call allowed her to go on and start Zelman & Associates.

While I did agree with the general premise, what I noticed was that, instead of taking down lots of land for development and using bank financing like in the 1980’s home builders were using options to hold land and also used significantly more unsecured term debt to finance their operations. I even made a bet with a more senior analyst that, even after the collapse all the major home builders would avoid bankruptcy (a bet I won).

So with home buildings trading at less than book value and PE ratios in the mid single digits, maybe it is time to see what will happen to them as mortgage rates climb to 7% (My first house had a mortgage rate of 12%).

This post is simply a rough starting point. If there is interest from followers, I could do a much deeper dive.

This table was done in about an hour and my not be 100% accurate, but close enough. These numbers are from the last SEC filing. What jumps out at me is the number of home builders whose market caps are below their total inventory levels. I have not adjusted for debt, but that piques my interest. The thing about home builders is they become a cash flow machine when they stop growing.

I saw a note somewhere that housing costs now take up over 40% of household income. Housing prices are declining, home builders are increasing incentives, affordability is at a multi-decade low. I don’t know how people will afford a home with rising rates, stagnant incomes and all the other problems going on. Investors that are positive on housing stocks say that we are still under-building houses by the millions and the age of the housing stock is approaching all-time highs. People have to live somewhere and something has to give. So maybe this is the place to start.

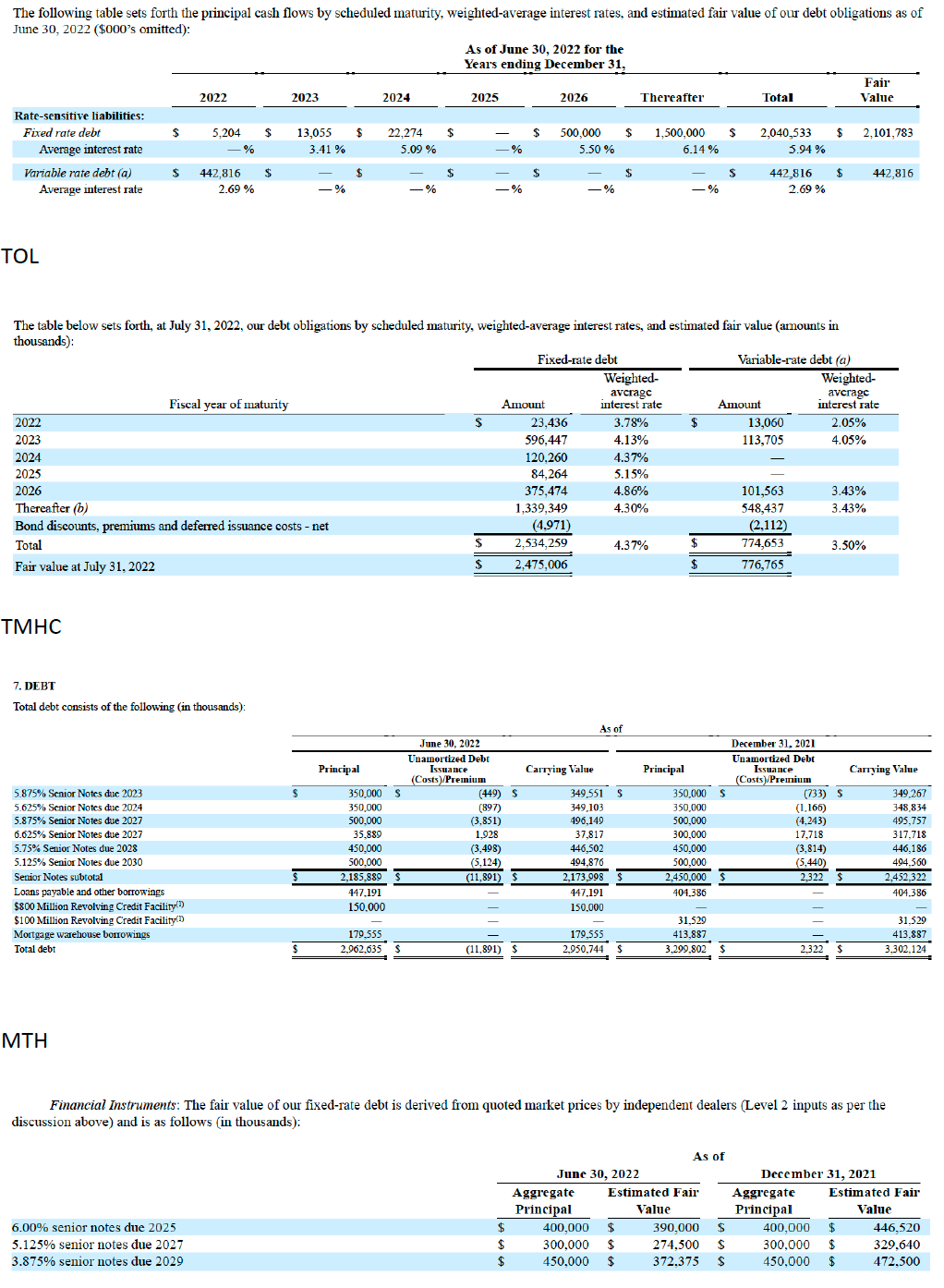

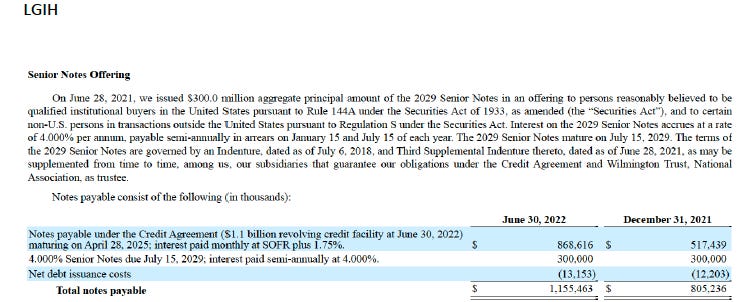

Debt

Summary of the debt and interest rate exposure of the major builders.

PHM

The most important thing I forgot to say!

I would strongly encourage you to look at the sector in more depth and share your findings!

I certainly would appreciate it.

I have also been poking around at the housing sector. Seems like there MIGHT be some bargains here.

When you are buying something at a 3-4 P/E, the company does not have to keep going very long at that rate of earnings to make a serious amount of capital (in relation to market cap).

Where I am at, housing is still strong, but slowing down a bit. I suspect it will take a while to fully "cool off", a year or so maybe?

If a homebuilder is well managed, got a good balance sheet, in decent markets, they should STILL be able to make money even if the market cools off. They just won't be making 1/4 of their market cap. Maybe their earnings get cut by 2/3? Still not too bad if you buy right?