IDW Media Holdings (IDW)- Come for the Comics, Stay for the Show!!

$7M EV Creates Significant Optionality for New Business Model Success

Description

IDW Media Holdings, Inc., a Delaware corporation, is a holding company consisting of the following principal businesses:

IDW Publishing, or IDWP, a publishing company that creates comic books, graphic novels, digital content through its imprints IDW, Top Shelf Productions, Artist’s Editions and The Library of American Comics; and

IDW Entertainment, or IDWE, is a production company and studio that develops, produces and distributes content based on IDWP’s original IP for a variety of formats including film and television.

Dual-Share Structure

12.4M Class B Shares Outstanding. 1/10th votes per share

.5M Class C Shares Outstanding 3 votes per share (Converts 1 to 1 to Class B shares)

12.9M shares total outstanding

Ownership

Howard Jonas 2.56M Shares Class B (20.3%) 8.2% voting power.

Jonas Trusts 545K Shares Class C (100%) 1.18M Shares Class B (9.6%) 61% voting power.

Nantahala Capital 1.23M Shares Class C (9.9%) 4.3% voting power.

Raging Capital 829K Shares Class C (6.7%) 2.9% voting power.

Stock Price: $1.79 per share

Market Cap: $24M

Enterprise Value: $7M

Brief Company History

Source: EF Hutton/Benchmark

· On August 6, 2021, IDWMH closed a registered public offering of Class B common stock and EF Hutton, as representative of the Underwriters exercised the over allotment option included as part of the offering in full. The Company sold an aggregate of 2,875,000 shares of the Company’s Class B common stock for gross consideration of $10,350,000 less Underwriters commissions of $724,500 and Underwriters expenses of $75,000.

· Company up listed to the NYSE.

Analyzing the Business Model Change

In order to understand IDW as it stands today and why the new model is substantially less risky than before, investors need to understand how the company has changed since 2020. Prior to 2020 the company was responsible for funding the production of its own IP, such as V Wars, October Faction and the first season of Locke & Key. This means the company paid the production costs and carried them on their balance sheet until the show was sold to a 3rd party steamer such as Netflix or Apple+. This resulted in a significantly leveraged balance sheet as seen on the company’s Oct. 2019 balance sheet. The company was carrying $43.5M in receivables, $9.4M in production costs and a total of $49M in long and short-term debt.

Since the change to a fee-based model (80-90% Gross Margins), the company’s balance sheet and liquidity has substantially improved. The company collected over $28M in receivables, sold its CTM division and received over $25M in proceeds from stock sales. IDW is debt free and as of October, 2021 the company had almost $18M in the bank.

The IDWE division, which is responsible for the production of those shows lost over $36M over those last three years. This is the reason the company has switched to an “asset-light fee-based” model. IDW is paid a licensing fee to oversee the production of the project. The distributor/streamer is financially responsible for the actual hiring of talent and costs of production. Just as important, IDW is not responsible for any cost overruns on the project. The change in the model means the company no longer needs to leverage its balance sheet and hope for a successful return on the investment. While the new model significantly reduces the upside from a blockbuster hit, it also reduces the chances that an unsuccessful show will bankrupt the company. We view this as a significant positive change in the long-term prospects of the company.

Complete Overhaul of Top Management Complete

In order to execute the new business strategy of increasing the acquisition of full rights IP and accelerating the time from development to revenue generation, the company brought in a substantial number of industry veterans. In addition to promoting Ezra Rosensaft to CEO in 2020 (joined company in 2017/CFO in 2018), over the past two years the company hired these six individuals to high level positions. We believe that management is stronger than it has even been at the company and the level of industry experience is very impressive for a company of IDW’s size.

1. CEO Ezra Rosensaft - Joined IDW in 2017. Became CFO in 2018 and CEO in 2020. Spent 13 years at HBO financial planning & analysis and strategy.

2. Nachie Marsham hired in September 2020 and was appointed as publisher. Spent 12 years at Disney as editor and 7 years at DC Comics as editor.

3. Jeff Brustrom as IDW Entertainment VP for Kids, Family and Animation – Spent 16 years at Disney.

4. Daniel Kendrick, Director of Animation.

5. Jonny Gutman Vice President of Series - Funny or Die.

6. Mark Doyle Editorial Director of Originals - Spent 14 years at DC Comics.

We have had several conversations with Ezra and believe that he is the right man for the job. We believe his tenure at HBO gives him valuable insight and experience into the entire production process and negotiations of IP rights. In addition, his CFA/CFO background gives him a very strong financial background that was lacking with previous management. We are confident he will not do a deal just to get it done unless it makes financial sense for the company. We think investors are underestimating how the recent changes made by Ezra have fundamentally changed the way the company operates.

Analyzing the Two Divisions

IDWP – Creates the Content

Description from 10K:

IDW Publishing, or IDWP, a publishing company that creates comic books, graphic novels, digital content through its imprints IDW, Top Shelf Productions, Artist’s Editions and The Library of American Comics. IDWP is an award-winning publisher of comic books, original graphic novels, and art books. Founded in 1999, IDWP has a long tradition of supporting original, powerful creator-driven titles. In 2002, IDWP published 30 Days of Night by Steve Niles and Ben Templesmith followed by other horror titles that kickstarted a resurgence in horror-comic publishing across the industry. Since then, IDWP has significantly diversified its publications. Joe Hill and Gabriel Rodríguez’s Locke & Key, Jonathan Maberry’s V Wars, Stan Sakai’s Usagi Yojimbo, Beau Smith’s Wynonna Earp, Alan Robert’s The Beauty of Horror adult coloring books, and Darwyn Cooke’s graphic novel adaptations of Richard Stark’s Parker novels are just a few of the hundreds of outstanding, award-winning titles published since its inception. In FY20, the company sold over 5.2M units.

Over the last two years, IDWP has grown revenue by 25%, while keeping SG&A flat. Operating losses have been substantially reduced and the division is running at almost breakeven. The company hopes to grow its IP titles by 30-40 new titles a year. This should help the top line to continue to grow. However, he division still has several obstacles to overcome before it will be able to sustain profitability.

From the 10K:

In October 2021, Hasbro informed us that effective March 2023, our licenses for the Transformers and GI Joe titles will be terminated. While the cancellation of the licenses for Transformers and GI Joe are anticipated to decrease revenues by approximately $1.2 million in fiscal year 2023, IDWP plans to mitigate the loss of revenue by enhancing its current key licensor brands.

Since 2020 the cost of shipping internationally has increased more than 50% above the long-term trend, established since the last recession in 2004, and is expected to continue to rise through 2022. Prices are expected to stabilize in 2023, but at a higher rate than previously seen in the industry. The price of a shipping container rose from $1400 in March 2020 to over $11,000 in September 2021. Additionally, once on US soil the goods are subject to increased rail or trucking costs, roughly 23% over 2020.

Additionally, revenues from originals editorial (sic) will begin to materialize in July 2022 with five to six new IDW original titles spanning fiscal 2022 and a planned output of doubling quantities each progressing fiscal year.

Beginning June 1, 2022, Penguin Random House (PRHPS) will replace Diamond as IDWP’s distributor to the direct market. The agreement includes an agreement that PRHPS will provide the warehousing of comic book inventory. This could lead to some cost savings for the company. For example, IDWP leases 36,000 sq. ft of office/warehouse space in San Diego, CA. Both these leases expire May 2022 and fiscal 2021 rent was $547,197. While it is unclear how much space the company may retain, we do believe that the company would prefer to eliminate the warehouse space, which would lead to some reduction in rent.

In essence, IDWP is the engine that creates the content for IDWE to monetize at a 90%+ gross margins. The long-term strategy to reach sustained profitability relies on this funnel eventually creating a layered revenue model with 4-6 new projects being greenlit each year and hopefully several previously distributed titles being renewed for additional seasons (i.e. Locke & Key). It should be noted that since the company is no longer funding the production of a show, once a show is licensed by IDW, the company no longer owns the exhibition rights on that season (think of each season as a “one-time asset sale”). The company does however retain the publishing rights and the right to license future seasons and merchandising rights and publishing rights.

It is well documented that demand for content is soaring, which benefits IDW. However, the competition for creators is also soaring and IDW is a relatively small player in the industry. However, it is the 4th largest producer of comic books and has a great reputation in the industry. The fact that company continues to see over 1,000 submissions a year shows the company does possess a strong reputation within the industry.

In addition to providing the funnel to acquire original full rights IP, IDWP publishes many titles under licensing agreements with well-known companies such as Hasbro (note: IDW is scheduled to lose $1.2m in revenue in 2023 due to loss of Transformers and G.I Joe), Disney, Marvel, DC Comics, SEGA, Viacom and Lucasfilm. The licensing business provides stability and predictability to the division and gives the company high profile titles to use to attract more IP.

IDWE - High Margin Monetization of Owned IP

Description from 10K:

IDW Entertainment, or IDWE, is a production company and studio that develops, produces and distributes content based on IDWP’s original IP for a variety of formats including film and television.

IDWE has developed and/or produced the following television shows.

· Wynonna Earp

· V Wars

· October Faction

· Locke & Key

Under the previous model the IDWE division produced and funded the cost of the show. This resulted in IDWE losing $36M over the previous three years. This is the reason the company has switched to a “cost plus” fee model. The company no longer needs to leverage its balance sheet and hope for a successful return on the investment. While the new model significantly reduces the upside from a blockbuster hit (i.e. once each season or show is sold, the company no longer retains the rights to that particular season or show), it also reduces the chances that an unsuccessful show will bankrupt the company. We view this as a significant positive change in the long-term prospects of the company.

From our conversations with management, it is our understanding that the 100-title catalogue was relatively bare of full IP rights owned “A” quality content. This is one of the reasons the company has changed its business model and is trying to accelerate the number of titles it publishes each year. The company is also trying to reduce the time it takes from acquisition of new IP to the monetization of the IP.

Traditionally it has taken 18-24 months to develop a show from its initial pitch to the delivery of the content. If IDW waits until the comic book series is published and a fan base is created, it could take much longer. For example, the first issue of Welcome to Lovecraft (first Locke & Key comic) was released on February 20, 2008. IDW announced the series was picked up by Netflix in July of 2018, but the show didn’t premier on Netflix until February of 2020. Under the new model, IDW hopes to start pitching the new IP at the same time that it is developing the comic series. It is our understanding, all of the titles on the slide below have been pitched

Another significant change in the business model is the broadening of the IP to include more young adult and kid-oriented titles. This increases the number of potential buyers of IDW’s content (Nickelodeon. Nick Jr., Nicktoons, PBS Kids, Apple+) and also shortens the time from pitch to production as animated series typically take less time and cost less. Surfside Girls, which will run on Apple+ would be considered part of this new genre. Of course, since the company is getting a fee based on the production costs of the series, a mix shift to more animation would result in lower revenue per series (currently $2M-$4M per season).

While it will take years to fill the catalogue with valuable titles that could ultimately result in the sale of the company (Entertainment One, WOW, Dark Horse, MGM have all been or are being acquired), we are encouraged because the company is starting to show some success with the new model. Below are several deals that have been officially announced or disclosed in the company’s recent 10K filing.

Positive Developments:

Announced:

· Renewal of Locke & Key for Seasons 2 and 3 (Season 2 revenue to be realized next quarter)

· New live action series based on the graphic novel Surfside Girls, is in production for Apple TV+. (Expected to air by calendar 2022 year-end).

Disclosed in 10K:

IDWE recently closed a deal to develop a new animated series based on one of our popular Top Shelf graphic novels with a major kid’s cable network.

Revenues from originals editorial (sic) will begin to materialize in July 2022 with five to six new IDW original titles spanning fiscal 2022 and a planned output of doubling quantities each progressing fiscal year. (We believe these titles can generate $50K to $100K per episode.)

The rights to IDWE’s streaming genre series V Wars reverts back to IDW in 2022; as a result, we will be exploring opportunities to monetize the past season and potential opportunities to continue the story with a new partner. (The company has several options now that this title (that was produced at a cost of over $20M before tax credits) is back under full control. The company can resell the season to another distributor. Or more importantly, the company can use the first season to negotiate a second season and generate more revenue.

Risks to Consider

If it were obvious that IDW was going to be successful, the stock would not be trading for an enterprise value of $7M. Investors need to weigh the positive changes at the company with the following risk factors.

· Insider control - The company has a dual-class share structure. This puts most shareholders at a disadvantage and they must rely on Howard Jonas and trusts that he controls to act in the best interests of all shareholders. Mr. Jonas and the trusts control over 61% of the voting rights and over 20% of the total shares outstanding.

o Some investors have very favorable views on Howard Jonas and his IDT empire, such as Alta Fox Presentation here and Greystone Capital Management here. But we have spoken to some investors that have an unfavorable view of Mr. Jonas due to what they perceived was self-dealing at the expense of shareholders (see note on CTM transaction).

· Lack of liquidity – The average dollar volume for IDW is less than $200K a day. Over 50% of the Class C shares outstanding are controlled by three investors.

· Lack of comparable financials - The sale of the CTM business to Howard Jonas in 2021 resulted in the division being reported as a discontinued operation. As we have mentioned before, the company’s IDWE division has switched to a fee-based model so revenue and costs of goods expenses are no longer comparable for analysis purposes. Sold CMT business in 2021. The company could receive up to $3.25M from the sale based upon a recovery of quarterly revenues of CTM to 90% of its fiscal 2019 levels during the 18-month period following the CTM Sale Date.

· The business is nearly impossible to model – Investors tend to favor companies that have predictable, recurring revenue that can be counted on for years. While IDWP is relatively straight forward and somewhat predictable revenue and expenses, the IDWE division is virtually impossible to model due to its reliance on the licensing of its IP. This results in lumpy revenue and the revenue is only realized after the show has been delivered.

· Relatively unproven model - The company only started the asset light model in 2020. Many other public companies such as Thunderbird and Wildbrain and Lionsgate ate continue to fund the production of some of their IP. It is too early to determine if IDW’s model will be able to sustain revenue growth.

· Cash burn - Excluding the $38M the company received from the runoff of receivables from the production of past shows the past two years, IDW’s cash from operations was actually negative by $13M. We believe that the company’s $17M cash balance is more than sufficient to support the new business model for several years ($2-$4M per year), there are no guarantees.

Summary

The demand for content continues to increase as media companies continue their aggressive pursuit of new subscribers and increasing their retention rates. Numerous recent acquisitions of content providers highlight this trend as well. IDW is one of the few remaining content companies trading in the public markets. The appointment of Ezra Rosensaft as CEO and a complete overhaul of top management, combined with the change to an “asset-light/fee-based” model gives IDW a chance to benefit from these trends. Ezra’s CFA/CFO background brings a financial discipline to the company that was not there before. Frankly, an investment in this company is a bet on Ezra and his team to create new IP to build a significant catalogue and monetize the IP. If IDW can achieve their goal of 4-6 TV shows in production each year and eventually a movie or two and increase the catalogue by 40+ titles a year, we believe the company would become an attractive acquisition candidate. We have not created a model due to the highly variable and unpredictable nature of the business. The IDWP division operates at almost break-even on a cash flow basis. The IDWE division’s SG&A overhead could be between $6M-$8M a year. Revenue in this division is very lumpy and the cash from announced deals still takes 12-18 months to arrive. As disclosed on the last conference call, the company should generate some cash in calendar 2022 to offset a significant amount of IDWE SG&A overhead. As the company sells more shows, revenue at IDWP could also grow as it sells more comic books related to the IP and perhaps starts to sell merchandise as well.

Q421 Conference Call:

CFO Feinstein:

We expect to recognize high-margin revenue from Locke & Key Season 2 in the first quarter and from Locke & Key Season 3 and Surfside Girls Season 1 in the second half of 2022 calendar year, provided that current production timeframes hold. IDW Publishing revenue will also get a nice boost in the first quarter from sales of Batman Adventures ($2.2M).

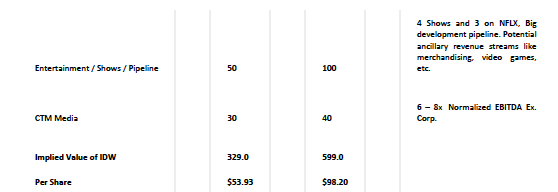

What could IDW catalogue be worth?

CEO Rosensaft attempted to answer that question on the last call. Because the number of what would be considered “A” titles is still a relatively small portion of the overall catalogue, we do not feel that IDW’s current catalogue should be valued at $100M. However, we do believe it is worth several times the current enterprise value of the company.

CEO Rosensaft

But we believe the acquisition (Dark Horse) and other consolidation in the space makes us increasingly excited about the value of our IP. I don’t want to give conjecture as to what companies should be valued at. I’ll leave that to everyone at their discretion.

But just to give you a little more context, we don’t get into the particular size of our library. But what I can say is that 100-plus original IP, that is climbing very fast, as we talked about 40-plus annually, which drives the publishing pipeline through to the development slate, IDWP, IDWE.

And in the industry, many use the metric of $1 million per original title. And it’s very crude, because obviously it depends on the quality. You could have – Walking Dead, it’s obviously worth one more than 1 million per title, but that’s the rough ballpark. So if you use that, you can begin to calculate our enterprise value or what it truly should be at. I won’t speculate on why the price is what it is, given the history.

Appendix:

We have spoken to Mr. Wyden. He has sold his position and is no longer involved in the company and has no plans to reinvest in the company at this time. The company is also significantly different from when he did the SOTP valuation and should not be considered a current estimate of the value of the company.

NEW YORK, March 5, 2019 /PRNewswire/ -- Adam Wyden of ADW Capital Partners, L.P. ("ADW Capital")("the Fund"), a New York City based hedge fund, transmitted today a letter to the board of directors and management of IDW Media Holdings, Inc. (the "Company") (OTCBB: IDWM)(OTCPK:IDWM) seeking a sale of the Company. ADW Capital along with its affiliates hold over 9% of the Company and believe that a sale to a strategic partner will help ensure that the Company maximize the value of its intellectual property.

Found below is the full text of Mr. Wyden’s letter to the Company:

March 5, 2019

IDW Media Holdings, Inc.

c/o Howard Jonas, Chairman and CEO

11 Largo Drive South

Stamford, CT 06907

Dear Board and Management of IDW Media Holdings, Inc. (OTCBB:IDWM)(OTCPK:IDWM),

I would like to begin by commending the Board on the Company’s recent changes to its executive management. Specifically, IDW Publishing’s hiring of Chris Ryall as President and Editor-In-Chief in our opinion was an excellent move and we believe Chris’ history with the Company and depth of relationships in entertainment and with creators will serve the Company extremely well.

Perhaps even equally important, we are incredibly excited about the Board’s decision to name Howard Jonas as CEO of the Company. As you know, ADW Capital and its affiliates have been long term shareholders of the Company since its original spin-off and were also extremely successful as shareholders in IDT Corporation. Howard Jonas’ experience in value creation through strategic sales of unique assets – Net2Phone to ATT, Fabrix to Ericsson, IDT Entertainment to Liberty/STARZ, and most recently its sale of Straight Path to Verizon — is borderline unprecedented and we believe it is an extremely valuable asset to this Company, which we believe is equally strategic and incredibly valuable.

Bill Gates and Sumner Redstone are famous for a number of things but few know that they are credited with the statement, “Content is King”. We believe those words have been never truer than today. Disney’s decision to pull its content from Netflix was akin to Princip’s shot of Archduke Franz Ferdinand that thrust the globe into its first world war. We believe this “Content War” is in the early innings and see the likes of Disney/Hulu, Apple, Google, Amazon, Netflix, TimeWarner/DC, and others trying to vie for its supremacy in the over-the-top subscription space race. As the “cord gets cut”, the distribution (OTTs) needs to justify why the consumer should subscribe to one service vs. the other – they can’t subscribe to all of them. In our mind, the only way these distribution companies can differentiate themselves is access to exclusive content.

IDW is the only publicly traded pureplay IP/content company in the market place today that we are aware of. The Company is in an enviable position as the fourth largest comic book publisher by dollar share. We are consistently amazed by the quality of the Company’s leadership and its ability to source, incubate, and add to its growing library of content/intellectual property. We believe the creative talent, ingenuity of management, and library of content would be invaluable to many large-scale players who are starved for new funnels of content on their growing distribution platforms in this emerging “content war”. It is our understanding that IDW Publishing owns/co-owns over 200 IP assets / franchises, over 1,000 characters, and is creating over 20 new pieces of content / “storylines” per year. From our research, there are no other independent content “landbanks” that are growing their IP portfolio and have also successfully taken 5 shows and a movie to market. Wynonna Earp recently received a People’s Choice Award and was recently renewed for a 4th and 5th season by SyFY. More recently, Netflix executed on a three show straight-to-series deal for Locke & Key, October Faction, and V-Wars which are slated to air over the next twelve months. It is our understanding that the Company’s development pipeline is robust and the market’s demand for IDW’s content has never been greater.

So what are the challenges?

Independent content companies are like biotech firms or “landbanks”. Often times, they have the skill, expertise, and understanding of what the market wants/demands but are unable to successfully take these assets to an “income producing” state. The reasons maybe personnel/operational resources, access to the right cost of capital, and/or experience. We believe IDW has struggled to financially monetize its content for all the above reasons. Large studios / distributors are at an implicit advantage as they have monthly subscription fees and fully depreciated content portfolios that are earning them royalties / cash-flow to facilitate the development of new TV and movies and manage working capital swings. These companies also have large in-house production teams and a balance sheet that allows them to retain 100 percent of the economics of a production and eliminate frictional costs like special purpose production financing and other fringe costs.

But what it does not mean is that our content is any less valuable. It simply means our Company does not have the resources / the right cost of capital to BEST monetize its large and growing IP/content portfolio. Summarized below is our “Sum-Of-The Parts” analysis / valuation of the Company’s assets today.

As evidenced above, we believe the intrinsic value of the Company’s assets is far higher than the Company’s trading price would indicate. We believe the market is discounting the Company’s ability to financially monetize its IP portfolio given its lack of scale, operational resources, balance sheet, and/or willingness to monetize the Company through a sale.

In a 12/21/2018 press release, IDW mentioned “anticipating the need to raise future funding through a capital raise to existing stockholders”. Our firm would be supportive of such a “rights offering” if the Company made a public commitment to “dollar defined” expense management / cost reduction, ceased its “deficit financed” TV business (after fulfilling its existing obligations), and adopted a license/option model where the Company does not control production but retains ancillaries like video games, merchandise, etc. which generate large margins and require little capital It is our understanding that companies like Valiant Entertainment, Skybound, etc. have sought to monetize their content in these far less capital-intensive ways.

It should also not be lost on management / the Board that control premiums in the marketplace for portfolios of content are at record highs. There have also been two recent comic book content transactions. It is our opinion that those library assets were far smaller than IDW’s and were not really creating/sourcing new content. The two transactions we note are Netflix recently acquiring Millarworld and DMG’s acquisition of Valiant Comics – both we believe are nine figure transactions. We think the Company could structure a stock-for-stock transaction with a larger public company that would allow current shareholders to receive an even higher premium for their stock than if the consideration was paid solely in cash, while allowing shareholders the option to participate in the value and synergy IDW should add to the new platform — just like what happened when Verizon acquired Straight Path.

I am asking management to do the right thing for all stakeholders today and publicly announce a strategic alternatives process and its engagement of a major investment bank. By seeking a strategic partner at this stage in the game, it should ensure that the Company can grow significantly without many of the competitive / cost of capital risks of staying a small and independent public company.

ADW Capital Partners, L.P. and its affiliates hold just over 9 percent of the Company’s shares and urge the board to take our recommendations seriously. I look forward to hearing your response.

Sincerely yours,

Adam D. Wyden

Managing Member of ADW Capital Partners, L.P.

CTM Transactions

Related party loans

On August 21, 2018, the Company entered into a loan agreement with the Company’s Chairman of the Board of Directors for $5,000,000. Interest accrued at prime rate plus 1% and the loan was due to mature on August 20, 2022. Payment of principal and interest were payable from 70% of the Free Cash Flow, as defined in the loan agreement, of the Company’s CTM Media Group Inc. subsidiary. All outstanding shares of CTM Media Group Inc. stock were pledged as security under the agreement. On December 1, 2019, the Company amended the agreement providing that up to 60% of the interest due may, at the option of the Company, be paid in shares of Class B common stock (and the remaining amount in cash) with such shares valued based on the average closing prices for the Class B common stock on the ten trading days immediately prior to the applicable interest due date. The cumulative shares issued in connection with the loan interest was 63,255. The interest was to be paid quarterly on the loan. In conjunction with the loan, the Company issued the lender a warrant to purchase up to 89,243 shares of the Company’s Class B Common Stock with an exercise price of $42.02. The warrant expires August 21, 2023. On July 13, 2020, $1,250,000 was converted into 314,070 shares of Class B Common Stock (Note 3). On February 15, 2021 the Company closed the previously announced CTM Sale and since the loan balance equaled the purchase price ,the Company wrote down the loan of $3,750,000 to an outstanding balance of nil.

On July 16, 2020, the Company settled its intercompany payable to CTM totaling $6,982,305 and subsequently received a distribution of $6,800,000 from CTM. This transaction was booked into additional paid in capital with CTM and IDWMH to have an immaterial impact and did not trigger any tax impacts.

On February 15, 2021, pursuant to a SPA dated as of July 14, 2020 IDWMH sold all of the stock of CTM to an assignee of the Chairman in exchange for (i) the cancelation of $3.75 million of indebtedness owed by IDWMH to the Chairman’s designee, (ii) a contingent payment of up to $3.25 million based upon a recovery of quarterly revenues of CTM to 90% of its fiscal 2019 levels during the 18-month period following the CTM Sale Date, and (iii) a contingent payment if CTM is sold within 36 months the CTM Sale Date for more than $4.5 million. Prior to executing the SPA, the Company obtained a third-party’s valuation of CTM and a fairness opinion that stated the consideration being received by the Company in the CTM Sale was fair. In addition to the Company’s Board of Directors approving the CTM Sale, the Audit Committee of the Board of Directors, which is comprised entirely of independent directors, approved the CTM Sale in compliance with the Company’s Statement of Policy with respect to Related Person Transactions. The CTM Sale was also approved by (1) stockholders representing a majority of the combined voting power of the Company’s outstanding capital stock and (2) stockholders representing a majority of the combined voting power of the Company’s outstanding capital stock not held by the Chairman or immediate family members of the Chairman, including, without limitation, trusts or other vehicles for the benefit of any of such immediate family members or entities under the control of such persons. On December 15, 2020, the right, title and interest to the SPA were assigned to The Brochure Distribution Trust, a South Dakota trust. The Company does not expect to have significant continuing involvement with CTM after the sale closes.

CTM (Discontinued operations)

As of July 31, 2020, CTM was reported as a discontinued operation and CTM’s operations have since been included in the consolidated financial statements as discontinued operations. On February 15, 2021, the Company closed the CTM Sale. The loan of $3,750,000 was forgiven in part of the sale and the Company recorded a gain of $2,123,219 based on CTM’s net asset value as of the CTM Sale Date. CTM’s assets are no longer reflected on the consolidated financial statements for the periods following the CTM Sale Date and CTM’s operations are only consolidated in the Company’s consolidated statements of operations results until the CTM Sale Date. There was no contingent gain recorded since there was no foreseeable contingent payments to the Company.

As a result of the economic downturn related to the COVID-19 pandemic, and the impact it had on CTM, the Company decided to sell CTM and focus on our entertainment and publishing business. Pursuant to a SPA dated as of July 14, 2020, we sold all of the stock of CTM to an assignee of the Chairman in exchange for (i) the cancelation of $3.75 million of indebtedness owed by us to the Chairman’s designee, (ii) a contingent payment of up to $3.25 million based upon a recovery of quarterly revenues of CTM to 90% of its fiscal 2019 levels during the 18-month period following the CTM Sale Date, and (iii) a contingent payment if CTM is sold within 36 months of the CTM Sale Date for more than $4.5 million. The CTM Sale closed on February 15, 2021 and CTM is only consolidated up until the sale date with the gain reflected separately in the consolidated statement of operations.

IDW is selling as a Ben Graham net-net. $17m in cash, no debt, at a market cap of $17m. Are the IP worth nothing? The business model has changed to a less risky asset light model. 2023 revenue is unknown because there has been no production deals. The market hates uncertainty and the $1.30 share price is crazy...

2 questions...

1) Are you concerned that there has been no production deal announcement since Surfside about 6 months ago? No deals = no IDWE revenue in 2023...

2) What do you think about IDWP's strategy to produce original IP to become profitable?