Four Corners Inc. 11% Dividend Yield, but Worth the Risk?

Maybe Not

Four Corners (FCNE)

Four Corners is a $20M holding company and the parent of K&B Sales, Inc. K&B is a licensed distributor of electronic equipment and supplies for the charity bingo industry in Texas and has been in operation for over 42 years. The company generates between $13M-$17M in revenue and approximately $1.7M-$2M in net income.

Note: The company is dark, but does send financials to current shareholders. The stock is highly illiquid with only about 1.7M shares out of 11M shares outstanding available to trade. The average trading volume is 3K shares a day.

Industry Overview

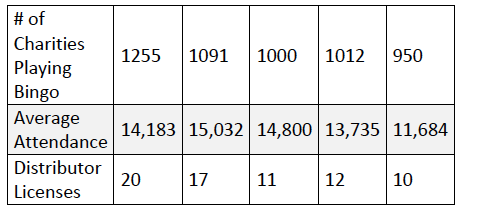

The size of sales into the charity bingo market in Texas have averaged approximately $36M over the last five years. Four Corners is the market leader and has been growing its share since a change in management in 2016. Three companies dominate the industry with 85% market share. The decline in total sales in 2020 was the direct result of bingo hall closures due to the pandemic. The industry had seen modest growth until then. Quarterly reports are filed with the state of Texas and can be found here. Four Corners is the only publicly traded company in the industry.

The industry is highly regulated and the barriers to entry are fairly high. All of the distributors, manufactures and charities need to be licensed to operate in the state. There are limits on the dollar amount of prizes that can be offered with certain games and limits on the amount of time that can be spent playing each session. There are even requirements that distributors and charities pay their suppliers and customers within 30 days to prevent fraud and other improprieties.

While the industry has been in steady decline when measured by attendance, number of charities playing bingo and the number of distributors, total industry revenue was actually growing. This would seem to be at odds with the fact that there is a limit to the value of the prizes that can be awarded. However, charity bingo is much more than just daubing numbers on paper squares (flashboards).

Most people, including myself, assumed that charity bingo was played by 60+ year old people and was played on the traditional 25 square BINGO cards. However, the age of players is much broader (i.e. a charity raising money for the school band) and the types of games played is also much broader. While the amount of money that can be won playing the traditional flashboards is restricted to $2,500 per session, there is no restriction on the amount of money that can be won playing what are known as pull-tab games.

These games have pull-tabs that reveal a prize and the payouts can range from $10 to $250 depending on how many cards are sold and the price. For example, a charity may sell 4,000 cards for $1 a piece and award six winners a top prize of $250 a piece and payout a total of $3,000. These types of games have become extremely popular this has been the main reason for FCNE’s increase in market share and sales growth over the years.

Company Overview

What initially attracted us to the stock was the fact that the company had paid $0.20 per share in dividends when the stock was $0.30 per share. Since March of 2018, the company has paid regular dividends of $0.04 per share to $0.06 per share, with the exception of the June 2020 quarter are the peak of the pandemic. The improvement in the company’s growth and dividend payout can be directly attributed to the current CEO Glenn Goulet.

Mr. Goulet arrived at FCNE in January of 2015 as a consultant and was eventually named the CEO and President. Mr. Goulet is the former CERO of Table Trac and worked at Intralot and Multimedia games (now Everi). I visited the company’s offices in Dallas, TX and spent almost two hours with Mr. Goulet. His knowledge and background in gaming is extensive.

One of the major changes that Mr. Goulet made after his arrival was to terminate the agreement to rent class II electronic gaming machines to a Native American tribe in Oklahoma. This occurred in 2017. In 2018, the company stopped renting keno a table games to another Native American tribe in Oklahoma. Everi is a major competitor in this market and Mr. Goulet’s previous experience there was a deciding factor in these decisions. Subsequent to these events, all of the company revenue is now derived from sales of bingo related products in Texas.

The turnaround in the company has been dramatic since his arrival. From 2016-2020, the company paid off $2.8M in debt and increased free cash flow from $630K to over $2.5M. We believe FCNE will continue to distribute nearly all of the free cash flow as dividends for the foreseeable future. Insiders own approximately 9.3M shares. Since the shares are very illiquid, the only way they can realize any cash returns on their shares is through dividend payments. At the current market price of $1.85 the shares are yielding approximately 11%.

The main driver of increased sales has been the increase in instant and pull-tab sales. The company has the #1 position in market share in this business. FCNE offers approximately 750 different games, which is 2x-3X the other major competitors. Since the arrival of Mr. Goulet, the sales staff has been empowered to help design the new games and help the charities develop strategies to maximize sales. This was a significant change from previous management. Employee turnover is also very low, which helps foster strong relationships with customers.

Declines in quarterly sales have improved since the start of the pandemic. Approximately half of the decline in sales in Q1 2021 was due to a loss of a Native American casino client. Capacity issues are not a limiting factor at this point since Texas is now open to 100% capacity and bingo halls are rarely filled to capacity. I asked Mr. Goulet why he is still working at his age after all the success he has had in his career. He said he loves the challenge of returning the company to the record high sales figures that it had before the pandemic.

Risks and Final Thoughts

Four Corners operates in a highly regulated and relatively simple business. Even though the company operates in a declining industry, it has been able to grow its revenue and cash flow through better management and innovation. While the current 11% yield is certainly attractive in today’s interest rate environment, there are risks that potential investors need to consider.

The industry is in a structural decline and there are fewer opportunities to offset the decline in attendance and charities playing bingo with market share gains. The top three distributors have gone from 78% to 85% market share in the last five years. We believe there is a low probability of FCNE being able to acquire one of the other two major companies to increase its market share and several of the smaller players have strong niches.

For the first time, there are serious talks in the state legislator of allowing casinos and sports betting in the state. We believe at some point this will happen, which will put more pressure on the charity bingo market. FCNE mainly operates in major cities, which is where any casino would open. For example, in a suburb between Dallas and Fort Worth there is the Lone Star Park horse track and in Houston there is Sam Houston Race Park. While it will take years to build major casinos once gaming is approved in Texas, these parks could have slot machines installed relatively quickly. We do not believe that the charity bingo business would go away completely, but legalized gaming would certainly siphon off some of those discretionary gaming dollars.

Another factor to consider is the relative illiquidity of the stock. Since there are only approximately 1.7M shares that are registered in street name, it would be difficult to acquire a large position and even more difficult to ever have to sell those shares. The insiders are basically trapped in their ownership, which is why the company has started paying out all free cash flow as dividends. It is providing the insiders with a cash return since the gains in the stock from $0.20 to $1.85 are virtually impossible for them to realize.

If sales do not rebound, we would expect free cash flow to decline and the dividend payout to decline as well. The loss of the Native American casino contract means the company will have to replace $400K-$600K in revenue.

Finally, the new SEC rules regarding dark companies may have an impact on the liquidity of the company’s shares. While the company does send financial statements to shareholders, it is currently considered a dark company on OTC Markets and it is unclear if the company would provide the necessary financials to meet the listing requirements.

We are long the stock and do have bids in at lower prices in case a market disrupting sell order hits the market. However, investors need to decide for themselves if the industry risks and extreme illiquidity are worth the current dividend payout and the potential for dividend cuts in the future. I can send the last four years of financials to anyone that wishes to receive them.

FCNE reported Q2 numbers.

Revenue is higher than 2019. EPS fully taxes of $0.07 per share vs. $0.05 per share in 2019. Declared $0.07 dividend.

$1.8M in cash $1.1M in receivables and $320K in Federal income tax deposits. Steady as she goes.

Q2 21 Q2 20 Q2 19

Revenue

Bingo $ 4,786.00 $ 2,342.00 $ 4,675.00

Other $ - $ - $ 8.00

Total $ 4,786.00 $ 2,342.00 $ 4,683.00

YOY 104% -50%

COGS

Bingo $ 2,565.00 $ 1,285.00 $ 2,485.00

Other $ - $ - $ 2.00

Total COGS $ 2,565.00 $ 1,285.00 $ 2,485.00

GP $ 2,221.00 $ 1,057.00 $ 2,198.00

GP % 46.4% 45.1% 46.9%

Other operating

Bingo $ 1,172.00 $ 1,054.00 $ 1,382.00

Game distribution $ - $ - $ 5.00

Corporate Overhead $ 23.00 $ 23.00 $ 27.00

Total Expenses $ 1,195.00 $ 1,077.00 $ 1,414.00

Op Inc $ 1,026.00 $ (20.00) $ 784.00

Other Inc $ - $ 1.00 $ -

EBIT $ 1,026.00 $ (19.00) $ 784.00

Taxes $ 223.00 $ 3.70 $ 170.00

Tax Rate 21.7% -19.5% 21.7%

Net Income $ 803.00 $ (22.70) $ 614.00

EPS $ 0.07 $ (0.00) $ 0.05

S/O 11054 11009 11269

YTD

CFO $ 779.00 $ 965.00 $ 1,214.00

PP&E $ (80.00) $ (62.00) $ (92.00)

Dividend $ (554.00) $ (1,108.00) $ (1,218.00)

Cash Start $ 2,248.00 $ 1,248.00 $ 1,063.00

Change $ (205.00) $ (74.00)

Cash End $ 1,838.00 $ 1,043.00 $ 989.00