Dave & Buster’s Entertainment ($PLAY) Management Sees Potentially $1B+ in Incremental EBITDA in 2025, Will Investors? One Hour Analysis

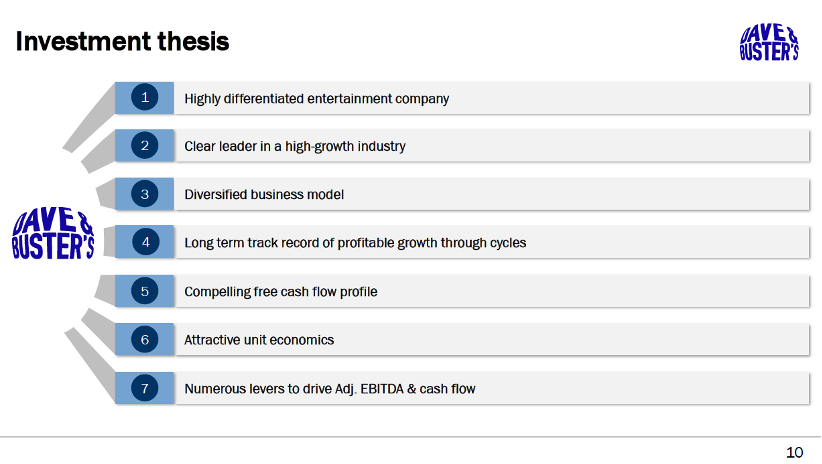

In the past, we have been skeptical of Dave & Buster’s ability to grow profitably. However, in the last year the company acquired Main Event (merger presentation can be found here), had a significant turnover in upper management and hosted an Investor Day that laid out a path for $1B in additional EBITDA by 2025. The company is currently valued at only 5.1X EV/EBITDA which would seem to suggest that investors are highly skeptical that this EBITDA growth goal can be achieved. In this report, we will revisit the prospects of the company.

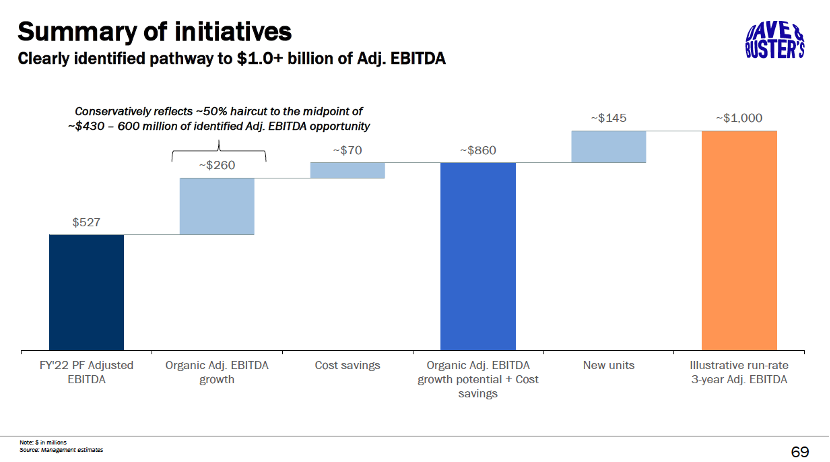

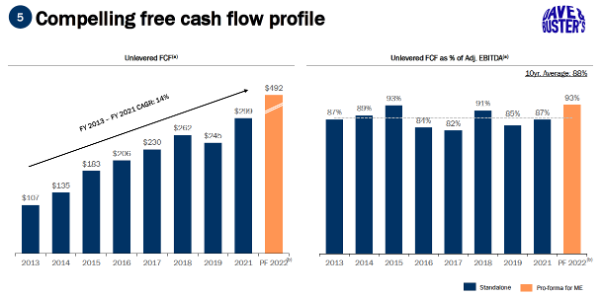

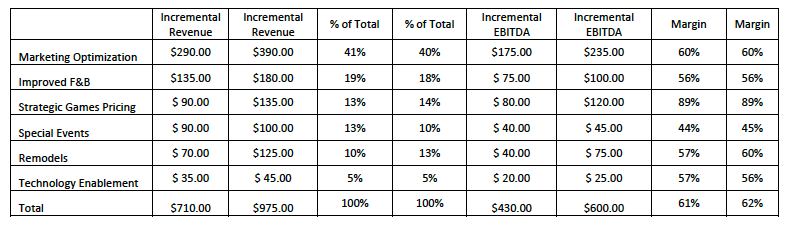

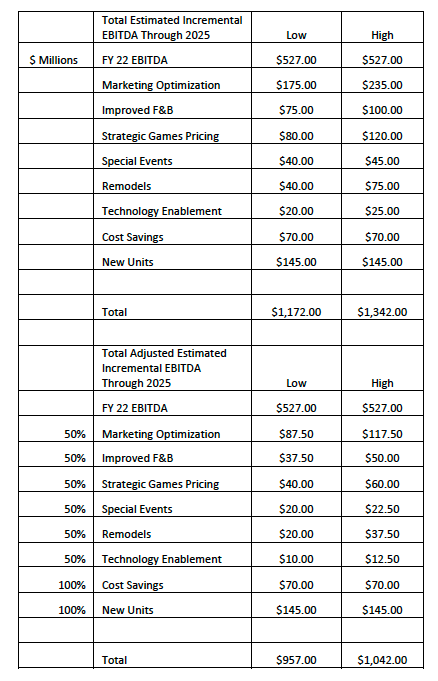

Here are the most relevant slides from the Investor Day presentation. Notice that the $1B in incremental EBITDA only includes 50% of the $430-$600M of identified EBITDA opportunities management believes the company can produce. In the following report, we will look at the opportunities the company has to reach these goals and the likelihood of achieving them.

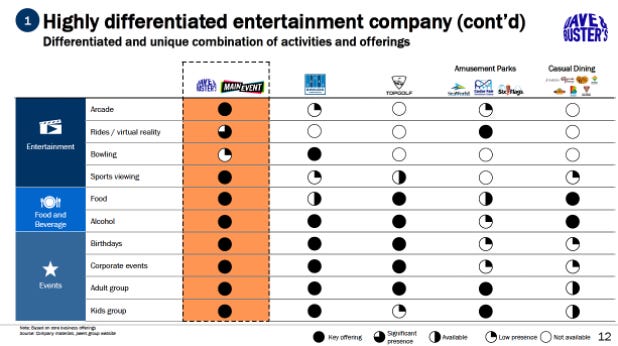

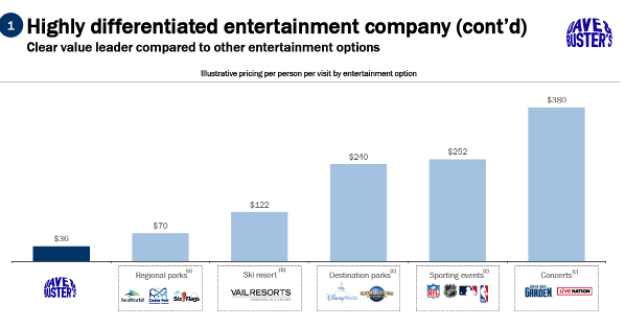

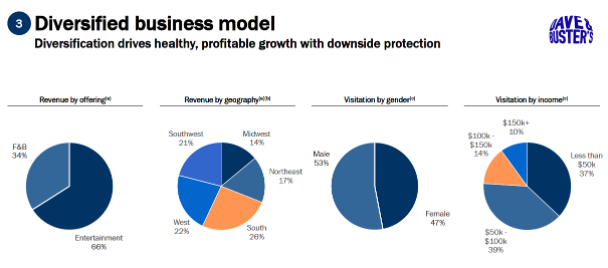

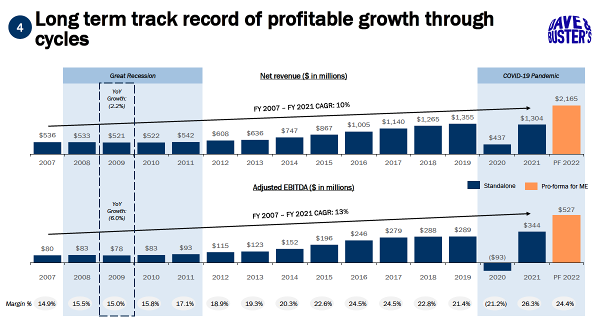

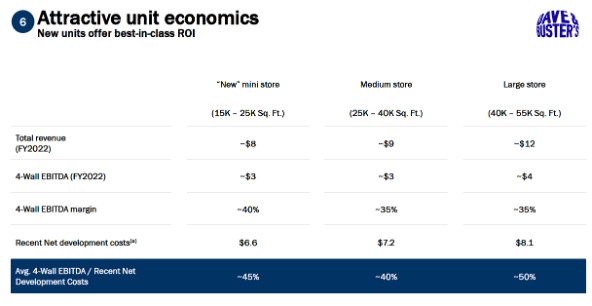

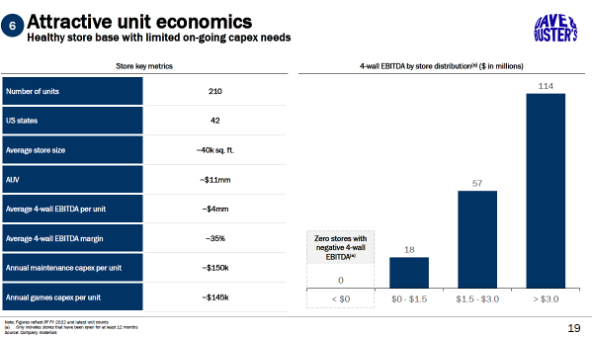

Additional Background Slides from Investor Day.

Before we take a closer look at the six levers the company says it will use to boost EBITDA by at least $1B by 2025, we thought it would be helpful to include some additional slides from the presentation for background.

Management Believes There Are Six Levers for Organic EBITDA Growth.

At the Investor Day presentation, management discusses six levers the company has to increase EBITDA by $430-$600M over the next several years. The table below breaks out those levers and the percentage of the total each represents. We will take a closer look at the incremental revenue opportunities presented in the table to see how likely the company will be able to achieve them.

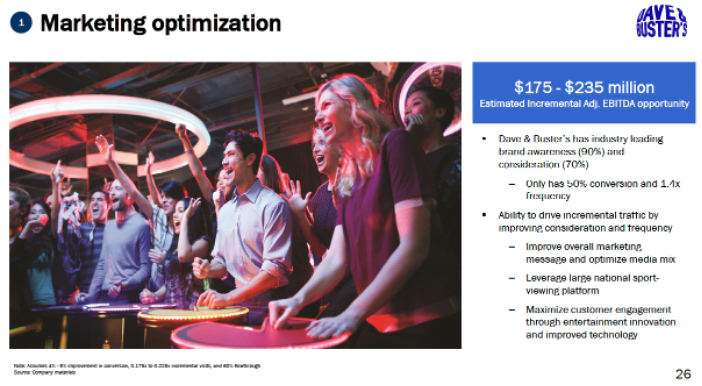

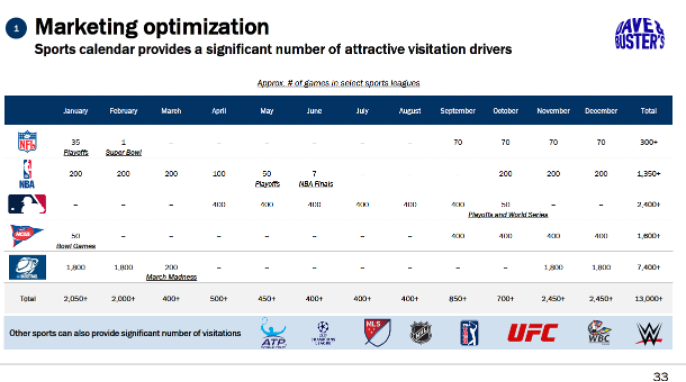

Marketing Optimization Strategy

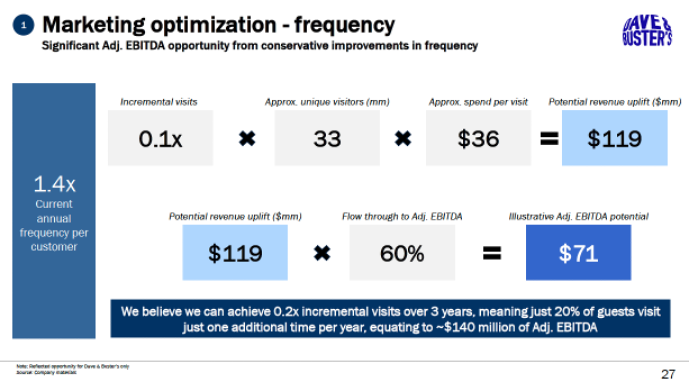

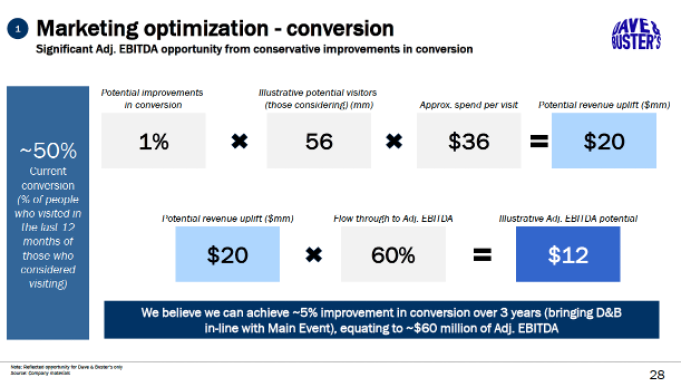

The biggest category by far at 40-41% of the total EBITDA goal is what management calls its Marketing Optimization Strategy. This is defined as increasing both frequency of visits and conversions of people that considered visiting but didn’t by improving marketing spend and targeting. Management believes there is a $175-$235M incremental EBITDA opportunity if the strategy is successful.

By improving marketing messaging and focusing on driving customers to stores to watch sports, management believes that it can achieve 0.2X incremental visits over three years. Another way to look at it is that if 20% of guests visit just one additional time per year, the company would generate an additional $140M in EBITDA in three years.

The second component is increasing conversion by 500bps, which would increase EBITDA by $60M over three years.

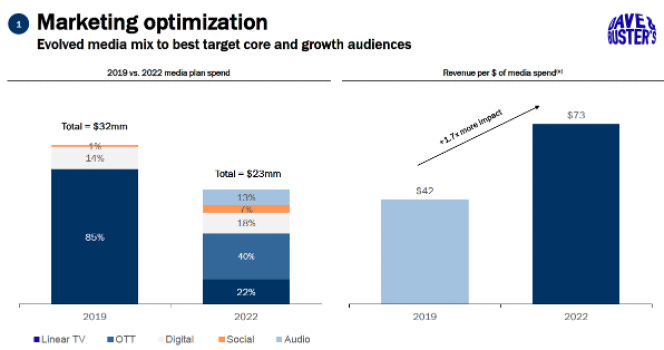

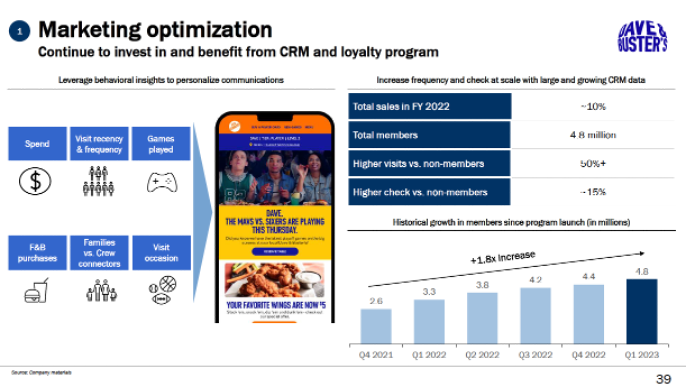

The company plans to achieve these goals by emphasizing sports watching to boost both frequency and conversion. D&B hopes to reach customers with a shift in media spend away from linear TV to digital, social, and audio channels. The company has 5.2M loyalty members that it hopes to motivate and incentivize to increase their frequency and conversion rates as well.

While many of the strategies discussed at Investor Day to achieve these goals seem reasonable, it is important to point out that these EBITDA goals will be the hardest of the six to achieve. The company is going to have to change consumer behavior, which will be tough to do. While emphasizing sports is a logical strategy due to the large games and bar focus of the concept, there are already several strong competitors in the sports watching space. These competitors include Buffalo Wild Wings, Chili’s, Applebee’s and numerous local bars and restaurants. While current management did have success while at Main Event in boosting traffic, it will still not be easy.

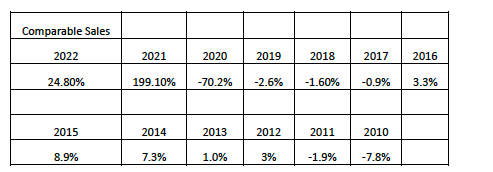

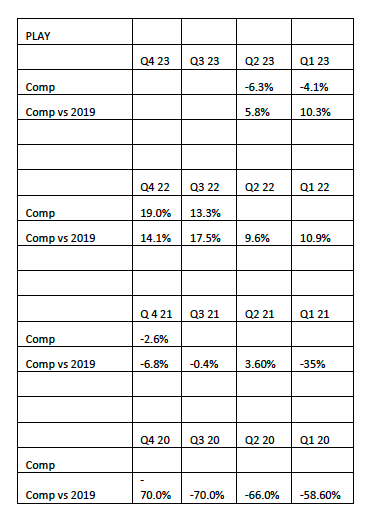

Another reason we believe that investors are skeptical of management’s ability to achieve these goals is the inconsistent growth in comparable store sales over the years. Before Covid, the company only achieved positive same store sales in 5 of the last 10 years. However, there is a totally new management team in place, so these past results may not be representative of the future potential.

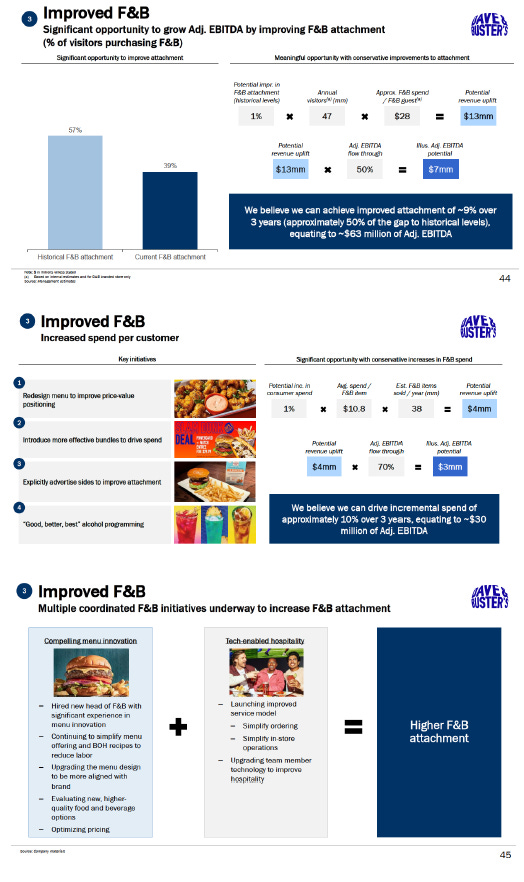

Improved F&B Opportunity

The second largest incremental EBITDA opportunity (18-19% of the total) is increasing the average check by increasing the attachment rate of additional food items. The estimates for achieving this goal seem fairly reasonable. They require modest improvements in attachment rates (from 39% to 48% vs. 57% historically) and a 10% increase in incremental spend per person over three years. But like the marketing optimization strategy discussed above, these goals will require a change in behavior. Increasing the average check after most restaurants increased prices significantly over the last three years, will also be difficult if consumers do not see the added value.

Strategic Games Pricing

The third largest component of the increment increase in EBITDA is a change in the strategic pricing of games. Here is how management described the opportunity at the Investor Day:

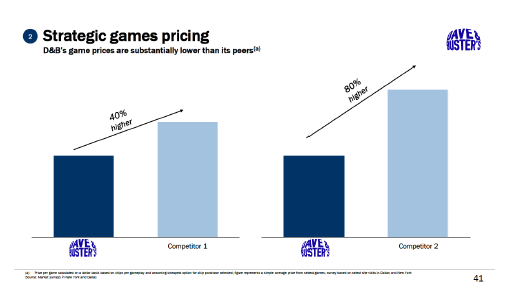

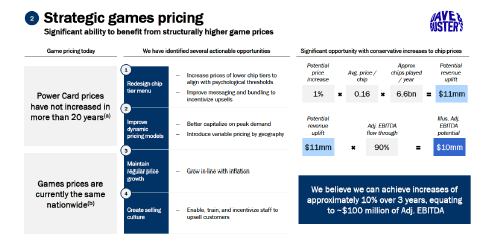

As you can see on this slide, our game prices are 40% to 80% lower than some of our competitors in several of our markets. As we started to dig into this more, there are 2 main observations: number one, power car prices have not increased in more than 20 years, which seemed crazy to us. The second observation is that we don't have tier game pricing. What that means is game prices are currently the same nationwide.

There are 4 main things we're doing to address this. One, we're going to redesign our chip tier menu. Two, we're going to implement dynamic pricing models to better capitalize on peak demand. Three, we're going to maintain regular price growth in line with inflation. And finally, we're going to create a selling culture out in the stores to upsell our guests. The opportunity is significant. As you can see on the right-hand side, we're showing the math on what the size of the prize is. A simple 1% price increase on games would amount to $11 million increase in revenue, with 90% flow through, that's a $10 million opportunity alone. We believe we can achieve an increase of approximately 10% over a 3-year period, equating to a $100 million impact to adjusted EBITDA and still protect the value proposition in the business.

On the latest conference call, management stated that these initiatives are already being implemented:

Second, strategic game pricing. Playing games is at the core of our business model and what we are and will always be most known for as a brand. As highlighted during our Investor Day, we believe there is a significant opportunity to implement a new comprehensive game pricing strategy to drive meaningful additional revenue, adjusted EBITDA and cash flow, while still maintaining our everyday value proposition with game prices still well below our peers. While we require certain investments to fully implement all elements of our new strategy, we are currently unlocking new ways to optimize regional pricing that we expect to have a positive impact in the fourth quarter of 2023 during our key holiday period.

Chris Morris

Yes. So, I'll give you the two main takeaways. One, towards the end of the quarter, so there was really no benefit in Q2. We did adjust the rate card, which is the buy-in at the kiosk. When you look at our pricing before, the low-end entry point was $15, and then it went from $15 to $25 to $35 to $45. We adjusted those rate cards to actually start with $20. And then it goes from $20 to $30 to $40 to $50. The dollar value per chip that the customer receives is consistent. So it really wasn't much of a, call it a price change as it was a change in just the buy-in amount at the minimum level, and then it went up through there.

The other aspect of what we're looking to accomplish is, as we've talked before, one of the strategic unlocks in pricing is the ability to alter pricing between geographic areas. So no different than when you look at food and beverage, costs in major metropolitan areas usually cost more from a price point than in more regional markets or smaller towns. Right now our limitation is that all pricing for all games is consistent across the entire system. We're now able to unlock that and be able to put regional pricing in place, which will start going into test in the next couple of weeks. One of the key things we want to do though in doing such is make sure that we maintain the value of our product offering in relation to our peers. So, from that respect, we haven't communicated nor would we, what we think that estimated growth would be in Q4, but we would expect there to be something there.

Almost 30% of Incremental EBITDA Come from Three Levers That are Mostly Under Management Control

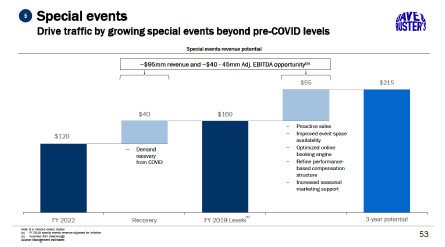

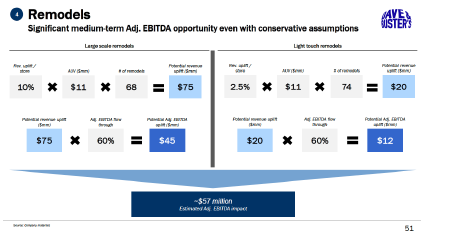

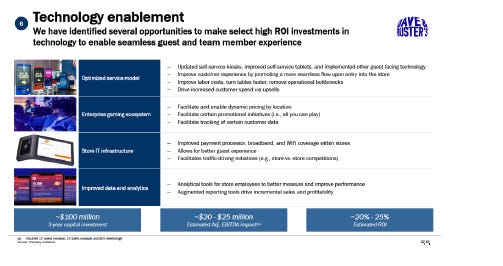

The last three levers for EBITDA growth presented at the Investor Day are Special Events, Remodels and Technology Enablement. All together these levers could produce upwards of $130M in incremental EBITDA. Of the six levers management has discussed, we believe these three have the greatest chances of success because they are relatively straightforward and mainly rely on prudent capital expenditures on remodels and technology upgrades.

In additional to the capital expenditures, nearly 50% of the incremental EBITDA from improvements in special events comes from just getting demand back to pre-covid levels. That seems like a very achievable goal.

The $57M in incremental EBITDA from remodels seems very achievable as well. The current management had a great deal of success with remodels at Main Event and these types of returns have a long history of predictable results.

Finally, the company thinks it can get 20-25% ROIs on $100M in technology investments. We think these are reasonable assumptions and based on historical results.

Results from Q2 FY23 were Mixed.

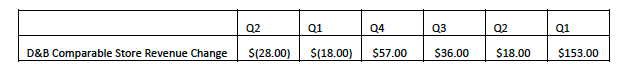

PLAY released its Q2 FY23 earnings on September 6th. The company reported earnings of $0.60 per share, which was a miss of $0.33 per share. Revenue was 6% shy of estimates as a result of worse than expected comparable sales of -6.3%. The stock fell 6% after the release.

A SHORT-TERM CAVEAT – We Can’t Ignore Negative SSS “Comps”

As strong as Dave & Buster’s is financially, as strategically well positioned as they are, and as promising as the intermediate to long term future looks, the next two reporting quarters, Q3’23 and Q4’23, are going up against tough sales comparisons. Combined sales comps were up 13.3% in Q3’22 vs. ’21 and up 17.5% vs. ’19, then up 19.0% in Q4’22 vs ’21 and up 14.1% vs ‘19. The likely negative comps in both Q3 and Q4 of ’23 vs. ’22 might (or might not) provide buying opportunities, so investors might keep some powder dry in that event. It’s also possible, however, that the analysts and investors have learned not to expect too much. After the last two “disappointments”, if they come close to unexpectedly matching last year’s number, and provide an encouraging update relative to the operating initiatives, the stock could rise sharply. In any event, the first quarter of ’24 will be the first “normalized” comparison, with the opportunity for SSS to look better, against both ’23 and ’19.

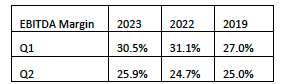

The good news is that D&B has been able to maintain strong EBITDA margins.

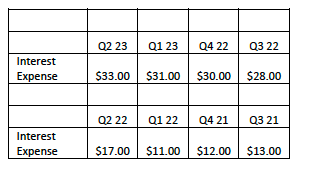

Interest expense has risen Q/Q for five straight quarters and has doubled over the last year. However, in July the company announced an amendment to its Credit Agreement that reduced the interest rate spread by 1.25% and upsized the Term B Loan to $900M. The company also increased its stock buyback authorization to $200M.

Conference Call Tidbits:

While the initial reactions on the quarter from investors was negative, management was significantly more upbeat. Here are some of the comments we thought were the most interesting:

In addition, our loyalty database is now 5.2 million users, up from 4.8 million users last quarter, as our mobile app experience keeps getting better. Continuing to grow our loyalty database will be a key benefit for our top and bottom-line as customers in our loyalty database visit approximately 50% more frequently and spend approximately 15% more when they visit.

We recently completed a test of the next phase of our new Dave & Buster's menu of the future in new hospitality focused service model, which we are pleased to report was successful. During the test, these stores saw a low single digit increase in sales, a 170 basis point improvement in food cost of sales, improved labor costs due to operational efficiency, improved speed of service and OSAT scores. We are on track to launch this phase of our new menu and F&B strategy system-wide by the end of September.

Although it's only been three weeks, the new format is being well received by our guests and performing ahead of expectations of a double-digit improvement in comparable store sales growth trends. There will be eight more test remodels coming online in the balance of 2023 with the remaining three in 2024. Once these tests are complete, we will provide more comprehensive financial observations of these test remodels and how these initial results are sharpening our strategy for the planned rollout of the remodel program to the remaining D&B locations in 2024 and beyond. However, you can rest assured that we remain laser focused on generating highly attractive returns on invested capital for the remodels.

And after increasing our share repurchase authorization, we currently have $200 million of share repurchase authorization. Also in the quarter, we opportunistically repriced our credit facility, reducing the spread on our Term Loan B and any future revolver borrowings by 1.25%.

Jake Bartlett

And my next question is just on the trajectory of the business. Obviously, we're -- the comps versus '19 have been decelerating pretty consistently now for the last four quarters. What is your confidence that that's going to stabilize, the excess demand essentially that was kind of -- that occurred post-COVID has worked its way out and that you should see a reacceleration? And I guess within that question, are you seeing that yet? Is there any -- as you look at the trends within the quarter, the quarter to date, any indication that you're seeing that stabilization, even outside of some of the initiatives that seem really promising coming up in the next quarter or two?

Chris Morris

What you're going to consistently hear from us, this is the team that's very much focused on delivering on that long-term plan, and that's where our focus is. As I said, there's a clear line of sight in our ability to deliver on that plan over the long run. And so we don't really get caught up in month to month trends.

What I'll tell you is, it's like -- look, the comparisons to the prior year are challenging. Last year at this point in time, we benefited from the post-COVID surge along with all of our peers. And as we're lapping that period of time on a year-over-year basis, comps are challenging. We're pleased that compared to 2019, we're still up 6% over that comparison.

Mike Quartieri

When you look back a year ago, we comped plus 17.5% in Q3. And so that is a huge number to overlap. And so when you go back versus '22, yes, it's a tough comp. We look back at '19 and we see still the growth in the business that we wanted to see, which is that 2% type growth on an annual basis going forward, which is a more normalized environment that you would expect to see in businesses like ours.

What has us at this point, we can't control the macroeconomic factors that are driving traffic into those effect. What we do control is what happens in the four walls of our business. And that's the type of attitude and the -- I'd say -- I call it bringing it every day to control those four wall EBITDA margins. And that's the value that you're seeing in that EBITDA margin today, even in this type of environment where we can expand on those EBITDA margins. The actions that we're taking today around that are permanent in nature and will be able to benefit us even further as traffic and economy returns back to more normalized levels.

Miscellaneous

THE MANAGEMENT TEAM

The current management team at D&B is experienced, typically over 25 years with Entertainment and Food and has often previously worked together, at Main Event, also at CEC Entertainment and On The Border.

The CEO is Chris Morris – formerly CEO at Main Event, President of California Pizza Kitchen, CFO of On the Border, CFO at CEC Entertainment.

The CFO is Mike Quartieri. – 1.5 years at D&B, previously CFO at LiveOne, CFO of Scientific Games, at Las Vegas Sands and Deloitte.

The COO is Tony Wehner – COO at Main Event, previously CEO at BIgShots Golf, COO of Bar Louie, previously with On the Border.

The CMO is Ashley Zickefoose – was CMO at Main Event, previously CMO at CEC Entertainment and CMO at On The Border.

The CIO is Steve Klohn – formerly CIO of Main Even.

The Chief Development Officer is John Mulleady – 11 years, as CDO at D&B.

The Chief Int’l Development Officer is Antonio Bautista – 1.5 years at D&B.

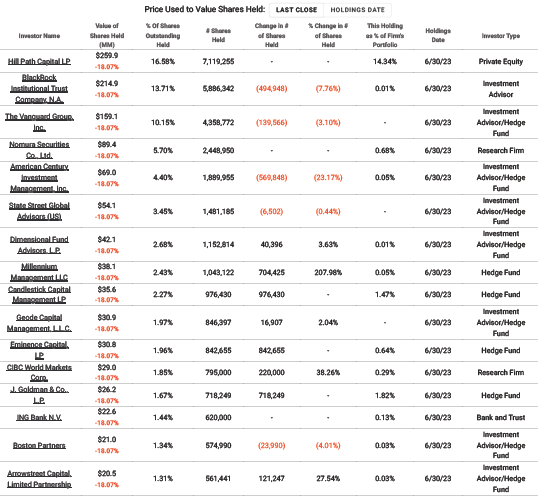

STOCK OWNERSHIP

CONCLUSION

The pieces are in place, with a lot of apparent ways to win. In terms of downside risk, the business seems stable and productive enough to continue generating above average returns on invested capital. In terms of a “rosy scenario”, over the next several years the cash flow and earnings could double, and the valuation multiplier could at least double as well. Our simplistic approach therefore points to a potential quadruple in the common stock, without too much downside risk if fundamentals turn out to be disappointing. Management and the Board of Directors seem to feel the same way because they have spent $200M (about 10% of the capitalization) this year buying back shares for the Company and have recently authorized an additional $200M. Relative to the Board of Directors, a seat is held by a representative of Hill Path Capital, which owns about 15% of the common shares. Whether instigated by Hill Path or another institution, private equity could come to this bargain table at any time.

The free cash flow should allow for ongoing stock repurchase in ’24 and beyond, as well as capex for renovation and new stores. If the Company’s Enterprise Value is only 5x this year’s cash flow, perhaps 4x next and 3.2x ’25, share buyback generates an immediate 20% cash on cash return in year one, leveraged from the growth to 25% in year two, and 30% or so in year three. That’s a lot better than a T-bill, even with rates up recently, a lot easier than chasing real estate deals, and doesn’t preclude the latter in any case. Subject only to the short-term caveat just above, we don’t remember a better time (other than early ’20 when the world shut down) to invest in Dave & Buster’s.