One Hour Analysis: Is Rocky Mountain Chocolate Factory Management High? $RMCF

New Management + New Board + New Strategy Is Intriguing, But The Turnaround Will Probably Take Longer Than Most Investors' Investment Horizon

After a 4-year proxy fight with one of the company’s largest shareholders, new management and a revamp of the Board has been installed at the company.

Management has issued a plan to reinvigorate the brand.

Strong insider buying is interesting.

Clean balance sheet and the company owns their factory in Durango, Colorado.

While the company has taken numerous steps to improve current operations and return the company to growth mode, we still have several concerns:

Weak franchise system is a major hurdle to overcome.

Significant percentage of current franchisees are single store operators.

AUVs are very low at $574K per store.

Same store sales have never been that strong.

0-1.5% same store sales growth is not very good.

How Did We Get Here?

After earnings peaked in FY 2016 at $0.75 per share, they have steadily declined. Since FY 2021, the company has been losing money. Four years ago, AB Value Management and other shareholders representing approximately 17% of the shares outstanding began a proxy fight to replace several members of the Board. Global Value Investment Fund (an 8% owner of the shares) nominated its own slate of five directors and issued a letter to shareholders. Over 70 filings relative to the proxy contests were filed in 2021 and 2022. A detailed summary of events here.

Eventually, Global Value Investment Fund prevailed and new management and Board members were installed. A standstill agreement was reached with AB Value Management. Since that time, the new management team has been very busy trying to revitalize and improve the business. The purpose of this one hour analysis is to provide an overview of the plan and its merits and give investors a starting point for their own analysis.

First Step to Recovery is Acknowledging You Have a Problem.

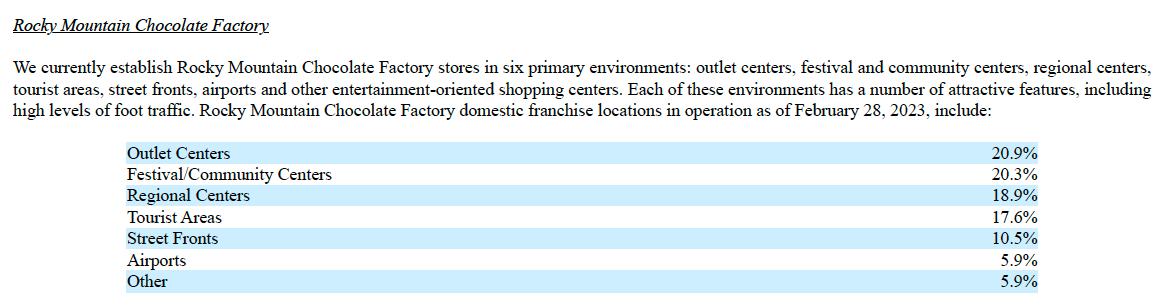

The steady decline in earnings over the last seven years shows that former management and the founder had become complacent and let the business decline. The most disappointing aspect of this decline was that it occurred during a period of strong industry growth. As the graphic above points out, company chocolate factory sales DECLINED by 30% even as the industry experience a 25% GROWTH in sales. The loss of market share over that time is stunning.

Now that the lengthy and costly ($4m-$6M in added costs) proxy fight is over, the new management team and Board have a clean slate and mandate to turnaround the company. What follows is a summary of the plan and my thoughts on the prospects of its success.

The Plan and My Thoughts

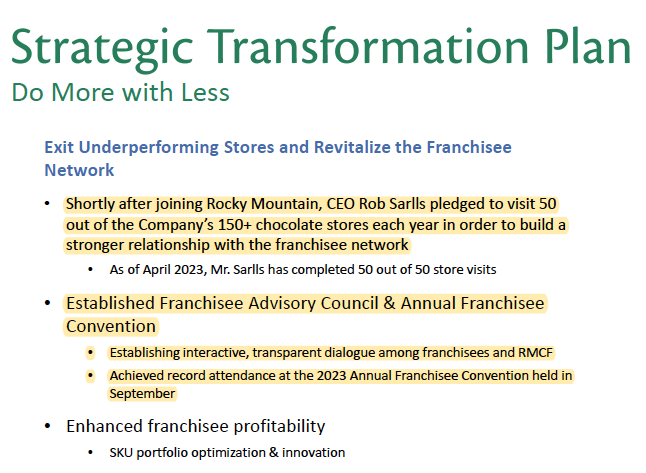

Management has spent 2023 putting the pieces in place for what they call their “Strategic Transformation Plan.” The latest presentation can be found here. In several respects, their plan reminds us of the turnarounds taking place at Mama’s Creations ($MAMA) and Potbelly’s ($PBPB). I will go through the slide deck and include my thought’s as well as my concerns.

Thoughts:

All of these key imperatives address the structural problems the company has faced for the last 10-15 years.

Like many microcap companies that were run by the founder, the company lost focus, became less efficient and the brand became stale. New management recognizes this and is addressing these problems directly.

Thoughts:

One of my biggest concerns is the very weak franchisee system. Without a significant improvement in the quality of the franchise system, I do not think that the company’s long-term plan can succeed.

When I talk about “quality” I am not trying to being derogatory towards the current franchisees. I am sure they are all hard working people and I hope they all achieve their dreams. However, I estimate that approximately 130 out of the 153 franchised stores are owned by single unit operators. This is very high for a franchised model and increased the risk of a high degree of store closures and makes it difficult to add stores at a reasonable pace.

The establishment of the Franchisee Adisory Council and the introduction of a national convention is a positive step. This will help invigorate the current franchisee base and provides opportunities for them to give direct input and advice on how to improve the brand.

Thoughts:

Similar to what was going on at Mama’s Creations, there is a lot of low-hanging fruit when it comes to logistics and cost control at the factory level. I believe these savings and improvements are by far the easiest goals to achieve.

In the past year the company hired a Senior Supply Chain/Optimization Advisor and a SVP of Manufacturing & Supply Chain. It appears as though these hires are starting to make an impact. This is a significant positive step towards improving profitability.

Thoughts:

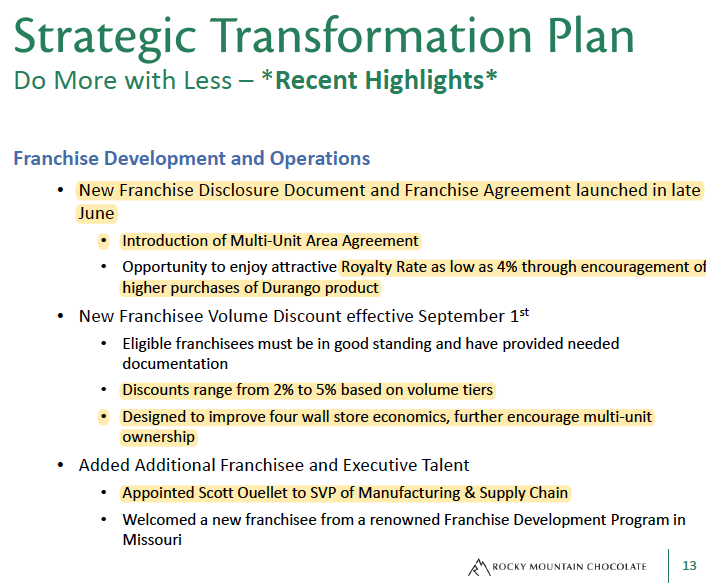

As I mentioned earlier, this long-term plan cannot succeed without upgrading the franchisee system and focusing on Multi-Unit Franchise operators. This is probably the biggest risk/reward to the long-term success of the company. Potbelly’s turnaround is being driven, in part, by signing numerous franchise agreements with multi-unit operators to reignite its unit growth.

4% royalty rate is attractive.

Establishing a Mult-Unit Area Agreement is a significant plus.

Thoughts:

Quite simply, simple is better and all these steps are positives to help management focus on the important aspects of the plan.

Expenses related to proxy contests inflated SG&A and took away management focus on running the business. Recent operational changes shows management is now focusing on turning around the company.

Thoughts:

More examples of how new operations personnel are making an impact.

All of these changes seem to be improving margins without sacrificing quality or operations. These changes are similar to what MAMA 0.00%↑ was able to do in just 6 months (1000bps of gross margin improvement).

Thoughts:

The only way to add 100 new stores is through multi-unit operators. Improving the current franchise base with the modest investments and showing success in boosting same-store sales and returns is required to be able to successfully recruit multi-unit operators. This will take years, but Potbelly’s has been successful with a similar strategy.

I think they need to fix the base before they really start to grow units. This has been a problem for NDLS 0.00%↑ and most other restaurant companies that struggle. They jump the gun and return to growth mode too quickly. This is a danger for success of the plan.

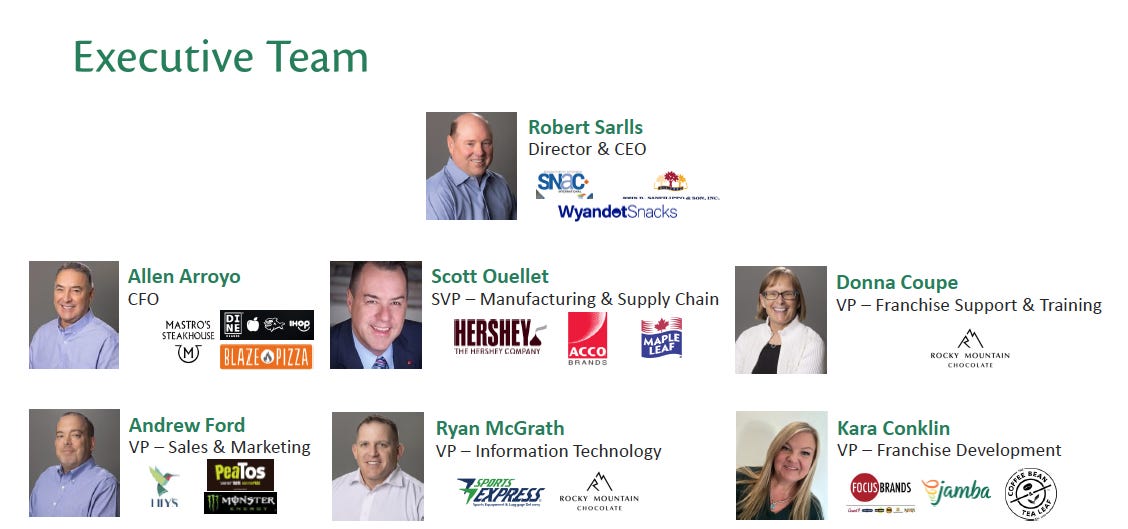

Recent hires and appointments to the Board are positive for the company.

DURANGO, Colo., Sept. 22, 2023 Rocky Mountain Chocolate F announced today that global snack industry veteran Scott Ouellet has been appointed to the role of Senior Vice President, Manufacturing and Supply Chain, effective September 18, 2023. Mr. Ouellet has acted as a Senior Supply Chain Advisor to RMCF since October 2022.

Mr. Ouellet brings over 25 years of experience in supply chain transformation and strategic business advisory, primarily in the confection and snack industries. Prior to his engagement with RMCF, Mr. Ouellet served as a supply chain advisor for the leadership team at Wyandot Snacks, and also held supply chain leadership roles at The Hershey Company, Amplify Snack Brands, ACCO Brands and BLACK+DECKER®, among others.

In connection with his appointment, the Compensation Committee of the Board of Directors of the Company approved an inducement award, in accordance with Nasdaq Listing Rule 5635(c)(4), to Mr. Ouellet, granted on September 18, 2023, consisting of an aggregate of 19,591 restricted stock units ("RSUs”).

DURANGO, Colo., Nov. 13, 2023 Rocky Mountain Chocolate Factory Inc today announced the completion of the rebuilding of the Company’s senior leadership team with the appointment of Kara Conklin as its new Vice President of Franchise Development, effective November 13th. She is reporting directly to Rob Sarlls, CEO of the Company. Ms. Conklin has nearly two decades of franchise development and operating experience, beginning her career with the Subway® network, Quiznos®, Coffee Bean & Tea Leaf®, and Jamba®, among others. Most recently, she served as Director of Franchise Sales for the West Coast for Focus Brands®, representing such brands as Auntie Anne’s®, Cinnabon®, McAlister’s Deli®, Moe’s Southwest Grill®, and Schlotzksy’s®.

Durango, Colorado--(Newsfile Corp. - February 2, 2023) - Rocky Mountain Chocolate Factory, Inc. today announced the appointments of Tyson Snider as Senior Director - Manufacturing, and Justin Bashein as Director - Research & Development ("R&D") / Quality Regulatory Compliance (QRC).

"Both of these new positions are based in Durango, Colorado and are critical to meeting the first phase of the Company's strategic plan: improving and enhancing factory operations and the entire end-to-end supply chain," said CEO Rob Sarlls. Most recently serving as Business Director for contract manufacturer Wyandot Snacks, he brings strong expertise in manufacturing, finance and technology, critical factors necessary to oversee operations efficiency.

Justin Bashein, the Company's first permanent R&D director, leads both product formulation and new product development. He joined RMCF from Roth Industries, a leading prepared foods manufacturer and distributor, where he served as R&D Manager. He previously held QA jobs at Conagra Brands (CAG) and Thanasi Foods, and served as an inspector for the Colorado Department of Agriculture.

DURANGO, Colo., Dec. 04, 2023 Rocky Mountain Chocolate today announced that Steve Craig has been appointed to the Company’s Board of Directors. Mr. Craig is a seasoned business strategist with over 30 years of executive and board experience for both public and private companies, primarily in the real estate sector. For nearly four decades he has developed, owned and operated commercial real estate, primarily outdoor malls for retail shops and restaurants, throughout the United States.

Durango, Colorado-- Rocky Mountain Chocolate Factory, Inc. today announced that Starlette Johnson has been appointed to the Company's Board of Directors. Ms. Johnson is a results-driven business strategist and operations leader with more than thirty years of success in consumer-facing retail businesses, including extensive experience in the franchise restaurant and hospitality business sectors. Her leadership roles with global brands included serving as President/COO of Dave & Buster's (PLAY) and as EVP/Chief Strategic Officer for Brinker International.

Thoughts:

All of these ideas seem like good ideas. Do they move the needle in terms of boosting same-store sales in a sustainable way? This is something to follow and without increases in same-store sales, unit growth will not be successful.

Thoughts:

I believe these ideas are positive and also necessary.

Thoughts:

Online presence is mandatory.

Online chocolate shopping now accounts for 40% of consumer behavior.

As I pointed out in the MCD 0.00%↑ update, digital and loyalty programs are also mandatory in restaurant industry. They can increase sales and allows the company to gain valuable insights into customer behvior.

I do not think that these moves drive significant revenue growth, but they are table stakes in the industry these days.

I think that the company should consider buying, rather than building a new premium concept. I like the idea of having an upscale brand, but starting one from scratch seems like a tough way to go.

Interesting that Kilwins was recently bought by PE.

https://www.clickondetroit.com/features/2023/03/10/should-tourists-be-concerned-about-sale-of-this-popular-michigan-based-company/

Levine Leichtman Capital has a portfolio that also includes Tropical Smoothie Cafe, Mountain Mike’s Pizza, Nothing Bundt Cakes and Wetzel’s Pretzels.

Thoughts:

All of these actions are necessary and totally under management control. These are the kinds of things management gets paid to do and separates the good operators from the bad.

Interesting that the company underspent capex by at least $4-$5M over the last few years to pay a dividend to try to support the stock price. Classic short-term focused management hurting a brand long-term.

Thoughts:

Doubling revenue and pound volume is a nice goal, but going to be hard to do for several reasons.

Growing Same-Store Sales to help reach this goal will be very, very hard to do because they company has never really grown them in the past. If they start to sustain 3%+ same-store sales growth, this would be a significant positive.

Doubling stores to 250 and $800K/revenue per store seems to be the most bullish outcome. At some point I or someone will model this out and show how the stock is a multi-bagger. This would be the Holy Grail result.

We are skeptical it will happen in the next 2-4 years for the following reasons:

UAVs have never been close to $800K and are current one of the lowest we can think of in the restaurant space.

Since SSS have never been above 3%, it is going to take a significant amount of time to grow AUVs to a level that will allow the company to recruit multi-unit operators to open the 100 new stores.

10% E-commerce goal is certainly achievable, but does it really move the operating income needle in a meaningful way?

Current operational changes could help drive manufacturing margins back to 25-30% levels.

What is the Upside to Gross Profit Dollars?

Since this is a “One Hour Analysis” (actually hour 12) I am not going to create a model with a bull/base/bear case. But I thought it would be informative to see what kind of improvement in gross profit dollars (you can’t spend gross profit margins) could happen in all of management’s goals were achieved. This doesn’t include increases in franchise fees and royalties or any E-commerce or new corporate stores. This is simply taking millions of pounds of chocolate produced at the factory and multiplying it by various gross profit dollars per pound.

The company is currently in the box highlighted in the upper left-hand corner. The highlighted boxes in the lower right-hand corner would be gross profit dollars if the company achieved the goal of “doubling the pounds sold at a 25-30% gross margin”.

Management and Board

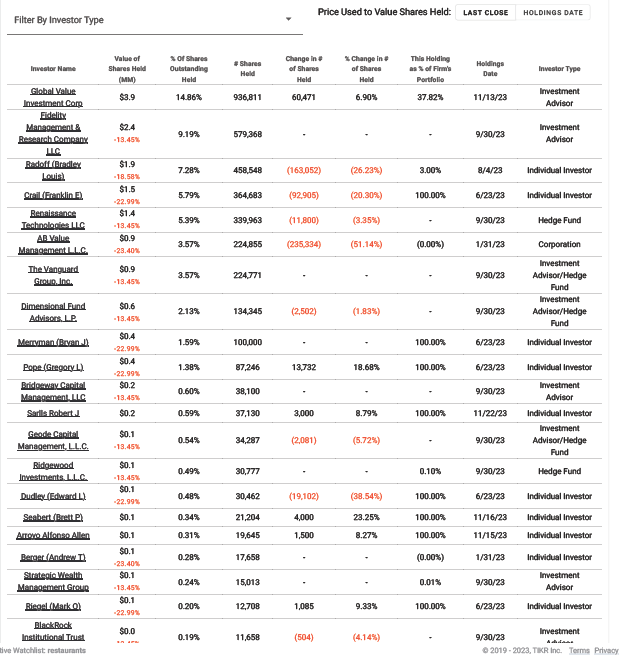

Clusters of Insider Buying

There has been small, but consistent cluster buying of stock by insiders since July. Management seems to have confidence in their plans.

Significant Concentration of Ownership.

Summary

To sum it all up, I believe that management has a reasonable plan in place to address all the problems created over the last ten years. The new management team and new Board members have significant experience in the areas that need to be addressed and improved on. This is a positive first step. The industry is growing and relatively recession resistant, which provides a good tailwind for the company.

However, as Warren Buffett has stated, “When a management with a reputation for brilliance tackles a business with a reputation for poor fundamental economics, it is the reputation of the business that remains intact” and there are significant obstacles for management to overcome. My biggest concerns are; historically the lack of significant increases in same-store sales (declining traffic), the extremely low AUVs, the extremely large number of single-unit franchise owners (risk of closing stores and lack of unti growth), the desire to increase stores by 100 units (must also overcome from 25-35 expected closures), the ambitions to rebrand the entire store system and eventually develop a higher-end concept.

While recent insider buying is encouraging, I think the turnaround will take a significant number of years and investors following management stock purchases may be disappointed in the time frame of the turnaround. I believe the focus on improving the margins at the factory will be successful and as my calculations show, the increase in gross profit dollars could be substantial ($7M-$11M on a market cap of $26M). The attempt to recruit multi-unit operators is the right strategy, but they will need to see tangible improvements in sales and returns before they will commit to large uit growth numbers. The goal of $800K in UAVs (up from $574K) feels more like a “pipedream” than a “stretch goal” and I am skeptical it can be achieved within the investment horizon of most investors these days.

The investment upside to a successful turnaround is certainly large and management seems to be moving the company in the right direction. Significant changes to operations need to take place (some of which are happening today), but the current limitations will be difficult to overcome. I look forward to following the progress of the company and doing subsequent writeups.

Disclaimer

Investing501 uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The articles and reports published by Investing501constitute the author’s personal views only and are for entertainment purposes only. They are not to be construed as financial advice in any shape or form. Investing501 does not predict the price at which the securities of any company may trade at any time. Every investor has different strategies, risk tolerances and time frames. You are advised to perform your own independent checks, research, or study, and you should contact a licensed professional before making any investment decisions. From time to time, the author may hold positions in the stocks mentioned in articles published by Investing501. To the extent the author does have such positions, there is no guarantee that he will maintain such positions. Neither the author nor any of its affiliates accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein

The company does have some $1M stores, which is encouraging.

Q1 Conference call:

Roger Lipton

Right. Okay. And just another question which occurs to me since you mentioned, the flagship store is now -- that looks like another $1 million store. I'm curious to know how many stores in the system do over a $1 million?

Rob Sarlls

Well, sure. Actually, our top 37 stores average over $1 million and we have some phenomenal outperformance dragging that up. But I would say that our store count in the $1 million plus range at current rates is somewhere in the high teens to low 20s.

thanks for the write-up, surely going to follow this company

I also checked out an interview with Rob on YT and in the interview I saw and heard some very good signals (he's enjoying himself, he's happy with the involvement of the board,..)