One Group Hospitality (STKS) - One Hour Analysis: Quick Thoughts on Benihana Acquisition. Building an attractive acquisition candidate by acquisition?

On March 26th One Hospitality Group Announced the acquisition of Safflower Holdings Corp., the owner of Benihana Inc., a leading operator of highly differentiated experiential brands that owns the only national teppanyaki brand in the U.S. and also owns RA Sushi. The transaction was valued at $365M. Investors reacted favorably with the stock rising approximately 40% since the announcement. What follows is our one-hour analysis of the transaction and potential returns.

According to the press release:

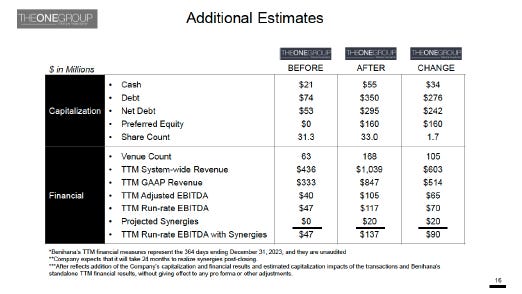

Currently Benihana operates 88 company-owned restaurants and franchises or licenses an additional 17 venues in the Americas. Once closed, the acquisition is expected to add approximately $575 million in annualized system-wide revenue and approximately $70 million in annual run-rate EBITDA before synergies, which are estimated to be $20 million annually. The Company expects that it will take 24 months to realize synergies post-closing. This is expected to bring the Company’s pro forma annualized run-rate EBITDA with synergies to more than $135 million. The transaction is expected to be immediately accretive to earnings per diluted share.

In February, FSR Magazine published an article on Benihana that provided some additional background on the company. A couple of highlights from the article:

· Same-store sales were up 30 percent versus pre-COVID.

· The chain’s business is mostly a celebratory occasion, with guests coming 2.2 times per year.

· AUV is about $6.5 million, and restaurant-level margin is 20%.

· Some higher-performing locations include Miami, $11.3 million; San Diego, $11.1 million; Burlingame, California, $11.1 million; Orlando, $11.1 million; Las Vegas, $10 million; New York City, $8.9 million; Dallas, $8.5 million; and Farmington Mills, Michigan, $7.4 million.

· Sixty-two percent of customers are millennials, followed by 18 percent baby boomers, 12 percent Gen X, and 8 percent Gen Z. In terms of household incomes, 25 percent of guests are between $100,000 and $150,000. The next ranges are fewer than $50,000, 24 percent; more than $150,000, 19 percent; $50,000 to $75,000, 16 percent; and $75,000 to $100,000, 15 percent.

Acquisition Details:

Acquisition is valued at $365M.

Financing

$160M Preferred 13% PIK with Hill Path Capital LP

Hill Path also receives 1.7M warrants at $0.01 per share (5.33% of fully diluted shares) and 1.067M warrants with a strike price of $10.00 per share.

New debt financing arranged by Deutsche Bank of $390M, which is comprised of a $350 million Senior Term Loan B and a $40 million unfunded revolver. Interest is SOFR (Approximately 5.3%) plus 650 basis points on the Term Loan B and SOFR plus 600 basis points with step-downs on the revolving line of credit.

“We are particularly pleased that there are no financial covenants on the term loan, amortization is low, and leverage is very manageable.”

All in interest expense (counting the 13% PIK) is about $35M a year. The PIK dividend is not payable for 3 years and could be refinanced in year four.

The interest rate on the 13% PIK will INCREASE STARTING NEXT YEAR. THIS IS THE BIGGEST CONCERN OF THE DEAL. The interest rate increases every year and it appears as though the company cannot refinance for four years. THIS IS VERY EXPENSIVE PAPER.

“Regular Dividend Rate” means, with respect to each period set forth below, the interest rate set forth opposite such period:

Initial Issue Date until [●], 20251

13.0% per annum

14.5% per annum

From and after [●], 20274

15.5% per annum (which shall increase by one additional percentage point on each anniversary of the Initial Issue Date from and after the fourth anniversary of the Initial Issue Date)

STKS Ability to refinance Preferred:

(a)Commencing upon the earlier of (i) the fourth anniversary of the Closing Date and (ii) the Mandatory Redemption Date or Fundamental Change Repurchase Date, if the Mandatory Redemption Price (as defined in the Certificate of Designation) is not paid in full on or before such date then, in either case, if any shares of Preferred Stock remain outstanding, the Company shall, upon receipt of a written request from the Hill Path Investor (a “Refinancing Request”), commence and use commercially reasonably efforts to engage in a process (a “Refinancing Process”) to explore one or more debt or equity transactions (“Refinancing Transactions”) to generate the net proceeds that would be used to redeem all of the shares of Preferred Stock then outstanding at the then applicable Optional Redemption Price (as defined in the Certificate of Designation) in accordance with the terms hereof; provided that, for the avoidance of doubt and notwithstanding anything to the contrary in this Section 5.18, (x) the Hill Path Investor shall not have the right or power to require the Company to, and the Company has no obligation or duty to, consummate a Refinancing Transaction and (y) the decision of whether or not to consummate a Refinancing Transaction is subject to the determination of the disinterested

Presentation Slides of interest:

Interesting Conference Call Comments:

Third, the transaction creates a sizable and meaningful publicly traded company at scale that we could not achieve in the near term organically.

Having been in the public equity markets for more than a decade, we are keenly aware that institutional interest in smaller cap names such as us is rather limited, despite us having grown our business significantly with respect to revenue, EBITDA and our restaurant locations over time, including acquiring Kona Grill 4 years ago.

We view this as a proven and scalable international platform now with compelling white space with an addressable market of over 800 venues.

We think the white space opportunity for Benihana brand restaurants in the U.S. alone is about 400 restaurants, which suggests that the brand is early on its potential (Note: Interesting that management thinks a 60-year-old brand can grow store base 4X). Each location is designed to involve an authentic Japanese atmosphere and provides an escape from everyday restaurant dining. This model works everywhere and is enabled through flexible footprints and distinctive designs that generate dramatic curb appeal and facilitate exceptional and memorable guest experiences.

I think there's a significant amount of synergies when it comes down to supply chain. There's also synergies when it comes to integration of operations such as call center, so I think there's a lot of things that will shape over the next 2 years in terms of those synergies, not to mention operating and marketing synergies. (Note: Darden mentioned $20M in supply chain and G&A savings over two years in the RUTH acquisition.)

Who is Hill Path Capital LP?

Hill Path Capital LP is led by Scott Ross. He is currently the Chairman of the Board of United Parks (formerly SeaWorld). His firm has focused on entertainment and restaurant companies. Below is his biography:

Mr. Ross is the Founder and Managing Partner of Hill Path Capital. Mr. Ross was previously a Partner at Apollo Management (which he joined in 2004) where he focused on private equity and debt investments in the lodging, leisure, entertainment, consumer and business services sectors. Prior to Apollo, Mr. Ross was a member of the Principal Investment Area in the Merchant Banking Division of Goldman, Sachs & Co. and a Member of the Principal Finance Group in the Fixed Income, Currencies, and Commodities Division of Goldman, Sachs & Company. Mr. Ross was employed by Shumway Capital Partners from August 2008 to September 2009. Mr. Ross currently serves as the Chairman of the Board of Directors of SeaWorld Entertainment, Inc., and has previously served on the Board of Directors of Diamond Eagle Acquisition Corp., Great Wolf Resorts, Inc., EVERTEC, Inc. and CEC Entertainment, Inc. (the parent company of Chuck E. Cheese’s and Peter Piper Pizza). Mr. Ross graduated magna cum laude from Georgetown University with a B.A. degree in Economics and was elected to Phi Beta Kappa.

Hill Path Capital LP. Current Holdings:

Note: Firm owned shares in Ruth’s Chris which was acquired by Darden Restaurants.

This acquisition compares favorably to Ruth’s Chris acquisition by Darden.

While the valuation of the acquisition is significantly higher than the Kona Grill transaction, it does compare very favorably to the Darden acquisition of RUTH.

Kona Grill Acquisition Revisited

In October 2019, STKS made a strategic move by acquiring 24 Kona Grills from bankruptcy. Our analysis suggests that this acquisition was highly favorable. With the purchase, STKS gained access to $100 million in revenue and approximately $11 million in restaurant-level cash flow, all for a mere $25 million in cash (with an assumed $11 million in liabilities). These figures represent some of the most favorable acquisition metrics we've encountered. Notably, the absence of poorly performing restaurants in the deal further mitigated risk for STKS. Additionally, due to the substantially lower interest rates prevailing in 2019, the interest cost for the acquisition was a modest 8.5%.

Restaurant Metrics

$4.2M AUV

11.4% restaurant margins

$100M in annualized revenue

$11M in restaurant cash flow

New Debt Metrics

$48M Senior Secured Loan (Goldman Sachs).

$12M Revolver (Goldman Sachs).

8.5% average interest rate.

Other Thoughts:

Debt had increased significantly in the two years before the acquisition as the company has outspent cash flow to grow the store base (Cap Ex $86M vs. CFO of $56M).

Debt is still manageable at less than 2X Debt/EBITDA.

Based on management’s comments about growing the company to make it more attractive to institutional investors and our long history of investing and analyzing restaurant companies, we feel that there is a reasonable chance that this company is sold in the next 3-5 years. There is a significant concentration of ownership, which makes a takeover easier. Kanen Wealth Management increased its ownership percentage to over 15% just before the acquisition announcement. The founder, Johnathan Segal, owns nearly 13% of the company. Hill Path Capital owns 5% of the company and would increase that ownership to approximately 8% if it exercised the warrants with the $10.00 strike price. The current CEO was the COO/CFO at Einstein Noah Bagels and CFO at McCormick & Schmick’s. Both of those chains were taken private. If the company were acquired by Darden or Bloomin’ Brands, there is also the opportunity to refinance the $160M outstanding in 13% PIKs ($21M annual cost) and the $300M in debt costing around 11-12% ($15M+ in savings potential). Darden’s acquisition of Ruth’s Chris was done at a multiple that is nearly 2X the current multiple of STKS.

Summary:

The Benihana acquisition is more transformative than Kona Grill in many ways. The company is acquiring 4X the number of units relative to the Kona Grill acquisition. The chain is also much more established (60 years old) and an iconic brand. The brand does fit into the company’s VIBE experiential restaurant philosophy. However, the financing costs are significantly higher (300-500bps) than the Kona acquisition. There is also a minimum of 5% shareholder dilution though the issuance of warrants.

Combined company is still statistically very inexpensive.

Feels like management is trying to build the company to a scale that will either attract institutional investors (which could increase EV/EBITDA multiple) or become an acquisition candidate for companies like Darden, Bloomin’ Brands, Landry’s or private equity.

Lots of work to do, but current valuation does not appear to discount a high chance of success.

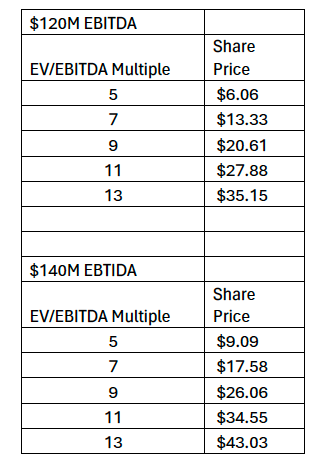

If the acquisition proves successful (a big if), the returns to current shareholders could be significant. The table below shows a wide range of outcomes using just the current $120M EBITDA run-rate and the potential $140M EBITDA run-rate if the synergies are achieved. However, there are several very significant weaknesses to these estimates.

The Preferred equity is a 13% PIK with increases the preferred balance by $21M a year (or $0.63 worth of equity and increasing each year). So these share price estimates more than likely overstate the stock price.

If the company achieves its unit growth guidance of 3-5 STKs, 3-5 Kona Grills and 3-5 Benihana restaurants, the company will be outspending its cash flow, meaning the debt balance will increase, also lowering the equity value component of the enterprise value calculation.

Hill Path Partners would more than likely exercise the 1.07M warrants that are struck at $10.00 if the stock was above that strike price.

Offsetting these negatives is the fact we do not increase EBITDA to account for these new units or any increase in same-store sales (guidance of 3-5%) or management’s stated objective of growth EBITDA by 15% per annum. But since this is just a free one-hour analysis to start readers on their journey, we encourage you to make your own adjustments. We will do a deeper dive into STKS at a later date.

Note" 13% PIK can be called after three years at $102.25