When stocks are going down and many investors are just focused on the stock price movements, I always like to step back and revisit balance sheets and cash flows.

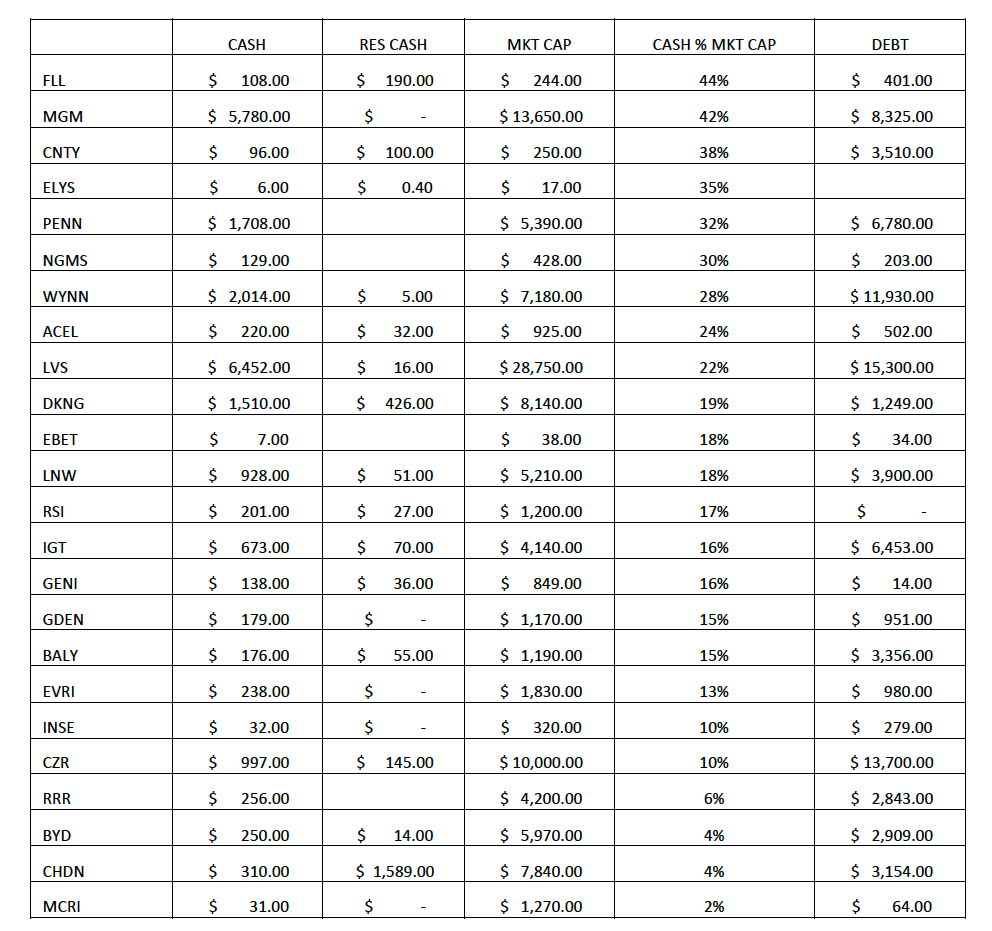

The last quick view is the gaming industry.

MGM transformation is fascinating. Here are the balance sheets from Dec 2018 and June 2022:

The company did sale/leasebacks for most of its casinos to MGP (now VICI) and sold its MGP shares as well. Company went from $20.7B in net PP&E in 2018 to only $5B today. Note how lease obligations rose from zero in 2018 to $25B today. Shares outstanding declined from 549M to 421M.

Hello:

I have another company that you might wish to consider adding...Butler National (BUKS). They own the Boot Hill casino in KS. They have spent a tremendous amount of money & effort on this. They bought out their minority partner, they have managed to get a mortgage on the casino land, and have signed an agreement for sports betting. The casino is putting up good numbers, and is very likely to put up even better numbers once sports betting gets up & rolling this Fall.

When you look at the money put into the casino division, it is quite a bit MORE than the current market cap of the company.

The also have an avionics division that is doing well.

They also have nice slug of cash for a company their size AND considering that most of their debt is the mortgage on the casino.