MARCH QTR CONFERENCE CALLS (OVER 35 IN TWO WEEKS!) – YOUR TIME IS VALUABLE SO WE BOIL IT DOWN FOR YOU – OUR SUMMARY, ALONG WITH SUPPORTING DETAILS

PROLOGUE: We have always believed that the best long-term investments in the restaurant/franchise/retail industries result from quality management teams exploiting robust unit level economics. It is always illuminating for us to listen to or read as many quarterly conference calls as possible each quarter to help us identify those teams and business models. The process also allows us to compare corporate performance in terms of dealing with industry, as well as macro, issues. Our decades long surveillance, including frequent personal visits to many of the publicly held companies’ operating units, provides a transparency offered by very few industries.

So what have we learned from the latest batch of conference calls?

OPERATING HIGHLIGHTS

Commodity Inflation is moderating.

We always consider commodity costs to be mean reverting and this year is proving to be no different.

After rising 10-15% last year, the consensus is for a 4-6% increase in commodity price. If fact, there is actually some deflation occurring in dairy and chicken. For example, bone-in wing prices have declined 50% YOY.

Similar to commodity costs, labor inflation is also moderating.

After increasing 10-15% last year, most restaurant companies are expecting a 4-6% increase in labor costs.

Exception is First Watch, which is seeing 8-10% wage inflation this year.

In spite of the scary headlines, the current macro environment is relatively stable.

In spite of the turmoil in the regional banking sector and the strong possibility of a recession this year, most companies are relatively upbeat and none of the companies that gave guidance earlier in the year have lowered their outlook.

Even though many companies beat guidance in Q1, they are not raising guidance out of macro uncertainty.

Companies with strong digital presence continue to outperform the industry.

We have been pointing out to readers that there is a large disparity in the success of companies in their digital strategies.

One of the underappreciated aspects of a strong digital presence is the ability of a restaurant company to communicate directly with their customers. This allows them to create customer specific offers and drive more traffic to their stores. This is one reason why companies are trying to get customers to use their own apps and not go through third party delivery services (which keep the customer data to themselves).

Companies that have the largest numbers of digital app users are faring much better than their peers.

Two examples are McDonald’s and Chipotle.

In McDonald’s top six markets, digital sales now represent almost 40% of system-wide sales, or nearly $7.5 billion, growth of more than 30% over the last year.

Chipotle reports that digital sales make up 39% of their sales.

Companies are growing units again.

In spite of construction costs being 20-30% higher than 2019, companies are maintaining or increasing their unit growth targets.

Every company that has reported as of the writing of this article has said that they are intending to growth their store base over the next three years.

Growth is not being slowed by the regional bank crisis as unit growth is being funded out of cash flow.

MACRO COMMENTARY

(The excerpts from (literal) conference call transcripts, in the following sections, have been (lightly) edited to clarify context and ease reading by our subscribers. We do this, so you don’t have to😊)

El Pollo Loco:

I think it’s pretty similar to what we have talked about really, I think in the last couple of quarters where we talked about that we do think we are seeing maybe some pullback from a lower call it, income consumer, in two ways. One is around just not spending as much…… I think you may also be seeing it a little bit in terms of vacant seats. And I think we tend to see it more – a little bit more dinner than we do, say, during the rest of the day. So, we are working on some things to bring more value to the menu. But I don’t think the trends have changed that much from what we have seen really since fourth quarter last year.

Shake Shack:

There’s still much work to do and there is risk around the macro environment and continued cost inflation this year, but with a plan the team has put in place, we’re guiding Shack-level of profit of 19% to 20% for the full year and we see the opportunity to return to over 20%.

We understand the many macroeconomic risks…. However, our business has demonstrated a level of stability that now allows us to go back to our pre-Covid guidance practices and reintroduce full year guidance for total revenue, same-Shack sales, our licensed business and Shack-level operating profit.

In fact, even with the inflationary and potential macroeconomic pressures, we are planning to grow fiscal 2023 adjusted EBITDA by at least 50 to 70% this year to $110 to $125 million as we target achieving record profits this year. We have line of sight to exceeding this range. However, this will be dependent on the degree of pressures we face throughout the year.

Analyst Question:

I think investors are concerned…in first quarter results beat expectations. I’m wondering if you can maybe share your thoughts on the trend through the quarter. I’m just trying to get your sense for how you think the consumer’s behaving through the first quarter and through April as that impacts your second quarter outlook?

Management Answer

Great. thank you. So……… we started strong. We had a lot of very good new Shack openings as well, kind of helping as the tailwind at our back. But then…. in February and the launch of white truffle, kind of coincided about the same time… we did see above average sales performance in our more mature Shacks.

We saw, pretty healthy behavior from high income consumers where, we over-index too. But kind of throughout income cohorts, we were pretty pleased with what we saw. We are taking a mindful approach though as we’re going throughout the year for all of the reasons that you just discussed and…. About how the back half of this year could play out.

But from what we’re seeing right here we are pleased with our performance. We’re very pleased with the trends that we have seen in April consistent with what we saw exiting the first quarter. But that, that that’s just one month. So we’ll have to see how the rest of the quarter plays out.

However, if there is more material macro-economic contraction than what we’re pricing in our guidance, we may miss that. So that’s kind of how I would think about the guide on that side. We over-indexed to higher income consumers, we were really encouraged by that 4.8% traffic (gain) we generated in the first quarter.

McDonald’s:

Though challenging macro dynamics are still evident across many parts of the world, each of our segments and our global comp sales grew nearly 13% for the quarter. This demonstrates that no matter the operating environment, our customers continue to rely on McDonald’s as an affordable destination for the delicious food they love delivered with the great service that they expect.

As we look to the remainder of the year, consistent with the expectations we communicated in January, we expect macro headwinds will continue with the potential for a recessionary environment across both the U.S. and Europe.

Analyst Question:

You talked about how you anticipate a recessionary macro environment to unfold in the U.S. and Europe. And how do you anticipate such a scenario to impact your operating results? Because back in the Great Recession, your same-store sales remained very strong and in some instances even outpaced analyst expectations.

Management Answer:

Going back to Q3 I think of last year is when we started getting asked questions about our outlook for the macro environment in 2023. And I would say our view remains unchanged, in which our base expectation is for a mild recession in the U.S.

In Europe, we expected it to be more challenging. I think things are looking better in Europe than they were certainly back in Q3, but still compared to the U.S., I think more challenging in Europe. So our base expectation from a macro standpoint for 2023 is unchanged.

I think how we’re positioned, it goes back to the word I used in my opening, which is consistency. And our job is to make sure that no matter what the environment, whether you’re in a boom cycle or whether you’re in a more challenging macro environment like I think we are in right now, our business has to continue to perform.

And one of the things that I feel really good about is, as you mentioned, in good times or in bad times, McDonald’s tends to do well. I would just add a little color, which is we do see some of the pressures that give us reason to believe that our view on the macro outlook is accurate, which is, one, we are seeing a slight decrease in units per transaction. So things like: did someone add fries to their order, how many items are they buying per order, we’re seeing that go down in most of our markets around the world slightly, but it’s still going down.

And then the other thing is we continue to monitor very closely the acceptance of our pricing. I’m really proud of how our system has executed pricing in light of the double-digit inflation that we have been experiencing. But we are seeing, in some places, resistance to pricing, more resistance than we saw at the outset.

So I think all of those things are reflective of, again, a more challenging macro environment. But again, McDonald’s, we perform well in good times and in bad. And so that’s what gives us the optimism as we go through the rest of this year.

Chipotle Mexican Grill:

We anticipate comps in the mid-to-high single-digit range for the full-year, assuming we do not see further deterioration in the macro environment.

We believe that these efforts will position us to successfully navigate through macro uncertainty and more importantly, strengthen our foundation for sustained long-term growth.

So right now, we kind of like the environment we’re in, where consumers have jobs. They have money. They’re visiting restaurants, and the inflation that we’re seeing is pretty modest. So that base case that we put together and how we plan the rest of the year feels pretty good to us. We wouldn’t mind inflation going down, but we’d love it if it didn’t.

Analyst Question:

You talked about the macro environment staying as it is now. So I just wanted to kind of make sure I understood what your kind of base case is for the macro environment in the back half of the year. And should we think of a kind of slight recession on the low end? How should we think about the macro-outlook in your guidance? And maybe how you think you’re positioned if we do see a deceleration in the consumer?

Management Answer:

So first of all, in our prepared comments, we did say our guidance assumes that there’s not a meaningful change in the macro environment, okay? Because obviously, all bets are off if that happens. But in terms of our outlook, our base case does not include a recession or certainly not a meaningful recession. Again, it looks like unemployment is holding up really well. It looks like consumer spending is strong right now.

I mean, Brian mentioned — we saw softness in the second-half of last year, especially the fourth quarter in lower income consumer. We saw those consumers come back almost at the same rate as our higher income consumers. And we see that as a positive in a positive macro sign. So we’re cautiously optimistic about what’s going to happen in the second half of the year.

Now if there is a recession, we feel like we’re really well prepared. We have — we own all of our restaurants. We don’t have any debt. So we don’t have the possibility of franchisees under pressure if they have debt payments and that there is a softening of demand. And we don’t feel like we have to run the business based on a quarter-by-quarter tally. So if we need to ride a couple of tough quarters here or there, we certainly think we have the financial wherewithal and we have the long-term view to do that. But again, we’re cautiously optimistic that the economy will hold up.

Domino’s Pizza:

The balance we have in our stores with carry out contributing around half the orders and 40% of sales has allowed us to mitigate the more recent macro headwind in the delivery category.

I think you’re asking about the global retail sales outlook of 4% to 8% a rating that is still expected to be at the low end for 2023. And I think when we go back to what we said last time and again, what we’re saying this time, not really changing the narrative of what we said, drove that adjustment in the first place, which was the challenges that we were seeing in the U.S. delivery business was the primary driver of the lowered estimation of the global retail sales outlook.

And we have talked about the macro. It’s not gone away, and that is impacting us to some extent.

But we don’t want to keep making excuses about the macro. We want to focus on what’s in our control, and that’s why we’re really putting our foot forward and actually driving all of those initiatives to get to the outcomes that we need. So super bullish on the long-term. I think we just have to work for some of these short-term issues.

Analyst Question:

I mean, I guess, again, you guys talked about the lower income demo kind of shying away from delivery a bit given the macro pressures. Can you just provide some color on how that different income cohorts kind of performed within delivery versus takeout.

Management Answer:

I did say that we’re going to have to continue to monitor real disposable income and the trends in that. Because what you’re seeing right now is inflation on a downward trend, but wage growth seems to be holding up in the U.S. economy.

But I think it cuts a little bit differently depending on income strata. So I think over time, you’re going to basically see potentially a change in the dynamic. But as of now, we still see this being a pressure point.

And I think what I’d add: a lot of times we’re asked on these calls, do you see any trade down from delivery to carryout. I talked earlier about how there’s a little overlap between the two. We’re seeing a lot of trade down from non-Domino’s carryout into Domino’s carryout. And I think it’s those consumers we’re talking about. So certainly, from a delivery standpoint, there are macro pressures, but I think that’s actually an advantage for us on the carryout side.

BJ’s Restaurants:

I think at the same time, from a macro standpoint, there was a certain amount of excitement for guests to get back out and celebrate after two years of challenges around COVID. So I think from what we can control and execute, I think we’ll do better. We continue to monitor what I would call the macro side of it.

Analyst Question:

Okay. I’m not sure if you mentioned any changes in guests’ habits or anything with mix or appetizers, drinks, things like that, that you noticed over the last couple of months. But maybe just to remind us if there were any changes you noted?

Management Answer:

Yes. I think in Tom’s comment, he mentioned that we’re seeing some really strong sales coming in late night and at lunch. And I think some of that has to do with obviously the BJ’s concept. We’ve got great lunch specials. We updated our lunch specials this year and in the first quarter, introduced some new items that are becoming best sellers for us. We have see general party size start to normalize a little bit, still a little bit better than where it was versus 2019 and our incidents are up versus the 2019 timeframe. But versus 2022 last year, we have seen a little bit of a slowdown in alcohol incidents. I think we mentioned that on the Q4 call. That’s one area that we continue to watch. But generally everything else seems very consistent in our business.

Restaurant Brands International:

One, from a macro perspective, we feel like we’re really well positioned in any macroeconomic environment. What we do, in quick service restaurants, we provide convenient and affordable food every day. And I think overall, from a big picture perspective, we’re in a good spot, regardless of the macro environment that we’re in. In terms of what the key drivers are of traffic and sales in our industry, I think the biggest one really is employment. That’s really what drives our guests having money in their pockets and being out and about. And so that is probably the kind of the highest correlation item that we see towards our sales and traffic. And the fortunate thing is that that employment in the U.S. continues to be really good. And I think that’s reflecting a bit in some of the industry momentum. So overall, we feel pretty good about where we are, and as I said, we’re very focused on growing traffic as we move through the course of this year in those U.S. businesses.

First Watch Restaurant Group:

And while the macro backdrop may be changing and potentially become more challenging, we continue to be highly confident in our long-term outlook based upon steps we’ve taken and decisions we’ve made leading up to this point. As a reminder, while others were aggressively taking price in 2021, we maintained our pricing structure through the entire year with a focus on increasing customer count, which resulted in us earning incremental market share.

To be clear, we’re not seeing anything from a consumer behavior inside our restaurants that you would typically see — with check management. Our beverage attachment is actually up and our shareables have remained steady. So as Mel said, the only — we’re really responding more to commentary about the macro environment in general. And that, coupled with the choppiness that we saw in April that we believe was mostly attributable to the shift in calendars is really what we were referring to.

Denny’s:

Analyst Question:

….and obviously, I think, Robert mentioned being at the higher end of your same store sales guidance. With just the choppiness that we’re seeing out there and the macro, what are the sort of the risk factors at play that might cause you to not be at the higher end that you guys are closely monitoring?

Management Answer:

With regard to the quarter itself, it pretty much played out the way we thought it would. I think, during our year end call, we provided guidance that we thought Q1 would be one of the stronger quarters of the year…….somewhat of an easier lap, so it played out. Towards the end of the quarter and I think you’ve heard this commentary (from) several that have reported right now, it started to get pretty choppy. Frankly, as we move through the rollover spring break and Easter, the mismatch year-over-year presented a pretty difficult read. I would suggest that’s the way April is for us, somewhat more difficult to read. With regard to the balance of the year and what would prevent us from achieving the higher end of that guidance range: The biggest item to me, I think, it would be staffing, unemployment, just people being employed, lower unemployment, higher employment. As long as that holds, which right now it appears to be regardless of what the rhetoric is about the macro environment, I think we’re in pretty good shape. But even let’s say it does back up, just a conjecture, not hypothetical. In that environment, We believe that we are the beneficiary of trade downs in the restaurant segment. So again, we don’t anticipate that happening. I think unemployment will remain low from what we’ve seen but in the eventuality of a kind of a cooling, we think we’re pretty well positioned for that also.

Yum! Brands:

Our relevant and iconic brands consistently demonstrate that they are uniquely positioned to thrive in any macro environment and create lasting shareholder value.

If you step back at a macro level, we think about this in developed versus emerging markets. And in our developed markets, we have had some labor challenges that have been well publicized, not only in the restaurant sector, but in all sectors over the last couple of years. Those labor challenges are abating. We’re seeing application rates increase, retention rates continue to increase, and our staffing levels are back to at or near 2019 levels.

Wingstop:

We are maintaining a strong cash balance that stands at over $200 million, and it allows us to be opportunistic as we navigate any uncertainty in the macro backdrop in the back half of this year.

Analyst Question:

I did want to ask about the guidance. I guess the guidance assumes your comps moderate pretty significantly and maybe even your seasonally adjusted volumes moderate pretty significantly from what you just reported for Q1.

So, I guess first question is are you already seeing that, are you seeing something, or is this just maybe a bit of conservatism as you think about the second half of the year?

Management Answer:

Yes, David I think it’s probably more of the latter. Obviously, there’s still a fair amount of uncertainty with the macro environment, the consumer recession. Everyone is trying to understand what’s going to happen later today with the Fed as an example. And we’re all trying to get our arms around exactly what that means to the overall consumer.

That said, and I mentioned it just a second ago we feel like, we’re in a pretty unique spot as a brand to be able to raise our guidance this year even considering that overall macro backdrop and deliver a really strong year.

Analyst Question:

Clearly there are concerns of macro easing and rate increases and just over the best month or two a lot of small bank concerns. So, I’m just wondering if any or all of those factors you think are having any impact on your unit growth outlook. I know you’ve reiterated the guidance for this year for 12% plus.

But just trying to get some color on whether you think that has any impact at all. I think you mentioned your pipeline is 1200 units. So, I’m just wondering maybe that could provide some color maybe what was that pipeline last year and the year before? Any kind of color in terms of the any headwinds on that unit growth outlook based on the current macro?

Management Answer:

Yes, the pipeline as we sit here, we mentioned is at a record level 1,200 strong. And just to provide some perspective that was close to 1,000 this time a year ago. And then you layer on top of that the openings we had over the past year of 200 roughly. It really speaks to the demand that we’re seeing from our brand partners to reinvest in Wingstop and their desire to continue to grow.

And as we sit here we have pretty good visibility into our pipeline. And in fact the number of sites that we need to deliver on that outlook that we reiterated of 240 net new units are sitting in our pipeline today. And so we feel pretty confident regardless of what happens in the overall macro to be able to continue to deliver industry-leading unit development.

And a lot of that has to do if you think about financing the rate environment or these regional banks there’s not a lot of lending or leverage conversations, we have with our brand partner community. A lot of their growth is fueled by cash flow from operations.

And then on top of that compared to other brands it’s a relatively modest initial investment to open a Wingstop. So, I think all those things help position us to be able to sit here today with confidence in delivering another industry-leading return from a unit development perspective.

Brinker International:

The strategy for advertising was simple, with more and more guests looking for great value, given the macro environment, we believe we could drive traffic through hard hitting food spots that showcased our leadership value.

Analyst Question:

Might macro weakness be, impacting the delivery channel?

Management Answer:

The off-premise for Chili’s was around 29% and off-premise for Magliano’s was 25%, so both hanging in there pretty steady and the breakout still about 50:50 between delivery and to go.

Dine Brands Global:

But with the current macro uncertainty, we’re taking the more prudent approach and are leaving our outlook and change across all metrics despite the strong Q1 performance, along with executing on our strategies to deliver results and investing in our business, we’re equally focused on managing our balance sheet and returning cash to our shareholders. We believe we are well positioned to leverage our cash flow generation ability to drive long-term growth.

Analyst Question:

Two questions first, just following up on the prepared remarks when you referred to the late first quarter slowdown. I just wanted to clarify, John, are you saying that that’s a broader industry comment in terms of macro factors and headlines that all consumers are seeing, that your brands have not seen any change in behavior in recent weeks or months? Just trying to clarify whether there’s any reference to your portfolio rather than just the industry? And if you were to see a slowdown, how would you respond?

Management Answer:

Sure.- so you know we don’t comment on – Q2 on this call. So my comment is about the industry in general and that we’re watching it, and we are – and we’ll react to it if and when we need to. And in terms of what we would do if we see a significant slowdown, obviously, we would work with our franchisees and our marketing teams and really focus and make sure we’ve got the right marketing and promotions in place at that time.

Yes, happy to do so, John. With the Applebee’s, it’s essentially a brand that’s built on abundant value for our guests, right? So it’s one of our core tenants. It’s part of our DNA. So when the economy struggles or there’s uncertainty, we doubled down on what our guests need to make sure that our relationship is front and center. If you look at Q1, we delivered value through targeted campaigns such as our all-you-can-eat promotion that we ran in January and February at $14.99 and we had tremendous results.

It’s an excellent example of combining terrific food with, I think, generous abundant portions at a reasonable price. It’s compelling, and it provides that value that guests are seeking in this environment. It’s one of the reasons why we continue to outpace many of our direct competitors from a value attribute perspective.

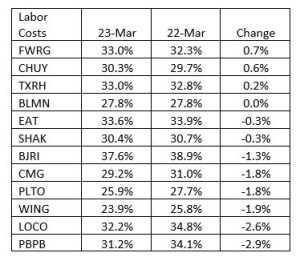

LABOR COST LEVERAGE IN MARCH QUARTER

A moderation in wage increase, combined with increases in same-store sales has resulted in operating leverage for most restaurant companies this past quarter. Restaurant companies are guiding towards increases in labor costs of 4-6% for the year, about half the increases they were seeing last year.

Texas Roadhouse:

And on the labor side, wage pressure has been persistent as it remains a competitive hiring environment. Labor dollars per store week increased 13.1%, primarily due to wage and other labor inflation of 8% and growth in hours of 4.8%. Similar to commodities, we expect that the level of labor inflation to moderate as we move through the year. At this time, our full year 2023 guidance of wage and other labor inflation between 5% and 6% remains unchanged, but current trends would put us closer to the high-end of that range. And we will see what happens in the back half of the year, we’re still learning what that kind of algorithm will be – do labor hours grow at 50% of traffic or does something else happen there.

Potbelly Corporation:

This improvement is attributed to top-line leverage, along with continued optimization of our hours-based labor guide and other labor-saving initiatives like PDK. We continue to see wage rates moderate and expect this to continue to normalize as we move through the year.

I’ll start with the quality and the quantity of staffing. We’re really enjoying much, much better days than we were certainly through the pandemic and even last year. So our applicant flow is stronger. Our turnover is still below the industry standard. We’ve been able to fully staff our shops.

For us, it looks like labor (costs?, increases? Availability?) really kind of peaked early last year. And while the rates are still high relative to history, the increases in our labor rates have really moderated. And we came in better than we thought we would for the quarter. That certainly helped us in terms of margins.

And as we look ahead for the full year, we still expect to be kind of in the mid-single digits on labor inflation.

Chuy’s

Primarily due to hourly labor inflation of approximately 7% at comparable restaurants as well as incremental improvement in our hourly staffing levels as compared to last year.

And then we’ll continue to increase our labor line over the last couple of quarters, if you’ve noticed that. And we’ll continue to look at a little bit of that as we move forward and invest in our people a little bit more.

Portillo’s:

This decrease was primarily driven by the increase in our revenue and operational efficiencies partially offset by incremental investments in our team members, including hourly rate increases. As of the end of the first quarter, our average hourly rate represents a 7% increase versus prior year and also represents a 28% increase versus 2020. We feel really good about how we are taking care of our teams.

And – we think that there is a little bit of upside in terms of sales, but….that’s not why we are doing it. But it does let us be more efficient with labor. So, that’s a big unlock for us. It’s got the potential of reducing somewhere between one and one FTEs during the day. And so that’s a big deal. Those people can do other things for us. They don’t need to be moving because it’s a lot of conveyance is how the kitchen was designed. So, Kitchen 23 is a big unlock, continuing to take prep to the suppliers and letting them do more for us is another big unlock for us.

The One Group Hospitality:

And then this first quarter is the last quarter where we’re lapping significant inflation on labor, because we start feeling it mostly on the second quarter last year on labor. So I think that we have a positive momentum on labor, because we’re finishing the lap on the wage, which was significant for us.

I think we’re seeing significant wage inflation on a year-over-year basis. And then anything related to wages, we’re also seeing inflation as well,

And then as Tyler mentioned earlier, a majority of the labor inflation pressure that we got was in the wage, so we’ve worked through that in the second, third, fourth quarter last year. And I think, as I mentioned earlier in one of my responses, the first quarter this year is kind of the last quarter, where we had significant pressure on that. So as I look at our ability to continue working on the P&L, I think the future is bright relative to the indicators that I just went through.

El Pollo Loco:

We expect wage inflation of 4% to 5% for 2023. And certainly, in those restaurants with the high kiosk usage, we are going to be testing, reallocating labor and possibly removing labor.

Bloomin’ Brands:

Labor inflation was up 6.4%. …… I think you might see much lower commodity inflation as well as labor inflation. I think just as we start to lap increases from a year ago, those things will continue to get a little bit better in Q2. We have long been a leader in retention in the industry. Our turnover rates are very good, the trends are good and there’s managing partner that runs the restaurants, whether it’s the manager, whether it’s our team members. So we’ll put our numbers up against anybody. It’s really good.

First Watch:

Labor remains an area of great attention as our teams adjust to sales volumes and wage increases, while embracing new tools and processes to optimize these costs.

We continue to expect hourly labor inflation to be in the range of 9% to 11% with an overall restaurant level labor inflation in the range of 8% to 10%.

I think when we are able to manage labor in the restaurants at 33% and below, that’s a pretty good target for us. And so I think we still have some work to do on the full year, but we don’t want to do anything that, in any way, degrades what we know to be a gracious experience that the customer enjoys in the restaurants.

Analyst Question:

The first one I had was just on labor. And you guys I think are one of the few that are guiding up kind of closer to 10% labor inflation. And are you — we’re hearing from others that turnover seems to be starting to break a little bit. Are you seeing that as well in your restaurants? And is that having any impact on entry-level wages. I’m just curious what the dynamic is out there.

Management Answer:

Our turnover has been in descent. I think we still view it as an opportunity for the last year or so. We’ve seen some of the turnover metrics for our hourly employees begin to improve over time. But we still have work to do there. Most of the wage inflation that we see is where we have regulatory increases in minimum wage that are due in some of the states we operate in, Florida being notable.

Starbucks:

Additionally, items per labor hour, a metric which reached a record high in December 2022, continued strong pace into and throughout Q2 despite seasonal trends. This demonstrates increased productivity in the midst of strong volumes, all by partner engagement and customer connection scores stabilized.

Yum! Brands:

We’re encouraged by trends in commodity inflation and labor availability as both bode well for the health of our franchise system, which is the foundation of our industry-leading development engine.

Yes, good question around the labor environment. If you step back at a macro level, we think about this in developed versus emerging markets. And in our developed markets, we have had some labor challenges that have been well publicized, not only in the restaurant sector, but in all sectors over the last couple of years.

Those labor challenges are abating. We’re seeing application rates increase, retention rates continue to increase, and our staffing levels are back to at or near 2019 levels. And we’ve seen labor inflation abate in those markets which is helping our franchisees from a margin standpoint.

Brinker International:

As I mentioned last quarter, we’re also working to optimize our labor model to further improve the guest and team member experience.

Top line growth offsets wage rate inflation of approximately 5%. One thing to note, the additional hours we invested into the Chili’s labor model to improve both our guests and team member experiences, impacted our overall labor expense by approximately 65 basis points for the quarter. The incremental hours are making a difference. Our new labor model combined with operational simplification efforts, are helping improve turnover in both the manager and hourly ranks and supporting guest metrics in the dining room now exceeding pre-pandemic levels.

So, when we look at the simplification to put additional dollars at this point in the labor model. I do think there that we’re doing it is getting up hours to reinvest back into the business, but I don’t anticipate us needing are some changes that we need to make to the front of the house to get it as — to get the improvements as strong as we’ve seen in the heart of house.

Dine Brands Global:

And third is labor. Based upon information from our franchisees, Q1 staffing levels continue to improve, while late night hours remain challenged. For the first time since 2019, however, franchisees on average, are seeing revenue rise at a rate that offset increases in labor costs.

Chipotle Mexican Grill:

The benefit from sales leverage was partially offset by wage inflation. For Q2, we expect our labor cost to remain in the mid-24% range as continued labor inflation will be offset by leverage from seasonally higher sales.

We’re still thinking there’s going to be continued labor inflation in the mid-single-digit.

We saw our transaction turn positive. We’re still running menu price increase compared to last year at about a 10% range. So when you have that kind of a flow-through where transactions are flowing and menu prices are flowing as well. That was a significant benefit in the quarter. We did have some labor inflation, so that was an offset to it. And then we did see some efficiencies. So we did see, really, for the first time, the labor scheduling tool we put into place last year was really starting to pay off.

And then the fourth thing I would just say is normally this time of the year as our sales begin to increase seasonally, that is the time where our labor tends to be more efficient.

Analyst Question:

And if I look back a decade, your labor as a percentage of sales was in the 23% area. I know a lot’s changed in the labor market since then, but you’re working on a lot of stuff, not just the focus and the training, but also the double-side grills and hopefully some breakthroughs with hyphen. I mean do you think you could get back there? Is that the sort of labor productivity that’s possible that you can imagine over the next few years?

Management Answer:

It’s theoretically possible. I think the one thing, David, that is different now is labor rates are much, much, much higher. And our menu pricing hasn’t really stayed caught up all the way with the labor over the last few years. And in fact, the biggest move that we made in the second quarter of 2021, we basically raised wages by 15% and only a raised price by 4%. So we basically offset the dollar value of that. We didn’t try to protect the margins and certainly didn’t try to protect the labor line at all. So I think there’s been a bit of a dislocation there.

Having said that, we do have a very efficient labor model.

McDonald’s:

I think labor inflation will still remain elevated just on the back of a really continued strong labor market.

Fortunately, we’re seeing the labor situations improving. In fact, in the U.S., they’ve made a lot of progress on staffing in the restaurants, which is partly what’s driving some of the operations improvement.

COMMODITY COSTS STARTING TO MODERATE, SHOULD HELP MARGINS

As we mentioned earlier, we believe that commodity prices are mean reverting and usually within a year price increases tend to moderate and in some cases actually decline. This year is proving no different. Commodity prices are expected to increase at about half the rate of last year. As a result, only one company, Texas Roadhouse, was unable to lower food cost as a percentage of revenue.

McDonald’s:

So if you look at commodity inflation on the food and paper front in 2022, we were in the mid-teens level in the U.S. This year, we think it will be mid- to high-single-digit.

And then I think if you move to Europe, from a food and paper commodity standpoint in 2022, we were in the mid-teen levels in Europe, and we expect to be in the mid-teens again in 2023.

Chipotle Mexican Grill:

Our base case is to see modest inflation in the back half of the year. We’re predicting somewhere in the low to mid-single-digits.

First Watch:

We now expect commodity inflation to be in the range of 2% to 4%, which is lower than our original expectation of 4% to 6%.

Denny’s:

Commodity inflation moderated sequentially from 13% in Q4 2022 to 10% in Q1 2023 and we anticipate meaningful improvement as we move through the balance of the year.

We are projecting commodity inflation for 2023 to be between 4% and 6%, with roughly 60% of our market basket currently locked.

Yum! Brands:

We’re encouraged by trends in commodity inflation and labor availability as both bode well for the health of our franchise system, which is the foundation of our industry-leading development engine.

Wingstop:

With our supply chain strategy and based on what we know today with leading indicators for our core commodities, we believe we have line of sight to a predictable food cost for 2023 in the low 30% range.

Combined with this deflation in our core commodity, our supply chain strategy to reduce the volatility in our food cost is paying dividends, and is generating quite a bit of excitement among our brand partners as unit economics have strengthened to near record levels.

Clearly the deflation of 50% plus on the bone-in wings is incredible.

Our expectation is, you’ll probably have a commodity inflation rate down in the lower-single digit range, kind of, let’s say that 3% to 5% range.

Dine Brands Global:

Next is commodities. We expect to see cost of goods prices continue to moderate as the year progresses. Q1 improvement was driven by easing and cost of coffee, eggs and poultry, although wheat and beef remain elevated. We expect cost easing to be more prominent in the second half of the year based upon our proprietary data and analysis.

Papa Johns’ International:

And when I tell everybody about this business, is — like if you believe that there is going to be a normalization of commodity costs over the next year, 18 months,

The commodity inflation that we’ve seen is unprecedented in this business. And record highs for a lot of the input costs. And I fundamentally don’t believe that could stay that way in perpetuity. I believe in efficient markets; I believe that their supply is going catch up to the demand regardless of the macroeconomic environment.

Are you still expecting commodities to be modestly deflationary?

So, we do and our forecast have continued moderation of commodity costs even if Q1 hasn’t fully realized those costs. When you look at what we’re lapping. Q2 of 2022 was by far the highest input cost environment that we operated in. So plus 18% year-over-year.

Texas Roadhouse:

As Jerry mentioned, commodity costs have been in line with our expectations so far this year. With approximately 75% of the overall basket locked for Q2 and approximately 40% locked in the back half of the year, our full year guidance for commodities remains unchanged at 5% to 6%.

Chuy’s:

Based on the current market conditions, we are currently expecting flat to slightly positive commodity inflation for the fiscal year, with deflation of low single digits for the second quarter.

Portillo’s:

We continue to expect that overall commodity inflation will ease and are currently estimating mid-single-digit commodity inflation for the full year.

DIGITAL SALES ARE BECOMING CRITICAL

Digital sales (defined generally as orders originating on an app or kiosk) are steadily increasing as a percentage of sales. Typically, 30-40% of sales are digital, with some companies reported digital sales as high as 70-85% of sales. The more sales that are generated through a company’s app, the more information the company learns about its customers. This helps drive more sales, increases customer loyalty and creates opportunities for targeted offers.

Potbelly:

We enjoyed another outstanding quarter of performance with our digital efforts. 39% of sales were attributed to digital channels.

Papa John’s:

Today, approximately 85% of our sales come through digital channels and we have nearly 30 million loyalty member accounts.

Shake Shack:

We had a 36% digital mix in the quarter. Now that includes app, web and delivery.

Wingstop:

Within our sales growth we saw further expansion in our digital channels achieving a record 65% digital sales mix for the quarter.

Yum! Brands:

These efforts resulted in broad-based acceleration in digital sales growth, leading to a record quarter for both digital system sales of nearly $7 billion and a digital sales mix that exceeded 45%.

Taco Bell U.S. is leaning into its digital initiatives to drive customer engagement, with year-over-year digital sales up approximately 60%, leading to an 8-point improvement in its digital mix.

Restaurant Brands:

We built a powerful digital platform at Tim Hortons Canada, including the number one food and beverage app and number two e-commerce app in Canada. During the quarter, we saw our 4.8 million monthly active users visit our app an average of eight times per month, helping us to sustain over 33% of sales through digital channels.

Burger King – During the quarter, France and Spain generated over 70% of sales through digital channels.

Bloomin’ Brands:

In Q1, approximately 79% of total US off-premises sales were through digital channels. (Approximately 16% of total sales).

Chipotle Mexican Grill:

Digital sales represented 39% of sales.

McDonald’s:

In our top six markets, digital sales now represent almost 40% of system-wide sales, or nearly $7.5 billion growth of more than 30% over the last year.

To the second part of your question, I think even though our digital sales are now roughly 40% of overall sales and about half of that being identified, it’s still early days for us in our journey there. I expect that we’re going to continue to see digital as a percent of the business grow.

You look at China, where it’s almost 80%, 90% of the business, it gives you an indication of potentially how high is up. As you get more and more of your sales on digital and as more and more of your customer base becomes identified, I think you can get much more specific around how you’re delivering personalized value.

UNIT GROWTH ACCELERATING, IN SPITE OF HIGHER COST

El Pollo Loco:

The opening of 3 to 5 new company-owned restaurants and 6 to 9 new franchised restaurants..

The ONE Group:

We expect to open 8 to12 new venues this year, representing our strongest development pipeline in history.

Chipotle Mexican Grill:

255 to 285 new restaurant openings (including 10 to 15 relocations to add a Chipotlane), which assumes utility, construction, permit and material supply delays do not worsen

Domino’s Pizza:

The Company had first quarter global net store growth of 128 stores, comprised of 22 net U.S. store openings and 106 net international store openings. The Company had 168 gross store openings and 40 closures during the first quarter of 2023.

Consisting of 25 store openings and three closures, bringing our U.S. system store count to 6,708 stores at the end of the quarter, which brought our four-quarter net store growth rate in the U.S. to 1.7%. As mentioned on our last call, we expected the U.S. store development pipeline will continue to be pressured by permitting and store construction and supply chain challenges before seeing a gradual recovery starting in the second half of the year, marked by stabilization first before an inflection in trend.

And frankly, the appetite for store openings is very strong. And that’s why we feel that yes. First, we’ll see a bit of a stabilization in the second half, and then we’re going to see that inflection. And as Russell said, it’s into 2024 because we have a pipeline that goes beyond 2023 right now. And that’s why we have so much confidence.

BJ’s Restaurants:

As we said many times, we believe there’s an opportunity to double the number of BJ’s locations in the U.S.

However, we will continue to execute our expansion strategy at a rate that provides high quality sites and execution over growth for growth’s sake. Our new restaurants continue to provide solid results as the BJ’s restaurant concept remains in strong demand by guests across many regions throughout the U.S. To-date, we have opened two new restaurants and expect to open three more restaurants this year for a total of five new restaurants in fiscal 2023.

Bloomin’s Brands:

But on the openings, clearly, we’re seeing strong new unit openings, and we have earned the right to own and grow.

Restaurant Brands International:

From a development perspective, we opened 54 net new restaurants in the first quarter, and overall restaurant count grew 4.24%. The first quarter is historically our quietest development quarter and our results also reflected BK U.S. closures that I’ll discuss in a few minutes.

Even after taking into account BK U.S. closure activity, we feel confident we can accelerate consolidated net restaurant growth in 2023 with progress more back halfway to way.

First Watch:

We opened 10 new system-wide restaurants during the quarter, 4 of which were company-owned and 6 of which were opened by our franchise partners. As a reminder, our company-owned restaurant development schedule is heavily weighted toward the end of the year, the fourth quarter in particular.

We’re reiterating our expectations of openings between 38 and 42 company-owned restaurants and 10 to 12 franchise-owned restaurants. And we plan to close 3 company-owned restaurants, resulting in a total of 45 to 51 net new system-wide restaurants.

Denny’s:

Starting with our development highlights. Denny’s Franchises opened five new restaurants during the quarter, including four international locations. We have also opened one Keke’s franchise location in April and continue to build a pipeline of both developers and site locations as we look to accelerate growth in the back half of 2023 and into 2024.

We anticipate opening 35 to 45 restaurants on a consolidated basis, inclusive of eight to 12 Keke’s openings with a consolidated net decline of 15 to 25 restaurants.

Starbucks:

Importantly, we accelerated our store development in the quarter, opening 153 net new stores, more than doubling the net new stores in the previous quarter. We now operate over 6,200 stores across 244 cities, keeping us on track to meet our goal of 9,000 stores by 2025. Our bold decision to continue opening new stores over the past three years, despite COVID disruptions in mobility restrictions, is paying off as they continue to deliver returns and profitability.

We also continue to expand our store footprint across the U.S., reaching over 9,300 stores where stores opened in the last few years, driving nearly 50% cash-on-cash returns despite the inflationary environment.

Yum! Brands:

Now moving on to Bold Restaurant Development, we opened 746 gross new units during the quarter. Full year 2023 is shaping up to be another incredible year of development, similar to 2021 and 2022. But it’s important to note the quarterly cadence of development will be weighted more heavily towards the second half of the year.

As we’ve said before, we have great line of sight into our development pipeline, with over 80% of 2023 planned units at KFC and Pizza Hut outside of China committed with well-capitalized road-ready franchise partners.

KFC Division, which opened 385 gross units this quarter. China, India and our Latin America markets led the charge this quarter, with each opening more than 20 units.

As for the Pizza Hut Division, the team opened 271 gross units this quarter, including the China, India and Turkey markets each opening more than 20 units. As we had anticipated, we exited our Pakistan Pizza Hut franchise partner and closed all 77 stores in the market

Turning to Taco Bell. The team opened 79 gross units in Q1.

Taco Bell International is off to a record-breaking start, with 46 units opened this quarter, and Taco Bell China becoming our fourth international market to cross the 100-unit threshold, along with Spain, the U.K. and India. These top four markets accounted for 60% of new builds this quarter, illustrating the power and scale to drive accelerated growth.

In summary, we remain confident in our ability to maintain our industry-leading development momentum.

Wingstop:

We opened 37 net new units during the quarter representing a unit growth rate of 11.4%.

In fact, as of the end of the first quarter, we now have a record global development pipeline that’s approaching 1,200 restaurant commitments. We also are seeing a record number of approved sites through the start of the year which supports our outlook for openings in 2023.

This strength in momentum and development helped us hit an exciting milestone for the brand opening our 2000th restaurant this past month. Truly exciting times for Wingstop with an accelerated pace of development and the incredible opportunity we have in front of us to scale to more than 7,000 global restaurants.

We’re making great progress in our international markets where we see an opportunity to open more than 3,000 restaurants.

Brinker International:

We opened three new Chili’s this past quarter all opening very strongly with sales above our brand average weekly sales. During this fourth quarter, our plan is to open an additional six to seven Chili’s, which will bring us to 14 new restaurant openings for the fiscal year.

Dine Brands Global:

We opened 21 gross new restaurants globally, demonstrating our franchisees’ belief in our brands and their appetite for development.

And under Tony’s leadership in Q1, Applebee’s launched a financial development initiative for franchisees that’s intended to drive openings in 2024 and beyond.

Like Applebee’s, IHOP also introduced a financial incentive to accelerate development in 2024 and beyond.

Shake Shack:

We opened six company operated and seven licensed Shacks in the quarter, and we have 25 Shacks currently under construction on our way to opening about 40 new company operated Shacks this year. Based on our increased pipeline and strong execution in our domestic and international license business already this year, we’re raising guidance today to 30 to 35 (licensed) Shacks expected to open throughout 2023.

Papa John’s International:

In the first quarter, we also opened 59 new restaurants.

In Q1, we announced the development agreement to enter into India through a partnership with PJP Investments Group. PJP currently operates more than 100 Papa John’s restaurants across United Arab Emirates, Saudi Arabia, and Jordan. They are a seasoned, successful restaurant operator, and plan to open 650 new restaurants in India over the next 10 years.

And then our development. We’re going open up across the system between 270 and 310 net new units, so, over 400 units built this year.

Texas Roadhouse:

At this time, we continue to expect to open 25 to 30 company-owned Texas Roadhouse and Bubba’s 33 restaurants this year as well as 3 company-owned Jaggers. Our franchise partners are on track to open approximately 10 international and domestic restaurants, including 2 Jaggers.

But we will eventually get Bubba’s growing at 10 plus and feel very good about the responsibility to the investment there.

Chuy’s:

During the first quarter, we successfully opened one new restaurant in Fayetteville, Arkansas, bringing our total to 99 restaurants. Looking ahead, we remain excited about the organic growth opportunities ahead for the brand through accelerated unit expansion. For 2023, we continue to anticipate opening six to seven new restaurants focused on our markets where our concept is proven with high AUVs and brand awareness.

Portillo’s:

During and subsequent to the quarter ended March 26, 2023, we opened the remaining four restaurants that were planned for 2022, completing our seven restaurants in the “Class of 2022”. Our six new restaurants opened in 2022 and 2023, positively impacted revenues by approximately $10.6 million in the quarter ended March 26, 2023. We plan to open nine more new restaurants in 2023 (“Class of 2023”).

The ONE Group:

We expect to open eight to twelve new venues this year, representing our strongest development pipeline in history. During the first quarter, we opened a new, redesigned Kona Grill in Columbus and a rooftop bar at our existing STK in Scottsdale. We view our addressable market as at least 400 restaurants including 200 STK restaurants globally and 200 Kona Grills domestically with best-in-class ROIs of between 40% and 50% for new Company-owned STKs and Kona Grills, respectively.”

NOTE: Roger Lipton of Lipton Financial Services contributed to this analysis.

Disclaimer

Investing501 uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The articles and reports published by Investing501 constitute the author’s personal views only and are for entertainment purposes only. They are not to be construed as financial advice in any shape or form. Investing501 does not predict the price at which the securities of any company may trade at any time. Every investor has different strategies, risk tolerances and time frames. You are advised to perform your own independent checks, research, or study, and you should contact a licensed professional before making any investment decisions. From time to time, the author may hold positions in the stocks mentioned in articles published by Investing501. To the extent the author does have such positions, there is no guarantee that he will maintain such positions. Neither the author nor any of its affiliates accept any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.