CHUY’S: A COMPELLING OPPORTUNITY OR A “VALUE TRAP”?

Could the company be a potential activist target?

Chuy’s Holdings, Inc. (CHUY)

Price: $21.25

Market Cap: $389M

EV/EBITDA 4.5X

Net Cash: $90M

We occasionally do screens to find companies that may be overlooked or undervalued so we can do a deeper dive for subscribers. Chuy’s Holdings, Inc. (CHUY) popped up on a recent screen of stocks with high cash balances relative to market cap/enterprise value (Ark Restaurants (ARKR) is still the highest at 26%) at 23% of market cap. Since this restaurant chain is my wife’s favorite Mexican restaurant, we decided to investigate further. For investors not familiar with CHUY, we would advise you to visit their website and their presentations page. Each location is unique, their Jalapeno Ranch Dressing is awesome and their “dog wall” is fun to look at.

CHUY has $90M of cash on the balance sheet relative to a market cap of approximately $390M. Excluding operating leases the company is trading for around 4.75X TTM EBITDA. EBITDA has grown from $35M in 2018 to $64M in 2021. In this report we take a closer look at the factors that drove the increase and look at the sustainability of the current profitability.

Large Cuts in Staffing Drive the Large Increase in EBITDA from 2018 to 2021

In spite of revenue in 2021 being relatively the same compared to 2018 ($396M in FY21 vs. $398M in FY18), the EBITDA rose from $35.2M to 64.4M. The EBITDA margin rose 750bps from 8.8% to 16.3%, a remarkable increase in such a short period of time. The obvious next question: “Are current EBITDA margins sustainable?”. If they are, the stock is incredibly cheap and should eventually re-rate higher.

A closer look at the income statement shows that the $30.7M decline in labor costs drove the entire increase in EBITDA. As a percentage of revenue, the company was able to lower labor costs from 36.2% to 28.7%. The company has stated that they are operating at about 80-85% staffing levels compared to where they believe they need to be to maintain customer service quality levels.

CHUY 10Ks provide a significant amount of useful historical information to help investors understand the drivers of the company’s business. Since 2014, the company has made significant cuts to the number of managers and hourly employees in each store. Remarkably, the company employs approximately the same number of managers and hourly employees today that it did in 2014, with 37 FEWER stores. This nearly 40% reduction in staffing is very unusual in the industry and we believe it is unsustainable. On the Q1 FY22 conference call, management stated that it believed that staffing would return to 90-95% of 2019 levels. This implies 10-12 more employees per store are needed.

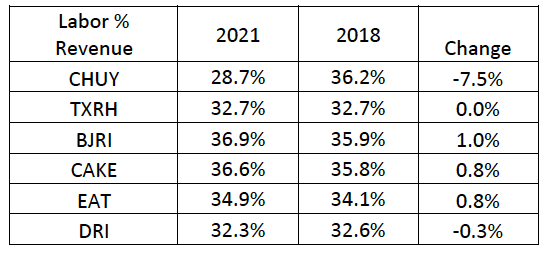

The significant reduction in employees per store (some of which management attributes to more efficient use of technology, especially at the manager level), reduced labor costs as a percentage of revenue from 36.2% to 28.7%. This reduction is in stark contrast to the trend experienced by many of its peers over the same period of time. As shown in the table below, most peers showed an increase in labor as a percentage of sales of 80-100bps. Darden has been able to lower its labor costs slightly over that period of time. Since 2015, labor costs as a percentage of revenue have averaged 33.5% at CHUY. We believe that this percentage is a more reasonable level of future costs than the current run rate. In fact, in spite of a 14.6% increase in revenue, labor costs rose 140bps in Q1 FY22. While management suggested that the labor situation is starting to normalize and “help is on the way”, the table below shows that other full-service operators are not showing the same degree of abnormality.

Labor inflation is picking up as well. Not only is CHUY facing increases in staffing levels that will drive labor costs higher, but inflation in the hourly labor rate is high and expected to continue.

The hourly labor rate increased 13% in Q1 FY22 (well above the 3.3-4.6% increases in recent years) and management guided to a sustained 10-12% increase in Q2 and perhaps beyond.

· Labor Inflation (hourly labor rate)

o Guidance +10-12%

o Q1 22 13%

o 2021 4.6%

o 2020 0.4%

o 2019 3.3%

o 2018 3.3%

“Normalized” EBITDA Potential Could Be as Low as $44M

We continue to focus on the labor situation at Chuy’s because long term macro trends suggest that other costs, such as operating, occupancy, marketing and G&A will probably not decrease in the foreseeable future. It is important to note that, in spite of closing 18 locations (16% of the 114 there would have been) in the last six years, AUVs have declined from $4.87M in 2014 to $4.20M in 2021. Since the stores that were closed would more than likely be generating sales below the company average, the smaller store base should have shown an increase in AUVs if the remaining stores were stronger.

At the same time, net investment per new store has increased from $1.8M to $2.5M, which has lowered the AUV/Net Investment ratio from 2.71X to 1.68X. It is extremely difficult to lower costs when you cannot leverage them with rising AUVs. More worrisome is the decline in customers per location from 36K in 2014 to 24K in 2021. CHUY can only raise prices so much to offset this steady decline in traffic (3.3% long-term trend), further reducing the levers available to improve sales and margins. We believe that the other costs of running the business will stay close to current percentages of revenue, highlighting the importance of labor costs.

Wall Street is estimating $425M of revenue and $51M in EBITDA for FY22 and $475M in revenue and $58M in EBITDA in FY23. Simply taking the recent percentage of revenues of all costs except labor and increasing labor a modest 130bps to 30% of sales (and exclude pre-opening costs) our EBITDA estimates come close to analysts’ estimates. However, considering the factors we discussed above, we feel that 30% labor costs as a percentage of revenue could be too low. If labor costs rise to 32% of revenue, which would still be 150bps below the long-term average and many of its peers, EBITDA drops to $44M-$49M or almost 30% below the current run rate.

OTHER CONSIDERATIONS

(1) Officers and Directors own less than 2% of the outstanding shares.

(2) Margins were shrinking for several years prior to COVID, “adjustments” were in process.

(3 ) Company sold 3.04M shares at $15.86/share (19% dilution) in ’20, after purchasing 90K shares at $15.57. In ’21 repurchased 462k at shares s at $31.45/share. In retrospect…..sad.

(4) Non-operating Impairment Charges – $53.3M from ’18, ’19 and ’20.

CONCLUSION

The above discussion provides more questions than answers. We have no visibility as to what will provide a predictable, sustainable growth trajectory. Our conservative view is that EBITDA in 2022 will more likely approximate $44M than $65M and we are concerned that the Chuy’s basic dining experience may continue to lose traffic. On that basis, we would rather bet on restaurant companies that are in a stronger competitive position.

NOTE: Roger Lipton of Lipton Financial Services contributed to this analysis.

Thank you! This was an interesting analysis.