One Hour Analysis: Full House Resorts CEO Dan Lee Thinks the Company Could Be Worth $30-$40 a Share in 2025, Will it?

Full House Resorts- FLL

Price: $7.07

Shares outstanding: 34M

Market cap: $238M

Cash: $298M (Note: $190M is restricted)

Debt: $419M

Enterprise Value: $359M

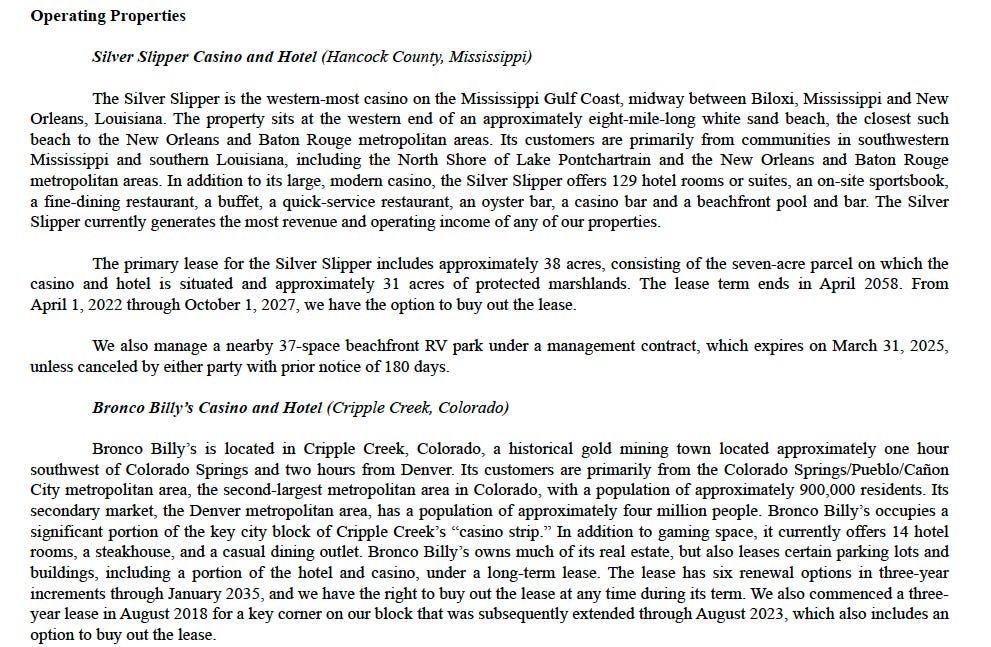

Full House Resorts Description

Full House Resorts, Inc. owns, develops, invests in, operates, manages, and leases casinos and related hospitality and entertainment facilities in the United States. The company owns and operates the Silver Slipper Casino and Hotel in Hancock County, Mississippi. It also owns and operates the Bronco Billy's Casino and Hotel in Cripple Creek, Colorado. In addition, the company owns and operates the Rising Star Casino Resort in Rising Sun, Indiana. Further, it owns and operates the Stockman’s Casino that is located in Fallon, Nevada. Company was recently selected to build a casino in Waukegan, Illinois and is building the Chamonix Hotel and Casino in Cripple Creek, Colorado.

We read lots of conference call transcripts. During earnings season, we try to read as many transcripts from a single industry at a time as possible. This gives us a fairly good overview of an industry’s current situation and how each company is performing on a relative basis. It also tells us what analysts/investors are currently focused on (consensus view) and what they might be overlooking or overly discounting (contrarian view).

We find that there is also much that an investor can learn about a company’s operations and management from the contents of their script and the answers given to questions on the calls. Many answers are general and vague, but sometimes management will give candid, detailed answers and thoughts about the company’s business and future plans. We have posted examples of this in the past, including many of our updates on Ark Restaurants (ARKR).

We have followed gaming stocks for over 40 years. We miss Steve Wynn’s candor on Wynn Resorts calls and Sheldon Adelson always starting each call with, “yay dividends!!” Full House Resorts President and CEO Dan Lee tends to give a lot of details on the company’s conference calls. For over a year he has been giving his thoughts and projections on what he thinks the company will look like after it completes its current major development plans (the Permanent Casino in Waukegan, IL and completion of Chamonix Casino & Hotel in Cripple Creek, CO). This blog post will look at those projections.

Quick Overview

Currently 55% of the company’s adjusted EBITDA comes from one casino — the Silver Slipper in Mississippi. It is located about 60 miles east of New Orleans and is subject to closures during hurricane season. The company is attempting to significantly diversify its cash flow streams by building the Permanent Casino in Waukegan IL and the Chamonix Casino & Hotel in Cripple Creek, CO. Over the next 2.5 years, the company is going to spend approximately $750M (utilizing $650M in debt + FCF) to complete these projects. The company has $298M in cash on the balance sheet to fund the completion of the Chamonix (Q2 2023) and the Temporary Casino in Waukegan, (Q4 2022).

Dan Lee’s Elevator Pitch

On the March 2022 earnings conference call, CEO Dan Lee laid out an investment case for the value of the company’s stock to reach $30-$40 per share by 2025.

And Chamonix, when it opens, we'll have 300 guestrooms. Now let me compare this with the Monarch Casino, which opened in the fourth quarter of 2020. So it's been open a little more than a year now. They have 500 rooms. Both Chamonix and Monarch have parking garages, theirs is bigger than ours, but we also have pretty significant surface parking lots, which they don't have. We have far more conventional meeting space -- convention meeting room space than they have. We can actually see the 1,000 people for a show in our ballroom. They don't have anything close to that.

The casinos are very similar in size. They both have about 900 slot machines, 20 table games. We have less competition. We'll be the only 4 star hotel, frankly, the only casino hotel of this size in Cripple Creek. They have competition from Ameristar and Jacobs Place and the Isle of Capri and a few others. Of course, they're close to Denver, which is the bigger city, we're close to Colorado Springs. Those 2 cities are 1 hour apart. So somebody from Denver is 1 hour from Black Hawk and 2 hours from us. And any from Colorado Springs is 2 hours from Black Hawk and 1 hour from us. So our most important market will always be Colorado Springs, but our strong secondary market will be Denver because people will sometimes travel further to check out a different place.

Anyway, if you look at Monarch, they're a public company. They only have 2 casinos, 1 in Reno and the 1 in Black Hawk. And they played hide the whinny a little bit. They don't break it out. But you can go back and look historically at what they earned in Reno, and it's been pretty consistently $30 million to $40 million a year for many, many years. And then they acquired the Riviera in Black Hawk, which made about $15 million. Those numbers were broken out by Riviera, which is a public company. And then -- but if you take Monarch's results for 2021, their operating income plus their depreciation is about $135 million, $137 million, I think it was.

And so their EBDIT (sic) is about $137 million. And probably $37 million of that is from Reno and $100 million, roughly, is from Black Hawk. And so we're 3/5 their size in number of guestrooms, similar in size in terms of casino capacity, much greater convention space and everything else, not unreasonable to expect us to make $50 million a year once we're open and mature. So -- and that will be opened in the second quarter of 2023. And like Lewis mentioned, you can see the details on the website.

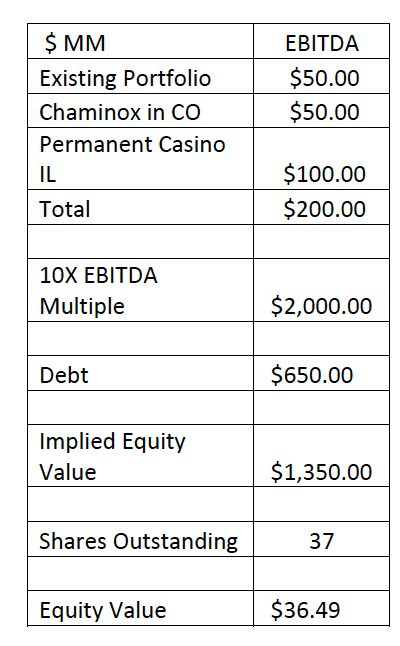

So at that point, actually, yes, 3 years, 3.5 years now, so you start adding it together, at that point, you've got $50 million, from today, $50 million from Chamonix and now $100 million from the permanent. So the company has got about maybe $200 million of EBDIT, I don't know whether we we'd want to sell it at that point or continue to run it, other things come along that might be good. But let's assume it was worth 10x EBDIT (sic) at that point. And if you look at what the Mirage is getting sold for or Peninsula is getting sold for or even the price at which a Bellagio is either going to go private or get sold for, 10x is pretty reasonable these days, especially since we haven't done the opco/propco thing. We own all of our real estate or we lease it with an option to buy it. And so we'd get a pretty good multiple if we did try to sell the company.

Well, at $200 million at 10x, that's $2 billion, subtract the debt that we would anticipate to have when the permanent opens of $650 million that's $1.350 billion. We have 37 million shares outstanding. And that's something north of $30 a share, which is a quadruple of our stock price from where it is today.

Here is his basic math:

The question for investors is, how reasonable are the assumptions that go into that calculation? Let’s take a quick look.

Can the Existing Portfolio Generate $50M in EBITDA in 2025?

Looking at YTD numbers, the company could generate about $40M in EBITDA (after corporate expenses) in 2022. It should be noted that $5M of the YTD revenue is from the one-time payment of market access fees for sports wagering. So, annualizing that number over-estimates the annual run-rate. One mitigating circumstance however, is that Circa is guaranteeing at least $5M in payments for their relationship with Full House for sports wagering in Illinois. The WS models we have seen model around $47-$52M in EBITDA by 2024. Being conservative, it looks possible that the existing casinos and the sports wagering EBITDA could run $40M-$50M. More than $50M seems like a bit of a stretch. As a check, in 2019 the company generated $20.6M in EBITDA (including $3M for Bronco Billy’s which will now be Chamonix). It remains to be seen if the record high EBITDA margins being posted by almost every casino company is sustainable. It should be noted that 75% of FLL’s revenue comes from the casino (90% of which is fairly stable slots) and the high margin sports wagering segment. This means the revenue streams and EBITDA margins should be fairly predictable under normal circumstances.

As a check, in 2019 the company generated $20.6M in EBITDA (including $3M for Bronco Billy’s which will now be Chamonix). It remains to be seen if the record high EBITDA margins (driven mostly by lower FTEs) being posted by almost every casino company is sustainable.

Can Chamonix Generate $50M in EBITDA in 2025?

https://www.chamonixco.com/

One of the main catalysts for the development of the Chamonix was passage in November of 2020 of Amendment 77 that eliminated the betting cap of $100 per bet in Colorado. With the potential of significantly increased revenue as a result of the elimination of the cap, Full House decided to expand its proposed plans for the Chamonix from 180 to 300 hotel rooms. This raised the estimated cost from $180M to $250M. The 300 hotel rooms will nearly double the size of hotel rooms available in Cripple Creek creating more of an opportunity to be a destination city.

Even with the increase in rooms and slot machines at Chaminox, Cripple Creek will still be significantly smaller than Blackhawk and we are skeptical that a significant number of Denver residents will switch their gaming visits to the Chaminox. We have visited both cities in the last year and the gaming facilities and rooms in Blackhawk are of a higher quality than what is available in Cripple Creek. While the new Chaminox will be a major upgrade to the city, generally speaking the town of Cripple Creek has a much more rural/western feel than Blackhawk .

https://visitblackhawk.org/about/

https://www.visitcripplecreek.com/cripple-creek-lodging/

Can American Place (the permanent casino) Generate $100M in EBITDA in 2025?

https://www.americanplace.com/

In December of 2021, FLL was selected by the Illinois Gaming Board to develop the American Place Casino in Waukegan, Illinois. The company is scheduled to open a temporary casino, called (you guessed it) The Temporary, in Q4 of 2022. The facility will be a Sprung Tent facility (Tesla uses Sprung Tents at their production facilities as an example). The details are included in the slide below. The total cost to complete American Place (including costs of the Temporary) is expected to be $500M.

Of course, the unknowns are how much revenue can American Place generate and at what EBITDA margin? Dan Lee uses the Rivers City Casino in Des Plaines as an example to illustrate the potential in Waukegan.

March 2022 Earnings Call Transcript:

Dan Lee:

Now, what do we expect the permanent and the temporary to make? Well, the closest casino to us is the Rivers Casino, which is about 32 or 33 miles away. And they're doing about $500 million in gaming revenues in a place that was limited to 1,200 slot machines they're expanding it now.

That's with typical margins you have an original gaming, that's probably $200 million a year in EBIT. We don't expect to make that much. They're in a more densely populated area and it’d be great if we could do $200 million, but we don't expect that. Now, we're in the town of Waukegan, which about 80,000 it's kind of an old rust belt town. Pleasant town, but typical of a lot of towns in the Midwest, but it is the county seat of Lake County. Lake County, Illinois is 700,000 people and it's the 27th wealthiest county in America and we’ll have the only casino there.

Now, if I just take the population of Lake County and assume they gamble $300 per person (national average is between $300-$350). That would be $200 million in revenue and on that we would have EBTDAT (sic) of close to $100 million in regional gaming type margin. That's ignoring the other $11 million people who live within 90 minutes of our site.

So, it's not unreasonable to think that the permanent could do $100 million of EBTDAT (sic). (Note: FLL estimates the temporary casino will generate $50M in EBITDA).

In order for American Place to generate $100M in EBITDA (at a 30% EBITDA Margin) the casino would have to generate $300-$350M in revenue. Of course, at a 40% EBITDA margin, American Place would only have to generate $250M in revenue. That would make the casino the second highest revenue casino in the state and up to 2X the third highest revenue casino. There are 12 million people within a 75 mile radius of the casino. It is important to note that the Rivers Casino does sit between Chicago and the American Place, which means that visitors to the new casino would have to drive past its major competitor.

Closing Thoughts

Dan Lee’s estimates seem possible but feels more like a ceiling than a floor. The estimates require the base business to show no deterioration over the next three years. The relationship the company has with the Circa Resorts Sports Book could generate higher than expected revenue to offset any decline at the Silver Slipper. Chamonix is a significant upgrade in Cripple Creek and it should dominate the area. However, the town still has significantly less rooms and quality facilities than Blackhawk. Blackhawk’s gaming assets are valued at 6X those of Cripple Creek (2020 Division of Gaming Factbook) and generates about 4X the revenue. Colorado Springs will always be the main source of gamers. The Census ACS 1-year survey reports that the median household income for the Denver-Aurora-Broomfield Colorado metro area was $85,641 in 2019 and for the Colorado Springs Colorado metro area it was $72,633.

American Place is the biggest uncertainty, but with the most upside due to its proximity to 13 million people. However, the population in the city of Chicago has been relatively flat to declining since the 1980s. Illinois population has been flat since 2010.

Even with just modest success of both of the expansion projects, the company’s stock could increase over 50% in the next three years. Using more conservative EBITDA estimates and applying a modest 7X EBITDA produces a stock price of nearly $13 a share. It seems as though a more realistic stock price range in 2025 is $12-$30 a share. We do not try to be highly accurate in our estimates with narrow ranges if there is a significant amount of variability in the company’s business model. But we think this report provides enough information and analysis to be used as a starting point for further investor research.

Dan Lee Bio:

Daniel R. Lee joined the FLL Board, and he was appointed as the President and Chief Executive Officer, in November 2014. Mr. Lee was the Managing Partner of Creative Casinos from September 2010 through December 2014. He was previously Chairman and Chief Executive Officer of Pinnacle Entertainment from 2002 to 2009. In the 1990s, he was Chief Financial Officer, Treasurer and Sr. Vice President of Finance and Development at Mirage Resorts, reporting to Mirage CEO Steve Wynn. During the 1980s, Mr. Lee was a securities analyst for Drexel Burnham Lambert and CS First Boston, specializing in the lodging and gaming industries.

Dan Lee’s career has not been without controversy:

https://www.reviewjournal.com/business/casinos-gaming/veteran-executive-lee-brings-hands-on-approach-to-full-house-resorts/

https://lasvegassun.com/news/2014/dec/01/pinnacles-lee-takes-over-full-house-resorts/

https://www.reviewjournal.com/business/casinos-gaming/dan-lee-after-bicycle-accident-resigns-as-palms-ceo/

https://www.lasvegasadvisor.com/stiffs-and-georges/dan-lee-raises-hoosier-hackles-sioux-city-mess-not-done-yet/

https://www.reviewjournal.com/news/pinnacle-entertainment-ceo-resignation-may-alter-projects/

https://lasvegassun.com/news/2002/jul/30/casino-fined-226-million-over-allegations-of-prost/