One Hour Analysis: Can Potbelly Really Be the 10X Nierenberg Investment Management (D3 Family Funds) Thinks It Could Be?

Potbelly Corporation (PBPB)

Price: $5.45

Share outstanding: 28.76 million

Market cap: $156 million

Cash: $14.7 million

Debt: $22 million

Enterprise Value: $161 million

Description:

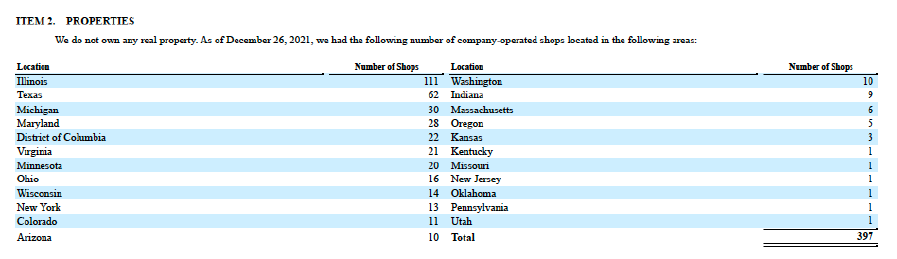

Potbelly Corporation, through its subsidiaries, owns, operates, and franchises Potbelly sandwich shops. As of June 30th, 2022, it had 440 shops in 33 states and the District of Columbia, which included 393 shops and 47 franchisees operated shops. The company was formerly known as Potbelly Sandwich Works, Inc. and changed its name to Potbelly Corporation in 2002. Potbelly Corporation was founded in 1977 and is headquartered in Chicago, Illinois.

The purpose of this report is to provide investors with a strong base to start their own analysis on Potbelly Corporation. We like to do these “One Hour” Analysis (which actually take much longer to complete!!!) reports to help us understand the main investment points that we need to research further. We read a lot of hedge fund letters, conference call transcripts and attend/listen to many investor conferences to generate research ideas. What caught our attention on PBPB is the cluster of institutional investors discussing the company and its recent mention in Snowball Research Monthly report (this is a paid service).

David Nierenberg/D3 Family Funds Files 13D

After increasing its ownership in PBPB to 9.4%, D3 Family Funds filed a 13D on July 21st, 2022. In the 13D the company made a case for the stock to increase to $40-$60 per share in ten years. We have included the contents of the filing below:

The Reporting Persons increased their ownership of the Company to 9.4%, making the Reporting Persons the largest shareholder of the Company, because they believe that the market is far from recognizing the Company’s rapidly improving unit and corporate economics, its substantial potential profitability increase from franchising, the quality and experience of the Company’s management and board, its brand, and unique positioning. The Reporting Persons believe that several things should be done now to close the gap between the Company’s current market value and what the Reporting Persons believe to be its intrinsic value.

The Reporting Persons view the Company as a coiled spring that could become as much as a 10X for its shareholders over the next decade. Using a 10% discount rate, the Reporting Persons estimate that this $5 stock could be worth $17.77 today; with a 15% discount rate, it could be worth $10.03 today, double where it is right now. (NOTE: We think a 15% discount rate is much more reasonable than a 10% discount rate given the risks)

The Reporting Persons know that prior management did not deliver. But they are long gone. The Reporting Persons recognize the risks of inflation and recession. But, by now there should be little doubt about the ability of the Company’s current management to improve shop performance and protect profitability from inflation. The Reporting Persons hope that the Company may announce additional franchising deals soon.

Over time the Reporting Persons expect the current impediments to the Company investors’ liquidity to melt away. Right now, less than 25,000 shares, worth only $125,000, trade per day. But, with continually improving operating and franchising performance and solid investor communication, the Reporting Persons hope the Company may join the Russell 2000 Index and that the Company’s liquidity will improve.

Moreover, as the Company raises raise shop margins to 16%, and grows its system to 2,000 shops, with 1,700 of them franchised, the Reporting Persons envision revenue rising to about $575 million and EBITDA reaching $140 million. If the Company were to use future free cash flow to freeze its share count at 29M, the Reporting Persons could envision EPS climbing to over $2.00 in 10 years. With profitable, growing franchisors valued at 20X earnings and 3X revenues, the Reporting Persons could see the Company’s share price rise to about $40-60 in 10 years, the midpoint being 10X where it is today.

The Company’s management and board already have demonstrated their commitment to owning the stock and alignment with shareholders three ways: (1) six outside directors receive their retainer fees in stock, rather than in cash; (2) in CEO Bob Wright’s initial contract, he requested and received stock, instead of cash, for his first year salary; and (3) the Company’s Long Term Incentive Plan (LTIP) emphasizes absolute share price performance and total shareholder return.

While the Reporting Persons appreciate this, they believe that more can and should be done now to close the gap between the Company’s market and what the Reporting Persons believe to be its intrinsic value. The Reporting Persons note, for example, that in the past 22 months only two insiders bought Company shares. The total number of shares they bought was only 16,350. Given the size of the valuation discrepancy today, the Reporting Persons strongly hope for much more insider buying than this. They also hope, with the clean-up of the past progressing well, that the Company can improve profitability now by reducing corporate overhead. While franchising growth takes time, corporate cost reduction can be addressed now.

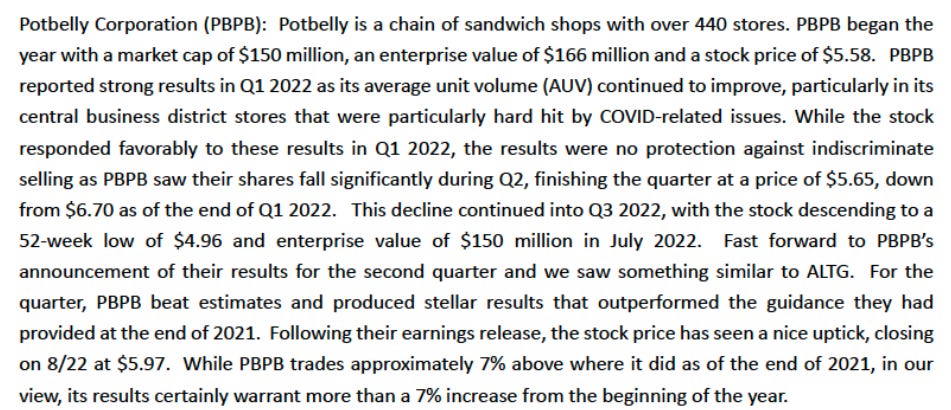

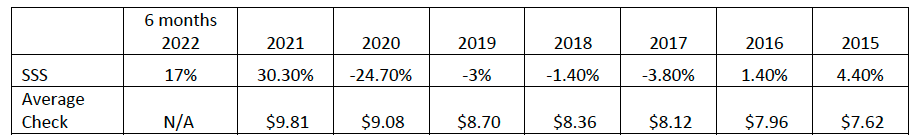

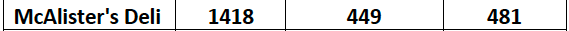

D3 is not the only respected investor that owns shares in PBPB. Both Arkto Capital and 180 Degree Capital (symbol: TURN) mentioned the company in their latest Q2 letters to shareholders. We have included their comments below:

Arkto Capital Q2 Letter:

Potbelly (PBPB) – delivered 17.2% same-store sales (SSS) and 19% revenue growth in 2Q22, including record Average Unit Volume (AUV) at shop levels. The company reaffirmed its 2022 guidance which should result in nearly 20% revenue growth and sustainable cash flow generation. More importantly, the company’s continued commitment to having at least 25% of its locations be refranchised in the next couple of years while growing the overall location base, should result in substantial cash inflows and business model profitability. This was reaffirmed with the signing of a major delivery partnership with REEF, the largest operation of virtual restaurants, and reporting a healthy pipeline of new franchise candidates.

180 Degree Capital Q2 Letter:

A paid service, Snowball Research (Similar to the must read Kuppy’s Event Driven Research but on a much smaller scale) also highlighted Potbelly in its August addition. Here are some of the highlights:

How Realistic is a 16% Shop-Level Profit Margin?

There are two main components to the long investment thesis. The first is that the company can get back to 16% operating margins. The second is that the company can grow to 2,000 restaurants with at least 1,500 franchised. Let’s look at the opportunity to return operating margins to 16%.

Pre-Covid, the company did generate restaurant level margins in the 18-20% range so there is some historical precedent for the company generating margins over 16%. YTD restaurant margins are 8.5% (however in Q2 they were 11.4%). In FY21 the restaurant margin was also 8.5%. Let’s take a closer look at the expense line items to see where approximately 800bps of margin expansion could come from.

Food Costs

The last time the company generated 16% restaurant margins was in 2018 when food costs as a percentage of revenue were 26.5% of revenue. Food costs are currently running around 28.0% -28.5% of revenue. The company typically take two price increases a year but hasn’t disclosed the cumulative amount. Most restaurant we follow are showing 200bps+ higher food costs as a percentage of revenue (CMG is the exception with a 250bps IMPROVEMENT). Historically commodity costs tend to mean revert and we do not expect the current 10-15% commodity price increases to continue. At some point there will be relief on commodity costs and there should be some margin improvement. The 200bps drop on COGS as a percentage of revenue from 2015 to 2019 was driven almost entirely from price increases. Therefore, it appears as though the company does have some pricing power. However, a conservative estimate for a longer-term percentage of sales for food costs might be closer 27% than 26%.

Labor Costs

The last time Potbelly restaurant level margins were 16-20%, labor costs as a percentage of revenue were 300-500bps lower than FY21. We are not going to rehash all the well-known problems in the labor market. However, it does seem unlikely that labor costs as a percentage of revenue will decline to the 29% range in the company’s best years. Perhaps 30% as a percentage of sales is a reasonable goal for now.

Occupancy Costs

Occupancy costs as a percentage of revenue were running in the 13-14% range when Potbelly was generating 16-20% margins. Currently occupancy as a percentage of revenue costs are running in the 12-13% range. In 2020, the company took advantage of the Covid shutdowns to renegotiate 321 or about 75% of its store’s leases. We think that the current occupancy costs are about as good as they can be. Also note that the company has stated that AUVs are at all-time highs and occupancy costs were still about 12% of revenue in the latest quarter.

Other Costs

The biggest increase in terms of percentage of revenue costs has been “other” costs. These costs have risen from 10.6%-11.6% to 17.5%!!! It seems like this is an area that could produce the most improvement in the restaurant margin. The company describes “other” costs as:

Other operating expenses include all other shop-level operating costs, the major components of which are credit card fees, operating supplies, utilities, repair and maintenance costs and shop-level marketing costs. Note: up until 2021 the company called out musician expenses as well.

It is difficult to see how the company can make substantial reductions in most, if not all, of these costs on an absolute basis. In Q2, even though the company was able to leverage labor (160bps improvement) and occupancy (200bps improvement) on a 17% increase in same-store sales, other costs rose 50bps as a percentage of sales to 16.6% from 16.1%. Since this is a quick look at the company, it is difficult for us to make any definitive statements as to where these costs will eventually fall as a percentage of revenue. This is an area for further analysis.

If the company can achieve 200-250bps of improvement on the COGs and labor cost lines, the company would still need to find another 200-300bps of savings in other places, most likely in the other costs line. We have not done enough work in this preliminary look at the company to make a judgement on that. The fact that historically the company has not had sustained positive same-store sales and the average check is under $10, makes operating leverage more difficult to achieve long-term.

1,700 Franchised Units in 10 Years Reasonable?

The second component of D3’s 9-10X return over 10 years, is premised on the company achieving its goal of 2,000 units, at least 1,700 of which are franchised. The company currently 343 owned units and 47 franchised units, so the company would have to grow its franchisee restaurant total by 120-150 units a year on average (assuming it sells at 200-300 of its owned stores). This seems to be an extremely aggressive goal on several fronts. The company peaked with 55 franchise units in 2017. There are not than many chains the size of Potbelly that are growing at that pace and there is always the danger of hurting the brand by expanding too rapidly. The company also has to show that 16% restaurant margins are achievable to attract franchisees.

While the sales to investment ratio is favorable ($1M in revenue vs. $600K in startup costs) and cash return out two years is an attractive 20-25% (assuming normalized margins), the company has not shown sustained same-store sales increases in years. Increasing customer traffic is a sign of a healthy concept and helps maintain or grow operating margins. Since the company has been able to maintain its AUVs around $1M, the traffic declines seem to have been offset by modest price increases. The company has also historically been located in CBD locations or locations that are near office parks. Granted Covid has certainly distorted the numbers and the new marketing and food promotions have not been fully implemented so there is potential.

Below is a list of companies that have between 500 and 3500 units, with the majority of their units operated by franchisees. The deli/sub chains, Jersey Mike’s, Firehouse Subs and McAlister’s Deli have between 480 and 1856 units. Jersey Mike’s AUV of $936K is very similar to Potbelly’s $1M. Jimmy John’s currently has approximately 2750 locations of which 41 are owned. The goal of 2,000 restaurants seems like a reasonable goal, although the time frame is aggressive and until new agreements are announced it is difficult to judge the quality of their new franchisee base.

Additional Thoughts:

· Management is very strong, and the CEO does have a strong track record of success at Wendy’s, especially with franchising. Through his RSU issuance, he is also very incentivized to succeed so his goals are aligned well with shareholders.

· 7 of the top 8 positions in the company have been filled in the last two years, which brings fresh eyes and energy to the company.

· 1,800 franchised stores could generate $110-$130M in high margin royalty revenue.

· 16% shop-level margins would more than double shop-level profits and be about 2X G&A + Advertising expenses ($36-40M).

Almost 50% of the shares are held by institutions that will hold management accountable.

· Company’s focus on CDB may be a drag on sales going forward and expanding into new trade areas and cities could be more difficult.

· Turning around restaurant chains is hard and there have been numerous failures. While the company seems to be in better shape than many past turnaround candidates that failed, there have been numerous failures in the casual dining space including, Bravo Brio, Ruby Tuesday, Ignite Restaurant Group and California Pizza Kitchen.

Summary:

Potbelly has been receiving a significant amount of institutional investor interest lately and the long-term prospects are intriguing. While the current macro conditions and fears of a severe recession has soured investors on companies that is consumer related, we believe that PBPB should be on any investor’s list of companies to do more due diligence on now to better understand the progress or lack of progress in the future.

Appendix:

PBPB Latest Earnings Presentation:

D3 recent purchases as listed in 13D filing: