One Hour Analysis: Monarch Casino & Resort ($MCRI) What’s Not to Like? Debt Free, Shareholder Friendly, Free Cash Flowing Machine.

Market Data

Price: $68.00 per share

Market Capitalization: $1.28B

Net Cash: $34M

Enterprise Value: $1.25B

TTM EBITDA: $174M

EV/EBITDA Multiple: 7.2X

Summary:

Monarch Casino is one of the most conservatively run public gaming companies. Since 2009, and excluding the impact of Covid shutdowns in 2020, the company has maintained a debt-to-equity ratio of less than 1X and has had a net cash position in four of those years, including 2023. The company could throw off almost $250M in free cash flow over the next two years without any benefit from the significant improvements to its two casinos rooms completed over the last two years (and into 2025).

The company has consistently grown its market share in both of its markets by providing a location and amenities that are superior to most of its competitors ($900M in undepreciated property and equipment).

Management has been willing to distribute excess cash to shareholders in the form of a dividend and a special dividend. The company also continues to look at acquisition candidates and with a net cash balance sheet and significant free cash flow, the company could be in an enviable position to acquire other casino operators that become distressed in a recession. Management has shown patience, and we expect that to continue. However, the age of the principals could play a factor in what the company does in the next few years.

The company is in the rare position in the gaming industry where it finds itself with two unlevered properties that have some of the newest and best amenities in their markets. EBITDA margins are near the top of the industry, which shows the quality of management at the casino level.

While Monarch is exposed to the same risks as any consumer facing company and would be negatively impacted by the “weakened consumer” in a recession, the lack of debt means the company is in a strong financial position to weather a recession relative to any other public casino company.

Company Profile and History:

Free Cash Flow Will Increase Significantly in 2024.

o Over the last five years, MCRI spent $318M on significant grades to both of its casinos. These upgrades are nearly complete, and the company is set to generate $120M-$140M in FCF per year.

10K Disclosure:

We have continuously invested in upgrading our facilities. Capital expenditures were $51.4 million in 2023, $48.4 million in 2022 and $37.8 million in 2021. During the last three years, capital expenditures related primarily to: the transformation of part of the Monarch Black Hawk legacy facility; the major redesign and upgrade of all hotel rooms in the first and second towers and complete renovation of the high-end suites on the top floors of the third hotel tower at Atlantis; the redesign and upgrade of the Oyster and Sushi Bar Restaurant located in the Sky Terrace at Atlantis; the ongoing capital maintenance spending;

Wall Street is Not Expecting Any Benefit from Recently Completed Property Upgrades. Investor expectations are low.

o FY25 - Revenue $524M. EPS $4.63 per share EBITDA $177M

o FY26 - Revenue $540M. EPS $4.56 per share EBITDA $179M

Management/family owns 25% of shares outstanding. Three of the five Board members are over 72 years old, including two family members.

John Farahi is the Co-Chairman of the Board and CEO.

Owns 18%

He is 76 years old.

Bob Farahi is Co-Chairman of the Board and President.

Bob is John’s brother.

Owns 6%

He is 73 years old.

Ben Farahi was CFO.

Ben is John and Bob’s brother.

Owns 8%.

He is 61 years old.

Craig Sullivan, a Board member since 1998, is 77 years old.

While management has given no indication that they are ready to retire, they are at an age that retirement could be an option. That could create more of an urgency to realize the company’s inherent value.

Numerous ways to increase shareholder value long-term.

o Company could develop the 40 acres it owns in Reno.

o Company could make an acquisition.

We think all or part of Full House Resorts ($FLL) could make an attractive acquisition for company.

It would give the company recently completed high quality casino (Chamonix) in Cripple Creek, CO.

It would eventually give the company a high quality casino (American Place) in Chicago, IL.

o Company paid a $5.00 special dividend in 2023 ($95M). As FCF grows, company could pay another large dividend.

o Company repurchase authorization is 2.533M shares (13% of S/O).

The Company Compares Favorably to Its Peers

Similar to other regional focused gaming companies, MCRI generates the majority of its revenue in the casino, primarily from slot machines. However, the company does generate more revenue from food and beverage and hotel rooms than the other companies. We believe this is the result of the company’s proximity to the Reno/Sparks convention center in Reno and the disportionately high number of hotel rooms in Black Hawk relative to its competitors. We believe that highlights the competitive edge the company has in the markets in which it operates.

Monarch Has Substantial Market Share in Reno and Black Hawk.

Reno Market is Attractive

o The Reno aggregate gaming revenue has grown from $765M in 2019 to $921M in 2023 (4.7% CAGR).

o Atlantis casino is connected to the Reno Sparks Convention Center, giving it a significant competitive advantage.

10K Disclosure:

· We are the only hotel-casino physically connected to the Reno-Sparks Convention Center. In our view, Atlantis is uniquely positioned to capitalize on this segment. We believe the Reno-Sparks Convention Center has created, and we expect will continue to create, additional guest traffic for the Atlantis within this market segment that is presently underserved in the Reno area.

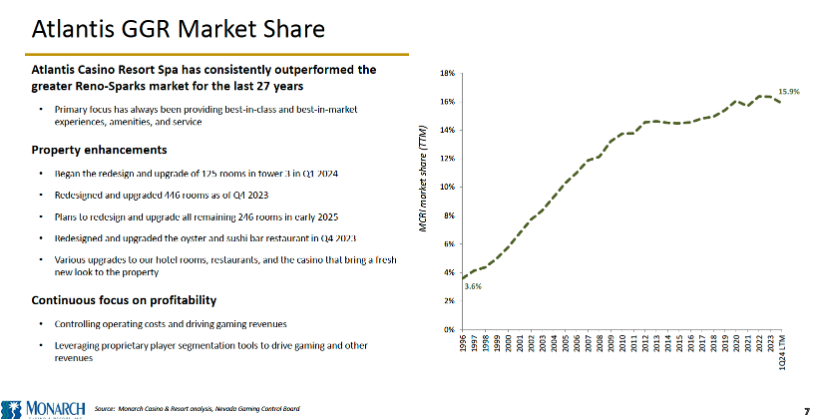

o Atlantis has consistently increased its market share.

Since 1996 the casino has increased its market share from 3.6% to 15.9%.

Room redesign and upgrade is 75% complete.

Spent $91M over last three years upgrading the property.

446 rooms completed in 2023.

125 rooms completed in Q2 2024.

246 rooms expected to be completed in Q1 2025.

Upgrades could generate incremental revenue (gambling/hotel ADR/Food & Beverage) and allow the casino to increase its market share even farther.

Hotel occupancy is significantly above the city average.

Even though the hotel’s cash ADR is in line with the market, the hotel occupancy is significantly above the market average. We believe the quality of the property and the proximity to the convention center, helps to drive above average occupancy.

MCRI Dominates the Black Hawk, CO Market

o Monarch’s prime location is a significant competitive advantage.

o Monarch casino has consistently increased its market share.

Since acquiring the Riviera casino in 2012, the company has increased its market share from 8% to 31%. We believe the prime location; the quality of the management team and the premium facility and amenities are driving this result. Many of the competitors are significantly smaller and most likely capital constrained, which means MCRI could continue to grow its market share. The casino is the second largest in the market behind the Ameristar Casino.

Black Hawk casino descriptions can be found here.

o Recently completed $48M casino expansion and upgrades.

o Company controls 31% of hotel rooms and 1,500 covered parking spaces.

From 2023 10K:

Black Hawk- Our marketing efforts are directed toward patrons from the Denver metropolitan area and Colorado mountain areas. Black Hawk, Colorado is approximately 40 miles west of Denver.

The Denver metro area is an attractive market with a population of approximately three million and a healthy population growth of 16.5% from 2013 to 2023 (national average is 6.5%). Denver metro area median household income in 2021 was 30% higher than the national average ($90,716 vs. $69,717).

Commercial gaming in Colorado is constitutionally restricted to three mountain towns – Black Hawk, Central City and Cripple Creek – which in 2023 represented 77%, 8% and 15% of total Colorado gaming revenue, respectively (Colorado Division of Gaming statistical summaries). These state constitutional limitations and the scarcity of available and developable land in Black Hawk create a strong barrier to new entries in the gaming market, limiting the threat of potential new competition.

The Black Hawk/Central City area gaming market generated approximately $803 million in gaming revenues for the twelve months ended December 31, 2023, according to the Colorado Division of Gaming.

Our Monarch Black Hawk revenues and operating income are primarily dependent on the level of gaming activity in the Black Hawk market. Leveraging our premium location, product and service, we are determined to continue to grow market share by attracting not only Black Hawk gaming guests, but by introducing our new luxurious resort to attract new guests to the market and our property. Our superior lodging, spa and dining products are predominantly intended to drive gaming revenue.

Monarch controls a substantial percentage of the available hotel rooms, which we view as a significant competitive advantage.

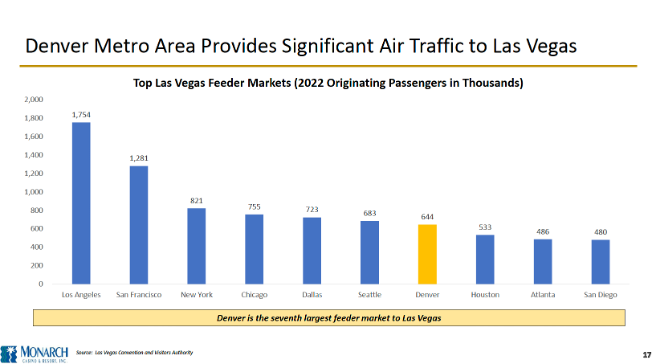

Proximity to Denver is a positive as Denver residents seem to enjoy gambling relative to other large MSAs. While Denver represents the 7th largest feeder market to Las Vegas (about a 1.5-hour flight), the Denver MSA is ranked 19th in population. For comparison, Houston (about a 3-hour flight) is ranked 5th. But per capita spending on gaming in Colorado is still relatively low. So as the quality of casino options improve in Black Hawk, Monarch could see a boost in per capita spending, which would be very high margin revenue.

Dan Lee, the CEO of Full House Resorts highlighted the opportunity to increase per capita spend in Colorado. Colorado per capita spend is significantly below states with similar demographics.

Q1 2024 FLL Conference Call:

You can actually get the tribal casino gaming revenues and when you look at it the people in the state of Washington are gambling about three -- I think it's $375 per capita now, which is over double what the people of Colorado gambling.

And there's no inherent differences in religion or education or something that would explain that. I would think people in Colorado will eventually gamble as much as people in Washington and there's other markets too. You can look at like in California, there's -- they gamble about $350 per capita to and most of the people do not live near a casino, they have to drive an hour to get to a tribal casino or four hours to get to Las Vegas. And so when you start looking at it in Denver and which is somewhere around $200 per capita gambling and Colorado Springs was even lower than that. I think as people understand the quality of what we built we grow the market.

Free Cash Flow is About to Increase Substantially.

Since 2019, the company has spent $99M on improvements to Atlantis (another $30M will be spent over the next 12-15 months) and $209M on the Black Hawk casino. Since 2021 the company generated $331M in free cash flow. When these major upgrades are completed, the company will start to generate even more free cash flow. Even if the company does not generate any more cash flow than 2023 (after all the consumer is always weakening and EBITDA margins are at or near peak), FCF could be over $125M per year in 2024 and higher in 2025.

Since the company has spent so much money on upgrades, maintenance capex should only be $15-$20M per year and then some additional capex on newer slot machines. The combination of no debt and rising cash flow gives management several levers to return cash to investors and/or increase shareholder value.

Free Cash Flow Should Increase Over the Next Two Years

In spite of the upgrades to the casinos, using estimates from TIKR.com, Wall Street is not expecting any significant improvement in cash from operations over the next two years. While the “weakening consumer” is always a risk and EBITDA margins seem to be peaking in the 34-35% range, we feel these estimates are conservative.

Since 2015 the EBITDA margin has expanded by 1000 bps. Margins are probably at or near peak. Other casino companies have shown that 30-35% EBITDA margins are typically near the high end of the range assuming normal operations. Going forward, EBITDA growth will most likely mirror revenue growth.

Even with these conservative estimates, the company will become increasingly attractive on an EV/EBITDA basis as the cash accumulates on the balance sheet.

What Could Management Do with All That Cash?

Dividends

o The company current pays a $1.20 per share in annual dividends. That consumers about $23M a year in cash.

o In February of 2023, the company declared a $5.00 per share special dividend. That payout was approximately $95M in cash. The company could have as much as $300M in cash on the balance sheet by the end of 2025. Therefore, an increase in the regular dividend, another special dividend or a combination of both could occur. Management owns 25% of the stock, so depending on their tax situation, they could be incentivized to utilize dividends to gain additional liquidity.

Stock Repurchases

o In 2014, the Board authorized a stock repurchase plan of up to 3M shares (15% of shares outstanding). The plan has basically been dormant since that time. However, in Q1 2024, the company purchased 218K shares for $19.5M ($69.40 per share). The company can still purchase 2.53M shares under the authorization, which would consume approximately $175M at today’s price. If free cash flow is close to $120M a year, the company could complete the program in two years. Assuming management did not sell any shares, their ownership percentage would increase to 29%. The family ownership would increase to 37% because the son Ben (who is no longer in management) owns 8% of the company.

Acquisitions

o The company has not made an acquisition since acquiring the Riviera Black Hawk gaming license in 2012. However, the company’s presentations always include an acquisition as a possibility.

o While we are not aware of what private casinos may be for sale that the company could acquire, using its criteria of regulatory stability, competitive set, growth opportunities, strong economic trends and population growth, there is a public company that does come to mind.

Organic Growth

o The company has 40 acres split on both sides of South Virginia St. in Reno that it could develop.

Could Monarch Eventually Acquire Some or All of Full House Resorts ($FLL)?

In September of 2022, we did a one hour analysis of Full House Resorts that can be found here. Full House is in the middle of a massive expansion campaign as its recently completed Chamonix casino in Cripple Creek, Colorado ($250M estimated cost) and the eventual completion (in 2027 or later) permanent American Place casino ($500M estimated cost) in northern Chicago. Every quarter CEO Dan Lee makes his pitch for why he thinks $FLL stock is undervalued and provides lots of data on the Chicago and Colorado markets. We encourage readers to read those transcripts

Here is how the Chamonix casino promotes itself as:

European Elegance Meets Colorado Comfort

Nestled in the majestic Rockies, at the center of historic Cripple Creek, the new Chamonix Casino Hotel offers Colorado’s best casino resort experience. With 300 high-end guest rooms and suites, and a spectacular new casino, Chamonix is less than an hour from Colorado Springs and only two hours from downtown Denver. Raise your expectations: come experience your new home in the Front Range.

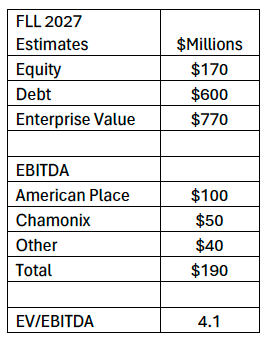

Dan Lee has consistently said that he thinks that when the Chamonix is operating as expected it could generate $50M a year in EBITDA. He has also said he believes Monarch’s Black Hawk casino generates $100M a year in EBITDA.

Dan Lee making his pitch on Chamonix potential on previous conference calls:

Let's get Colorado making good money and then people will see that we're actually less levered than most casino companies and at that point we should be able to refinance the debt on favorable terms with the extra money to build American Place, so that's the strategy, that's the plan.

We have 300 guest rooms. They each have about 500 (Monarch and Ameristar in Black Hawk). But we are nice, and frankly, it's a more romantic environment. I mean, Black Hawk is, I think, legally a historical mining town, but if you go there, you see very few vestiges of it. And Cripple Creek feels a little bit like Colonial Williamsburg out of brick. And so I think we're a better environment.

Now, distance-wise, the southern parts of the Denver MSA are about equal distance. So Centennial, Castle Rock, and so on, they can go to us as easily as they can go to Black Hawk. And so, obviously, we're doing double the revenue. Well, last year's revenues weren't very high. We're doing double, and that's not even close to what we should be doing and will be doing. But I think it comes from growing the market. I mean, the gaming per capita in Colorado Springs is one of the lowest places I know of in the country, and there's no inherent reason for that. So I think we grow the market.

If you run the math and just say, okay just get this stuff mature and you get Chamonix up to I mean Monarch is making over $100 million a year. We have two-thirds as many guestrooms is that. Can we make 50? We should be able to. It's not going to happen tomorrow but we should be able to get to that sort of number. And it might take us a couple of years to get there.

You have to appreciate; this is one of the largest buildings built in rural Colorado ever. I mean, it's bigger than anything in Vail or Aspen. The only buildings similar to this were Ameristar and Monarch and Black Hawk, and they had similar issues.

Here is Dan Lee’s summary of where Full House could be in 2027 if everything goes to plan, which we think is the best-case scenario and the results could be substantially less (especially for American Place).

Monarch’s Options:

Acquire just the Chamonix casino.

We think Monarch would find the Chamonix a good fit for its portfolio. It is located in Colorado, a market they understand well. The casino is brand new and is clearly the best facility in the market. While the acquisition would increase exposure to Colorado, it does add a second market that it can dominate and the $50M in estimated EBITDA could grow and provide significant free cash flow.

The cost of the acquisition would probably be in the 4-6X EV/EBITDA range or $200M-$300M. Monarch could easily afford this price.

It is unclear if FLL would sell just this casino, especially if it is performing as expected. However, if it is performing below expectations, the company might be compelled to sell to help fund the completion of the American Place casino in Chicago.

Acquire the whole company.

It could cost upwards of $1B to acquire the entire company after the American Place is completed in 2027-2028. The value would more than likely double the size of the company.

The Chicago market is a difficult market and we do not consider the state to be entirely gaming friendly as they consistently raise or attempt to raise the tax rate on gaming revenue.

For example:

Sports betting stocks were jolted in early action on Tuesday after the Illinois State Senate passed a bill on Sunday proposing higher taxes on online sports betting operations. Under the new proposal, online sports betting operators will begin paying higher taxes on July 1, ranging from 20% to 40% depending on their level of annual revenue. Sports betting operators in Illinois have been paying a 15% tax since June 2021. Governor J.B. Pritzker proposed an increase to 35% earlier in the year.

It will take a couple of years for the American Place to stabilize and there is no guarantee it will meet Full House management’s expectations.

We are not sure if the other two properties, the Silver Slipper casino in Mississippi and the Rising Star casino in Indiana (near Cincinnati) fit Monarch’s criteria for investment. They are well established, and the markets are relatively stable.

Given the conservative nature of management, the aversion to excessive leverage and the high degree of uncertainty around the future of the American Place, we do not believe a takeover of the entire company is likely at this point.

What about Dan Lee?

One thing that is intriguing about acquiring some or all of Full House Resorts is considering what the future of FLL CEO Dan Lee would be. Dan has been CEO of Pinnacle Entertainment, CFO at Mirage Resorts and a securities analyst for Drexel Burnham Lambert and CS First Boston.

Dan Lee is 67 years old, but that is younger than two of the three Farahi brothers and one of the independent Board members. If Monarch acquired all of Full House, Mr. Lee could become the CEO of the new company and the Farahi brothers could step away from the day-to-day management of the company.