ARCOS DORADOS (ARCO) – 2300 RESTAURANTS, A STRONG BALANCE SHEET WITH PREDICTABLE GROWTH AT AN ABNORMALLY LOW VALUATION

Arcos Dorados (ARCO) The Growth Inflection Point Is Here

CONCLUSION

On January 26th, 2022 Arcos Dorados (ARCO), operator and franchisor of about 2300 McDonald’s in Latin America reported preliminary results for calendar ’21, which were impressive. Unless another Covid variant appears, prospects appear to be better than ever. With a proven long term operating record and a still strong balance sheet exiting the Covid, the company announced substantially improved recent results and are pointing forward to the re-acceleration of store openings and modernizations. Overall, ARCO appears to be at an inflection point in terms of faster growth and steadily improving profitability. While franchisees, even large ones such as ARCO, traditionally sell at major discounts to the valuation accorded their franchisor, we believe the current valuation (6.0X-6.5 X EV/2022 EBITDA) is simply too large a penalty. McDonald’s, the franchisor, has a bright future, and its large partner in Latin America should prosper as well.

COMPANY BACKGROUND

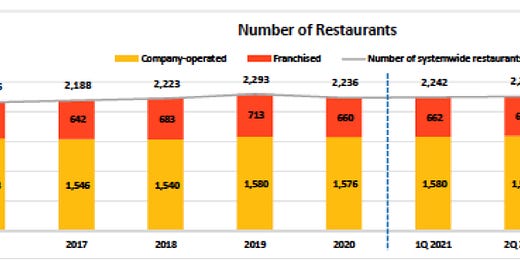

Arcos Dorados is the world’s largest independent McDonald’s franchisee, operating the largest quick service restaurant chain in Latin America and the Caribbean. It has the exclusive right to own, operate and grant franchises of McDonald’s restaurants in 20 Latin American and Caribbean countries and territories. There are more than 2,250 restaurants operated by the Company or by its sub-franchisees that together employ over 100,000 people. The company represents 2.8% of McDonald’s global sales (2020) and operates 6.0% of McDonald/s total franchised restaurants.

Unlike a typical restaurant franchisee, ARCO sub-franchises over 660 out of 2263 total units (30%). This gives the company normalized annual royalties of about $90M a year. which helps to reduce operating cost margin pressure and provides high margin income that can be used to fund new store growth.

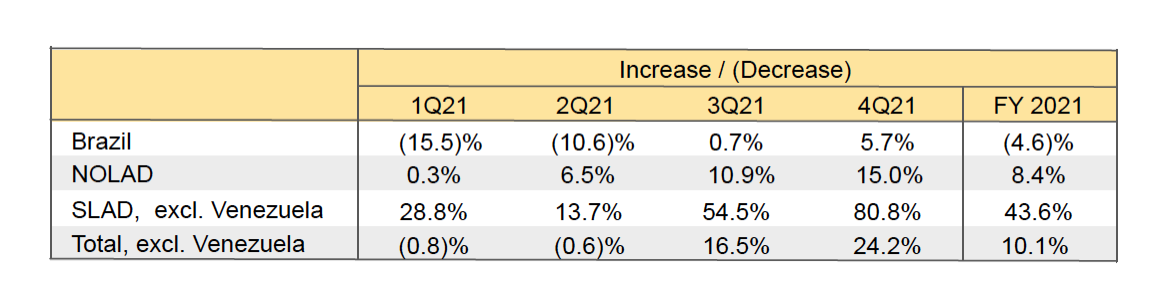

RECENT RESULTS – 2 YR. COMP SALES UP EACH QUARTER IN ‘21

Fourth quarter ’21 comparable sales increased 24.2% on a 2-year basis. The company has shown steady improvement each quarter. This brings the increase for the whole year to 10.1%. Importantly, the company’s largest market, Brazil (40-45% of revenue, typically 60-100% of EBITDA), showed a 5.7% increase over a very strong 9.5% comp in 4Q’19. In fact, December ’21 divisional sales in Brazil were the best in history.

From FY2015 to FY2019, the company grew comparable sales at an average rate of 9.1% per year. Due to factors such as population growth, their focus on the three D’s (Digital, Drive-thru and Delivery) and a higher ratio of freestanding restaurants in the development pipeline going forward (which have the benefit of a drive-through), we feel the company can return to a sustained comparable sales growth rate above this over the next few years.

THE PLAN

The Base

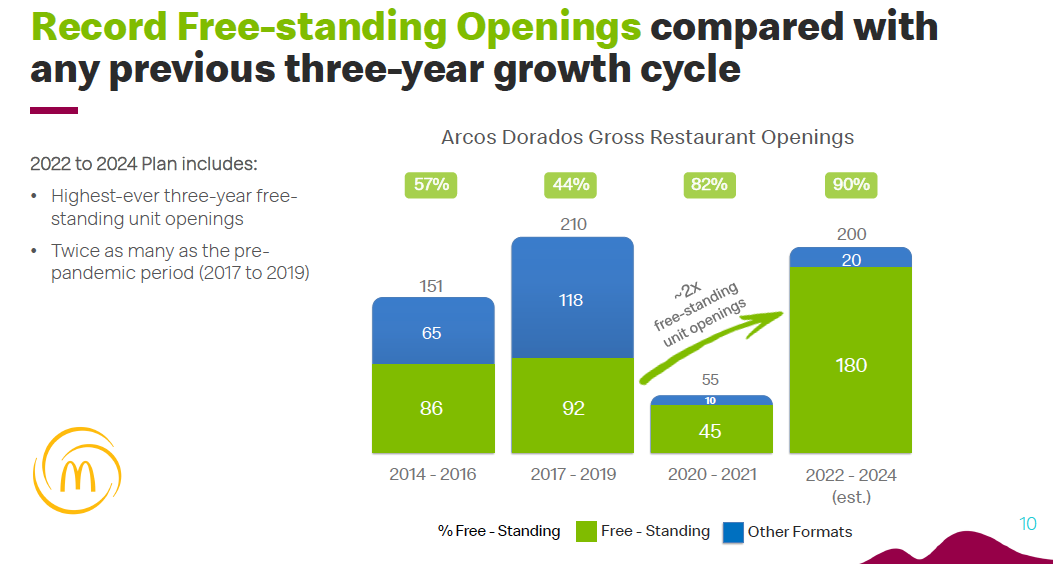

The improvement in the company’s comparable sales allows the company to resume its previous growth plans. Prior to the pandemic, ARCO had planned to open 285-300 new restaurants from 2020-2022. The total capital expenditures were expected to be $1B. From the end of 2019 through 3Q21 the company actually saw its total number of units shrink from 2293 to 2263. On the conference call, ARCO announced plans to open 55 new stores in 2022 and modernize an additional 75 stores. The new three-year plan is to open and modernize 200 and modernize 400 stores, respectively. Importantly, 60% of the new locations will be in Brazil where it has over 2.5X the number of free-standing stores relative to its nearest competitor. ARCO also has a dominant position in digital with over 50M mobile app downloads.

It is also important that 90% of new units will be free-standing units, much higher than the past 45-55% of new openings, since sales in free-standing restaurants have been 25% higher in 2021 than 2019. Part of the reason for the shift is the reduction in mall growth in Latin America. The company is also utilizing a design that is about 50% smaller than previous models (800 sqm vs. 1500 sqm) but maintains the drive through feature which helps drives more sales compared to mall-based or in-store units without drive throughs. The 200 additional stores would increase the number of free-standing units by almost 20%.

The modernization of 400 restaurants will also drive higher sales as these “Experience of the Future” (EOTF) restaurants include kiosks that also drive higher average checks than non-EOTF restaurants.

The company’s leverage profile and cash flow have already significantly improved over the last several years, and this trend should be sustained. As of 3Q21, cash of $207M was higher than any of the previous three years and the leverage ratio declined from 7.4X to 2.0X. The leverage ratio should be under 2.0X after 4Q21 is reported. This gives the company ample liquidity to execute its growth strategy and perhaps reinstate a modest dividend.

Management summarizes the situation well, per the January update call:

“As we mentioned on our last call, we now have enough visibility to return to our 3-year and long-term growth planning…..This plan is supported by strong cash flow generation and a solid balance sheet as well as continued McDonald's growth support.”

“Total new restaurant openings from 2022 to 2024 is about the same as we delivered in the last pre-pandemic cycle from 2017 to 2019. But this time, we are planning to open twice as many freestanding restaurants. In fact, the plan includes the highest ever 3-year total of freestanding openings in Arcos Dorados history. Around 90% of new unit openings in the next 3 years are expected to be freestanding restaurants, optimized to take full advantage of the drive-thru and delivery sales channels while still offering guests the aspirational and convenient experience of on-premise timing.

Total capital expenditures over this time frame are expected to be $650M. The company expects to pay for this growth with cash on hand and cash flow. McDonald’s has also agreed to reduce its royalty rate over the next three years to 5.5% (from the standard 7.0%) to help ARCO fund these expenditures. This means that the company’s debt should remain relatively flat while cash flow should increase.

“In fact, self-order kiosks, accounted for more than 50% of on-premise volume in EOTF restaurants in 2021 versus less than 30% in 2019. This is important because the self-order kiosk also generates a 15% to 20% higher average check compared with the front counter in most markets.”

2022 EBITDA: OUR INTERPRETATION

Management highlighted that 4Q21 generated the highest EBITDA in the company’s history. While the exact amount will be disclosed on the formal earnings call in March, the implication is that Q4 EBITDA could be $110M or higher and above $275M in total for calendar 2021. For 2022: if we assume that EBITDA in the first two quarters simply matches the 2020 results (conservative, considering the last two quarters exceeded 2020 results by 10-15% even including the negative impact of Omicron in Q4) the company would generate $320M in EBITDA. This would exceed the prior high of $305M in 2017. This possibility does not include an addition from new units or comp sales growth.

EBITDA is breaking out.

3Q’21 EBITDA margins were already equaling or exceeding pre-pandemic levels. In 2019 ARCO was able to achieve a 10% EBITDA margin, which was the highest in the company’s history. That historical high can possibly be exceeded, with the addition of smaller footprint locations with drive-throughs as well as higher frequency of visits through loyalty programs. ARCO also has a dominant position in digital with over 50M mobile app downloads.

The balance sheet has renewed strength for renovations, new units, and a dividend too.

As of 3Q21, cash of $207M was higher than any of the previous three years and the leverage ratio declined from 7.4X to 2.0X over the last several years. The leverage ratio should be under 2.0X after 4Q21 is reported. This gives the company ample liquidity to execute its growth strategy and perhaps reinstate a modest dividend.

ADDITIONAL CONSIDERATIONS

Ownership Structure

Outside of the standard operating risks of a restaurant company (wage/commodity inflation, etc.) ARCO investors are subject to a couple of risks that US-based companies do not typically face.

ARCO is controlled by Los Laureles Ltd., which is beneficially owned by Mr. Woods Staton, who paid $700M in 2007 to acquire Arcos Dorados. He opened his first restaurant in 1986 and served as President of McDonald’s South Latin American division from 2004 until the acquisition. Mr. Woods Staton, now Executive Chairman, owns or controls common stock representing 38.6% and 75.9%, respectively, of the economic and voting interests of ARCO.

Under the MFAs (Master Franchise Agreements), Los Laureles Ltd. is required to hold at all times at least 51% of our voting interests, which is accomplished through its ownership of 100% of the class B shares of Arcos Dorados Holdings Inc., each having five votes per share. McDonald’s has the option to acquire all, but not less than all, of the non-public shares at 100% of their fair market value during the twelve-month period following the eighteen-month anniversary of the death or permanent incapacity of Mr. Woods Staton. However, the publicly held class A shares are not similarly subject to acquisition by McDonald’s.

Currency Risk

Approximately 70% of the company’s revenues are derived from restaurants in Brazil, Argentina, Mexico, and Puerto Rico. The company also has exposure to Venezuela and its highly volatile currency. In terms of EBITDA, almost 40% is generated in countries that operate in hard or relatively stable currencies and almost 50% is generated in Brazil. Less than 8% is generated in Argentina. The big swings in currency prices causes large swings in foreign currency exchange results to flow though the income statement. While this tends to add noise to the bottom line on a short-term basis, as the table below shows, in the longer-run the swings tend to balance out over time. The effect is also not hugely material relative to several hundred million dollars of annual EBITDA.

Roger Lipton of Lipton Financial Services Contributed to this article