One Hour Analysis: Driven Brands Holdings ($DRVN), Road Kill or Road to Redemption?

Driven Brands Holdings Inc. (DRVN) – $13.46

Huck Looking for Investment Ideas

THE AUTOMOTIVE CARE INDUSTRY

Driven Brands operates in an industry that has many similar characteristics as the restaurant industry, including the sale of needs-based services that are relatively recession resistant. The automotive care industry is a $390B a year industry with strong tailwinds. There are currently over 285M cars on the road (growing 4% a year) and customers travel over 3T miles a year. The average age of a car on the road today continues to rise and is currently over 12.5 years. The industry is highly fragmented (80% independent shops) and the smaller competitors tend to be relatively unsophisticated. Also similar to the restaurant industry is the limited risk of eCommerce incursion, as well as the increasing importance of digital strategies such as loyalty programs. Brand recognition and reputation (e.g. McDonald’s, Chipotle, Starbucks) is crucial as well, as are the operational and marketing benefits of national scale.

DRIVEN BRANDS (DRVN) – THE COMPANY

Driven Brands is the largest automotive services company in North America with a growing and highly-franchised base of approximately 5,000 franchised, independently-operated, and company-operated locations across 49 U.S. states and 13 other countries. The Company has assembled a portfolio of highly recognized brands, including Take 5 Oil Change®, Take 5 Car Wash®, Meineke Car Care Centers®, MAACO®, CARSTAR®, Auto Glass Now®, and 1-800-Radiator & A/C®. Approximately 74% of the Company’s locations are franchised or independently-operated and portfolio system-wide sales are over $6B. In spite of the large number of stores, the company controls less than 5% market share in the industry segments it operates in. Excluding 2020, the company has generated 14 consecutive years of positive same-store sales growth and the latest two-year stacked SSS is 26%.

CONCLUSION:

Driven Brands (DRVN) is well established in an attractive industry, growing steadily (both organically and from acquisitions), is financially controlled by well regarded Roark Capital (62% ownership), and the stock seems inexpensive. The common stock, DRVN, is down over 50% from its high, mostly due to apparently short term headwinds. If management can meet their projections, DRVN could rise by 3-4x or more within three years. As described below, even with a shortfall from the 2026 projected results, DRVN could more than double. Based on management’s demonstrated operational skills, it seems unlikely that results could be so poor that current investors will find themselves at a loss three years from now.

THE HISTORICAL NUMBERS,in PERSPECTIVE

In this case, we start with the numbers because they tell a tale, with Divisional Dialogue to come later. The numbers below show that Maintenance, by far the largest division continues to have admirable results. Car Wash needs work (being addressed as discussed below) but is not so large as to cripple the entire Company. PC&G is also dragging, due to the recent integration issues, but the division’s decline in EBITDA is “contained”, is being addressed and (similar to Car Wash) is modest in size relative to strongly performing Maintenance. Platform’s EBITDA is comparable to Car Wash and PC&G and, though comps are down modestly this year, EBITDA continues to improve. Overall, Maintenance & Platform are doing very well, and could largely overcome the presumably temporary problems at Car Wash and PC&G. While the degree and timing of the “fixes” cannot be pinpointed, it seems reasonable that stability can at least be achieved and the $500M+ of trailing twelve month Adjusted EBITDA should not be in jeopardy. This should minimize the downside risk of this investment and allow time for the potential to develop.

FOUR DRIVEN DIVISIONS – MAINTENANCE, PAINT-COLLISION-GLASS, CAR WASH & PLATFORM SERVICES

Maintenance

Take 5 Oil Change and Meineke are the two brands in this division. They produce over $1.8B in system-wide sales. The customer base is evenly split between commercial customers (30+ insurance companies and 160+ fleet operators) and retail customers. The high exposure to commercial customers gives the division a strong recurring revenue base. The customer drives a 9-year-old vehicle, has an average household income of $79K and about 65% own a home.

Founded in 1984, Take 5 Oil, as of 12/31/22, had 257 franchised and 593 company operated locations, primarily offering oil changes. The Take 5 Oil Change Brand is the fastest growing brand in industry, servicing 12M cars a year. The brand offers attractive store-level economics to both company and franchisee store operations. As presented by management, Company store AUV is $1.27M, generate $470K of store level EBITDA, producing a 45% cash on cash return against the $1.05M investment. Franchisees generate a $1.3M AUV, with $300 of store level EBITDA that represents a 28% cash on cash return on their investment of $1.2M.

Other maintenance services, mostly under the Meineke brand (founded in 1972), had 795 locations, all franchised, offering a variety of car care services, including repair and replacement of components such as brakes, heating and cooling systems, exhaust and tires.

Paint, Collision & Glass

This division contains the Maaco, CARSTAR and AutoGlassNow! brands. This division generates over $3.2B system-wide sales through its 270 stores. AutoGlassNow! is now the second largest player in the industry ($5B TAM) behind Safelite Repair (50% market share). One of the most attractive aspects of the collision repair business is the ever-increasing cost of collision repairs. One example of this is the rising cost of windshield repair. Because an increasing number of windshields have detection systems in them (for example, autobraking and lane change alert), these windshields require a calibration process which typically adds over $400 to the cost of the repair.

Car Wash

This division contains the (mostly renamed) Take 5 (in North America) and IMO (in Europe and Australia) brands and is the largest cash wash operator in the world. The division has over 1,150 (over 400 in the US and close to 750 overseas) stores that generates over $0.6B system-wide sales. The U.S. Take 5 brand is a rollup of over 40 brands, with 85% having been rebranded since 2022 under the Take 5 name.

Platform Services

The Platform Services segment is primarily composed of the 1-800 Radiator, PH, Spire Supply, and Automotive Training Institute (“ATI”) brands. This segment drives growth opportunities through procurement, distribution, and training services and generates about $400M in revenues.

1-800 Radiator was founded in 2001, and is one of the largest franchised distributors in the automotive parts industry. 1-800 Radiator’s 203 locations, as of December 31, 2022, were almost all franchised, distributing a diverse mix of basic long-lasting automotive parts, including radiators, air conditioning components, and exhaust products to automotive repair shops, auto parts stores, body shops, and other auto repair outlets. In 2017 DRVN launched Spire Supply, an in-house distributor of consumable products, such as oil filters and wiper blades, which currently serves all Take 5 Oil locations and a portion of the Meineke stores, providing attractive pricing to franchisees relative to other options.

DREAM BIG PLAN 2026 – in the wake of recently disappointing results

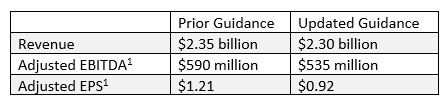

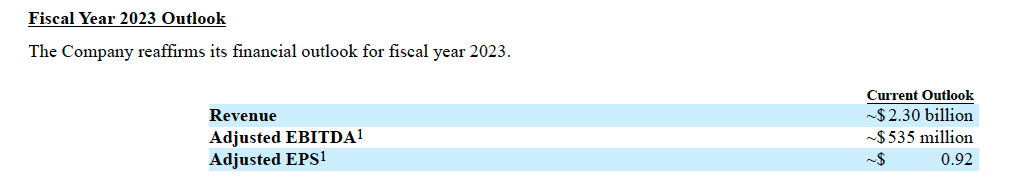

On August 2nd, the company surprised investors by significantly lowering its calendar ’23 guidance for revenue, adjusted EBITDA and adjusted EPS. The stock dropped 40% on the news (hardly any reduction of Revenues and less than 10% reduction of EBITDA) and has not recovered. Below is a table that summarizes the prior and updated guidance.

The company held an Investor Day in September. As part of the presentation, the company laid out what it calls the “Dream Big Plan 2026”. The goal of the Plan is to grow revenue from $2.3B in 2023 to $3.4B in 2026. The company plans to increase EBITDA from the downward revised $535M in 2023 to $850M in 2026. We discuss below management’s plan to overcome the current challenges.

Key Assumptions and Divisional Breakdown

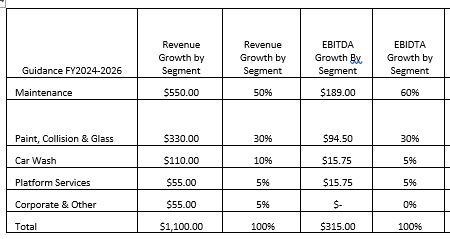

Projected is Company revenue growth of $1.1B (from $2.3B in ’23 to $3.4B in ’26) generated from 650 new locations, of which 50% will be franchised, and an average of 5% same stores sales growth (compared to 9% the last three years. There is no limited Car Wash growth in this assumption and no contribution from M&A. EBITDA Growth would take the recent ’23 guidance of $535M (23% margin) to $850M (25% margin) in ’26.

The following table breaks out the revenue growth and EBITDA growth by segment. The maintenance division drives over 50% of the revenue and EBITDA growth. The troubled Car Wash division represents only 10% of revenue growth (no M&A) and an even smaller 5% of expected EBITDA growth.

Looking at EBITDA growth another way, the growth is fairly balanced between the ramping of sales as stores mature (significant store base is less than 3 years old), new store growth and same-store sales growth at mature stores (SSS guidance is 50% lower than historical trends). We think this diverse way of growing EBITDA helps reduce the risk of any one strategy failing and significantly impacting results.

THE BALANCE SHEET – A MANAGEABLE DEBT STRUCTURE

One of the risks in turnaround situations is that the company’s debt structure can inhibit management’s ability to implement the necessary changes to achieve the turnaround. This should not be the case at DRVN. While the long-term debt is about $3.0B, the all-in cost of the company debt is 5%, with 80% fixed at 4.3%. The average weighted maturity is 4.2 years with no debt due before 2026 and about 75% of the debt is securitized notes. As of 9/30/23 there was $211M in cash, $175M of undrawn capacity on its securitized notes, and $135M that can expand a variable funding facility.

RECENT PROBLEMS SHOULD BE FIXABLE – FIRST, THE CAR WASH SEGMENT

There were two main reasons for the negative revision to EBITDA and EPS. The main problem is in the car wash segment. As a result of these problems, the company stopped new store growth, took a goodwill impairment charge of $851 million on the car wash segment, replaced the President, operations officer and the marketing manager and put up over $271M of assets for sale. On earnings calls, management has called out several issues, including weather, but that was a minor factor relative to the consumer and competition.

Same store sales trends in the industry have been weak all year, but DRVN has been significantly under-performing its main competitor Mr. Cash Wash (MCW). Over the last four quarters, MCW has had SSS of -0.6%, +0.3%, +1.7% and 0.3% while DRVN has generated -11%, -4%, -4% and -3.3%. We think one reason for that is the new loyalty program and car wash upgrade that MCW has rolled out, to be discussed later.

Increased Competition – discussed on recent conference calls

Because the car wash industry is still highly fragmented and the capital costs are low, the industry has been a favorite of private equity for the last few years. There are at least 15-20 private equity platforms that have been active in the space.

On the Q2’23 conference call management referenced about 1,500 new competitive locations over the previous two years:

“32% of our U.S. Car Wash locations have had a competitor open within 3 miles over the last two years. And these locations represent some of the oldest sites in our portfolio, part of the original acquisition in 2020. Consequently, these older sites are absorbing an outsized impact. We expect this impact to moderate as we finish our rebranding and fully activate the power of the Take 5 brand to drive new customers and take share. We believe there is still significant white space in select markets for express car washes. We continue to see undisciplined short-term growth from small chains and entrepreneurs.”

In terms of remediation:

…” some of those older stores had, I would say, sub-optimal real estate because they were built 10, 12, 15 years ago. So one of the things that we’re doing, is assessing the bottom 10% of our system, like every large scale multi-unit business, there’s a bottom 10%. So we’re assessing, is there an opportunity there to clean up the portfolio in terms of under-performing stores. So that’s number one.

“Number two is the brand positioning, the marketing, the promotional activity……so we think there’s probably some tweaks to both brand positioning, pricing, promotion activities in the balance of this year and as we look into next, do not infer that as incremental discounting, but that could be brand positioning and how we attract new customers.”

Are Mr. Car Wash’s Loyalty Program Impacting Results?

Driven Brands controls the one of the largest networks of car washes with approximately 1,133 stores (420 in the U.S.). One of the company’s main competitors is Mr. Cash Wash (MCW), which operates 462 stores. We believe that MCW has been impacting DVRN results, in part because of its loyalty subscription program. MCW has 3X the number of members per store than DRVN. While the Take 5 brand currently has over 700,000 members, MCW has about 2.1M members. As we have pointed out numerous times in discussing our restaurant companies, a strong loyalty program, such as the ones offered by McDonald’s, Starbucks and Yum Brands, is a huge competitive advantage. We believe that this puts DRVN at a competitive disadvantage and is one reason the company same-store sales numbers are trailing MCW. The company has also been more dependent on discounting than MCW. We are not fans of discounting because as the saying goes, “how you acquire a customer is how you keep them.”

The good news for investors is that management is well aware of this problem and has been working on improving its competitive position with the Take 5 loyalty program. There are several aspects of the program that could improve sales at both the Take 5 Oil Change and Take 5 Car Wash brands. Below are some slides from the Investor Day that we think illustrate the opportunity.

U.S. GLASS PROBLEMS, INTEGRATION RELATED – PRESUMABLY SHORT TERM

While the car wash segment has caused the biggest problems for DRVN, the U.S. Glass division is also experiencing results that are below expectations. Since the first acquisition in 2024, DRVN has made 11 additional founder-owned brand acquisitions that tripled the store base. The company is now the second largest operator in the sector (Safelite AutoGlass is the largest at 50% of the market). This meant the integration of 1,000+ employees, new payroll, benefits and comp plans and a new POS system. The company also added new calibration equipment and training and a new call center. As a result of less than expected results, the company has replaced some of the managers in the division.

Management Summarized the Problems at the Investor Day:

“We’re only in our second year of operating this business. Some aspects of the integration have been more complicated than we suspected but we have the right leadership team in place, the right go-forward plan and we have the benefit of experience, having done this many times before.

“Now regarding Car Wash and Glass, I am personally disappointed with their performance to date. These businesses are similar to Take 5 Oil Change and should be performing similarly. I know how to do this and I have done this. I am now the Chief Operating Officer because our Take 5 business is the blueprint for success across both Car Wash and Auto Glass Now. I helped develop and implement the blueprint for Take 5, which ultimately resulted in an amazing business. I know how to get this done across both Car Wash and Glass.

“ we’ve acquired and are currently integrating 12 different businesses……..we’re talking about getting over 1,000 people that all worked a certain way for a long time to work a different way with a different culture and a different brand on their shirt. We’ve touched every meaningful part of the business, new payroll systems, new comp plans, centralized purchasing, a call center. We’ve even switched out the point-of-sale system, the central nervous system of any retail business. We are now undergoing the difficult but necessary work to consolidate the business to 1 operating playbook.

OUR TAKE ON THE PROBLEMS

The first step in solving a problem is the recognition of its existence, and management clearly understands that there is work to be done. On the positive side (1) management’s history of operating success (2) the scale and still substantial operating cash flow (3) a balance sheet that seems manageable both short term and longer term (4) the presence of a financial sponsor (Roark Capital) with a history of successful guidance within the franchising industry and (5) ownership of leading brands in each of their operating segments all point to the likelihood of solid growth over time.

At the same time, our expectation of long term success could take more time than management or the financial community expects. Overbuilding in the car wash industry could takes longer to rationalize. The new Take 5 Loyalty program and cross marketing between Take 5 Lube and Car Wash locations could under-perform expectations. Growth and success within the Glass division could be inhibited due to aggressive competition from Safelite.

However, as the ongoing battle for market share in all divisions takes place, it seems to us that something like $500M+ of Adjusted EBITDA is reasonably secure. The operating cash flow, should be adequate to service debt, build new locations, and likely continue to re-purchase common stock as well. It is worth noting that $50M was repurchased in Q3’23.

THE REWARD/RISK EQUATION

As discussed earlier, management laid out a detailed plan called Dream Big Plan 2026. While we acknowledge that there can be a wide gap between “models” and “targets” and long term plans and actual historical results, it provides insight into management’s thought process and objectives.

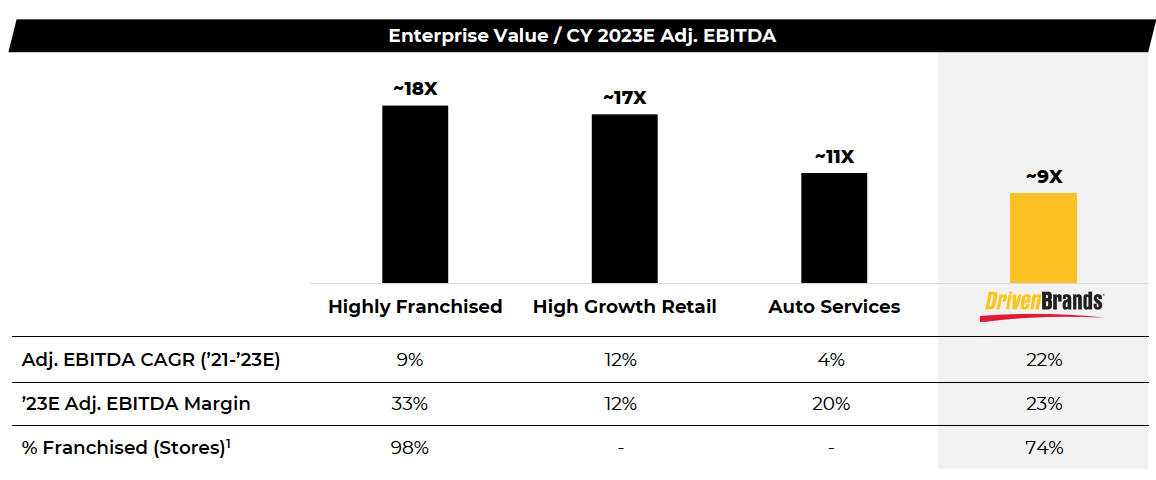

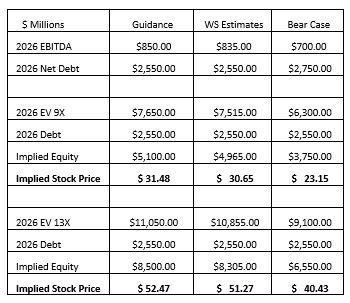

Below are some simple scenarios that give a range of stock prices based on the outcomes of those scenarios. The company is currently trading for a valuation of about 9X-10X EV/EBTIDA. Franchising companies that seem well positioned with respectable expectations of growth most often sell for EV multiples relative to TTM EBITDA (most often, “Adjusted” EBITDA) in the range of 15-20x. When “troubled”, the multiples dip to 10x or less, which is where we find DRVN today.

The official guidance from management has remained at $850M in EBITDA in 2026, in spite of the $50M reduction in the current year. Current Wall Street estimates are for $835M in EBITDA in 2026, so the investment community says “show me”. We have also included a “bear case” 2026 EBITDA estimate of $700M for further conservatism.

Using a 9.0X EV/EBITDA multiple on the range of EBITDA estimates (for 2026) produces a stock price range of $23-$31.50 per share within three years, at the midpoint about double the current stock price. Using a more optimistic, but still conservative, multiple of 13X, the stock would be 3X-4X higher than it is today.

While the table below does not show it, a multiple higher than 13x just described is more than possible, and the stock price range would obviously be proportionately higher.

Q4 Results Mostly As Expected

While working on this report, DRVN reported Q4 earnings. Reported results were as expected. We do think that the change the company made in reporting Adjusted EBITDA (it will no longer add back straight line rent expenses) caused some confusion with investors and made it appear as though the company missed its EBITDA guidance of $535M (it reported $516.9M adjusted for $18M in straight line rents). Straight line rent was $15M in 2022 and $12M in 2021.

Conference call tidbits:

Now let me give you an update on our full Car Wash segment. The headline is that we improved margins from approximately 17% in Q3 to over 23% in Q4. This approximate 600 basis point improvement was primarily from our US operations. Mostly due to our continued focus on detergent costs and labor.

Additionally, the team is making good progress on divesting any pipeline properties we owned when we made this decision. And we expect that during fiscal year 2024, we will likely see a meaningful return of capital from selling these pipeline sites.I think it'll happen throughout the course of the year and meaningful, for me, it's north of $100 million of capital.

Once again, Take 5 Oil Change has met or outpaced our competition. Take 5 Oil Change has delivered positive same store sales growth for 14 quarters in a row by delivering fast, friendly and simple oil changes with a net promoter score in the upper 70s.

Within the next 60 days, you'll see press releases from us announcing a new president of our US Car Wash business on SVP of operations for Take 5 Oil Change, and the new Chief Revenue Officer for Auto Glass Now,

In our Car Wash segment, we experienced the same store sales decline of 3.3% versus the prior year period. This decline was driven by our US Car Wash operations, total segment revenue decreased 1%. The Car Wash segment adjusted EBITDA margin decreased to 23.2% in the quarter from 26.9% in Q4 2022, resulting in segment adjusted EBITDA of $30.8 million.

For the full year we expect revenue to be between $2.35 and $2.4 5 billion, a growth rate of approximately 2% to 6% over 2023. Adjusted EBITDA will be between $535 and $565 million, a growth rate of approximately 4% to 9% over 2023. And adjusted diluted EPS is expected to be between $0.88 to $1 a growth rate of approximately 4% to 18%.

At the bottom end of our outlook reflects potential impacts from macro economic uncertainty and weather. As Jonathan previously mentioned, we've seen significant storm activity across the nation so far this year. The range also reflects various rates of improvement in our US Car Wash and US Glass operations throughout the year. The top end of our outlook is consistent with what we shared at our Investor Day. The slight difference in revenue outlook versus what we shared that day is driven primarily by refranchising and closures of company owned stores and other asset disposition since September 2023.

However, we have held adjusted EBITDA as we continue to focus on cost efficiencies. We expect same store sales growth of 3% to 5% for 2024, which primarily reflects continued growth in our maintenance segment, as well as improvement in both our Car Wash and PC&G segments. We expect net store growth of approximately 205 to 220 stores during the year. Maintenance should be approximately 165 to 195 net new stores, of which approximately 65% will be franchised.

In our PC&G segment, we expect net store growth of 25 to 35 stores with 85% franchise. And finally, and our Car Wash segment, we currently anticipate net store growth of five to 10 stores, all in the international portion of the business. We expect depreciation and amortization expense of approximately $175 million, we expect interest expense of approximately $170 million. Our effective tax rate is expected to be approximately 35% in 2024, which is in line with our FY 2022 effective tax rate.

Gross capital investments are expected to be approximately $260 million, which is less than half of the amount spent in 2023. CapEx spend is expected to be partially offset by approximately $40 million of sale leaseback of our own real estate, primarily in our maintenance segment. This results in net CapEx of approximately $220 million, which is in line with what we shared at our Investor Day in September.

Peter Keith

Thanks. Good morning, everyone. Thanks for taking the question. Just focusing on the Take 5, I don't want to scoff at a 7% comp. But it did slow rather meaningfully, sequentially from Q3 at 14%. And I'm wondering if this lap in price increases or if you give any color on continued deceleration? Are we going to settle out here at about 7%?

Danny Rivera

Hey, Peter, thanks. Thanks for the question. Yeah, you look, you hit it on the head, right. So really, the majority of that slowdown was just lapping over price increases that we took Q4 of 2022. So nothing systemic, they're just lapping over some price increases.

A significantly more detailed analysis of DRVN can be found here at Emeth Capital Value H2 2023 letter.

Disclaimer

Investing501 uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The articles and reports published by Investing501 constitute the author’s personal views only and are for entertainment purposes only. They are not to be construed as financial advice in any shape or form. Investing501 does not predict the price at which the securities of any company may trade at any time. Every investor has different strategies, risk tolerances and time frames. You are advised to perform your own independent checks, research, or study, and you should contact a licensed professional before making any investment decisions. From time to time, the author may hold positions in the stocks mentioned in articles published by Investing501. To the extent the author does have such positions, there is no guarantee that he will maintain such positions. Neither the author nor any of its affiliates accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Roger Lipton of Lipton Financial Services contributed to this report.