One Hour Analysis: Cato Corporation. Cash and Real Estate Rich. No One Cares. Who Would Own a Value-Focused Apparel Retailer on the Verge of an Apparent Major Recession?

Cato Corporation- CATO

Price: $9.30

Shares outstanding: 19.4M Class A 1.76M Class B (Votes 10-1)

Market cap: $196M

Cash: $157M (Note: $4M is restricted)

Debt: $0M

Enterprise Value: $39M

The Cato Corporation operates as a specialty retailer of fashion apparel and accessories primarily in the southeastern United States. The company’s stores and e-commerce websites offer a range of apparel and accessories, including dressy, career, and casual sportswear, and dresses, coats, shoes, lingerie, costume jewelry, and handbags, as well as men’s wear, and lines for kids and infants. It operates its stores and e-commerce websites under the Cato, Cato Fashions, Cato Plus, It’s Fashion, It’s Fashion Metro, and Versona names.

Initial Thoughts:

· President and CEO John Cato controls 50.2% of voting power of the company by owning 5% of Class A stock and 100% of Class B stock (10-1 voting power). This means the company effectively is exempt from compliance as a “controlled company” of certain governance requirements.

· Company is significantly over-capitalized with $157M of cash (28% of total assets) and no debt (except leases).

· Since 2015, company has returned over $340M to shareholders ($187M Dividend + $152M Buybacks). YTD the company has paid $7M in dividends and bought back $10M in stock.

· No net store growth since 2015. Store productivity since 2015 has declined from average sales per square foot of $161 to $135. Average sales per store have declined from $730K to $580K. Average lease life is only 2.2 years, giving management significant flexibility on managing store footprint.

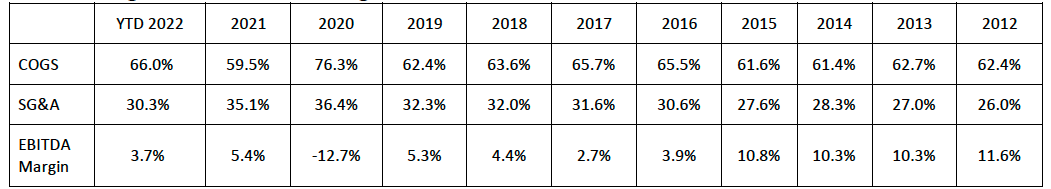

· SG&A as a percentage of sales has risen from 26% to 36%. Some improvement has occurred lately.

· EBITDA margins have declined from 10-11% in 2015-17 to 4-5% normalized now.

· While there is some room for improvement in gross margin (34% now vs. 37% historically), lower store productivity and higher costs makes a return to old highs unlikely.

· Inventory appears to be $20M-$40M higher than current sales would require, pressuring gross margins going forward.

· Company owns land and buildings that could be worth more than the enterprise value of the company, but it is not clear there is a willingness to monetize them (only $9M assets held for sale).

· As rates rise, the cash balance could generate $3-$4M a year in interest income.

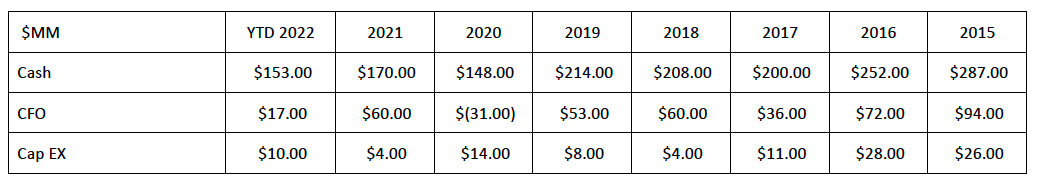

Comfort Cash?

The current cash balance of $157M represents approximately 80% of the equity value of the company. This is the highest percentage of any of the companies on our recent screen of cash as a percentage of market cap of apparel retailers. LINK However, that balance was $287M in 2015. So where did the cash go? From 2015-2021, the company generated approximately $250M in free cash flow. However, the company returned $340M. Before COVID, the company consistently paid out $33-34M a year in dividends. Since the dividend was reinstated in 2021, the company has been paying out $14M a year in dividends. There is currently an outstanding share buyback of 808K shares or around $7.6M worth. In Q1, the company bought back $9M worth of stock at an average price of $15.02. In the second quarter, the company only bought back $400K worth of stock at $13.70. The majority of the share repurchases since 2015 have occurred above $15 per share. The stock buyback program has not been timed well and it is unclear if the company will exhaust the 808K authorization by year-end or conserve the cash.

Inventory Levels Appear Too High

With all the negative earnings announcements in the retail space this year, it is not surprising that CATO appears to be carrying too much inventory. Inventory on December 31, 2021 was $125M. Historically, that level of inventory typically supported $525M-$550M in COGs ($825M-$850M in revenue). The trailing 12-month revenue run-rate is only about $750M. Inventory levels at the end of Q2 22 were $117M, which is up significantly fromQ2 21 inventory of $72M.

COGs as a percentage of revenue is up almost 700bps YTD. Since the company is carrying as much as $40M more in inventory than the current sales levels would indicate is needed, we expect gross margins will continue to be down significantly for at least the remainder of the year. It should be noted that some of the increase in inventory is due to higher costs per item and not necessarily the result of an increase in total units.

COGs vs. Inventory

EBITDA Margins Have Been in Decline for Years

After peaking at 1372 stores in 2015, the number of stores is currently 1312 or about the same as the company had in 2012. A typical store is 4,000 square feet. 93% of the stores are located in strip malls. However, productivity per store has declined from $161 of average sales per square foot to $135 of average sales per square foot. Average sales per store have declined from $730K to about $580K. This has negatively impacted gross margins as the company cannot leverage rising occupancy costs and store-level payroll expenses. This decline resulted in a decline in total sales from $1B to $761M, which drove SG&A costs as a percentage of sales from 26% to over 35% in 2021.

Total SG&A in 2015 was $275M and in 2021 it was $267M. SG&A per store remained relatively stable at $200K per store. We believe the lower average sales per store will make it extremely difficult for the company to lower COGs to the 61.5-62.7% range of 8-10 years ago. This means that 10-11% EBITDA margins are probably not going to be achieved for many years to come. However, there appears to be room for improvement in absolute SG&A costs to improve EBITDA margins in the future.

EBITDA Margin Has Been Declining

Average Sales Per Square Foot Has Been Declining

We noticed that the company has the shortest average lease life of many of the apparel retailers with market caps under $250M. This gives the company significant flexibility in managing the size of its store fleet and also the possibility of negotiating better lease terms in the future if the economy remains weak.

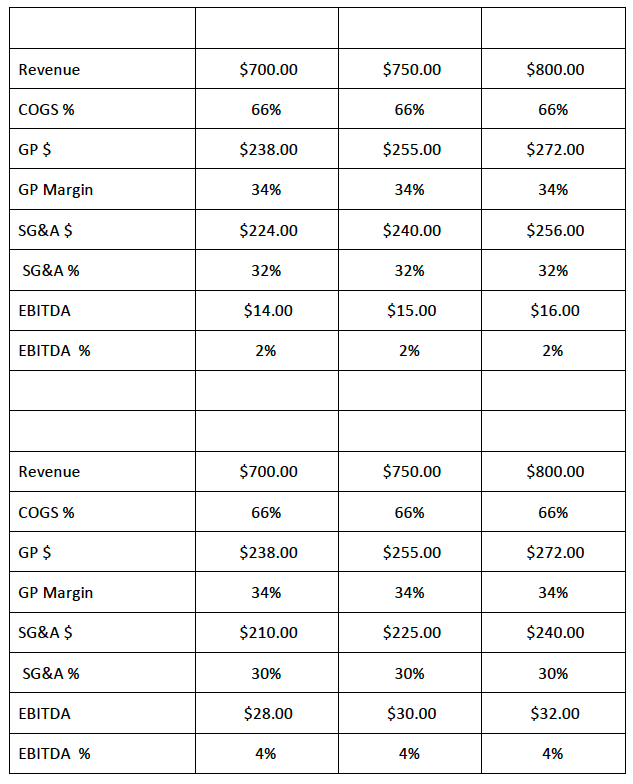

Simple Model Suggests Future EBITDA Could Range from $14M to $56M

We like to build over-simplified models to help us understand the dynamics of the company’s business model. These models result in a wider range of outcomes than most investors like to see. However, we are not trying to be too exact in our modeling and the wide ranges are the result.

Model Assumptions:

· Sales on a TTM basis are around $750M.

o We just simply bracket that by $50M either way.

o Severe recession could make $700M too high.

o We think the $800M is probably an aggressive number on the high end because of no real store growth and flattish sales per store over the last few years.

· Gross Margin of 34-36% seems reasonable in a more normalized environment, but that certainly could be too optimistic.

· SG&A ranges from $203M -$256M. So, we are assuming a significant amount of SG&A cuts in the future. SG&A in 2020 was cut by $60M but has returned to $267M level. So, our low-end EBITDA estimate of $14M could be too high.

· The result of these models is a range of 2-7% for EBITDA margins.

· CATO did generate $20-$50M in FCF per year from 2017-2021 (excluding 2020). Our models may turn out to be too conservative.

Company has a Significant Amount of Unencumbered Real Assets

While the company leases 100% of its store base, it does own several buildings and hundreds of acres of land. In December of 2020, Gate City Capital analyst Nicholas Bodnar wrote up CATO on Seeking Alpha entitled: Cato: Debt-Free Retailer with Fortress Balance Sheet and Hidden Real Estate. You can read the article here. Mr. Bodnar estimated the value of the real estate in the $30-$50M range. We will let his detailed analysis stand on its own. Gate City Capital is known for their extremely thorough due diligence and company/property visits.

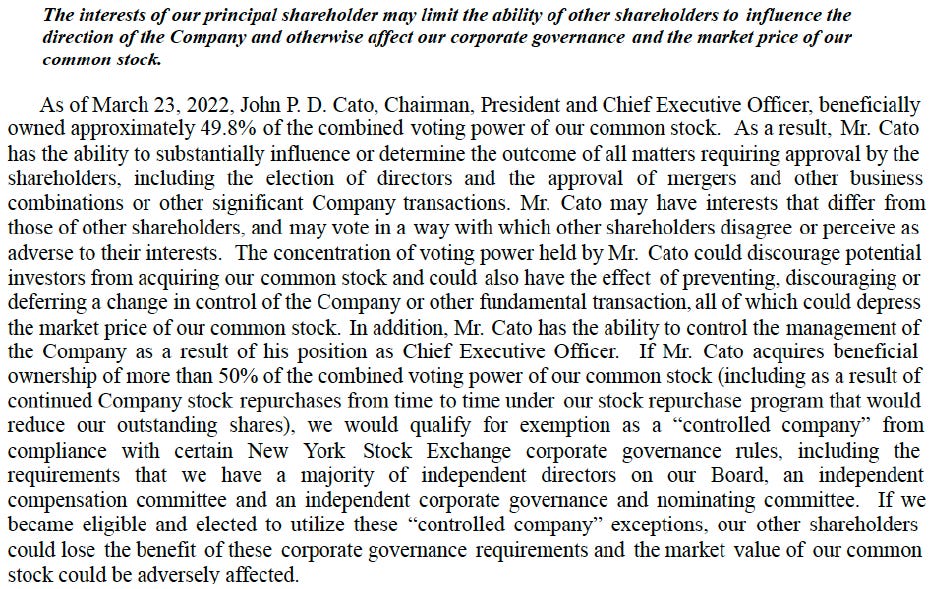

Company now Qualifies for Exemption as a “Controlled Company” from Compliance with Certain Governance Rules

On April 6, the company filed its annual proxy statement. Included in the proxy was this note:

Subsequent to the record date of March 21, 2022, as a result of recent repurchases of the Class A Common Stock of The Cato Corporation, pursuant to the Company’s stock repurchase program, that have reduced the total outstanding shares of the Class A Common Stock as of March 29, 2022, Mr. John P.D. Cato, Chairman, President and Chief Executive Officer of the Company and the largest shareholder of the Company, now beneficially owns 50.2% of the outstanding voting power of the common stock, which includes both the Class A Common Stock and Class B Common Stock.

As the risk section of the 10K points out:

For more information on what this could mean for shareholders go here. So far, Mr. Cato has been friendly to the minority shareholders in terms of returning excess cash and FCF to them. We do not expect that to change; however, it also prevents other shareholders from influencing the timing of any asset sales, cost reductions or return of the excess cash on the balance sheet.

Summary

CATO corporation has a cash balance of almost 80% of its current market capitalization with no term debt. The company also has a significant amount of unencumbered real assets that it could monetize with either a sale leaseback or outright sale. Historically, the company has generated between $20M-$50M in FCF. These attributes provide investors with a significant “margin of safety”.

However, the company is also “cheap for a reason,” and that reason is declining operating metrics. Sales per store have dropped 20% to $580K, while SG&A per store has remained relatively flat, pressuring margins. Inventory is too high and gross margins are under pressure. Reported numbers will probably get worse before they stabilize or improve. The company is effectively controlled by the President and CEO John Cato, so there is no way for shareholders or potential activists to accelerate any value creation at the company.

The Fed is aggressively raising interest rates in the face of mounting evidence of a recession, so investors are fleeing consumer related investments. Some investors have complained at the lack of net/net stocks in the U.S. If the markets continue to deteriorate, they may just get their chance to invest in one in CATO.

Are you harvesting my brain waves?! (hahahaha)

I bought some CATO the other day at about $9.36/share!

I've been trying to sell some calls with a strike of 10, potentially a great way to get income? The only problem is that the bid/ask is WAY too wide, and the volume of trades is pretty thin.

As always, you did a good analysis of CATO. I think CATO will be a very good way to ride out a rough market, especially when you add back the dividends/buyback/call writing.

The lower and wilder the market gets, the more bargains there are out there.

Thank you again for your thoughts. I did not think about the covered call angle, but that does make it interesting from a total return standpoint. Maybe write on half to keep any optionality on a tender or something like that.