Ark Restaurants (ARKR) – reports productive March qtr. - balance sheet is strong - current business looks good so quarterly dividend (at half the previous rate) is reinstated (a 3% current yield).

CONCLUSION:

We have followed ARKR since it came pubic in the mid-1980s operating with a few large-scale dinner houses in NYC (e.g., 500 seat “America” on 18th Street) catering to “yuppies”. There was often a “story” and the Company has been consistently profitable, though not on a straight-line upward path. For a combination of reasons, the publicly owned stock was hardly ever embraced. The lack of a “cookie cutter” brand with visible “white space”, operating results that proved to be inconsistent, and the Company’s ability to pursue growth initiatives without fresh capital from the public resulted in a lack of “coverage” by research analysts and statistical undervaluation of the stock. There has also been a limited amount of liquidity in ARKR since founder and CEO, Michael Weinstein, has always owned a practical controlling interest (27%) and outside public investors, with a long-term confidence in the Company, do not often trade.

An inflection point seems apparent. The balance sheet is the strongest in many years, easily capable of supporting future growth. The current base of cash flow generation, especially with the catering and special event activity just now rebounding from the Covid, is impressive relative to the Enterprise Value. Current properties, while running well, could be improved further once supply chain distortions and the labor crisis abates at least a bit, and there is an adjacent opportunity to build shareholder value through real estate (beneath restaurants) ownership. ARKR stock is statistically cheap based on trailing results alone, on top of which are (1) recovery of sales, especially related to catering and special events in NYC and DC (2) more growth in the southeast (3) long term participation in Las Vegas, which is booming again and (4) a material “kicker” by way of Ark’s ownership in The Meadowlands gaming venue. With an Enterprise Value only 4.3/7.8x trailing twelve months EBITDA (without/with capitalized leases), there seem to be a lot of ways to win with ARKR.

Q2 (ENDING MARCH ‘22) SUMMARY':

Revenues were $39.6M vs. Covid depressed $25.8M in ’21. Adjusted EBITDA, excluding mostly the $1.1M forgiveness of PPP Loans, was $1.481M vs. negative $.495M. Net Income, similarly adjusted, was $1.055M vs $4.161M.

The business continues to recover, as shown in the table below. The company’s major markets, Florida, Las Vegas, and Alabama (85% of total revenue) continue to see growth over 2019 levels. Florida’s growth of 95% over 2019 was aided by the acquisitions of JB’s on the Beach and Blue Moon Fish Company; however, revenue was still up 48.5% over 2020. The Original Oyster House acquisitions in Alabama continue to produce substantial revenue growth, with revenue up 19% since 2019. Las Vegas continues to be strong, with convention business returning, showing a 1% increase over 2019 (compared to a 12% increase in Q1). “Comp sales”, of concern to management and investors alike, are not strictly relevant at the moment, due to social distancing and other Covid-related operating limitations.

Per the Conference Call:

While many major retailers and some restaurant chains have reported a weakening in consumer demand, ARKR management continued to see strong demand in May. The rebound in the events/catering business in NYC and Washington D.C. is helping drive this sustained improvement.

Relative to the June quarter, according to CEO, Michael Weinstein:

“by way of illustrating current trends, Bryant Park is doing $100,000/day at the moment, up substantially from the March quarter, a lot of that driven by events and has a calendar that is full to the end of June. Sequoia is seeing the same thing, a lot of events on their calendar…….we are six weeks into the June quarter. We've seen extremely strong results from the restaurants. So, I expect the June quarter to exceed our own projections and expectations.

In response to a question regarding the current effect of Omicron variants:

“We're not seeing that in our location in Vegas, we're certainly not seeing it in New York…..and we weren't seeing it in Florida or Alabama as of last week. We've seen a dramatic pickup in New York and Washington D.C., in part driven by a very strong event calendar in May and June.”

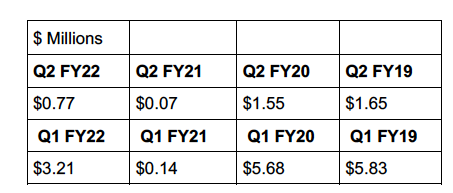

EVENTS AND CATERING POTENTIAL

The improvement in the events/catering business is starting to show up in the financials as well. While the earned revenue YTD (and last year) was about 50% of levels in the previous two years (as shown in Chart 1 below), unearned catering revenue (as shown in Chart 2 below), a leading indicator of future revenue, is $5.77M, over 40% above the levels of the past two years (Chart 3), when Ark did $13.80M and $7.36M in catering for the year. Since catering revenue for 2021 was only $3.2M, this venue should show a substantial increase this year versus last. Investors should keep in mind that Event/Catering Revenue generally carries relatively higher profit margins.

Event/Catering Revenue – Chart 1

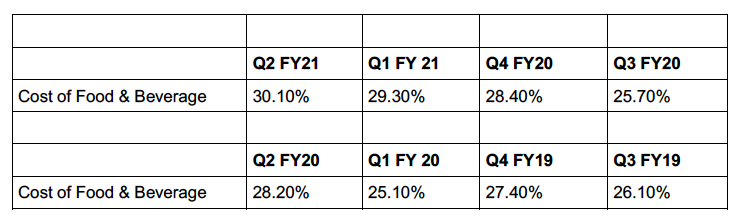

CHALLENGES REMAIN – LABOR, OF COURSE, AND COST OF GOODS AS WELL

For the third time in the last four quarters, the company has seen a 300bp contraction in its gross margin. ARKR continues to feel the pressure of higher seafood costs. However, ARKR is not alone when it comes to higher seafood costs. Here are comments from Full House Resorts, a casino company that operates the Silver Slipper casino in Las Vegas:

“Actually, crab accounted for about a 110% of the increase in the food costs. We used to buy crab $8 a pound, now we are buying it at $17 a pound. For the 12 months ended March 31, the recent 12 months ended, we spent $4.6 million on crab. We went back and looked at the 12 months ended March 31st, 2021, we spent $2.4 million on crab.” Note: Management used the term “crab” 49 times on the conference call.

At Ark, the 300bps increase in costs lowered the company’s operating income by just over $1M in the quarter. Rather than raising prices equally in all of its restaurants, as many restaurant chains do, management is raising prices selectively at each individual restaurant. Management believes that this attention to detail helps maintain brand equity in each market.

LAS VEGAS IS IMPORTANT, as shown in table above

The company has made significant progress on completing the three major lease extensions for the restaurants the company manages at the New York-New York casino in Las Vegas. On the conference call, CEO Weinstein said that all the leases are signed, or will be, within the next week or so. As a result of the extension, the company expects to spend up to $7M in leasehold improvements. Rents will be higher but there is pricing room on the menu, which will largely offset the higher occupancy expense. In the 10Q, the company disclosed that a 10 year extension for the Gallaghers Steakhouse location was signed in early April., Ark agreeing to spend $1.5M to “materially refresh” the restaurant. Considering that Las Vegas represents approximately one-third of the company’s revenue, this 10-year extension for all the leases in Las Vegas significantly reduces the risk while improving cash flow expectations.

UPDATE on MEADOWLANDS CASINO POTENTIAL

As usual, CEO Weinstein provided significant color on the opportunity that lies ahead for the company if New Jersey eventually approves a casino for northern New Jersey. The following quotes from the Conference Call provide the most salient points.

· “We’ve become constantly more confident that within the next two to three years will have a casino license at the Meadowlands. There are conversations going on that makes us feel that we're on the right path to getting that, so we're looking forward to that possibility.

· “We did 65% of the sports betting that took place in the State either in-person, which is called retail at the Meadowlands or over the Internet. But I think we were the only profitable entity handling these sports betting in the State, which then means the Atlantic’s casinos -- Atlantic City casinos actually were unable to make a profit on their sports betting enterprises last month. I think we made $4 million last month - FanDuel is our partner.

· “much like what's happened historically with casinos and other areas of the country, the licenses have gone to places where there's already betting of some sort and those are likely racetracks.

· “..all the environmental studies and everything needed to support the construction of casino elsewhere on vacant land would take several years. We already have a building, we have plans to expand that building.

· “….what we are likely to propose to the State is not only a casino, but a new 1,000 room hotel and convention center, which we are prepared to fund without any help from the State. We think that, that referendum will be quick to be passed by the Senate and the legislature in New Jersey. We think that timetable is about two years.

· “I think it's going to be successful, if I had confidence five years ago when we made this investment my confidence has consistently risen primarily, because Atlantic City is over, it's really over and a new gleaming casino on the Hill, I think it's what the State to look forward to.

· “…as you know we have an exclusive on all food and beverage with the exception of a carve out by Hard Rock for one Hard Rock Café. But that requires an investment by the New Meadowlands in terms of tenant improvement money, which…..would be a big investment for us to do the eight or nine restaurants and all the bars. But I think those projections would be a positive enough that we would be able to finance it pretty easily between our balance sheet and maybe bank loans or bringing other investors. But I'm not too concerned, if there is a license issue about that.

· “…conversations with MGM and their projection at that time was that the prior to paying any taxes to the State….they thought a casino….could easily do $500 million a year in cash flow. So whatever that means to us, it would be a significant, significant alteration of our projected EBITDA.

· “But I've said this in the past, I don't think it ever gets to that. My guess is we are a minority partner to casinos that’s being run by Hard Rock, I think we won't get to see that cash flow….in terms of our ownership in the casino….Hard Rock would want……to buy our minority ownership in the casino.”

FURTHER ACQUISITION POTENTIAL

On the conference call, CEO Weinstein kept that possibility open. As we have described in previous articles, in the past five years ARKR has been able to significantly improve a purchased property cash flow within two years of an acquisition. We believe that ARKR is in a unique position within a limited pool of bidders, to continue to acquire restaurants for below market multiples, in the area of 3-4x EBITDA, often paid entirely in cash. Ark’s typical subsequent approach is to retain operating management, providing them new growth opportunity which improves morale, at the same time providing administrative support and purchasing power which lowers operating costs. Larger restaurant chains are looking for “cookie cutter” brands that they can grow, while ARKR is happy to buy “one-off” well-established local institutions, typically looking for properties that can generate at least $1M in annual cash flow

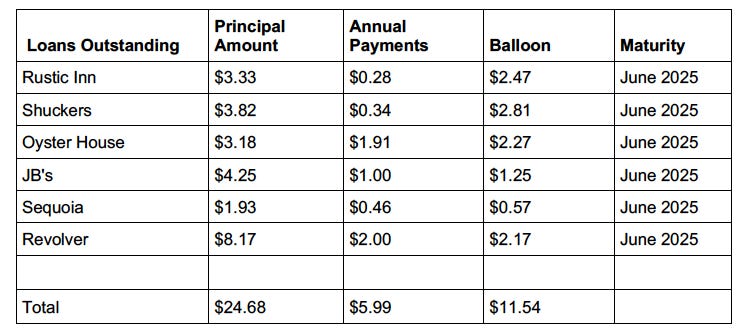

THE BALANCE SHEET

The company has very little net debt. More precisely, at the end of Q2, the company had net debt (excluding PPP loans outstanding of $2.6M) of $6.7M. Since the end of the quarter, the company received a tax refund and other cash which has increased the cash position to approximately $24M (40% of market capitalization) vs. $27.8M of total debt at the end of Q2. This balance sheet strength is obviously a source of comfort to management and investors, and has allowed the company to resume a $0.125 per share quarterly dividend (3% yield at current prices). The dividend will cost the company approximately $1.8M a year in cash.

The scheduled amortization of the currently outstanding debt, based on the current cash position and operating cash flow is very manageable at approximately $6M a year.

Roger Lipton of Lipton Financial Services Contributed to this report.