Pulte Group: PHM

Price: $41.25

Shares outstanding: 231.5M

Market cap: $9.55B

Cash: $732M ($69M restricted)

Debt: $2.03B (excludes $442M Financial Services debt)

Enterprise Value:$10.9B

Tangible Book Value Per Share: $32.70

Company Overview

Elevator pitch by company:

Initial Thoughts:

Similar to 2006-2011, Pulte is using long-term unsecured debt and options on lots to reduce the potential for a severe liquidity crisis in a housing recession.

With $1.5B in cash and credit and no debt maturities until March of 2026, the company appears to be in a relatively strong financial position.

53% of the lots are controlled by options by deposits totalling only $292M. Company’s stated goal it to control 60-70% of lots through options.

In spite of high inflation in labor and commodities, gross margins have expanded to record highs. Low interest rates and strong demand resulted in significant pricing power. However, recent record high margins do not seem sustainable.

YTD gross margin of nearly 31% is 500-800bps over historical average.

Lots acquired two years ago at a lower cost basis is helping drive current margins. At some point this tailwind will become a headwind.

The scope of this report is Pulte Group centric and does not look at any macro factors (yes we know those are extremely important, but this report is looking at the business model).

We have lived in Dallas, TX since the early 1980’s. We saw the S&L crisis first hand and watched as every public Texas-based bank go under or get acquired (with the exception of Cullen Frost Bank). We paid over 13% for our first mortgage and closed on a house the week after 9/11. We were the homebuilding analysts for a research firm from 2002-2008. We purchased a house in a brand new MPC three years ago and have seen housing prices on a square foot basis rise Let’s just say we have seen a lot of the homebuilding industry up close over our careers.

In spite of all the investor focus on macro issues like interest rates, demographics, household income, affordability, supply, etc., home building is a relatively simple business. A builder acquires raw land, develops the roads and other infrastructure for the community, builds models homes, subdivides the developed land into lots and then builds and sells a home on that land. Let’s look at some of the risks to the business model.

What are the risks?

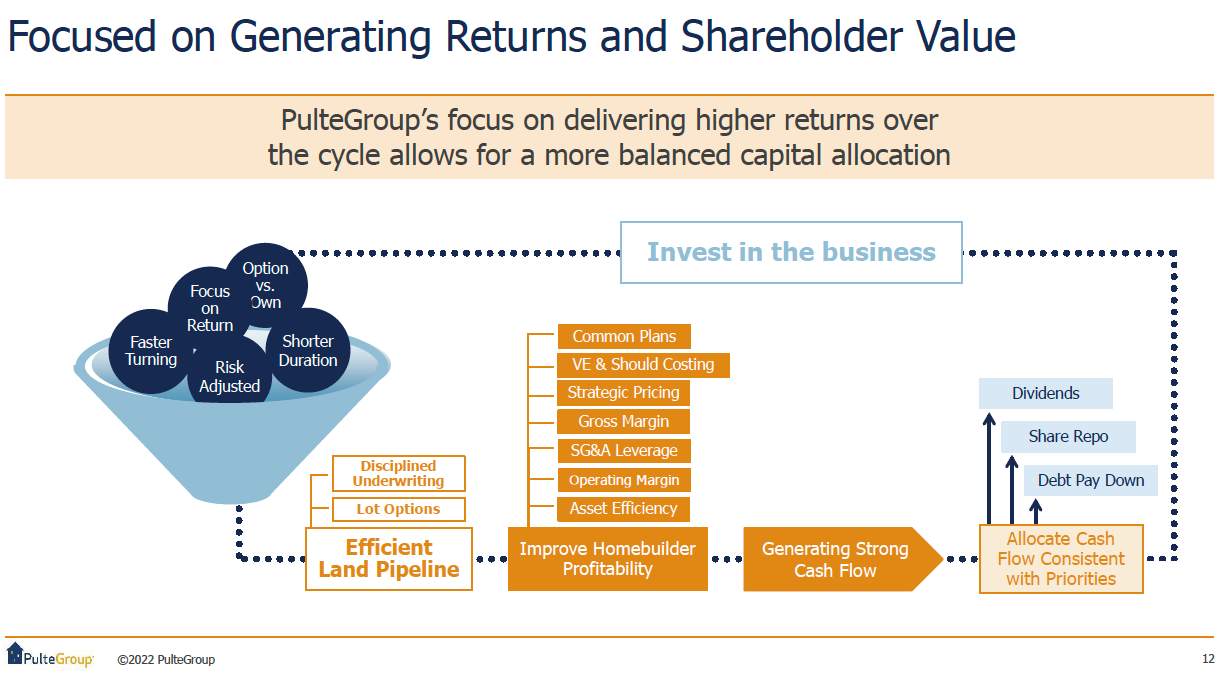

Typically the factors that have caused severe financial distress or bankruptcy for a homebuilder is a liquidity crisis due to a mismatch between the company’s financing and its illiquid land development assets. The company can almost always find a clearing price for its completed home inventory (even if it is at a loss), but it is significantly more difficult to stop or sell land under development or raw land. It typically takes 24 months or more to turn raw land into a lot with a house for sale. Since the early 2000’s, homebuilders have tried to mitigate their risks by issuing more term debt (not relying on bank debt or lines of credit that can be revoked or contain restrictive covenants) and using options to control land positions (using only 4-8% of the value of the lots) and not putting significant amounts of undeveloped land that cannot be sold on to the balance sheet.

Debt and Liquidity

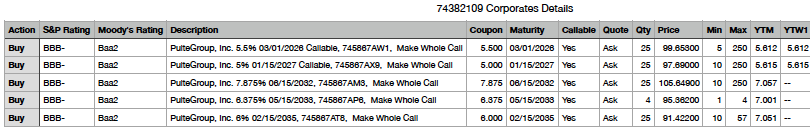

Pulte’s liquidity and debt structure should allow it to weather even a multi-year slowdown/decline in the housing market. As of June 30th the company had $662M in unrestricted cash and $903M available under its Revolving Credit Facility (recently extended maturity to June 2027). The company has $1.989B in unsecured senior notes. For the scope of this analysis we are excluding the debt associated with the company’s financing arm (yes that is a risk, but a totally separate analysis). The debt-to-total capitalization is only 20%. The nearest maturity is $500M notes due March 2026. Since the Revolving Credit Facility matures in 2027, the company could use it to pay off the notes at maturity. In addition, $1B (50% of the total) of the company’s debt matures between 2032 and 2035. The average interest rate on the debt is fixed at 5.94%. Since there are no maturities for several years, rising interesting should not impact the company’s interest rate expense. It should be noted that in 2006, PHM had $3.53B in debt with a 6.4% average interest rate. The debt maturity profile was also similar.

With $1.5B in cash and credit and no debt maturities until March of 2026, the company appears to be in a relatively strong financial position. Here are recent prices of the outstanding issues. The notes of 2026 are trading at about a 140bps over treasury bonds of the same maturity. The notes of 2032 are trading for about 320bps over treasury bonds of the same maturity.

As far as the company’s liquidity and debt profile is concerned, the company appears to have adequate liquidity to withstand a prolonged reduction in demand for housing. It is important to understand that homebuilders generate significant amounts of cash when they stop building as the inventory is sold and not replaced with more homes under construction or acquisition of addition land to develop. In spite of taking over $7B in writedowns during and after the last housing crisis, PHM was able to survive. In fact, the company generated $4.6B in CFO from 2007 to 2012, the worst part of the housing crisis.

Inventory Composition

As we discussed earlier, one significant risk to a homebuilder is carrying a significant amount of land under development and raw land that could be subjected to significant impairment charges if they were sold quickly (if they could be sold at all) to meet other financial obligations. PHM maintains a good ratio of relatively liquid homes under construction (3-6 month turnaround) to land under development and raw land (12-24 month turnaround) in its inventory on the balance sheet.

As of June 30th, 2022, almost 60% of PHM inventory was homes under construction and less than 40% was land under development and raw land. This is a significant improvement over the inventory mix as of December 31, 2006 when only 25% of the inventory was homes under construction. PHM also has about $500M less of raw land on its balance sheet compared to 2006. At quarter end PHM had 23,349 homes under construction.

In 2006, the company was growing both the land under development and land held for future development. PHM has kept those relatively constant in the last 18 months.

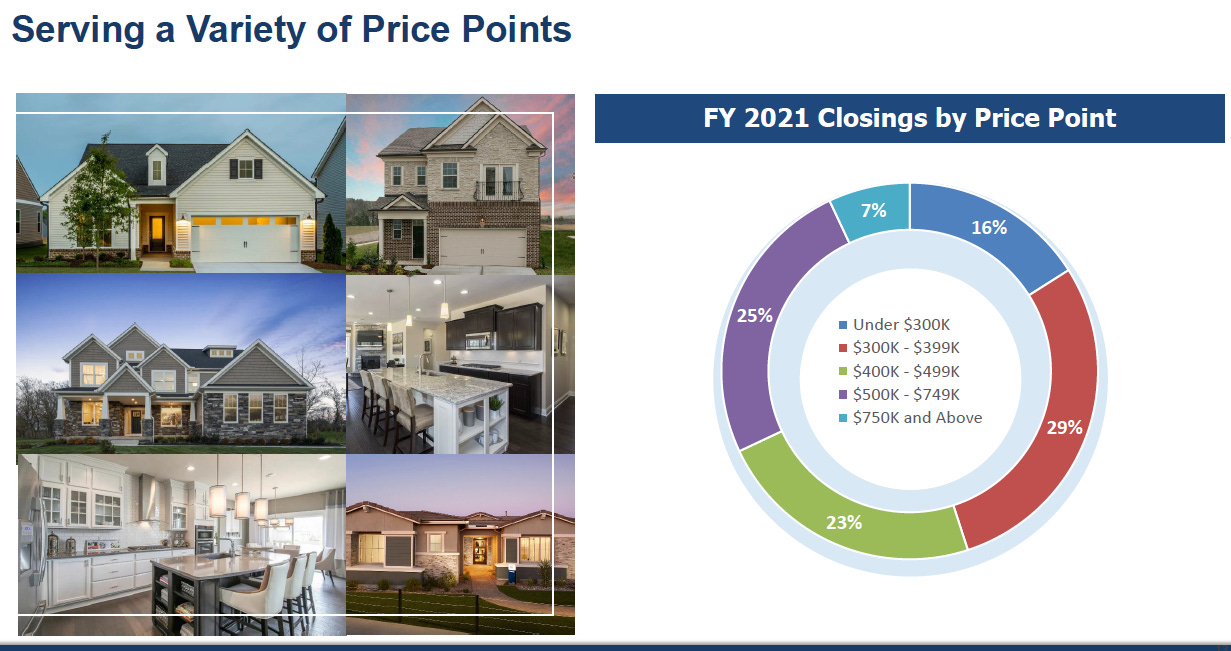

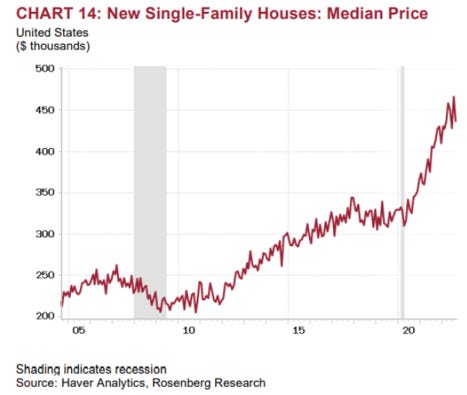

Another significant difference between 2006 and 2022 is the value of the homes under construction is higher on a unit basis. In 2006, the average selling price of a home was $337K. In 2022 the average selling price estimated to be $515K per home. PHM is selling about 10K FEWER homes in 2022 than it was in 2006. Selling higher priced homes on lots that it acquired assuming lower selling prices is one reason why gross margins have expanded by 1350bps since 2006 (30.9% from 17.5%). Historically, PHM gross margin has been in the 23-26% range.

At the end of the June quarter, PHM had a backlog of 19,176 homes, which is down 4% from last year (in 2006 the backlog was about 10.000 homes). However, due to strong price appreciation over the past year the value of the backlog actually INCREASED by 18% to $11.6 billion. At quarter end PHM had 23,349 homes under construction. As demand slows, gross margins could come under pressure (even as lumber and other commodity prices have come down) due to higher incentives and higher lots costs.

Use of Options to Control Lots

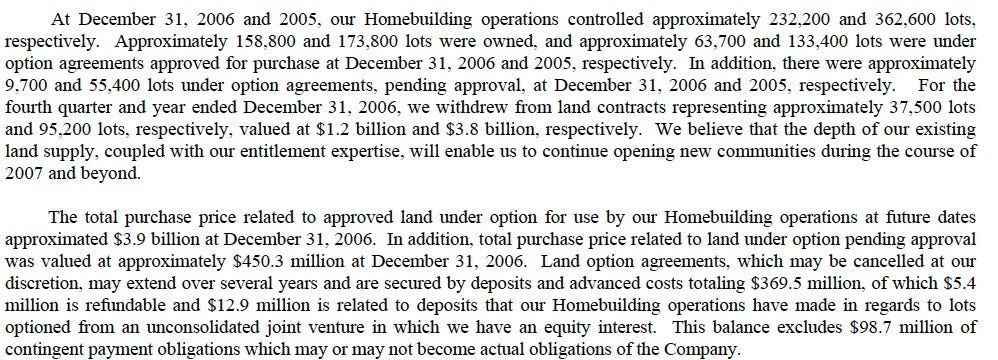

Another reason PHM was able to survive the housing collapse of 2007-2011 was the fact that they switched their business model to utilize more options to control lots to build on and not purchase the lots outright and put them on their balance sheet. This allowed PHM to walk away from lot commitments at a fraction of the cost of writing down the entire cost basis of acquired lots.

In 2005, PHM controlled options on 188K lots with a value of $7.6B with only $431M worth of deposits. From 2005-2007 PHM withdrew from a total of 177K optioned lots valued at $7.4B for a cost of only $410M is writedowns. While that is a significant amount of money, it is much less than the $1.8B in impairments in 2006 & 2007 the company took on land and land held for sale.

At the end of 2006, the value of the land and land underdevelopment was $6.85B. PHM lost 5% of the value of the lots it controlled through options, but 26% of the value of the raw land/land held for development over the same time frame. From 2006-2010 PHM took over $7.4B in valuation adjustment writedowns compared to around $500M in writedowns from abandoned options.

As of June 30th, PHM controlled 130K lots through options (53% of total) at a cost of $292M worth of options ($23M of which is refundable). The future obligation is $6.5B. In 2005, the company controlled 188K lots for $431M. The future obligation was $7.6B. The company has stated that its long-term goal is to have options control a target range of 65%, 70% of total lots under control.

While the company could certainly experience writedowns as it relates to their deposits on their lot options, the amount they could write down is very manageable.

Are Current Gross Margins Sustainable?

In spite of facing record prices for commodities like lumber over the last year, PHM has been able to generate record gross margins. YTD the gross margin is 30.1% compared to 26.4% in 2021. Historically a more normalized is in the 23-25% range. Excluding land and inventory valuation related write-offs, gross margins were 10-17% at the peak of the last housing crisis.

PHM is not the only homebuilder that has taken advantage of the recent market conditions. All of the major builders have shown substantial YOY increases in their gross margins.

We believe that homebuilder margins tend to be mean-reverting and over time they will trend back into the 23-26% range. One factor that investors might not be considering when looking at sustainability of gross margins is the cost of the lot. Typically a lot will represent around 20-25% of the final cost of the house. The homes being sold today are utilizing lots that were purchased several years ago at a much lower cost basis than what they would be acquired for today. In addition, PHM is most likely selling homes on these lots at prices that are substantially above what was assumed when the lot purchase price was underwritten. Therefore, as houses are built on the higher cost lots moving through the system, unless the homebuilders can increase the price of the home to reflect this increase in lot costs, the gross margin will decline (all else being equal). The probable increase in the use of incentives and cancellations will also pressure gross margins.

Many home builders have stated that lower lumber prices are helping them maintain or increase their margins even as higher lots costs start to flow through the system. But at some point the higher lots costs will impact gross margins.

Conference Call comments on Gross Margin Trends.

PHM

In addition to higher prices, our Q2 gross margins reflects the flow through of lower cost lumber purchased in the back half of last year.

Despite the ongoing inflation in materials and labor, including the meaningfully higher lumber costs, we are raising our margin guide for the third quarter and now expect to realize gross margins of approximately 30%. At the present time, we are maintaining our prior guide for fourth quarter gross margins to be in the range of 29.5% to 30%.

Question: Does that kind of point to potentially first half gross margins holding 4Q levels or are there other factors that we should be considering as well?

Ryan Marshall

Hey, Mike, I think it's too soon for that, honestly. We've obviously given a Q3 margin guide and a full-year margin guide. We've got a big backlog. And so we've got good visibility and what that margin profile looks like. And then we've certainly made an estimate on the specs that that will sell and close between now and the end of the year, but we'll give our 2023 margin guide later in the year.

DHI

On a per square foot basis, home sales revenues were up 3.9% sequentially, while stick and brick cost per square foot increased 2.4%. The increase in our gross margin from March to June reflects the broad strength of the housing market we experienced most of this year. The strong demand for homes, combined with a limited supply allowed us to raise prices and maintain a very low level of sales incentives in most of our communities.

We currently expect our home sales gross margin in the fourth quarter to be lower than the third quarter.

Bill Wheat

Mike, I’ll start with the gross margin on these guys may chime in a little bit more on the trends on incentives going forward. Gross margin guide itself. It starts with our backlog as we enter quarter. And as we mentioned, we had a lot of buyers that locked in their mortgage rates that they are expecting to close in Q4. And so we have more visibility to those homes that we expect to close in Q4 to the margins we expect to see there. So that’s the biggest piece of our visibility into our guide. We do still have some homes that we are selling in the current quarter that we will close, and those homes are more likely to be a little more exposed to the current incentive environment. And so we’d expect there to be a few more incentives in some of those homes, which has been factored into the guide as well. And so I think you have many comments in the market around level of incentives, I don’t I wouldn’t say those are inaccurate at all. But our closings in the coming quarter will partially reflect some of the current environment, but will also reflect some buyers that are in backlog and have their rates locked and marching towards closing in Q4.

Mike Murray

The margin guidance, we talked about earlier is also reflective of the cost environment that we faced over the past 6 to 9 months as we started homes at different times and at different lumber pricing, frankly, was a big driver of it. General inflationary pressures across most of our cost categories, but certainly, the lumber has had a great deal of variability over the past 12 months. It rose significantly, fell off a bit, it went back up again and now it’s back down. So as those homes push through the production process and deliver, they are going to have an impact on the gross margin as well.

Jessica Hansen

Sure, Matt. I think you led with the most important point, which is we’re starting at a 30% gross margin. So that really signifies that we’re a long way off from any sort of broad-based impairments. It would take significant margin erosion from declines in home prices. We don’t have any projects right now that are what we deem internally on our watch list because they are approaching a gross margin that we would have to do a more thorough impairment analysis and to really see even any sort of pickup in a watch list before we even get to the point of impairments, we’d have to see a pretty big home price decline.

LEN

We're fortunate to have solid gross margins and limited completed unsold inventory, so we should be able to get these markets on track shortly.

John Lovallo

Thank you for taking my questions, guys. The first one is, can you just help us on the sequential walk in gross margin from 3Q to 4Q? It's about 270 basis points at the midpoint. How much is base price reductions? How much is other incentives, rising costs? And how much of an offset is sort of the typical seasonal operating leverage?

Rick Beckwitt

Yes. So, putting cost aside, I would say that half of it was probably sales incentives. 40%, 30% of it was base price reductions, and the balance was probably some cost and mix. Jon?

Jon Jaffe

I think that's right. As we've talked about on prior calls, the second half and the fourth quarter will be our peak construction cost as the highest lumber work through that. And that will start coming down at the very end of the fourth quarter and into the first quarter. So, that makes sense what you said, Rick. And clearly, the biggest driver is what we're doing to adjust to market to keep our sales pace.

Stuart Miller

Yes. Let me just add to that and say that in addition to pricing and base price as well as incentives management, we're also managing our backlog, recognizing that as prices adjust, we also sometimes have to go back to our backlog. We don't want to turn yesterday's sales and customers into a cancellation. And so, there's some administration of that as well. And so, a lot of moving parts in the walk from third quarter to fourth quarter margins. It's not as linear as just what the new sales are.

KBH

Our gross margin of 27% is a particular highlight of the quarter, demonstrating the impact of our internal initiatives, along with our effective management of pace, price and starts to optimize each asset during the robust demand environment earlier in our fiscal year.

Relative to the vintage of our own lots, we contracted approximately 40% of these lots in 2019 or prior and another 40% were tied up during 2020. As a result, the vast majority of our own lots were underwritten before the run-up in average selling prices, which we believe supports our ability to sustain solid gross margins.

Our housing gross profit margin was 26.7%, up 520 basis points from 21.5% for the prior year quarter. This margin expansion mainly reflected the favorable selling price environment, supported by healthy housing market dynamics when most buyers contracted to purchase these homes.

Assuming no inventory-related charges, we believe our fourth quarter housing gross profit margin will be in the range of 25% to 26%, which is lower than our prior expectation due mainly to the anticipated impact of selling price adjustments in response to softening housing market conditions and a loss of leverage on lower expected housing revenues. At the midpoint, our fourth quarter gross profit expectation represents a 310 basis point improvement as compared to the prior year period.

Jeff Kaminski

Sure, Jeff. Yes, on the sequential gross margin guide. I think, first of all, it's important to point out with our guide at 25% to 26% at the midpoint is up 310 basis points year-over-year, which is a phenomenal level of improvement on a year-over-year basis. So first of all, we're really pleased with that gross margin progression and what we've seen there. There have been a few impacts that have changed that outlook a bit from what we we're expecting at the end of last quarter, a couple of them relate to pricing.

One is we took a more cautious approach reflecting current market conditions on pricing expectations relating to any quick move-in homes and those are the homes either sold in the third quarter or in the fourth quarter for fourth quarter delivery. So that had some impact. We did include some potential selective price adjustments that may be required for some of our customers in backlog. In certain cases, some of our communities now have pricing a bit below where some of the customers have locked in. And with current market conditions, we wanted to make sure we had some provision in there to cover that and that we need it.

We've also lost some leverage on the lower fourth quarter revenue expectation and we explained that a little bit with what we're seeing in the supply chain for the most part. So that had a small impact as well on our fourth quarter gross margin. And then finally, we did see some mix impacts. We beat the third quarter guide by over 100 basis points at the midpoint of the guide. And as a result, or part of the driver of that was closing higher-margin deliveries in the third quarter that we expect to close in the fourth, so we saw some mix impact also coming into play there.

Michael Rehaut

Right. Okay. No, I appreciate that, Jeff. And maybe just to drill down a little further on your answer, I guess. When you say that the bigger portion of the gross margin guidance reduction is from these -- an assumption around selective price adjustments, so if I'm hearing that right, it sounds like you're saying you haven't made those adjustments yet. These are assumptions of what you might need to do through the end of November. And so to me, that's a little surprising in that you have another 10 weeks to go.

Obviously, that's a decent amount of time but you're talking about a large number of closings. So I was a little surprised to hear that, that -- I would have thought that those price adjustments would have already been made. Just curious if that assumption is based on some price adjustments that you've already had to do in the last month or two and you're kind of projecting out a run rate on that? Or is it something where these are kind of active and ongoing and maybe you haven't hit the finish line yet, but it's certainly in progress?

Jeff Kaminski

Price adjustments on home center and backlog, Mike, are generally made very close to the closing date. So that if you decrease prices below some of its contracted price, but later increase the price slightly beyond that, you're not hitting the lowest common denominator. So it's always pretty close to the close date on those.

Yes, there's definitely a lot of extrapolation that's in the numbers right now because we just don't know what that environment will look like over the next couple of months and how many buyers may need to help or encouragement to get their homes closed.

Summary

PHM’s business model is reasonably simple. However the factors that determine the ultimate demand for housing are complex and largely out of the company’s control. Management has tried to mitigate the macro risks by maintaining low leverage using unsecured debt with long maturities and increasing the percentage of lots the company controls using options with low cash deposits. We think their strategy is appropriate and the company is actually in better financial shape today than at the beginning of the last house crisis.

From 2006 to 2011 PHM shareholder equity fell from $6.577B to $1.9B. The company took over $8B in total write downs over that period of time. Most of the write downs occurred once gross margins reached the 10-12%. The next large round of write-offs will occur when the lots costs of lots acquired in the last year or so start to work their way through the system and large incentives are required to move houses as affordability declines.

As long as job growth is OK and the secondary supply of houses remains low (Unlike in 2006-2011 Adjustable Rate Mortgages are still relatively low as a percentage of all mortgages reducing rate shock and large jumps in mortgage payments that, in part, drove an increase in secondary supply.) and can be absorbed by the single family home to rent buyers, we do not think that PHM will see such a large decline in book value in a housing recession this time. Housing prices are cyclical and investors should note that the average selling price of a PHM in 2010 of $259K was exactly the same as it was in 2003.

The company is doing as well as expected to control the aspects of its business that are the most vulnerable to a recession. Because of the way the business model works, during a slowdown, the company generates significant amounts of cash. As discussed earlier, the company was generated $4.6B in CFO from 2007 to 2012, the worst part of the housing crisis.

Disclaimer

Investing501 uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The articles and reports published by Investing501 constitute the author’s personal views only and are for entertainment purposes only. They are not to be construed as financial advice in any shape or form. Investing501 does not predict the price at which the securities of any company may trade at any time. Every investor has different strategies, risk tolerances and time frames. You are advised to perform your own independent checks, research, or study, and you should contact a licensed professional before making any investment decisions. From time to time, the author may hold positions in the stocks mentioned in articles published by Investing501. To the extent the author does have such positions, there is no guarantee that he will maintain such positions. Neither the author nor any of its affiliates accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.