One Hour Analysis: MamaMancini’s Holdings, All Hat and No Cattle. Can the New CEO & CFO Deliver the Long-Promised Profitability?

Investors are Skeptical

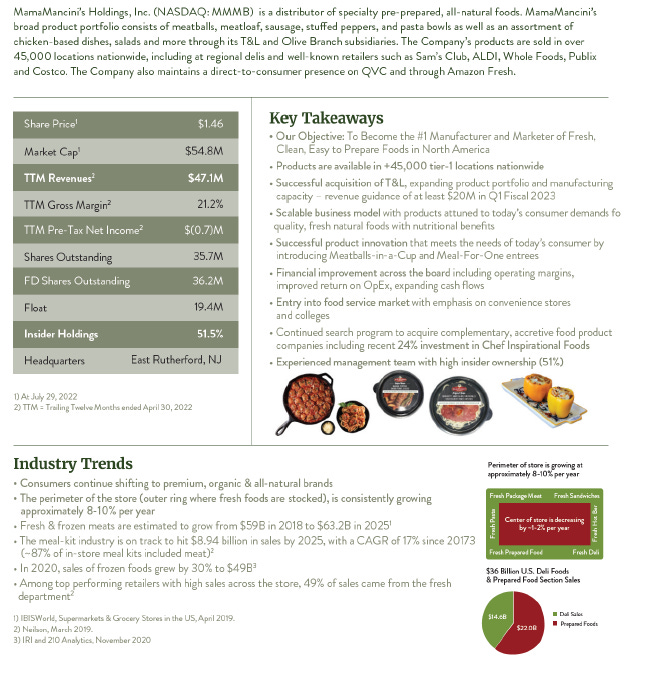

MamaMancini’s Holdings $MMMB

Price: $1.10

Shares outstanding: 36M

Market cap: $41M

Cash: $2M

Debt: $13M

Enterprise Value: $50M

Company Overview:

We tend to get annoyed with research reports or bloggers that fill their analysis with company slides and then do not follow them up with any analysis or comments. But since this is an OHA (one-hour analysis) we are going to do it as a way to speed up the reader’s understanding of the company. Below are the most important slides from the company’s recent presentation. It gives the basic “elevator” pitch of the company.

Initial Thoughts:

· Revenue has grown from $18M in 2016 to a $100M run rate as of Q2 FY23. However, gross margins have declined from 40% to 16% over that time frame costing the company at least $10M in EBITDA. This is the biggest concern about the company. On numerous conference calls and SEC filings management has predicted that higher gross margins were just around the corner. The company recently hired a new CEO and CFO. Perhaps they can reverse the trend. The company has leveraged SG&A.

· Recent acquisitions boosted revenue by 50% and could create platform for more growth. Recent announcements of 10,000+ new product placements highlights prospects for growth.

· Management owns 45.6% of shares outstanding, deterring activist or takeover activity.

· Respected investor Connor Haley (Alta Fox) (4.7% owner) has resigned from the Board after about 15 months. As of June 30th his firm still held 1.68M shares.

Profitability Has Not Kept Up with Revenue Growth

Since 2016, through a combination of new product placements and recent acquisitions, MMMB has tripled its revenue on a trailing twelve-month basis. Based on recent press releases, the company is now on pace to generate over $100M a year in revenue on an annualized basis. The company appears to be guiding Q2 FY23 revenue of over $25M (compared to $22.9M in Q2 FY23). However, while revenue has increased by $50M since 2016, gross profit dollars have only increased by $4.5M (9% gross margin rate). While higher commodity and transportation costs have been impacting margins this year, the gross margin has been declining for years.

It is concerning that management has been overly optimistic about the timing of improvements in the gross margin rate. The stock has declined nearly 25% since the company reported disappointing earnings on September 14th. The company reported a gross margin of only 11.8% compared to 28.1% in the previous year’s quarter. The gross margin was also 600bps below the previous two quarters.

Frankly, it is unclear to us why management has had such a difficult time getting costs under control. Below is a sample of management comments from the last four conference calls. On several occasions management thinks that gross margin improvement is coming in the next quarter, only to report disappointing gross margins.

Conference Call Q2 FY23

CEO Adam Michaels

Our three 'Cs', cost, controls, and culture, will provide a structure and framework needed to be laser-focused on the most critical improvement opportunities. Our cost focus will provide the rocket fuel for growth. Our financial and operational controls focus will make us fit for growth and our culture focus will provide us the design for growth. Over the next few months, you'll be hearing more from me and Anthony on these three Cs.

To address the specific headwinds we faced this quarter, we have already been aggressive in seeking out new ways to strengthen our firm-wide margin profile. For example, we have instituted a new pricing process that more accurately and rapidly tracks input costs including commodity costs to ensure that every single sale we make is meeting our required margin profile. In addition, we are conducting a thorough analysis of our suppliers and have already identified several areas where we have the potential to realize significant cost savings.

In summary, while we have seen some margin headwinds in calendar year 2022, we are well positioned to build significant momentum in calendar year 2023 as we drive organic growth, grow our team, expand our capabilities, and seek to become brilliant at the basics, all with the goal of building sustainable value for our shareholders over the long-term. I look forward to driving new momentum towards the realization of MamaMancini's significant potential.

Conference Call Q1 FY23

Management believes the balance between inflated raw material costs and the company’s price increases will normalize in the second quarter, returning gross profits to its historical range.

Analyst Howard Halpern

Congratulations, great kick-off to your first quarter. In terms of gross margin, do you anticipate that you’re going to be able to get back into that 20% area in the second half of the year?

CEO Carl Wolf

Well, yes. Right now, our adjusted EBITDA, which was a minor adjustment of $55,000 for acquisition expenses, is running around 3.5% of sales. Our norm is around 8.5%, so most of that will come from gross margins, so we should see 3% to 4% increase in gross margin, and as our sales grow, our expenses should come down, so we should be significantly above 20% as things normalize.

Conference Call Q4 FY22:

The decrease in gross profit in the fourth quarter is primarily due to increases in raw material, packaging and in-bound freight costs, which outpaced sales price increases during FY22 Q3 and Q4.

Analyst Howard Halpern

Okay. And as Matt was talking about with gross margins and the headwinds that are there, even with the headwinds, are you going to be able to get gross margins back towards the low 20% area – low to mid 20% area by the end of this year even if the conditions persist?

CEO Carl Wolf

Well, first of all, the margins are a little distorted because T&L and Olive Branch have lower gross margins with very low overheads. So, however, margins are increasing substantially right now for the quarter. And even though it's an average and overheads are in-line, so we expect results to be substantially greater or better than the fourth quarter. What's interesting is I think you and your projection had just about projected what we would earn. Sales were lower. So, it was not a total surprise as to having the headwinds this quarter.

Conference Call Q3 FY22:

The lower gross profit margin in the third quarter was due to higher cost of protein, cost of freight in all elements of supply. The Company expects gross margin will improve by fiscal year end as commodity prices normalize and higher production volumes will result in higher plant operating efficiencies, and significant price increases come into effect.

Analyst Howard Halpern

First question relates to, I guess, the gross margin that you anticipate improving over time. What do you think the lag time is between the price increases and them accepting it, and the leverage that you are creating also within the plant? If you could add some color to that over the next few quarters?

CEO Carl Wolf

I think this quarter is partial and the next quarter should be pretty close to complete. What happened this year is that in prior periods where there is spike in protein prices, they backed down as consumer had resistance, etc. Well, this year there wasn’t any back-down. If have you read the Tyson report, their protein prices were up about 35% on average and their sales were down around 15%, and their profits doubled.

So, we are getting the prices through, most of them will occur January 1 through mid to late January. Also there was -- we are really spending a lot of time on freight. Freight was $300,000 higher on way out, but about a $100,000 on way in. So we are spending a lot of time on managing that. So it affected us both ways.

The optimism on gross margin improvements also extended to 10K filings. Management has consistency expressed optimism on gross margin increases since at least FY16. Postage and freight costs have been consistently called out as the costs that have had the biggest impact on reducing the gross margin.

Can New Senior Management Get Costs Under Control?

Anyone that has followed MMMB for a while has probably met or seen long-time former-CEO and now Chairman Carl Wolf. He is a regular on the microcap conference circuit and frequently does zoom calls with investors. We have had meetings with Carl on several occasions at various conferences. He is a very optimistic person and tells the MMMB story with passion, enthusiasm, and candor. However, with the combination of the consistent over-estimation of margin improvement and a nearly 60% decline in the stock price over the last year, (25% in the last month) perhaps investors have lost confidence in his management skills.

Mr. Wolf has recently resigned his position as CEO and Adam Michaels was appointed as the new CEO (Sept. 6th) and was also appointed to the Board of Directors. On September 19th the company added Anthony Gruber as the CFO. The previous CFO had been with the company four years and was 71 years old. One thing that we like to see when a company has been struggling with certain aspects of its business is the appointment of new management with skills to address the issues. The new CEO and CFO have significant experience at large, high-quality companies and seem to have the skill sets needed to begin to address the long-standing cost issues. However, we always have concerns that part of the success of the new managers at their previous jobs was their access to substantial resources and additional management talent that are not always available in small companies like MMMB.

Adam Michaels:

Adam served with Mondelez International, a multinational food and beverage company with operations in over 150 countries., Over the past nine years, he has held numerous roles with increasing responsibility at Mondelez across Supply Chain Commercial Sales & Marketing and Strategy. Adam led Mondelez’s North American Insights & Analytics organization and was most recently responsible for M&A and Commercial for North American Ventures – a business unit comprised of high growth brands including Perfect Snacks, a refrigerated snacks brand, Hu, an ultra-simple multi-category lifestyle brand, and Tate’s Bake Shop, a premium cookie brand, among others. Before joining Mondelez, Adam was a Principal at Booz & Company, a management consulting firm, for seven years where he specialized in the Food & Beverage sector. He started his career at Capital One Financial and holds an MBA in Marketing & Management from Columbia Business School, as well as a BSE in Bioengineering from the University of Pennsylvania.

Anthony J. Gruber:

Previously he was Chief Financial Officer at De’Longhi America, Inc., an Italian small appliance manufacturer, leading a team in support of the 120-employee, $400M North American subsidiary. He also served as CFO at Richemont North America (13 years), Inc., a Switzerland-based luxury goods company with 2020 revenues of $2B, leading a team of 85 people and responsible for all aspects of finance for the organization. Gruber has a BS, Accounting, from the University of Bridgeport and is a Certified Public Accountant.

The two new executives have been on the job for less than a month, so we think investors should be patient in evaluating their ability to implement new cost control measures. However, we do believe that the change is a positive.

Recent Account Wins Encouraging

As we have mentioned before, MMMB has had no difficulty in growing revenue over the last 6 years. The company has been able to increase both the number of products and the number of distribution points, which demonstrates the quality and consumer demand for their products. The company recently announced several major placements of new products in a large number of Tier-1 regional and national locations. If the company was not growing their sales organically, we would have additional concerns about the potential for a turnaround.

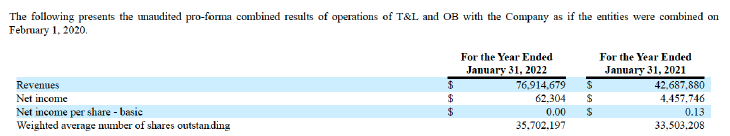

Acquisitions Help Create a Platform for More Growth

In December 2021, acquired T&L Creative Salads and Olive Branch, which are gourmet food manufacturers with a strong east coast presence. The total combined purchase price was $14M. The companies had total sales in 2020 of approximately $21M or 50% of MMMB sales. The acquisitions brought in both new customers and new products. The company also acquired another manufacturing facility as part of the acquisition. Both companies were growing before they were acquired by MMMB. The recent announcements of additional product placements have been driven, in part, by products and relationships of both T&L Creative Salads and the Olive Branch.

YTD revenues are $27M higher than last year. It should be noted that the gross margins of the two acquired companies is lower than MMMB historical business, but the operating margins are similar.

According to a recent press release, the company also acquired “a 24% stake in Chef Inspirational Foods, Inc. (“CIF”), a leading developer, innovator, marketer and sales company selling fresh and frozen prepared foods, for an investment of $1.2 million, at an implied enterprise value for CIF of $5 million. The investment consists of $500,000 in cash and $700,000 in MamaMancini’s common stock. MamaMancini’s retains the option to purchase the remaining 76% interest in CIF within one year. The purchase price is an additional $3.8 million, of which $3.5 million would be paid in cash and $300,000 in common stock, which would be paid within a two-year period from June 28, 2022. The company’s specialty is the Deli Department for prepared salads, prepared entrees and olives, with a unique line of different artisan flavors and styles. Based in West Palm Beach, Florida, and Long Island, NY, CIF expects 2022 gross sales of $30 million.” It is our understanding that at least $20M of the $30M in gross sales are actually intercompany sales to T&L.

Respected investor Connor Haley of Alta Fox Capital Management (4.7% owner) resigned from the Board after about 15 months.

Many readers of this blog are probably familiar with Connor Haley who runs Alta Fox Capital Management. Earlier this year he nominated five candidates to the Board of Hasbro. He also proposed the company spin out Wizards of the Coast segment that he felt could unlock $100 per share in value for shareholders. Mr. Haley had a previously successful activist campaign with Collectors Universe.

In 2020 Mr. Haley wrote up MMMB on his website. The report can be found at this Link.

Below was his Valuation Model. While revenue of $66M in FY23 is close to the current $64M in revenue on a TTM, the company lost $1M on an EBITDA basis compared to his estimate of $11.87M in EBITDA. Up to this point his investment thesis has not played out as he expected.

Subsequent to this report, Mr. Haley acquired 1.68M shares of MMMB (4.7%) and took a Board seat in March of 2021. It is our understanding that Mr. Haley was a very engaged Board member. Mr. Haley resigned from the Board in June of 2022. We are not sure if Mr. Haley will continue to hold shares of MMMB now that he is not on the Board and his thesis has not been proven out. His position in MMMB is relatively insignificant to his investment portfolio.

SEC Filing Tidbits

10Q Q2 FY23

Spartan Capital, LLC

The Company entered into a fourth Financial Advisory and Investment Banking Agreement with Spartan Capital Securities, LLC (“Spartan”) effective April 1, 2015 (the “Spartan Advisory Agreement”). Pursuant to the Spartan Advisory Agreement, if the Company enters into a change of control transaction during the term of the agreement through October 1, 2022, the Company shall pay to Spartan a fee equal to 3% of the consideration paid or received by the Company and/or its stockholders in such transaction. Upon consummation of the acquisition of T&L and OB in December 2021, the Company paid Spartan $401,322 pursuant to the advisory agreement. Based on this agreement with Spartan, as of July 31, 2022, the Company owed $36,000 to Spartan upon the consummation of CIF purchase.

AGES Financial Services. Ltd.

On July 6, 2022, the Company executed a Proposed Offering Engagement Letter with AGES Financial Services. Ltd. (“AGES”) to act as a non-exclusive (i) dealer-manager, (ii) placement agent and/or (iii) financial advisor for a proposed issuance, or series of issuances, for up to $5,000,000 of the Company’s Series B Convertible Preferred Stock (“Proposed Offering”) in a private placement to be conducted by the Company pursuant to the exemption from the registration requirements of the Securities Act provided by Rule 506(b) of Regulation D promulgated by the Commission under the Securities Act of 1933, as amended. Unless terminated prior to December 31, 2022, the period of the Engagement runs from July 5, 2022 through December 31, 2022.

In consideration for its services in the Proposed Offering, AGES shall be entitled a cash fee equal to four percent (4%) of the net dollar amount received by the Company from investors sourced by AGES plus five-year warrants to buy Common Stock of the Company at the rate of 1 warrant for every $100 of such net dollar amount. The Company shall be responsible for payment of all expenses relating to the proposed offering, including but not limited to costs associated with the registration of any Common Stock which may be issued upon conversion of the Series B Convertible Preferred Stock.

Series B Preferred Shares to be Issued

During July 2022, the Company received net proceeds of $515,000 from accredited investors pursuant to the above Offering which has yet to close and the shares have yet to be issued. The funds received are to be used for working capital purposes. The outstanding amount as of July 31, 2022 was $515,000 and is shown as “Liability for Series B Preferred Shares to be issued, net” on the accompanying condensed consolidated balance sheets.

10K FY22

During the year ended January 31, 2022, the Company incurred approximately $748,000 in transaction costs for professional fees and other expenses, which are included in General and administration operating expenses on the Consolidated Statements of Operations. Of these fees, approximately $401,000 was paid to Spartan Capital Securities, LLC (See Note 12).

During the year ended January 31, 2021, warrant holders exercised a total of 3,631,733 warrants and the Company issued 3,588,490 shares of common stock as a result of these exercises and received net proceeds of $3,773,182 which included $87,000 paid to the placement agent. Of the 3,631,733 exercised warrants, 80,000 warrants were exercised on a cashless basis by Spartan Capital and the Company issued 36,757 shares of common stock.

Agreements with Placement Agents and Finders

The Company entered into a fourth Financial Advisory and Investment Banking Agreement with Spartan Capital Securities, LLC (“Spartan”) effective April 1, 2015 (the “Spartan Advisory Agreement”). Pursuant to the Spartan Advisory Agreement, if the Company enters into a change of control transaction during the term of the agreement through October 1, 2022, the Company shall pay to Spartan a fee equal to 3% of the consideration paid or received by the Company and/or its stockholders in such transaction. Upon consummation of the acquisition of T&L and OB in December 2021, the Company paid Spartan $401,322 pursuant to the advisory agreement which is included in general and administrative expenses on the consolidated statement of operations.

Advisory Agreements

The Company entered into an Advisory Agreement with Spartan effective June 1, 2019 (the “Advisory Agreement”). Pursuant to the agreement, the Company shall pay to Spartan a non-refundable monthly fee of $5,000 over a 21-month period. Additionally, the Company granted Spartan 125,000 shares of common stock which are considered fully-paid and non-assessable upon execution of the agreement. During the term or this Agreement, the Consultant will provide non-exclusive consulting services related to general corporate matters, including, but not limited to (i) advice and input with respect to raising capital and potential M&A transactions, (ii) identifying suitable personal for management and Board positions (iii) developing corporate structure and finance strategies, (iv) assisting the Company with strategic introductions, (v) assisting management with enhancing corporate and shareholder value, and (vi) introducing the Company to potential investors (collectively, the “Advisory Services”). The advisory agreement was terminated according to its terms on March 31, 2020

Valuation

On numerous occasions, management has stated that it believes that the long-term steady state EBITDA margin is in the 8-10% range. Connor Haley thought the company could achieve 18% EBITDA margins. What we have chosen to do is a highly simplified valuation model. The model simply takes a range of EBITDA from $6M to $12M and applies an EBITDA multiple from 6-12X. Readers can make their own assumptions as to what level of sales and margins produce the EBITDA range.

For valuation purposes we simply take the implied enterprise value, deduct $13M in net debt (we assume the new preferred is not exercised and cash neutral) and divide by 36M shares. Readers can make additional adjustments from there.

These assumptions produce a stock price range from $0.64 to $3.64 per share. With the shares trading at $1.10, clearly investors are skeptical of a major improvement in profitability.

Note: Assumes $13M in Net Debt

Summary

MamaMancini Holdings has shown that it has quality products and can grow its revenue on a fairly consistent basis. Recent announcements of over 10,500 new placements reinforces this point. The company believes its new Meatball in a Cup product can double the size of its potential markets (breaking into foodservice and convenience stores).

The company has done a reasonable job of leveraging SG&A from 37% of revenue in 2015-2016 to just under 20% on a trailing twelve-month basis. However, the company has not shown that it can grow sales AND control gross margin. Over the same time frame, gross margins have fallen from 40% to 17% on a TTM basis. This has cost the company nearly $10-$11M in gross profit dollars. The hiring of a new CEO and new CFO with large food and consumer company experience could be the change that is necessary to address this weakness. However, turning around a microcap company is significantly more difficult that being a successful manager of a multi-billion dollar company.

The company is in the process of issuing $5M in a convertible preferred stock that should help liquidity.

If the company can achieve its 8-10% EBITDA margin goal and continue to grow revenue, the stock could trade in the $1.40-$2.40 per share range, which would be a substantial return on investment from current prices. However, this turnaround depends on the success of the new CEO and CFO to address the long-term gross margin contraction. Management controls over 45% of the stock, so there seems to be little chance that an activist could come in to address the margin issue, increasing the reliance of success on new management.