THE COMPANY

The concept is differentiated, serving (at more than 461 locations) a wide variety of noodles, pasta, soups, salads and appetizers at lunch and dinner, every dish made to order. The average expenditure per person is a modest $12.50, from a menu that can be enjoyed inside the 368 company and 93 franchised restaurants, taken to-go, or by delivery. The Company aims to eliminate the “veto vote” by satisfying the preferences of a wide range of customers, whether a family, a group of coworkers, an individual or a large party. The menu travels well, so is particularly well suited for off-premise dining occasions. The variety of flavors, dishes prepared to order, fast service and price/value appeal allows Noodles to compete against multiple segments throughout the restaurant industry and provides a larger addressable market than competitors who focus on a single cuisine. It is also a positive that 44% of customers have household incomes above $100k and 44% (also) of customers are no more than 35 years of age. At the same time, over the last five years, the Company has responded to the customer increased desire for convenience by improving the off-premise appeal. At this point almost three quarters of the meals prepared are consumed away from the store so smaller locations are now planned.

THE BOTTOM LINE

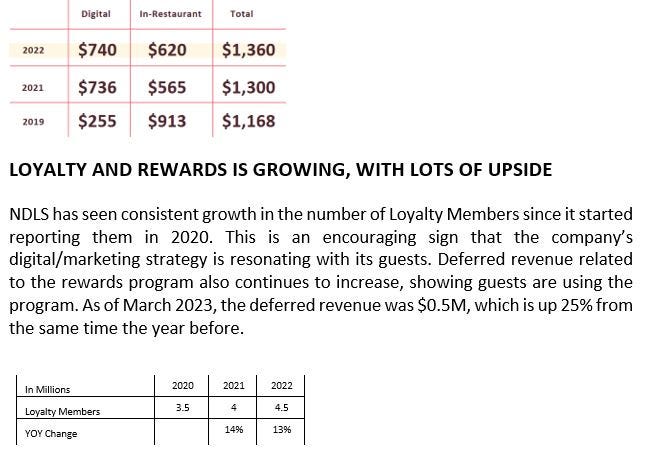

There are 461 locations (@ 12/31/22 – 368 company and 93 franchised) systemwide with AUVs in 2022 of $1.36M (up 16% from 2019). The typically 2,600 sq.ft. stores (the latest are up to 20% smaller) are in 31 states, with 1000 more possible over the long term. The current total of over 4.5M Loyalty Reward members is growing steadily. Though store level EBITDA margins were 13.8% in calendar ’22, well below the 20% peak of ten years ago, Adjusted EBITDA was $37M in the trailing twelve month (TTM) (thru March ’23). Company guidance for same is $45-$50M for calendar ’23. As of 3/31/23 the long-term debt (excluding capitalized leases) was a modest $51M and the Enterprise Value at $3.50 per share is about $211M. With an EV/ TTM Adjusted EBITDA at 5.7x, lower yet at 4.4x the midpoint for calendar ’23, there is obviously room for substantial capital appreciation.

There is another way for investors to win, since management controls hardly any shares, and activist interest is already in view. At 8-10x the current TTM Adjusted EBITDA of $37M, a buyout valuation would be up 51-96% from the current $3.50/share. At the $47.5M midpoint of projected calendar ’23 Adjusted EBITDA, the valuation would be up 102-160% from here.

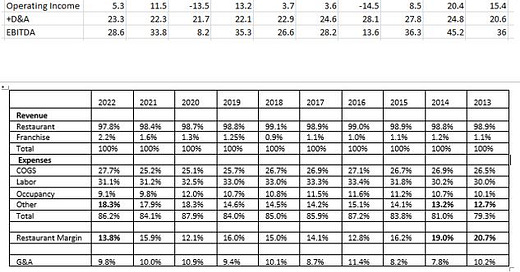

HISTORICAL RECORD – FROM IPO IN 2013 -THERE’S A STORY HERE

The charts just below show the operating history.

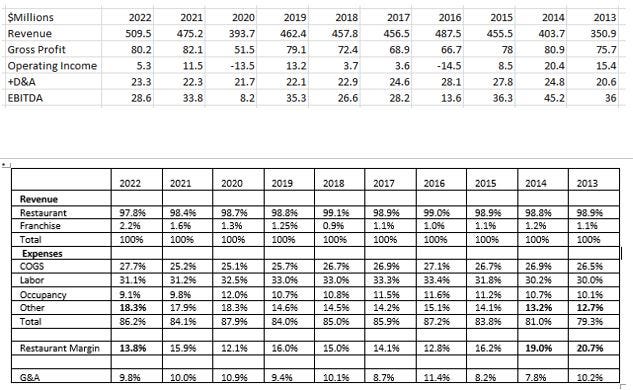

Shortly after the company’s IPO, NDLS significantly increased its store base. From 2013-2017 the company opened 212 restaurants (40 per year on average) which grew the store base from 276 in 2013 to 457 in 2017. However, poor performance of stores opened in 2015-2017 caused the company to significantly reduce its store openings to an average of four starting in 2018. The weak operating performance resulted in the closure of 76 stores in 2017-2018 and write-offs of $114M. Restaurant level margins declined from 20.7% to a low of 12.8% in 2016. These margins have remained in the 13-16% range. Since becoming a public company, NDLS has written off approximately $150M or about 50% of total capital expenditures over that time frame.

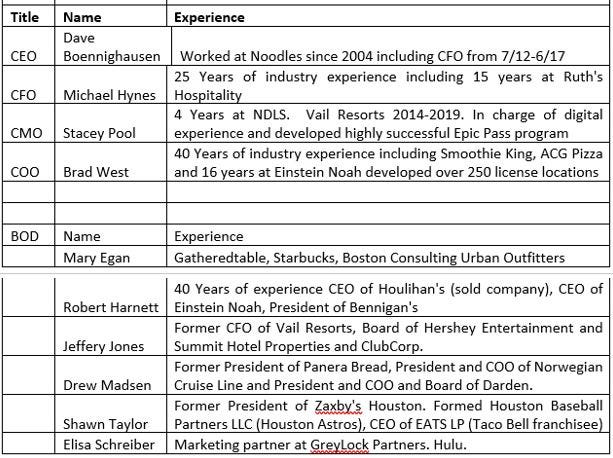

There were, predictably, some management changes during the period described above. Kevin Reddy, who had led the Company since 2006, stepped down in 2016. At that point Dave Boennighausen, previously CFO, was appointed interim CEO and Robert Hartnett, previously CEO at Houlihan’s was named chairman of the Board. A year later, in mid ’17, Boennighausen was named permanent CEO while Hartnett (remaining on the Board) was replaced by Paul Murphy (former CEO at Del Taco) as Executive Chairman. Murphy left in September 2019 to join Red Robin, replaced by Jeffrey Jones as Chairman, (ex CFO at Vail Resorts) who had served on the Noodles Board since 2013, most recently as lead independent Director.

Before describing the fundamental developments over the last five years, readers should be aware of the impressive credentials behind the top operating executives as well as the current Board Members. Their time at NDLS is indicated below.

Michael Hynes joined NDLS recently, Brad West in 2017, Mary Egan became a Director in 2017, Hartnett in 2016, Jeffrey Jones in 2013, Drew Madsen in 2017, Shawn Taylor in 2020 and Elisa Schreiber in 2019.

With the corporate history and credentials of both operating executives and Board members in mind, there have been:

TANGIBLE, FUNDAMENTAL DEVELOPMENTS OVER THE LAST FIVE YEARS

We don’t have to remind readers that ’20, ’21 and even ’22 were like no other. Noodles management, meanwhile:

In 2018 introduced healthy zucchini noodles (“zoodles”), installed expanded takeaway Quick Pick-up option.

In 2019 expanded healthy Cauliflower infused rigatoni, provided order ahead and drive thru capability, mobile app and Rewards platform, launched delivery.

Since COVID hit:

In 2020, with new CFO and CMO, expanded delivery and curbside pickup. Rolled out more efficient Kitchen of the Future. Launched Group Ordering, Apple Pay and Order. Expanded inclusion & diversity. Strengthened both company and franchise operating teams.

In 2021 introduced Tortelloni menu, new steamers, new franchise initiative, Loyalty Program reached 4 million.

In 2022 introduced lower carb, higher protein LEANguini, re-franchised 15 California locations with 40-unit development deal, launched Uncommon Goodness lunch, most new units since 2016, balance sheet strengthened along with credit facility.

A CASE CAN BE MADE: IMPROVEMENTS (IN PERSONNEL AND PROCESS) PRIOR TO, AND DURING COVID, HAS SET THE STAGE

Before providing management’s guidance for ’23 and beyond, we point out that growth in franchised units will be highly dependent on continued growth of AUVs and store level EBITDA margins growing back to the area of 20%. We have written many times that 15% EBITDA margins (and 20-25% cash on cash returns) for company operated stores does not (or should not) excite potential franchisees, since there will be a lot less cash flow left for franchised partners after royalties, marketing requirements, local G&A and other fees. While NDLS is apparently starting to attract new franchisees, including a recent area development agreement in California, demonstrated higher store level margins would help a lot.

Based upon management’s current assessment following first quarter results, the Company reiterated the following guidance for calendar 2023. The following was expected for the full year 2023:

Restaurant level contribution margins of 16.0% to 17.0%;

Adjusted EBITDA of $45 million to $50 million;

Depreciation and amortization of $25.5 million to $27.5 million;

Disposal of assets of $3.0 million to $3.5 million;

Net interest expense of $4.0 million to $4.5 million;

Stock-based compensation of $6.0 million to $7.0 million;

Adjusted EPS of $0.10 to $0.20;

Approximately 7.5% new restaurant growth system-wide, with a majority of openings being company-owned; and

Capital expenditures of $53 million to $58 million in 2023.

Importantly: Since the Company is reporting the second quarter in about a week, there could well be “news”, positive or negative, that could affect the short-term outlook and stock price. Whatever Q2 brings, we doubt it will affect the long- term prospect, so weakness would likely be a buying opportunity.

THE DIGITAL BUSINESS IS TURNING OUT TO BE STICKY

Noodles has one of the highest ratios of digital sales to total sales in the fast casual segment. The company says that digital sales are 54% of total sales. They have historically always been near 50%. The most successful companies in the industry, such as McDonald’s, Chipotle, Starbucks, Potbelly and Shake Shack have between 30-45% of their sales classified as digital. Some pizza chains have ratios above 70%. Noodles defines digital as online ordering, curbside (at select locations) and delivery. The company defines To Go orders as “in-restaurant”. Including To Go orders, we estimate that roughly 65-70% of sales are consumed off-site.

There are several benefits from having growing loyalty membership and a high digital penetration rate. The more NDLS knows about its guests’ dining habits, the more it can send personalized offers to them. This makes marketing expenditures more efficient and generates a higher ROI on them. If guests are receiving offers that are appealing to them, they tend to act on the offers and increase their frequency of visits. Companies with strong digital penetration and large loyalty membership bases report that loyalty members not only have a higher frequency of visits but also a higher average check.

THE PATHWAY TO 20% RESTAURANT EBITDA MARGIN

It is obviously desirable to return company store EBITDA margins back to the 20% level (achieved in 2013-2014), up from the current 16-17% guidance in ‘23. The company has included several slides in presentations that highlight the opportunity and areas from where the improvements can come. Below, we have included some of the most important aspects of the “pathway to 20%” margins.

2023 TARGET

In support of the calendar 2023 targeted 16-17%, up from 13.9% in ’22, management points out that in 2021 margins were 18.9% in Q2 and 18.1% in Q3. In 2022 CGS was 250 basis points higher, largely because of chicken prices. In 2023 2% deflation of CGS is expected, to the high 25% area, (compared to 27.7% in ’22) driven by fixed and formula pricing contracts. Labor inflation will not be as intense and there should be some occupancy leverage with higher sales. Restaurant level “Other Operating Expenses” are expected to be similar to ’22.

We think that the ability for NDLS to achieve its stated goal of 20% restaurant margins depends on its ability to improve occupancy and “other expenses” (utilities, insurance, trash collection, repairs & maintenance, etc.). As illustrated in the table above, occupancy expenses are already at the same level as a percentage of sales as FY13.

Occupancy Costs – “include rent, common area maintenance charges and real estate tax expense related to our restaurants and are expected to grow proportionally as we open new restaurants.”

Other Restaurant Operating Costs – “Other restaurant operating costs include the costs of repairs and maintenance, utilities, restaurant-level marketing, credit card processing fees, third-party delivery fees, restaurant supplies and other restaurant operating costs. Similar to certain other costs, they are expected to grow proportionally as restaurant revenue grows.”

Many of the expenses in these two categories require positive same-store sales in order to achieve operating leverage. However, the company has reduced the square footage of a restaurant from 2,600-2,700 in 2013 to 2,000-2,600 today. As the number of stores built at this lower square footage increases as a percentage of total units, there should be some improvement in occupancy costs as a percentage of revenue. Similarly, utility and maintenance costs could be lower for smaller stores. Third party delivery is an industry, and a fee structure that remains in a state of flux, but we are inclined to believe that creative ways will be found, by restaurant companies and third party delivery agents to reduce these costs. At the same time, dining customers are increasingly deciding to use the app or make a call, jump in the car and drive a couple of miles, taking control of the process and reducing their cost.

Lastly, in terms of getting to 20% store level margins, menu prices can be raised. No restaurant wants to lead the way in this regard, but inflation is a fact of life, customers understand that, and Noodles should be able to provide as valid a price/value equation as most any competitor.

CURRENT OPERATING CASH FLOW TO BE CONSUMED BY NEW STORE GROWTH – COULD GROW SLOWER AND THROW OFF CASH, WHICH IS APPEALING TO PRIVATE EQUITY INVESTORS

Since the company planned capex ($53-$58M in ’23), a large portion of which is for new company units, it is relying on a $125M credit facility that matures on July 27th, 2027. In 2022, the company was able to remove a capital expenditure covenant and increase the size of the facility from $100M to $125M to support its 7-10% unit growth. The interest rate is a reasonable SOFR + 1.50-$2.50%, which translates into a rate between 6.63% and 7.2%. It is worth noting that the company has $153M in net operating tax loss carryforwards.

One reason Noodles may eventually attract activist/takeover interest is the company’s significant cash flow relative to the market cap of the company. When restaurant companies stop growing, they can throw off significant amounts of cash flow. If management chose to slow down growth (7.5% planned unit growth in ’23, the majority for company stores) until it achieved its 20% restaurant level margin goa, it could generate $30-$35M in free cash flow. The current Enterprise Value of about $210M is only about 6.5x this potential free cash flow.

CONCENTRATION OF STOCK BUT NOT BY MANAGEMENT

As shown in the March 2023 proxy filing, four entities own over 35% of the shares outstanding. Management holds less than 3% of the shares outstanding. Since the proxy filing, Mill Road acquired an additional 245K shares (bringing their ownership to 13.35%) and Hoak & Co. filed a 13D after buying 2M shares or 4.31% of the company. It should also be noted that Hoak & Co. filed a 13D earlier this year on National Gas Services, which is a company that Mill Road is also invested in.

The Senior Managing Director at Mill Road Capital was recently added to the Board. He had served on the Board after his company provided financial support to NDLS during its difficulties in 2017-2019. In 2017, Mill Road invested $31.5M buying 8.87M shares from the company at $3.55 per share. In the same year, L Catterton, the company that owned NDLS and brought it public invested over $18.5M through a convertible preferred (converted into 4.25M shares) and also received warrants for an additional 1.91M shares at $4.35. Since L Catterton is very familiar with NDLS, they are no doubt paying attention.

There is another 5.6M shares (12% of shares outstanding) controlled by Emerald Advisers LLC (NDLS is their second largest holding), Royce Investment Partners and Plaisance Capital. Finally, in 2020 a firm called Tenzing Global filed a 13D on NDLS after acquiring a 3.4% position. The firm was buying stock in the $6.50-$7.50 per share range, eventually liquidating its position.

The combination of a returning board member that has been invested in the company since 2017 and currently controls over 13% of the company, a recent 13D filing by a new 4.3% holder, a low valuation and low insider ownership has probably fueled recent speculation about the company potentially becoming a takeover target. Time will tell but the valuation should provide a floor under the stock, at the least, while investors wait for improved operating results.

SUMMARY: AS DESCRIBED IN “BOTTOM LINE” ABOVE

Note: Roger Lipton of Lipton Financial Services contributed to this post

Disclaimer

Investing501 uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The articles and reports published by Investing501 constitute the author’s personal views only and are for entertainment purposes only. They are not to be construed as financial advice in any shape or form. Investing501 does not predict the price at which the securities of any company may trade at any time. Every investor has different strategies, risk tolerances and time frames. You are advised to perform your own independent checks, research, or study, and you should contact a licensed professional before making any investment decisions. From time to time, the author may hold positions in the stocks mentioned in articles published by Investing501. To the extent the author does have such positions, there is no guarantee that he will maintain such positions. Neither the author nor any of its affiliates accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

It is called Mono

And the answer is time to sow. Very surprising collapse in SSS in Q2 (although inline with industry).

Happy to see the "Slow growth" strategy being announced cutting unit growth to 5% from 10%. Would have loved to see it go to zero for now. Not a fan of the stock buyback if it is going to use debt to do it. That will just make things worse. After the digital board upgrade is finished in Q4, that should take some pressure off of out spending CFO. This is the second time NDLS has tried to grow fast and had to hit the brakes. The CEO has been there this whole time (originally as CFO). Would not be shocked to see the two activists bring in a new CEO to shake up the culture. The CFO is high quality and very experienced, which might help stabilize the business. Disappointing for sure, but not out of the range of possibilities and lots of the dreaded "optionality" still in the company at this valuation. Around 5X EV/EBITDA with new guidance.