One Hour Analysis: Alico Inc. Could Be Trading for 50% of NAV. Is That Enough Margin of Safety?

Could Be if 1.7M Trees Can Produce Over Next 4 Years

Alico: ALCO

Price: $31.56

Shares outstanding: 7.5M

Market cap: $240M

Cash: $7M

Debt: $108M

Enterprise Value:$340M

Company Overview

The elevator pitch by the company.

Initial Thoughts:

Based on historical sales of land and comparable valuations of similar acreage, ALCO estimates the net value of it land holdings to be between $400M-$500M or $52-$65 per share.

Since 2018 company has sold 49K acres of ranchland for $168M.

There are 25K more acres for sale.

If company sold remaining 25K in ranchland it would become debt free.

Executed 3 year option to sell 899 acres for $10M

Book value of citrus trees on the balance sheet is $327M.

Most of the land is used for growing oranges and will most likely not be sold.

Operation Overview

60% of revenue comes from selling Valencia Oranges.

35% of revenue comes from selling Early/Mid Season Oranges.

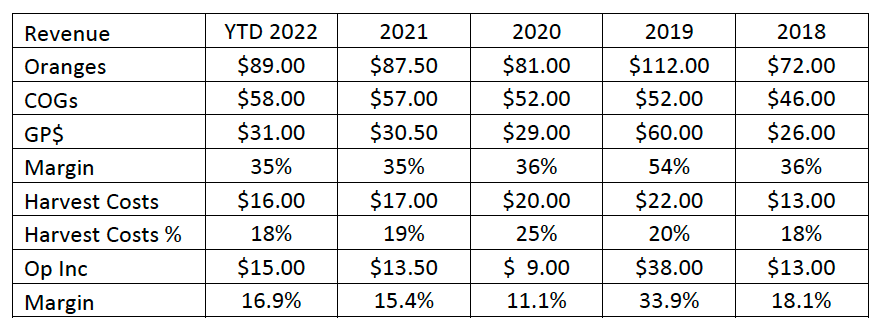

Gross margins are typically around 35%.

Harvest costs are around 18-20%.

G&A is around $10M a year.

5% of revenue comes from Grove Management Services. ($1M-$2M a year in profit).

80-90% of revenue is sales to Tropicana governed by two contracts that expire in 2024.

Sets a range of prices.

Generally speaking oranges are sold for $1.75-$2.75 per pound depending on the type.

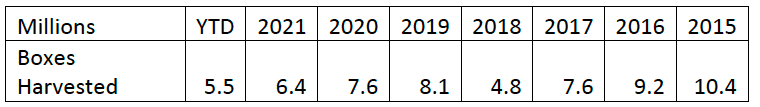

1.7M New trees set to go into production over next 4 years. Could boost production by 30-50%!!

Debt seems manageable with only $3.3M in interest payments due until debt matures in 2028. Switch to interest only payments saved company $5M-$6M a year in cash flow (partially funded big dividend increase).

Industry Overview

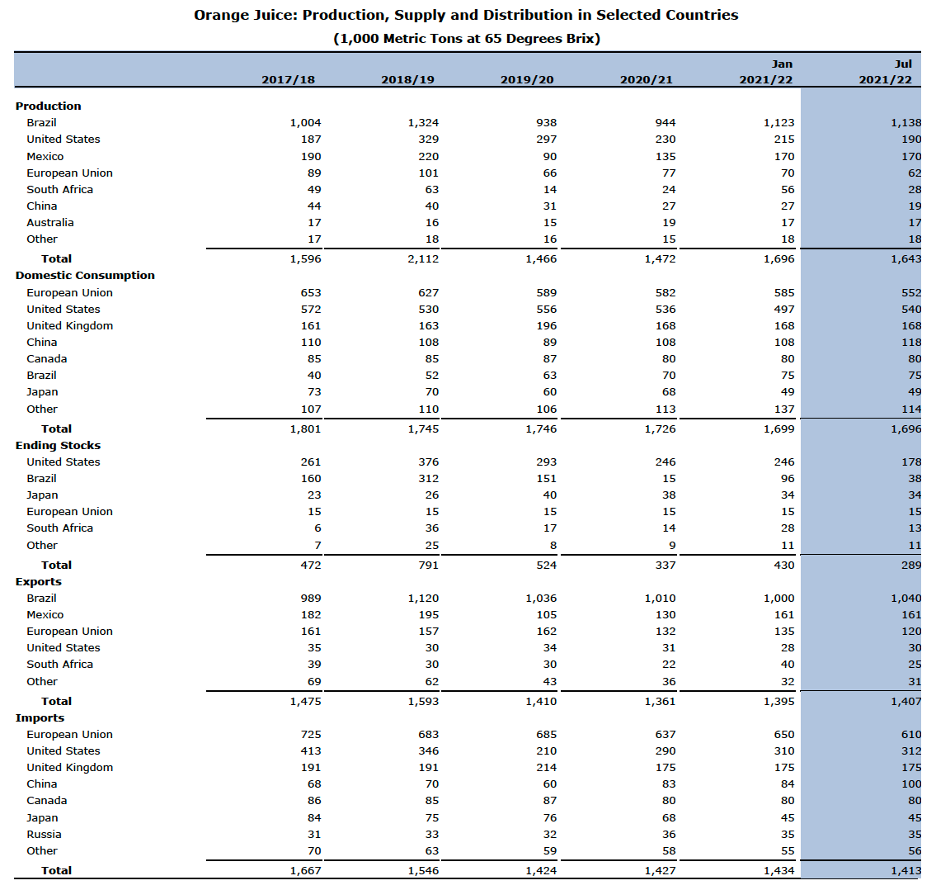

US Orange production has been in a 25 year decline (75% decline in production since 1998). Last year lowest production in 55 years.

Brazil produces 65-70% of world’s supply.

Citrus Greening has been ongoing problem.

Company increased its dividend from $0.18 per quarter to $0.50 per quarter in June 2021 ($14M a year). But additional raises seem unlikely.

Do recent results put dividend in jeopardy? Not if new trees produce as expected.

Land Holdings Valued at $400M-$500M.

Like many companies with large land holdings, ALCO attempts to give investors a picture of what it believes the value of those holdings are. Of course these are highly subjective and only important if there is a reasonable chance that the acreage will be sold. Below is ALCO’s estimates of the value of their land holdings.

Since 2018, ALCO has sold 49K acres of land for approximately $170M. Historically the value of the acres sold has been inline or even higher than the company estimates. We will give them credit that the rance of valuations is reasonable (however, with interest rates up 200-400bps a haircut to these values could be given, pick a number).

It should be pointed out that the implied equity value listed in their table is basically the equivalent of the value of their citrus acres. Therefore, there is little chance investors would see that money without the complete sale of the company, so some discount for the illiquidity is probably appropriate (25-30%??).

We believe the company, given the chance, would sell the remaining 25K acres of ranchland and utilize the proceeds to pay off as much of the $98M in net debt as possible after taxes. This would save $3M+ a year in interest expense. An alternative would be a buyback (which the company did in 2019 for $25.5M) or a one-time extra dividend.

Company Operations Overview

The company generates 95% of its revenue from selling oranges over two seasons each year. The balance is selling fresh fruit and managing other growers’ groves. 60% of revenue comes from selling Valencia oranges and 35% of revenue comes from selling Early/Mid Season oranges. 80-90% of the company revenues are generated from sales to Tropicana under long term agreements. These sales are governed by two separate contracts that are up for renewal in 2024. Prices of the oranges sold range from $1.75-$2.75. Other factors that determine the amount of revenue are, the amount of loss per tree due to weather or disease (drop), the average pound of solids per box (5.50-6.00) and total number of boxes sold. Freezes this year and hurricanes in previous years have had a major impact on the harvests. The company has planted over 1.7M trees in the last 4 years and the first batch of trees (300-400K) are expected to produce their first commercial grade fruit next year.

Margins are remarkably stable and SG&A costs have been averaging around $10M a year. The company generates about $1-2M a year in revenue from grove management contracts.

Management seems to have done a good job of controlling what it can control. One thing that it can control is how many trees the company has available for production. Over the last four year the company planted 1.7M new trees to replace those lost to citrus greening and to increase density of the groves. This is about 50% more than it typically plants over that time span (900K-1.1M). It takes about 4 years for trees to reach production maturity and peak production occurs about 4 years after that.

Management believes that these trees are about to significantly increase the amount of boxes the company will harvest starting next year.

Q4 FY21 CC:

We planted approximately 400,000 trees in fiscal year 2021 and have planted approximately 1.5 million new trees since 2018 with anticipated production from the first of those plantings expected in fiscal year 2022. We believe our tree planting strategy over the last 4 years has the long-term potential to enable the acres we now own to return box production close to our historic 10 million box level.

If the production can return to 10 million boxes, it would be a substantial increase over the last 6 years. For reference, in 2015, the last time the company produced 10 million boxes the company generated $150M in revenue (vs. $105M in 2021) and $33M in CFO (vs. $16M in 2021).

Industry Overview

It seems at though the orange juice market in the US has been in secular decline every since Billy Ray Valentine and Louis Winthorpe III manipulated the Frozen Concentrated Orange Juice in the 1983 film Trading Places. Declining demand for orange juice, the rise of Brazilian production and the ongoing battle with Citrus Greening have been hard on the industry. ALCO estimates that it controls 17% orange growing acreage in Florida. These risks are long-term in nature and will always be an overhang on the company’s ability to grow or maintain production in the long-run.

Summary:

ALCO management has been very good at controlling what they can control. They have sold down 2/3rds of the company’s ranchland holdings at very good prices and used the proceeds to reduce debt and fund a $25M stock buyback. They are actively pursuing the sale of the remaining 25K acres. Rising interest rates has probably reduced demand for this acreage for now, but it has shown it has been able to maintain or increase its value over time. We think management will be prudent in maximizing value for shareholders. The current 50% estimated discount is probably too large, but since more of the discount is derived from the citrus acreage that will more likely never be sold, some kind of discount to NAV 20-30%) is probably warranted.

Management has planted 1.7M trees that are just about to reach production maturity, which could boost output by up to 50% over current levels. THIS IS THE MOST IMPORTANT INVESTMENT POINT FOR INVESTORS TO CONSIDER. A normalization of weather and the next few years of harvests could be substantially above current levels, meaning even if there is some softness in pricing, revenue and cash flow could still grown. And this growth is not that dependent on macro factors that are currently buffeting the market. This could be an investment that is uncorrelated from the market for the next several years. We believe the potential production from these trees is a major reason behind the increase in the dividend to $2.00 per share. We also believe that the 6.7% dividend is relatively safe because the new trees, small purchases of new trees and a return of normal weather (no freeze next year) will produce more than enough FCF to cover the dividend.

Of course, the industry specific risks will always weigh on the long-term prospects of the company and will more than likely limit the upside and potential for sustained growth.

When interest rates were 0%, the 6.7% dividend looked much more appealing than it does with rates at 4.0%. But the dividend does seems secure, the performance of the company is determined mostly by industry specific risks and not many of the risks impacting most stocks today. Management has done a commendable job running the company. Insiders own 7% of the company and about 40% of the stock is held by long-term investors. But since much of the operating results in any given year are almost totally out of management’s control, many investors may not be comfortable with the high degree of uncertainty or would like to be compensated even more for the risks.

ALCO does own mineral rights on 90K acres, although the realization of that value is very uncertain.

Disclaimer

Investing501 uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The articles and reports published by Investing501constitute the author’s personal views only and are for entertainment purposes only. They are not to be construed as financial advice in any shape or form. Investing501 does not predict the price at which the securities of any company may trade at any time. Every investor has different strategies, risk tolerances and time frames. You are advised to perform your own independent checks, research, or study, and you should contact a licensed professional before making any investment decisions. From time to time, the author may hold positions in the stocks mentioned in articles published by Investing501. To the extent the author does have such positions, there is no guarantee that he will maintain such positions. Neither the author nor any of its affiliates accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

How do you view the risk that the 2 contracts responsible for 80-90% of revs won't be renewed come 24?